Hello from cold and rainy Myrtle Beach! We are doing a family vacation in the second part of this week to North Myrtle Beach and we are stuck inside due to a ton of rain today. The next few days should be better, but I had some free time, so I decided to do a quick blog as we head into the weekend.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

As I noted in Why Stocks Could Make a New High in 2023, I discussed how a good first half of the year tends to suggest potential strength in the final six months of the year for stocks. Today, I wanted to dig into that some more.

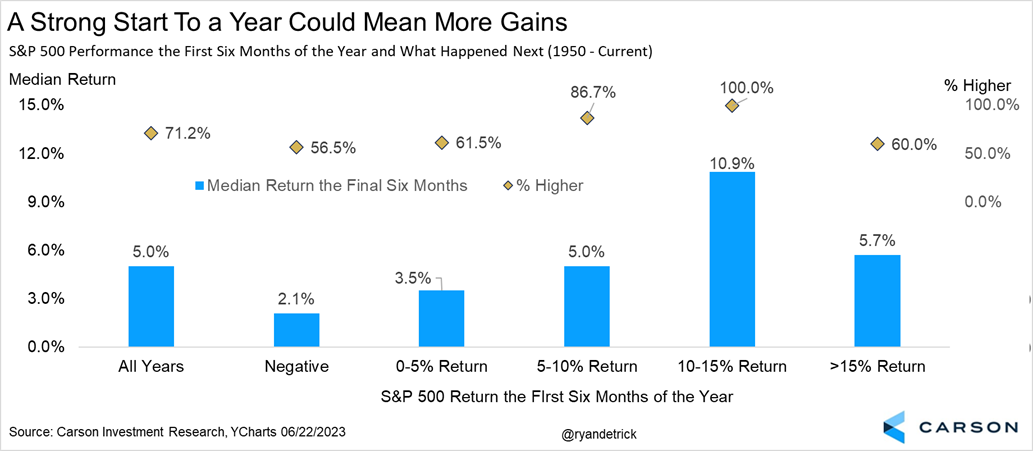

We found that the average year since 1950 has gained a median of 5.0% in the final six months of the year and has been higher 71.2% of the time. Similar to many of the other studies we’ve shared this year, the better things tend to do suggests better future performance.

Here’s what I mean, when those first six months were lower then historically the next six months were up a median of only 2.1%, versus up a very impressive 10.9% median return if those first six months gained between 10-15%.

Given the S&P 500 is up less than 14% year-to-date as we wind down the month of June, stocks are in that sweet spot for future returns and it could bode well for the rest of this year.

What about if the S&P 500 gained more than 15% in the first six months? Well, that includes 1987, which greatly skews the data. If you remove that historic outlier, the median return for the final six months jumps to 8.4% from 5.7%, well above the median final six-month return of 5.0%.

Like I said, this was a quick blog post, as I see some sun coming out. I hope everyone has a nice weekend and here’s to some sun down in the great state of South Carolina and some more sunny times for investors in 2023!