Cloud performance took center stage, delivering solid 28% growth, consistent with the previous quarter. While some may view this as a minor letdown, the growth suggests that Microsoft continues to win share from the market leader, Amazon’s AWS. For long-term investors, success in the cloud extends beyond the tens-of-billions of dollars in profits; it’s about owning the platform that underpins all computing. As demand for computing power continues to intensify, especially for applications like artificial intelligence, the expense of purchasing and maintaining the necessary hardware is out of reach for most businesses and individuals. It’s not just AI, Netflix’s library has over 17,000 titles that even the savviest cinephile couldn’t store, let alone organize and play on demand. As computational demands increase, the world will increasingly run on the cloud.

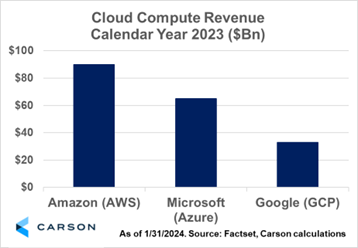

Three players dominate the cloud computing scene: Amazon’s AWS is the largest, followed by Microsoft’s Azure, with Alphabet’s Google Cloud Platform trailing as a distant third. Amazon pioneered cloud services, out of necessity to manage its sprawling retail operation. If you’ve ever ordered from Chewy, or Doordash, or Pinterest, it was made possible by AWS. Microsoft, leveraging its widely used Windows-based tools, differentiated Azure with seamless cloud integration – particularly attractive to retailers wary of Amazon’s competition. As Google strives to stay relevant in cloud, differentiating factors lie in the tools and services offered. This differentiation is incredibly important because it implies cloud computing isn’t a commodity; rather, these are distinct services that should increasingly enjoy pricing power.

Given the value-add of software and tools, artificial intelligence emerged as a game-changer. Microsoft highlighted that demand for AI applications drove 6% of Azure’s growth, implying a nearly $4 billion business still in its infancy. Given that the world will access AI primarily through the cloud, these providers have become some of the most valuable businesses globally (Microsoft recently eclipsed Apple as the largest publicly traded company). While a myriad of companies will harness the power of AI, their access will predominately be facilitated through the cloud platforms and create an increasingly powerful ecosystem for their owners.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Shares of Microsoft traded down marginally after the report which isn’t surprising given the more than 20% run shares enjoyed since their last earnings. I’m often asked about Microsoft’s $3 trillion valuation and whether the stock is overpriced. On any given day, the market decides what the appropriate multiple is. However, in coming years, Microsoft is expected to generate in excess of $100 billion in annual free cash flow, while also investing more than $50 billion a year in cloud computing and artificial intelligence. With yearly sales approaching $250 billion and growing at a double-digit rate – an anomaly for a business of this size – coupled with its commanding position in cloud computing and early lead in artificial intelligence, a 30x forward free cash flow multiple for a company with these exceptional characteristics doesn’t appear extravagant or indicative of a bubble, in my opinion.

For more of Jake’s thoughts click here.

02094354-0224-A