We’re releasing our 2024 outlook this week, and a big part of our investment process involves understanding the economic backdrop. To that end, Carson Investment Research produces a Leading Economic Indicator (LEI) for the US and 29 other countries, each one custom built to capture the dynamics of those economies. The individual country LEIs are also subsequently rolled up to a global index to give us a picture of the global economy. These were all developed more than a decade ago and form a key input into our asset allocation decisions.

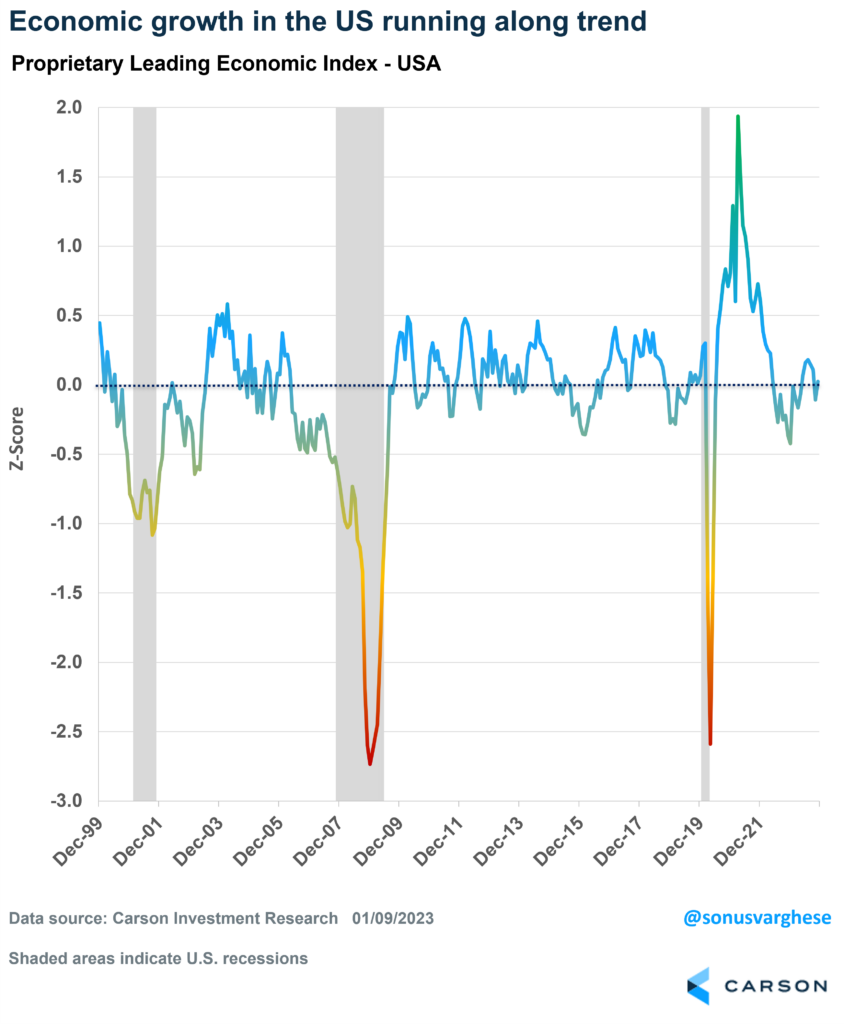

Right now, our LEI for the US points to economic growth along trend

In other words, the odds of a recession in the near-term (3-6 months) are really low. Of course, surprises can happen (remember Covid?), but barring that we believe recession is unlikely.

