You just can’t put this economy down. There are expectations and then there’s reality. Earlier this year, expectations were for a “mild recession” in the second half of 2023, and then that got revised to a more optimistic outlook as time went by (and data came through). On the eve of the third quarter GDP release, expectations for growth had risen as high as 3.8%. The actual reading blew past those expectations, with the economy growing 4.9% in Q3. That’s after adjusting for inflation.

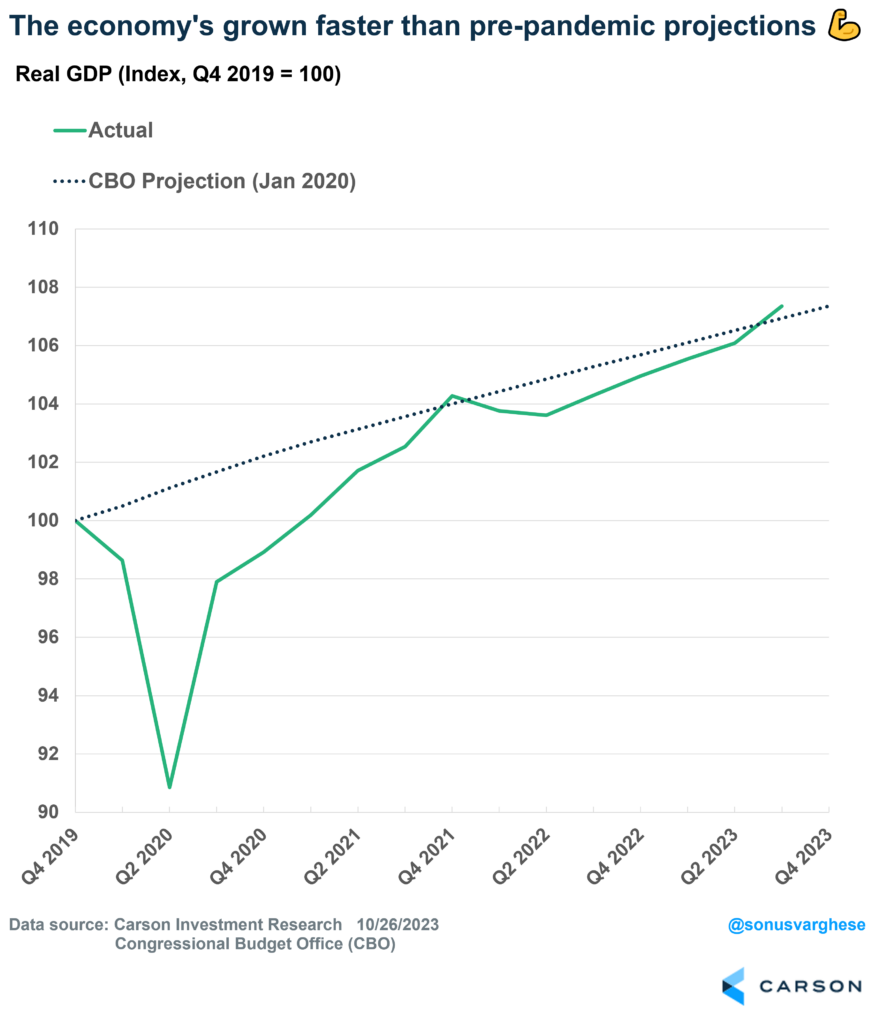

Sit with this: Real GDP growth has grown faster than what the Congressional Budget Office (CBO) projected just before the pandemic, in January 2020. They also projected that the unemployment rate in 2023 will be 4.4%. It’s at 3.8% now.

It’s important to keep perspective as well, because the economy has grown more than expected (in real terms) in the face of 3 massive shocks:

- A worldwide pandemic that killed millions of people, resulting in massive job losses and businesses going under.

- An energy price shock that sent inflation to the highest level in 40 years. Historically, energy shocks have pushed the U.S. into a recession, but not this time.

