The Federal Reserve (Fed) cut rates 0.25%-points at their September meeting, taking their policy rate to the 4.0–4.25% range. This comes after a long nine-month pause but the move was widely expected, especially given recent data showing a rapidly cooling labor market. While investors did not expect an extra-large 0.5%-point cut (fed funds futures markets priced that at a less than a 10% probability before the meeting), it was notable that Fed Chair Powell was quite dismissive of the possibility, saying there was no widespread support for anything more than a 0.25%-point cut. This in a nutshell captured the dynamics of how the Fed is thinking about this rate cut.

The Fed has two mandates—maximum employment and stable inflation—and things are going south on both sides. Payroll growth data are flashing a big red warning sign (I wrote about this a couple of weeks ago). At the same time, inflation is rising and running closer to 3%, well above the Fed’s target of 2%. So, there are risks to both sides of their mandate and the big question was, which one would they be more focused on?

Powell called the cut a “risk-management” move, and given they chose to cut rates, they’re clearly prioritizing the risk to the labor market over inflation. In other words, the Fed is more worried about the labor market deteriorating more rapidly than inflation spiraling out of control. In fact, they believe inflation risk has eased since early summer. Current elevated inflation numbers are due to tariffs but that will be “transitory” (Powell was careful about avoiding this word, but that’s essentially what he meant).

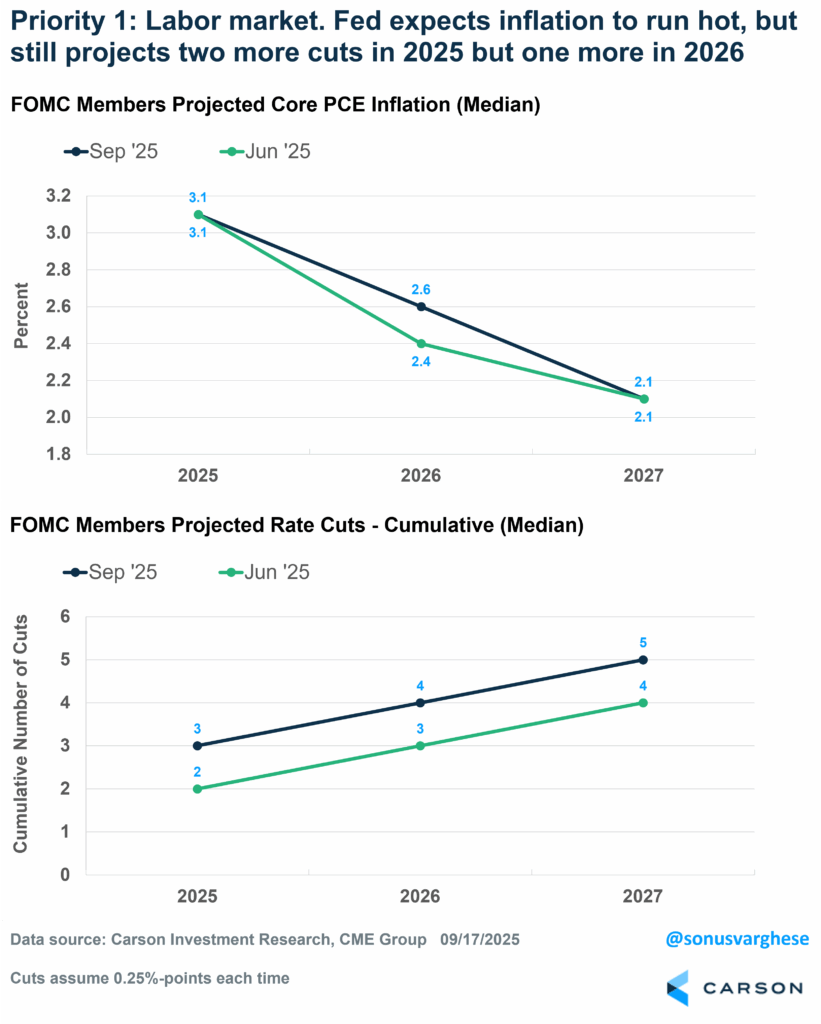

The Fed also updated their quarterly projections of future GDP growth, inflation, the unemployment rate, and their expectations for the policy rate (the “dot plot”). For 2025, the median Fed member projected two more cuts (0.25%-points each), which would take the policy rate to the 3.5–3.75% range. Relative to their June economic projections:

- The core inflation (ex food and energy) estimate for 2025 stayed unchanged at 3.1% (actual core inflation is currently at 2.9%).

- The unemployment rate estimate for 2025 stayed unchanged at 4.5% (currently at 4.3%).

- The real GDP growth estimate for 2025 was revised up from 1.6% to 1.8%.

Cutting rates by a total of 0.75%-points (including the September cut) over three months while revising their estimate of growth higher and expecting inflation to remain well above their target is a clear sign that the Fed is more worried about risks to the labor market.

They expect to cut rates one more time in 2026 (another 0.25%-points), even as core inflation is estimated to remain hot (they raised the 2026 inflation projection from 2.4% to 2.6%). By itself, that should also be a big tailwind for equity markets.

No Consensus on the Rate Outlook

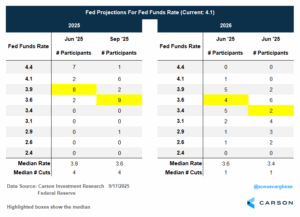

What you see above is the “median” expectation. The problem is that the 19 members of the Fed are all swimming in different directions. For 2025:

- Six members expect no more rate cuts this year.

