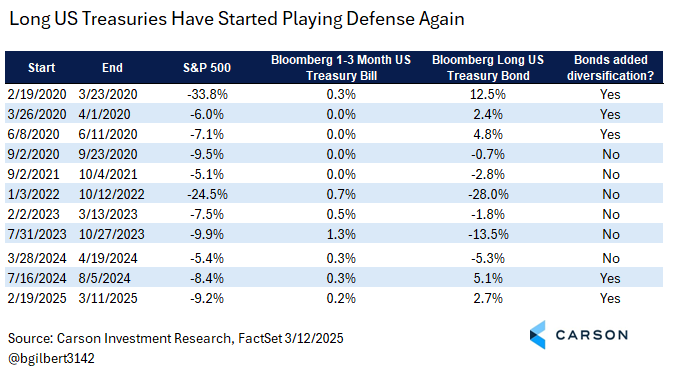

For the second consecutive decline of 5% or more in the S&P 500, long Treasuries have been playing defense, at least so far. Here “playing defense” means a return better than short Treasuries, although over short periods of time that’s usually near zero. I’m using long Treasuries here as a proxy for bonds, because they tend to play the strongest defense when bonds are working.

Is that a reason to “like” bonds again? It depends on what you mean by “like.” It’s not a reason to prefer bonds to stocks. In fact, over the course of the drawdown bonds have grown somewhat less attractive and stocks more attractive. And while we’ve downgraded our growth expectations and the likelihood of “animal spirits” giving the economy a boost, our baseline remains that strong income growth and the potential for a fiscal boost in the back half of the year makes a recession in 2025 unlikely. We would expect that to be a good environment for stocks (See Carson Global Market Strategist Sonu Varghese’s excellent commentary here and here.) The calendar also still looks generally supportive of equity gains over the rest of the year. (See Carson Chief Market Strategist Ryan Detrick’s always insightful thoughts here.)

There continues to be a lot of uncertainty around interest rates, as the Fed remains “higher for longer” amid the uncertain impact of policy, especially tariffs, on inflation. This doesn’t mean the Fed won’t cut, but only that outside a clear deterioration in economic conditions, the pace of rate cuts is expected to be slow and the point at which rate cuts stop will likely be higher than what we’ve seen starting with the Great Financial Crisis. Right now the market is pricing in three rate cuts over 2025 with the next cut coming at the June 17 – 18 FOMC meeting.

But bonds have two and a half things going for them that they didn’t have leading into the “bondmageddon” that started in August of 2020 and lasted until October of 2022:

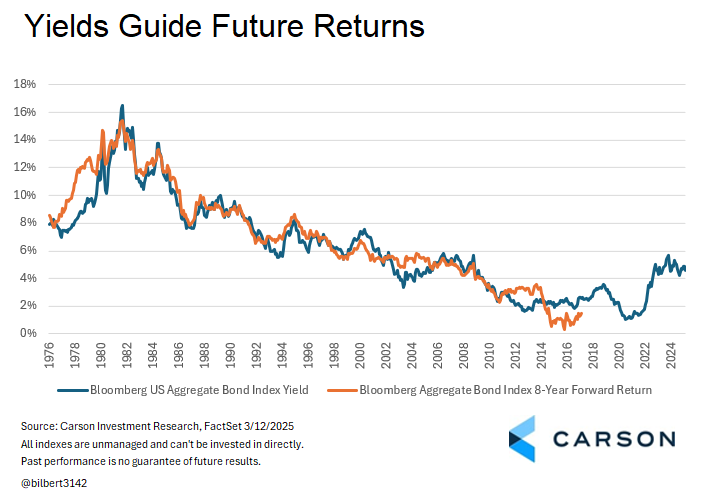

-Starting yields are higher, and over time (roughly the average maturity of the bonds currently in the index), yields are a good forecaster of returns (see below). Think of it this way. As of yesterday, the yield on the Bloomberg Aggregate Bond Index was 4.65%. If yields don’t move, that’s your expected return over the next year and provides some cushion if yields press higher. Back in August 2020, the yield on the index was 1.05%. That means that bond yields need to rise enough to cause a 3.6% decline in bond prices before 2025 is on roughly an equal footing with 2020.

-Longer-term yields (10-year Treasuries and longer) are slightly above shorter-term yields. Not by much given recent yield declines, but before the Fed started cutting rates, shorter-term yields were more attractive.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

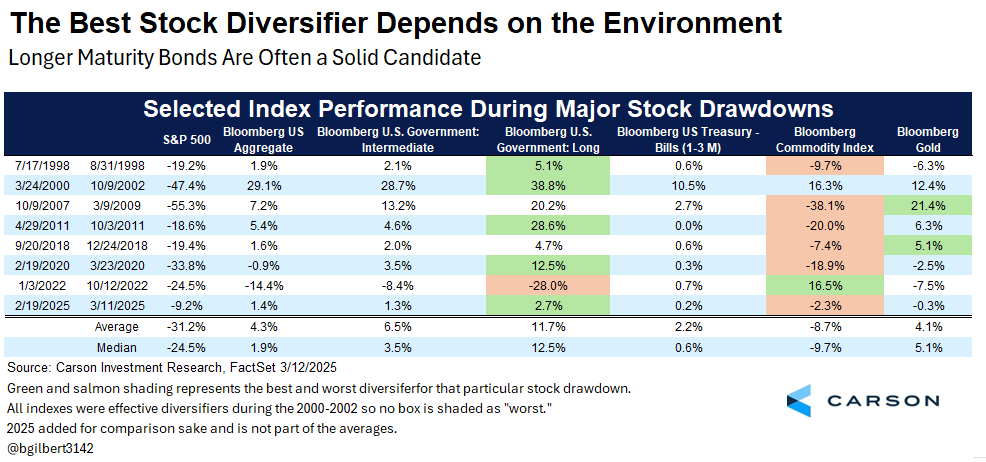

-And finally, bonds have been playing defense of late, but this one only counts ½ since it’s not going to play out in all scenarios. If we get a scenario where growth expectations slow meaningfully but inflation expectations rise, the correlation of stocks and bonds could rise, with bond declines accompanying stock declines. But slower growth is usually disinflationary, and if that outweighs any inflationary policy impact, then bonds can continue to play defense during a growth scare. These possibilities are captured nicely in the below chart from our Outlook 2025 with the current sell-off added for comparison.

So how to handle bond positioning? Since we are overweight equities, we remain biased toward higher quality bonds, preferring to take more equity-like risk in equities. That includes some exposure to Treasury inflation-protected securities (TIPS). Since we are underweight bonds, we are willing to run at a level of interest rate sensitivity somewhat above the Bloomberg US Aggregate Bond Index, which we use as a bond benchmark. But on a portfolio level that still leaves us below our multi-asset benchmarks in overall rate sensitivity. And we do look for ways to diversify stocks outside of just bonds (and diversify bonds!), including a tactical allocation to gold, incorporating trend-following strategies that can provide exposure to a wide range of assets, and even incorporating lower volatility stock exposure into our portfolios.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

7734976-0325-A