- The most aggressive Fed tightening cycle since the early 1980s. Surging interest rates crushed the housing market in 2022, which was not unexpected. Historically, housing downturns have preceded recessions, but not this time.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

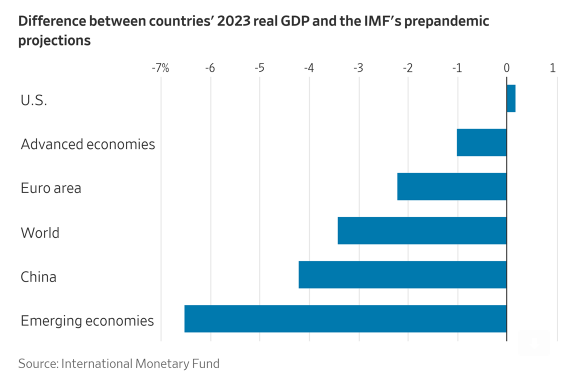

Keep in mind that the trajectory of economic growth was not a given, considering the scale of the shocks. In fact, most other developed market economies have seen economic scarring from Covid and its aftermath, with significant output loss relative to pre-pandemic expectations. The US is the odd one out, with output running above pre-pandemic expectations.

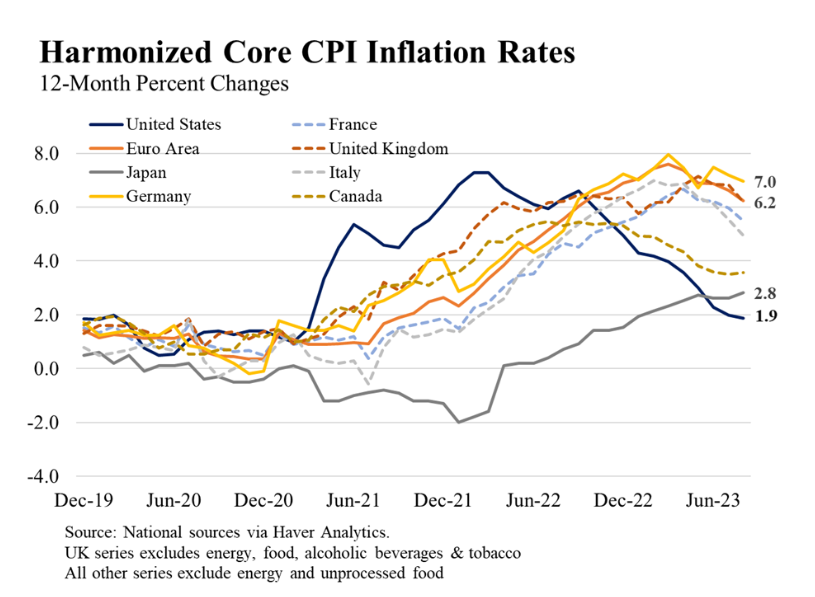

Even better, the inflation trajectory in the US is a lot better than in most other places. Despite pushing a lot more fiscal stimulus into the economy, inflation in the US is now running below a lot of other developed economies. The chart below shows core inflation – excluding food, energy, and owners’ equivalent rent – enabling cross-country comparisons.

So, What Comes Next?

