We got a rollicking GDP report on Thursday, showing the economy expanded at an annual pace of 3.3% after adjusting for inflation. That was well above forecasts of 1.8%. Yet again, the economy continues to be underestimated – a topic we’ve discussed on these pages time and time again. By now we were supposed to be in a recession, with unemployment rising, thanks to an aggressive Federal Reserve (Fed) that took interest rates from near zero to above 5%. Prominent economists said that inflation would not come down without the unemployment rate remaining above 5% for five years. Others raised the dreaded image of “stagflation” (a high unemployment with high inflation) a la the 1970s.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Instead, this is what happened:

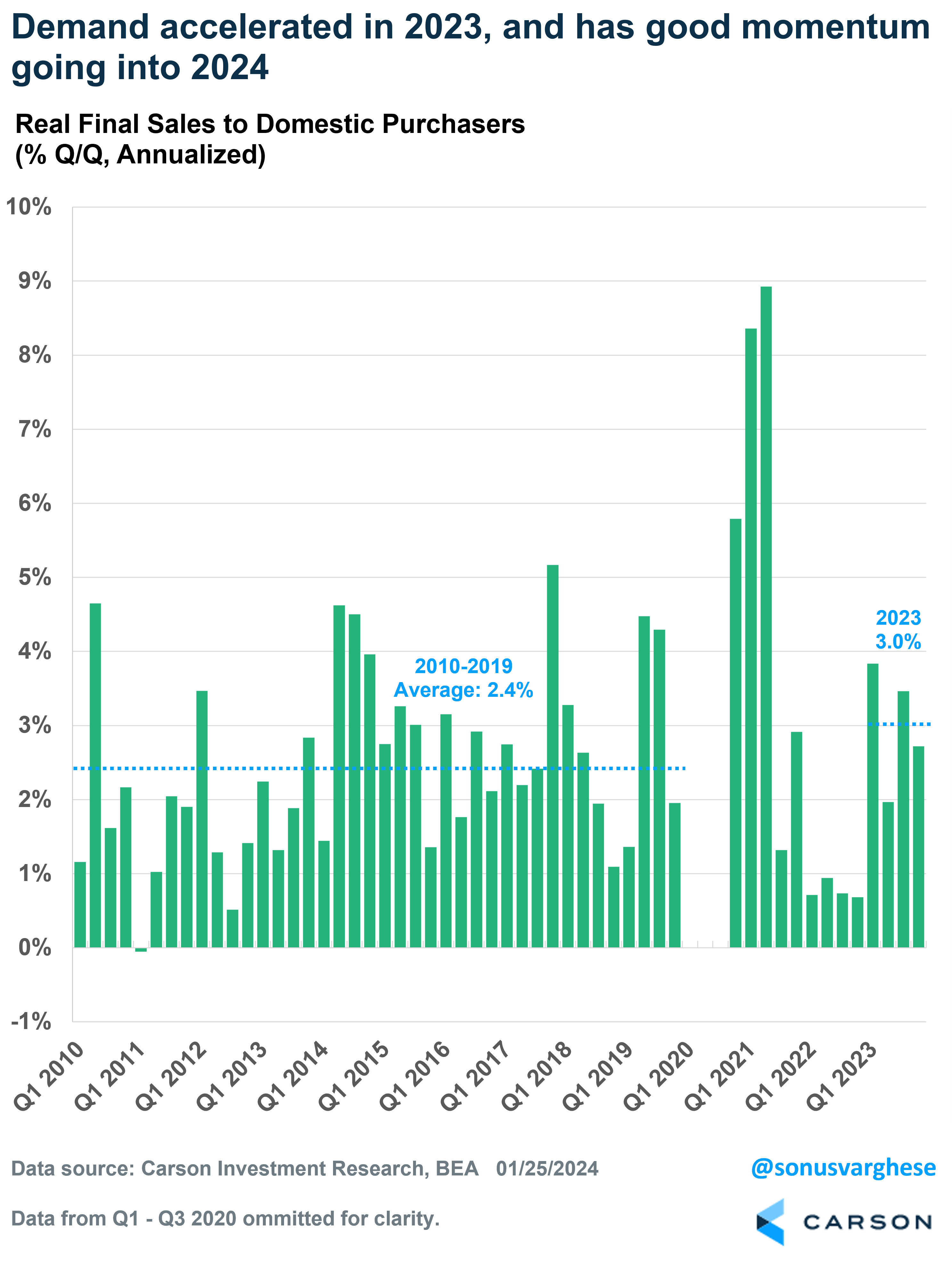

- The economy accelerated in 2023, with GDP growth rising 3.1%, well above the 2010-2019 trend of 2.4% and 2017-2019 pace of 2.8%.

