The Supreme Court today struck down the use of IEEPA (International Emergency Economic Powers Act) as a valid legal basis for many of the Trump administration tariffs in a 6-3 decision written by Chief Justice John Roberts with Justices Thomas, Alito, and Kavanaugh dissenting. It’s a complicated 170-page decision with concurrences, partial concurrences, and multiple written consents, mostly relating to the constitutional basis of the decision and the reading of the statute. Here’s a description of the different sections of the opinions from the document itself:

ROBERTS, C. J., announced the judgment of the Court and delivered the opinion of the Court with respect to Parts I, II–A–1, and II–B, in which SOTOMAYOR, KAGAN, GORSUCH, BARRETT, and JACKSON, JJ., joined, and an opinion with respect to Parts II–A–2 and III, in which GORSUCH and BARRETT, JJ., joined. GORSUCH, J., and BARRETT, J., filed concurring opinions. KAGAN, J., filed an opinion concurring in part and concurring in the judgment, in which SOTOMAYOR and JACKSON, JJ., joined. JACKSON, J., filed an opinion concurring in part and concurring in the judgment. THOMAS, J., filed a dissenting opinion. KAVANAUGH, J., filed a dissenting opinion, in which THOMAS and ALITO, JJ., joined

That’s a lot of different views and points to how difficult it probably was to find a consensus view the majority could sign off on. Needless to say, the legal points are complicated. But the main takeaway is clear: “Held: IEEPA does not authorize the president to impose tariffs.” At the same time, this does not mean the President can never impose any tariffs at all – they can, but will need Congress to weigh in. The court noted:

The Framers gave Congress alone the power to impose tariffs during peacetime … And the foreign affairs implications of tariffs do not make it any more likely that Congress would relinquish its tariff power through vague language, or without careful limits.

So even though the tariffs may have foreign policy implications, for example via the trade deals the administration has made around the world, Congress still needs to weigh in. We wouldn’t hold our breath on that, given the razor-thin majority of 218-214 that Republicans now have in the House of Representatives.

What Is IEEPA?

IEEPA was passed in 1977, and allows the President to “regulate international commerce” after declaring a national emergency. It was under IEEPA authority that the President imposed the following tariffs:

- China, Mexico, Canada tariffs in response to fentanyl trafficking

- Fentanyl tariffs on China were recently reduced from 20% to 10%

- Liberation Day (April 2nd) “reciprocal” tariffs imposed in response to “they’re ripping us off because of trade surpluses”

