“It isn’t about timing the market, it is about time in the market.”-Old investment saying

It took nearly 128 years, but the Dow closed above 40,000 for the first time in its history last week. This was yet another reminder to investors that one of the best ways to create long-term wealth and beat inflation is the stock market. Think about how many times early last year we were told a recession and bear market were coming, only to never see it happen. Many investors listened to the scary headlines and unfortunately sold and missed out on historic gains.

They say the stock market is the only place where when things go on sale, yet everyone runs out of the store screaming. That has been true throughout market history and will continue to be true, as investors are wired to think about the worst that could happen, instead of focusing on the positives. Our team tends to focus on the positives, as we know the long-term trend is indeed higher for stocks. Yes, there will be bad times and scary times, but those are also times investors can buy some great companies at wonderful prices. That’s the way you need to think to succeed over the long run.

The Dow hit 20,000 back in January 2017, so in just over seven years it doubled. Now think about all the really bad things that happened the past seven years. I listed many of them in the tweet below. It should go a long way to help remind investors not to panic the next time they are force fed scary headlines.

But what does the Dow at 40,000 really mean? To be honest, there isn’t any difference between 39,999 and 40,000, but we need to take notice of the psychological impact of big levels. They are reminders that we are indeed in a bull market and some of the best investors ever are the ones who set it and forget it, doing the equivalent of adding to their 401ks every two weeks no matter what is in the news.

I’ve done this for a long time and I’ve seen so many try to time the market and in nearly every case they do the exact opposite of what they should do. Look at the quote up top one more time. It is at the peak when investors usually turn super bullish, chasing some of the hottest names, while it is at the bottom of bear markets when they sell everything, as they can’t take it anymore. If you take anything away from 40,000, I hope it is that time is your friend when it comes to investing and the way to succeed is using those inevitable corrections and bear markets as opportunities, not times to panic.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The Dow hitting this new level is also a sign of underlying strength in the market. The Dow isn’t tech heavy like the Nasdaq or S&P 500. It has more financials, healthcare, and industrials in it, so the Dow at new highs suggests we are likely seeing broader participation from other groups, not a bad thing for the lasting power of this bull market.

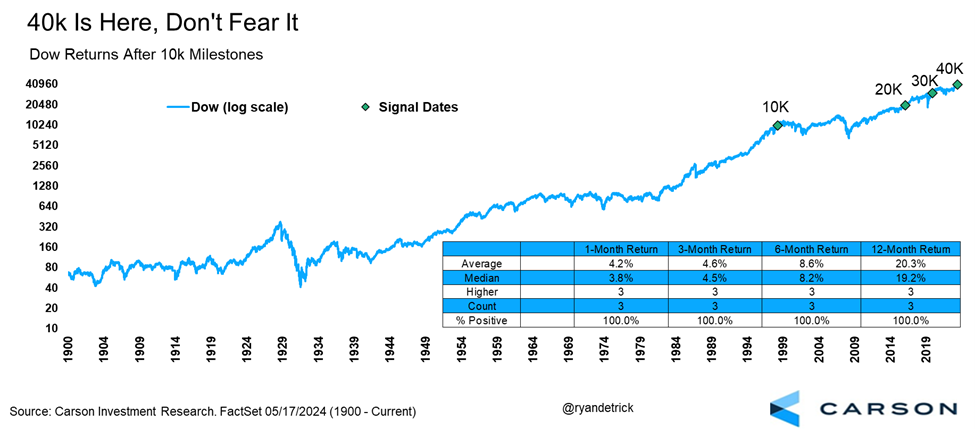

Did you know that after the Dow hit previous major milestones, like 10k, 20k, and 30k, bull markets continued? That’s right, 1-, 3-, 6-, and 12-months later the Dow was higher in all instances and up more than 20% on average a full year later. In other words, don’t panic and sell because things are ‘too high’ right now.

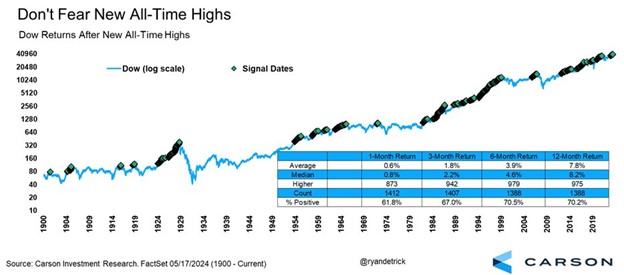

Yes, eventually the Dow will hit a major peak and a new bear market will happen, just like we saw in 1929, 1987, 2000, 2007, and 2020. But major peaks are rare and just a small fraction of all the total all-time highs. Did you know the average Dow return a year after any all-time new high is better than the average return for any random day? That’s right, I found 1,414 new all-time highs dating back to 1900 and the Dow was up a year later 70% of the time and up close to 8% on average, both a little bit better than the long-term averages.