- In fact, over the past six quarters, the period during which interest rates surged, real GDP grew at an annual rate of 2.9%.

- The unemployment rate is at 3.7%, not far above 50+ year lows.

- Inflation was 2.6% in 2023, and crashed down to 1.5% in the fourth quarter.

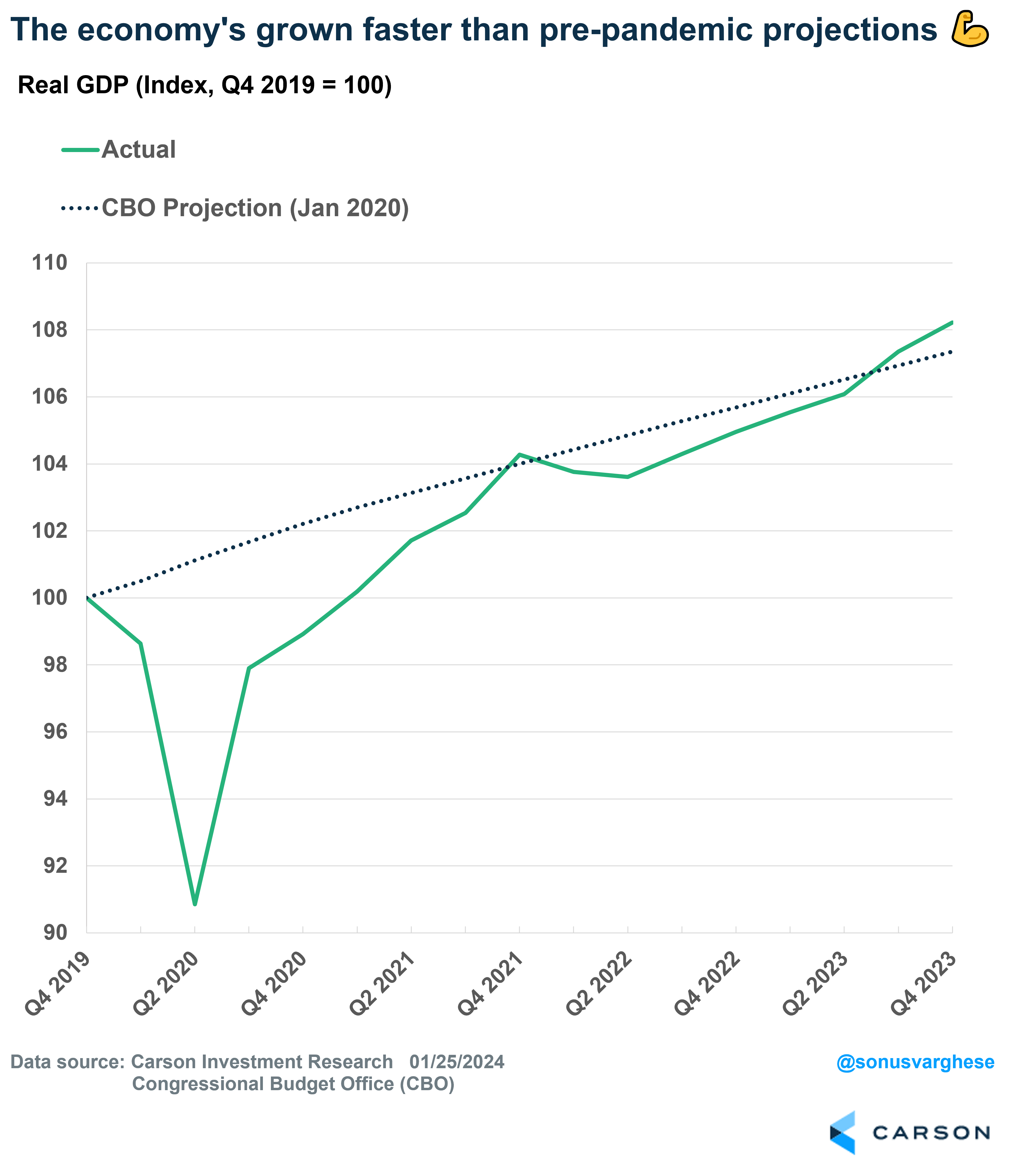

Here’s something pretty incredible: The economy has grown faster than the Congressional Budget Office forecasted back in January 2020, before the pandemic. In fact, inflation-adjusted growth has been almost 1% higher than what they projected. That’s despite a worldwide pandemic that killed millions of people, an energy shock that sent inflation to the highest level in 40 years, and the most aggressive Fed tightening cycle since the early 1980s.