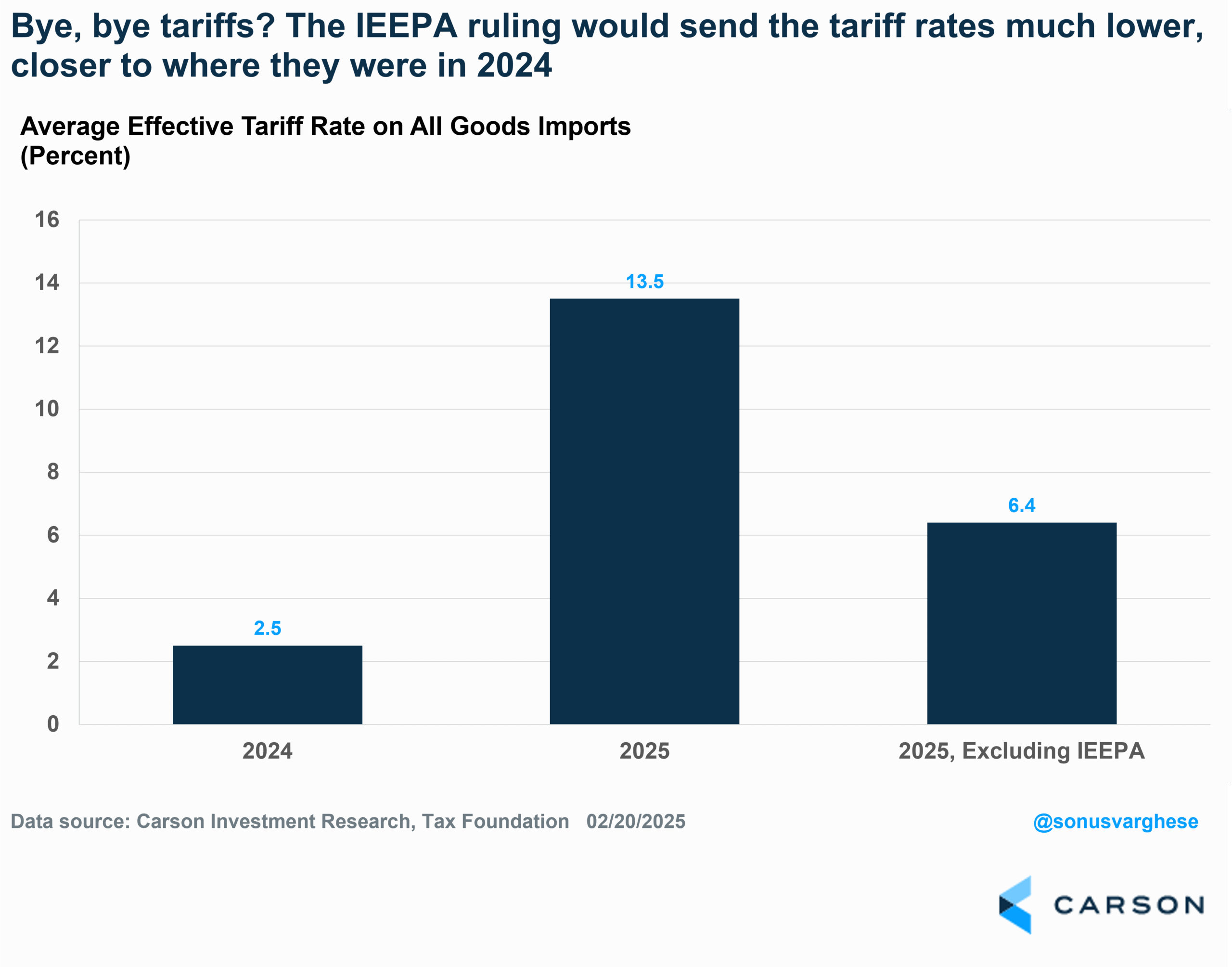

The IEEPA tariffs account for about 7%-points of the 11%-point increase in the effective tariff rate that is currently in place. That was already the best-case scenario even prior to Liberation Day last year, and now with the removal of IEEPA, the effective tariff rate would collapse to around 6%. As we wrote in our 2026 Outlook, that will be a positive tailwind for US importers going forward.

What happens now that tariffs are struck down?

The administration does have other tariff tools to impose the same tariffs if IEEPA tariffs are struck down.

- Section 122: Authorizes tariffs of up to 15% for up to 150 days and requires Congressional approval after that. But it doesn’t require any formal investigation process and so it could be used temporarily while the administration works on other tools.

- Section 301: Allows tariffs in response to unfair trade practices. But this would require investigations of trading partners before implementation, which will take several months. But there’s no limit on the level of tariffs.

- Section 232: Allows tariffs based on national security and also requires investigations. The administration has already used this to impose tariffs on steel, aluminum, copper, autos, and furniture.

- Section 338: Allows the president to impose up to 50% tariffs on imports from countries that “discriminate” against the US. This has never been used before, and is similar to 301 tariffs above, except it puts a limit on the level of tariffs. But there’s no investigation required.

The long and short of this is that now that the IEEPA tariffs are struck down, the administration has several other tools to re-impose the same tariffs, but those will take time. That leaves the future uncertain and messy with a lot of uncertainty for businesses. On the upside, there is an immediate reprieve from current tariffs, which may act as a kind of tax cut for businesses, at least temporarily. The downside—while slower moving, any tariffs imposed under these other statutes are more likely to be sticky. An added complexity—there’s also going to be uncertainty around the deals made by the Trump administration related to tariffs.

Will refunds go out now that IEEPA tariffs are struck down?