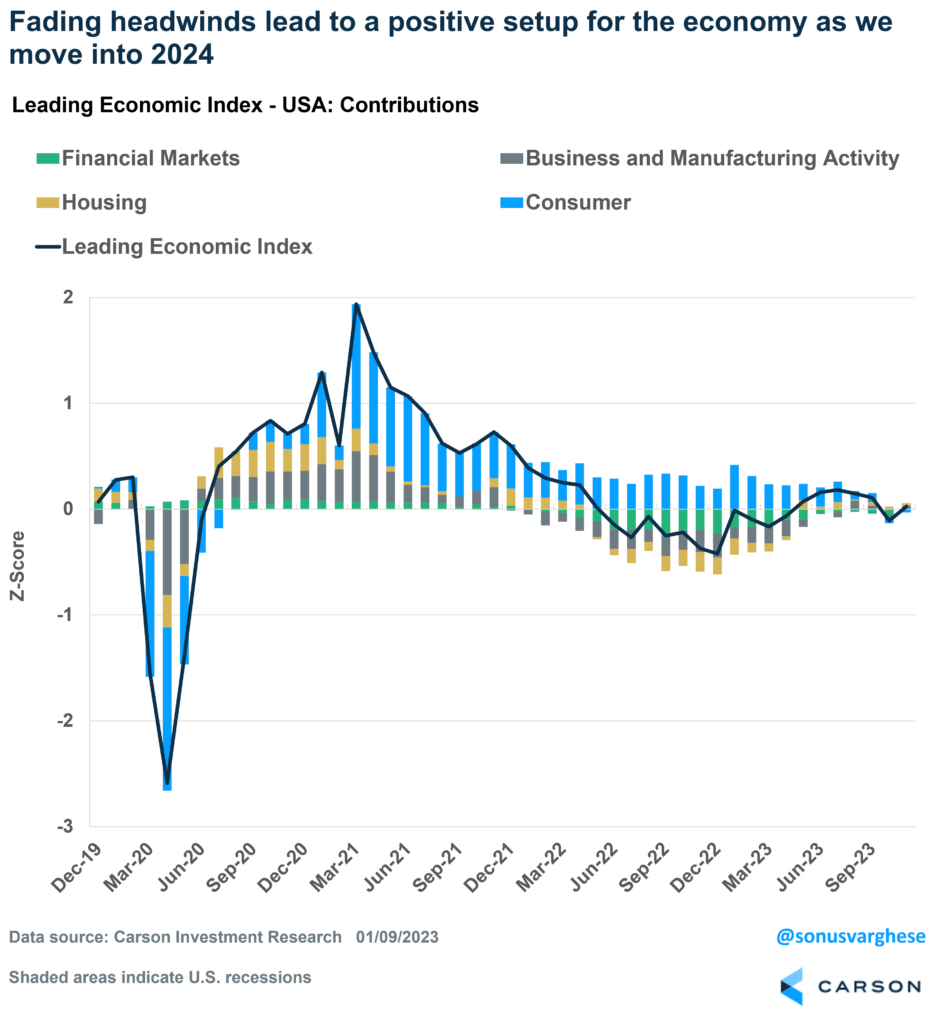

Our LEI includes 20+ components, including, consumer-related indicators (which make up more than 50% of the index), housing activity, business and manufacturing activity and sentiment, and financial markets. This contrasts with other popular LEIs, which are premised on the fact that the manufacturing sector, and business activity/sentiment, is the leading indicator of the economy. This worked well in the past but is probably not indicative of what’s happening in the economy right now.

The LEI captures whether the economy is growing below trend, on-trend (a value close to zero), or above trend. It can capture major turning points in the business cycle. For example, it declined ahead of the actual start of the 2001 and 2008 recessions. Last year, the index signaled that the economy was growing below trend, and that the risk of a recession was elevated. Note that it didn’t point to an actual recession. Just that “risk” of one was higher than normal. In fact, our LEI held close to the lows we saw over the last decade for a typical mid-cycle slowdown, especially in 2011 and 2016 (after which the economy, and even the stock market, recovered).

Right now, the situation looks better than it did a year ago.

Breaking our leading economic index for the U.S. into underlying components captures how the economy has evolved since the pandemic hit three years ago. In a nutshell, the consumer has driven the recovery and carried the economy through last year. That’s in the face of major headwinds, mostly driven by a very aggressive Federal Reserve (Fed) – which adversely impacted financial conditions and borrowing costs, housing, and business investment and manufacturing.