In fact, in nominal terms, the US economy grew 5.8% in 2023, which is faster than China’s growth rate of around 5%, the first time that’s happened in several decades!

“This Time Is Different” are the four most dangerous words in the investment business, but I think the situation warrants it now. We did point out the high likelihood of this scenario playing out in our 2023 Outlook (released way back at the end of 2022) and understanding the underlying reasons why this cycle has defied expectations has implications for 2024 as well, which we lay out in our recently released 2024 Outlook (download here).

The Economy Has Strong Momentum as 2024 Gets Going

Two volatile components of GDP tend to be inventories and exports, but if you strip those out, we get the underlying signal, which is “final demand,” or how much households, businesses, and government are spending. “Real” final demand, final demand after adjusting for inflation, averaged 3% in 2023. That’s well above the 2010-2019 average of 2.4% and indicates that the economy has strong momentum as we move into 2024.

Three reasons why we’re optimistic the economic momentum can continue:

- Household incomes are strong, especially with inflation easing (a lot), and that’s driving consumption. We expect inflation to continue to ease and that means real incomes are likely to remain strong.

- Investment remains relatively solid, with a sharp pickup in investments related to technology equipment and structures. Residential investment is also likely to be a tailwind if mortgage rates ease on the back of a Fed pivot to rate cuts.

- Defense spending has been picking up over the last few quarters, and state and local government spending remains strong. States and local governments pulled back on spending and investment in 2020 and 2021, as they looked to shore up budgets in the face of an anticipated recession. However, the recession didn’t arrive, and now they’re playing catch up with the excess money they have (including funds received from the federal government as part of Covid relief). This is likely to continue into 2024.

The Inflation Problem Is Over, and the Fed Needs to Cut

A common question going around investment circles is, “Why does the Fed have to cut interest rates if the economy is running strong?”

I think the simple answer to that is that inflation is running below a pace of 2% over the last 3 and 6 month, at least as measured by the Fed’s preferred metric, the core personal consumption expenditures index (PCE ex food and energy). Even the year-over-year rate, which partly relies on numbers from a year ago that aren’t relevant anymore, came in at 2.9% in December. A year ago, it was 4.9%.

Normally, a strong economy would raise concerns that inflation would remain high. But over the last 18 months, the economy has literally proved that model wrong, mostly because the spike in inflation was largely a supply problem due to Covid and the Russia-Ukraine war. Once the supply issues went away, inflation fell. The inflation spike was not caused by consumers spending too much money. To the contrary, consumer spending has been running well above trend over the past year, but inflation’s now fallen below 2%.

In short, the Fed does not have to worry about inflation surging again on the back of a strong economy.

On top of that, productivity is likely to have grown 2-2.5% in Q4, which means productivity growth would’ve clocked close to 3% in 2023. That’s well above the 1.5% average we saw between 2005 and 2019, and closer to what we saw in the late 1990s. The beauty of productivity growth is that you can have strong wage growth with low inflation, something we discuss in our 2024 Outlook.

Fed Chair Powell has noted that economic risks are now balanced: the risk of lowering rates and stoking inflation again is similar to the risk of staying too tight for too long and breaking the labor market. He’s also pointed out that inflation does not have to fall all the way back to 2% for them to cut rates – they just need to know that it’s on a sustainable path to that target. Well, it’s already there, and likely to fall further in 2024, barring any surprises. That means cuts are likely coming in the first half of 2024, perhaps not as early as March but likely in May and June. That’s going to be a relief for investors and provide a further tailwind for the economy.

Carson’s Chief Market Strategist, Ryan Detrick and I discussed all-time highs for the markets coming on the back of recent economic momentum on our latest Facts vs Feelings podcast. Take a listen.