Short answer: They should, but it’ll likely take some time for the refunds to start flowing out, and the onus will be on importers to seek refunds. Note that while the decision says the administration does not have the authority to collect these taxes, it does not directly address refunds. It makes sense that if the tariffs were unlawful they would need to be refunded, but actual refunds is a path businesses would have to pursue rather than being part of the decision itself. It could actually take some time to sort this out legally as the question works its way through the system, which means the timing of refunds is highly uncertain even if they end up being required.

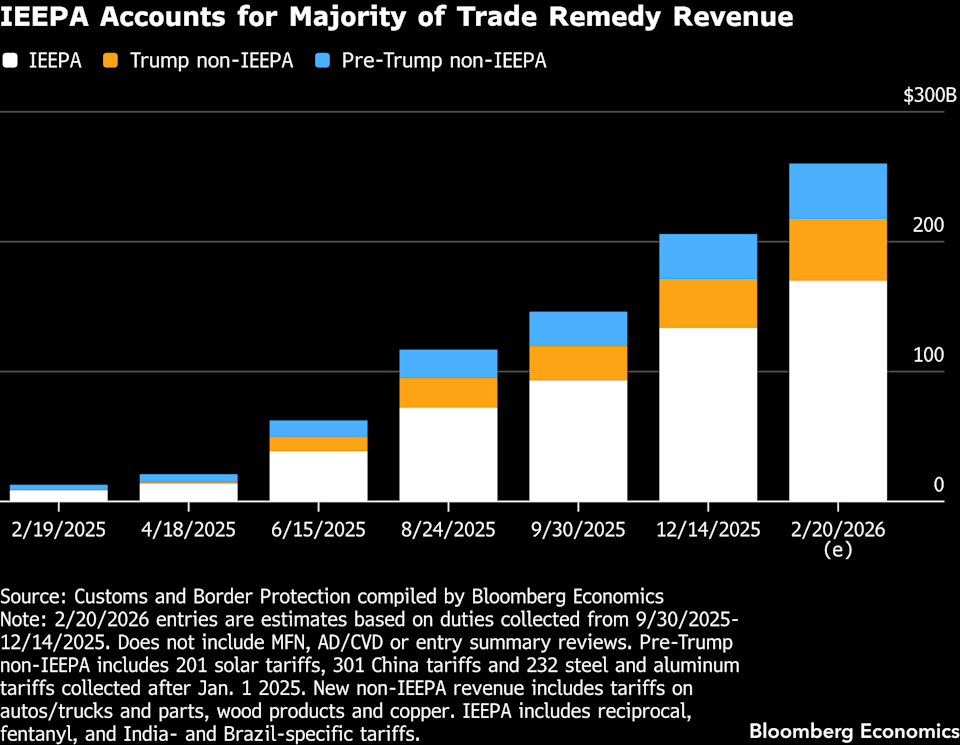

As of now, Treasury has collected an estimated $175 billion under IEEPA that may be at risk for being refunded. While tariff refunds will be a blow to the US treasury, they would be a boost for companies, and the economy. Think of the tariff refunds as a tax refund for companies (on top of the temporary tax cut from lower tariffs).

Will consumers see a benefit from lower prices?