The good news is that with the inflation pulling back, we see the Fed cutting rates in 2024. With markets expecting the pivot sooner rather than later, we’re already seeing previous headwinds fading, and that in itself is a big deal for the economy.

- Financial conditions are easing, with interest rates pulling back and stocks higher.

- Housing activity is picking up as mortgage rates pull back.

- Business and manufacturing activity seems to have bottomed in 2023.

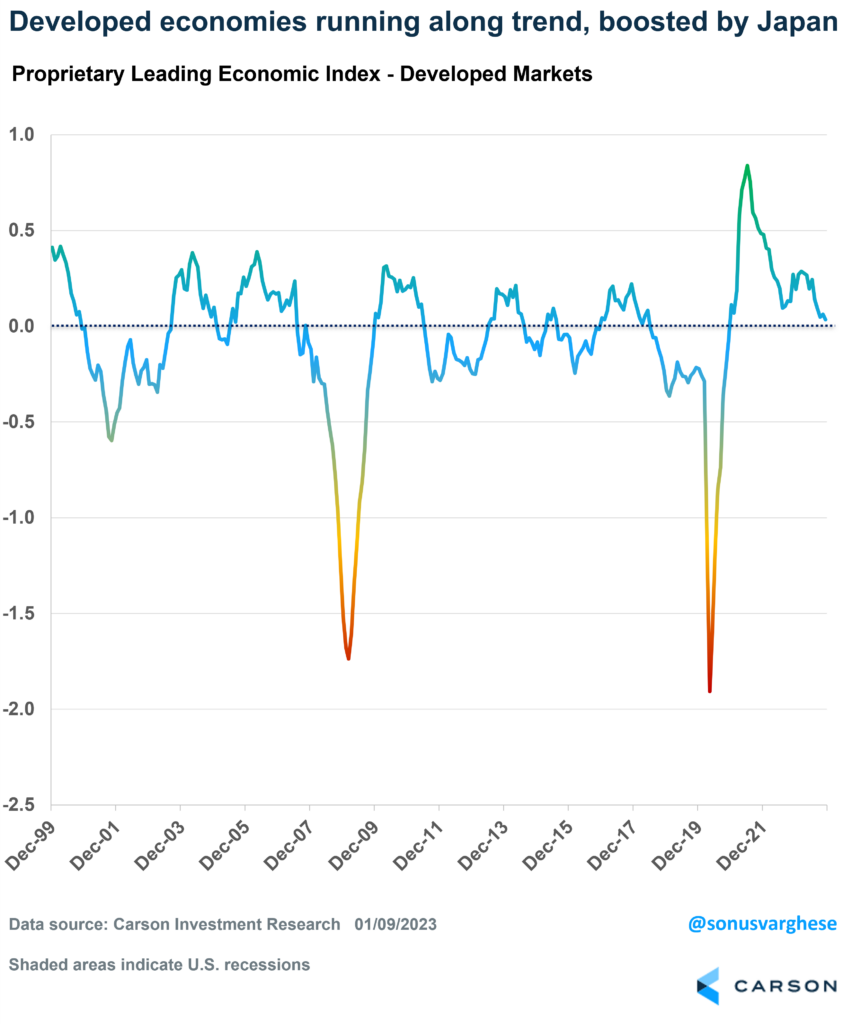

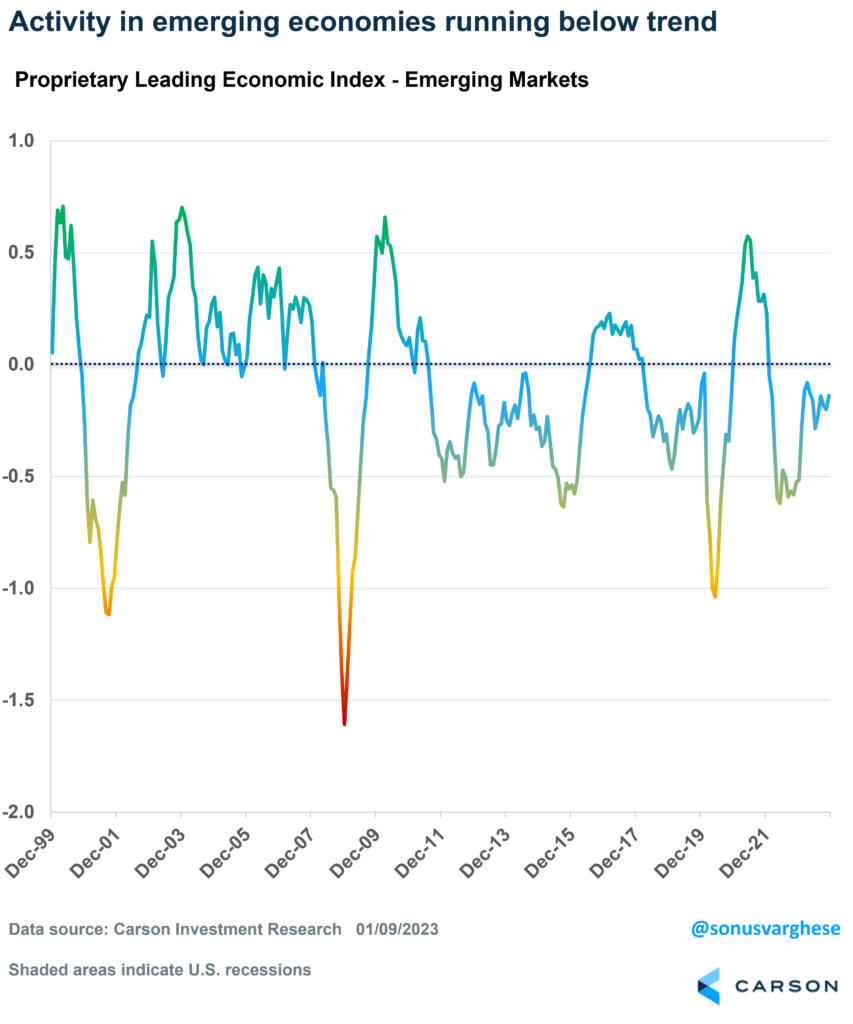

The Economic Picture Is Mixed Abroad

Our LEI for developed markets (excluding the U.S.) points to above-trend growth. This is mostly on the back of activity in Japan, which is running above trend. That’s in sharp contrast to Europe, where powerhouses like Germany and France remain in bit of a funk.

At the same time, growth in emerging markets is running well short of historical trend. This is mostly due to slower growth in China, but also places like South Korea, Indonesia, and Malaysia. The notable exceptions are India, Brazil, and Mexico, where economic activity is running relatively strong.

As a result of the global economic backdrop, we start 2024 overweight stocks relative to bonds in our portfolios. And within stocks, we are overweight U.S. stocks, neutral on developed market ex U.S. stocks, and underweight emerging markets. We are deeply aware of home bias, the tendency to prefer investing in one’s own country simply out of familiarity rather than based on an investment rationale. On top of that, international stocks are valued more cheaply than U.S. currently, and so it would seem straightforward to keep them at neutral weight. However, our macroeconomic views form the basis for overweighting U.S. stocks over others. Within the U.S., we also believe the recent stock market rally will broaden out, and so we are overweight small and mid-cap stocks, as well as sectors like financials and industrials.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Keep an eye out for our 2024 Outlook “Seeing Eye to Eye” for a more detailed discussion of how we see the economy and markets evolving in 2024, and beyond. In the meantime, here’s the latest Facts vs Feelings podcast episode, where Ryan and I discuss the outlook.

For more of Sonu’s thoughts click here.

02064295-0124-A