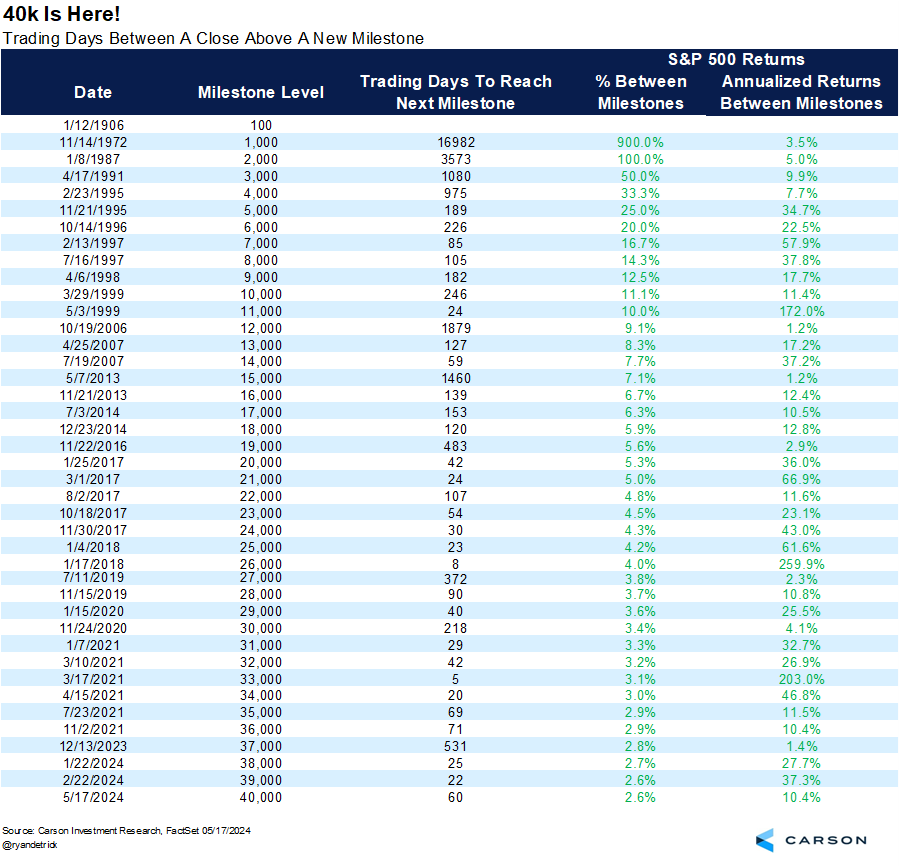

Here’s a list of all the Dow’s major 1k level new highs and how long it took to get to the next level. Sometimes it happened quickly and sometimes it took a while. Yes, as we go higher the percentage to get to the next level is smaller. Going from 1k to 2k is a much bigger leap than going from 39k to 40k. Still, what stands out to us is that move from 20k to 40k in about seven years.

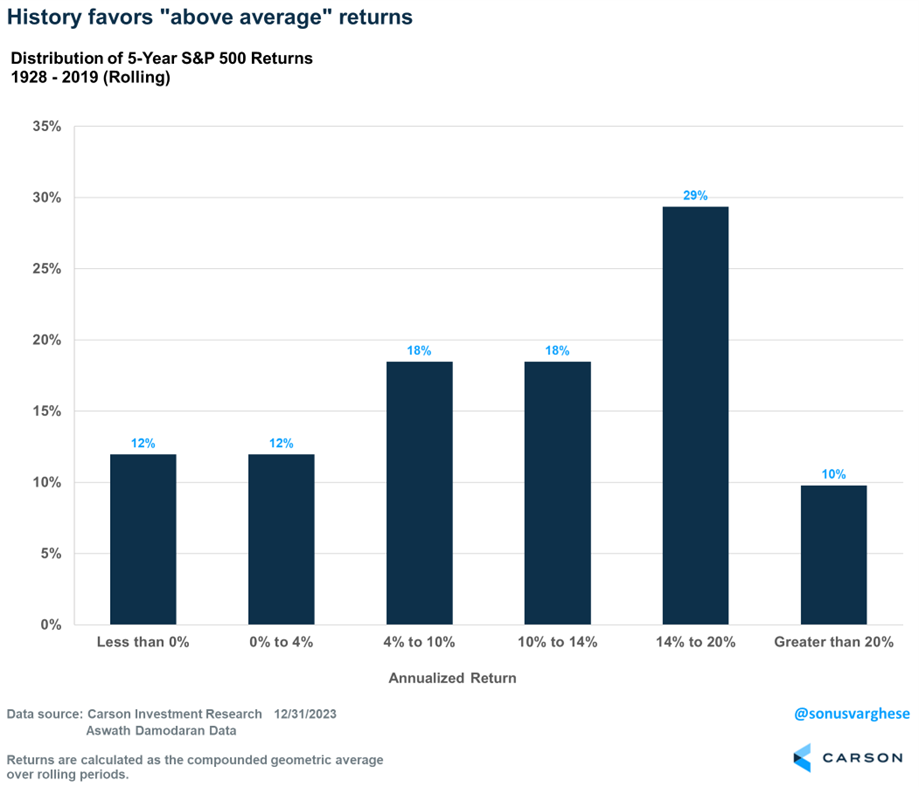

The Rule of 72 tells us that an average gain of 10.3% over 7 years will see prices double. To double in five years? You need just over a 14% average return. That’s the power of compounding. Given we just saw a move from 20k to 40k, how likely would it be to see 80k anytime soon? We found the S&P 500 gained more than 14% on a five-year basis nearly 40% of the time. It gained more than 10% over five years more than 57% of the time! Those numbers are probably higher than most expect, but this is mainly because the stock market rarely has average returns, as most years are up a lot or down a lot. Could stocks gain more than 14% annually over the next five years to double again before we hit a new decade? We aren’t saying it will happen, but we are saying it isn’t as out of reach as it might sound.

The bottom line, it has been quite a run and 40,000 is a time to reflect where we’ve been and where we are now. Carson is one of the few places that turned bullish in late 2022 and we’ve remained there this whole time. Our Midyear Outlook will come out in a few months (we are working on it now) and the good news is we still see many more positives than negatives. We appreciate all the readers and followers and here’s to more new highs coming in 2024!

For more content by Ryan Detrick, Chief Market Strategist click here.

02248343-0524-A