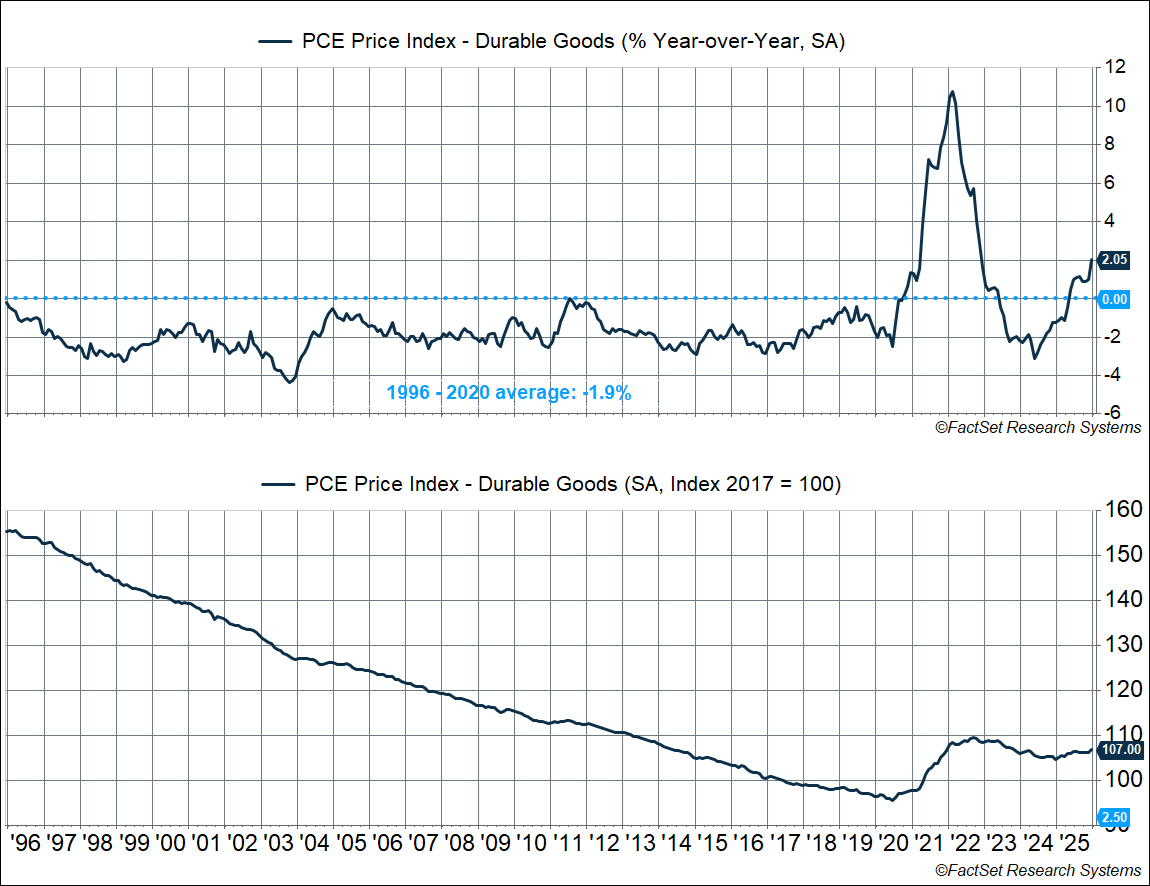

This is unlikely. Prices did go up as a result of the tariffs. The personal consumption expenditures index for durable goods rose 2.1% in 2025 — that’s a big reversal from 2024, when prices declined at 1.3% pace. From 1996-2020, durable goods prices fell at a pace of 1.9% per year, as increased globalization allowed for increasingly cheaper goods. Upending the global trade regime that existed for two and half decades was bound to send prices higher.

Still, goods inflation did not go as high as many expected for three reasons:

- The effective tariff rate wasn’t as high as expected amid numerous exceptions and carve-outs for various goods.

- US importers shifted goods away from high-tariffed countries (example: moving from China to places like Mexico and Vietnam).

- US importers/companies ate up a large part of the cost.

The first two reasons are also why the trade deficit didn’t really improve in 2025 despite the higher tariffs – the trade deficit in goods increased from $1.22 trillion in 2024 to $1.24 trillion in 2025. The third point is important because it gets to tariff pass-through from importers to consumers, and the potential reversal of these. A new study from researchers at the Federal Reserve shows that foreign exporters did not drop prices significantly to cover higher import duties, and instead US importers bore 80-90% of the cost of tariffs. At the same time, US companies haven’t quite passed through all of these costs to consumers, which is why inflation wasn’t even higher. However, that also means any refunds are not going to go back to consumers by way of lower prices. Rather, companies may pocket the refunds and bolster their margins.

Takeaway

This is a major loss on a central policy of the Trump administration, but while they’ve lost an important battle they have not lost the war. In the near term, all the main takeaways act as economic stimulus with the only negative the renewed uncertainty on what future policy will be. Worst case, the level of tariffs will eventually be something like where they are now, but it would take time to get there. In the interim this is good for businesses and we could see aggressive inventory restocking to take advantage of the pause, and a boost to margins also means this is a net positive for stocks.

For more content by Sonu Varghese, Chief Macro Strategist click here.

8784893.1. – 20FEB26A