- One member expects to raise rates again by 0.25%-points!

So, 7 of 19 members, a fairly significant portion of the committee, think nothing more should be done with policy rates this year.

On the other hand, 2 members think rates will be cut one more time this year, and another 9 believe two more cuts are forthcoming in 2025 – which is why the median estimate was for two more cuts. That’s 11 of 19 members who think more action will be needed to protect the labor market and probably believe inflation risks have eased (I imagine Powell’s in this camp).

Interestingly, one member expects a whopping 1.5%-points of rate cuts this year, i.e. 5 more cuts of 0.25%-points each! I’ll have more to say on this outlier below.

The dispersion across members is even more stark when it came to 2026 expectations, with the expected policy rate ranging from a low of 2.6% to 3.9% (we’re around 4.1% now after yesterday’s cut).

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The lack of clear consensus within the committee is why Powell wasn’t ready to commit to continued policy rate easing over the next several months. Instead, he implied that the September cut was an insurance cut (to protect the labor market) and said they’re going to consider any further changes meeting by meeting based on interim data.

But none of this may matter as far as 2026 is concerned.

One Dot to Rule Them All—The Only Dot That Matters?

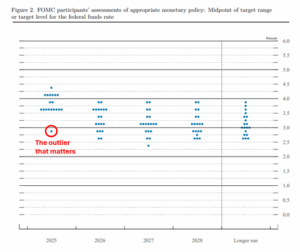

As I noted above, there was an outlier dot when it came to 2025 rate expectations, with one member expecting rates to be cut several more times this year, taking the policy rate to 2.9%. Here’s the dot plot from the Fed’s own materials (annotations are mine):

It isn’t hard to guess who this was—newly appointed Fed Governor, Stephen Miran. Miran was the Chair of the White House Council of Economic Advisors until Monday and passed Senate confirmation for the Fed Board seat just in time to make it to the Fed meeting that started Tuesday. Yet, this is only a temporary appointment until January (President Trump could re-appoint him, but he’ll have to go through Senate confirmation again) and Miran hasn’t resigned from his CEA position (he’s on leave). Safe to say, Miran is clearly the administration’s voice on the Fed Committee, and made his presence felt immediately.

It also gives us a clue as to what may be coming in 2026, which is what matters now. The President gets to appoint Chair Powell’s successor (Powell vacates his Chairmanship in May), and perhaps another governor. Combined with two other governors that were appointed by President Trump in his first term, there’ll likely be enough people at the Fed to push policy rates in the direction favored by the administration, i.e. lower, much lower. Even in the dot plot, you can see that five members already expect the policy rate to go below 3.0% by the end of 2026.

This is why markets are probably pricing a few more rate cuts in 2026 than the median Fed dot. Markets expect the policy rate to fall below 3% by 2026, versus the dot plot median of 3.4%.

What’s interesting is what comes after, which is a big disconnect in the opposite direction, with markets more hawkish than the Fed. The median Fed member expects rates to move closer to 3% in 2027 and stay there in 2028 and beyond, presumably as they expect inflation to hit their target and the unemployment rate to stay low. In contrast, the market expects the Fed to start raising rates again—likely because inflation becomes a problem—though markets probably believe the Fed will act on it only as President Trump’s term in office near its end in 2028.

Markets may have this completely wrong but it’s not a stretch to imagine that inflation starts to become a bigger problem next year (it already is elevated) if the Fed pulls rates all the way down to 3%. That’s going to boost cyclical areas of the market, including housing. If Fed rate cuts pull mortgage rates down to 5%, expect a flurry of refinancings and even homeowners tapping into home equity (which there is plenty of because of rising home values over the last several years). There’s “fiscal stimulus” for households in the works too:

- A tax deduction on tips

- A tax deduction for seniors – $6,000 for an individual, and $12,000 for spouses filing jointly

- A much larger SALT (state and local tax, including property tax) deduction, with the limit rising from $10,000 to $40,000, which will benefit upper middle-income households who itemize their taxes

All of this is retroactive for 2025, which means several million households will receive larger than normal tax refunds. Just take the SALT deduction. Increasing the limit by $30,000 means taxes for a household in the 24% tax bracket will fall by $7,200 (if they have sufficient state and local tax deductions). That’s a tidy sum of money and will probably be spent rather than saved.

Now some of this will be offset by lower income for savers who were used to earning a 4%+ yield on their savings/money market accounts. But even there, we may see a movement out of these accounts into riskier assets (like longer-term bonds) to boost expected returns. That’s a positive for risky assets.

All this is likely to fuel spending and boost demand for risk assets generally. All this obviously raises the question, what about inflation? Well, it’s likely to remain elevated as well, running closer to 3% rather than the Fed’s target of 2%. But in the eyes of the administration, and the Fed, that may be a small price to pay to keep growth humming. And that may be what we see as 2026 kicks off: a period of inflationary growth. But that is also a strong environment for profits, and bullish for stocks.

Ryan and I just talked about a lot of this with JP Morgan’s Chief Economist, Dr. David Kelly. Dr. Kelly is in the camp that a September cut was not necessary and that rates need to remain on the higher side. Take a listen below:

8408861.1.-18SEPT25A

For more content by Sonu Varghese, VP, Global Macro Strategist click here