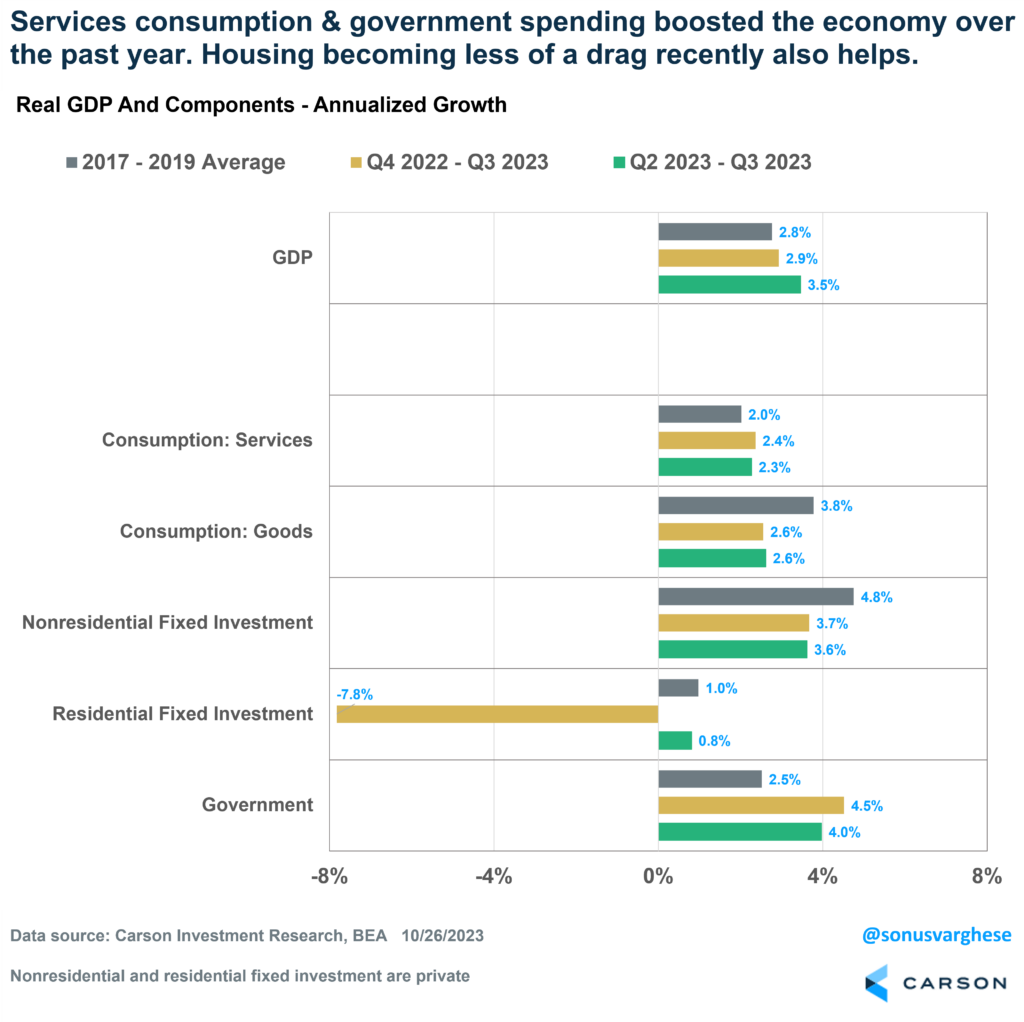

A big reason for GDP growth coming in close to 5% in Q3 was because businesses rebuilt their stock of inventories – it added 1.3 percentage points to the headline number. But inventories (along with net exports) can be volatile from quarter to quarter. It helps to expand the horizon a bit. What’s incredible is that the economy has grown faster than the 2017-2019 pace of 2.8%. Over the last year, it’s grown 2.9%, and over the last two quarters, it’s grown 3.5% (all in real terms). That should give you an idea of the current underlying speed of the economy.

Powering this are two major components that make up just over 60% of the economy, which should help us think about what could come ahead.

- Services consumption (45% of the economy) is running ahead of its pre-pandemic pace.

- Government spending (17% of the economy) is also running strong on the back of federal government nondefense and defense spending and investment, as well as state and local government spending.

More recently, housing has also gone from being a massive drag on the economy to a slightly positive contributor. Residential investment contributed to GDP growth in Q3 for the first time in 10 quarters. Incredibly, that’s come in the face of mortgage rates north of 8%. What’s happening is that high mortgage rates are locking a lot of homeowners in their homes, so the inventory of existing homes is low. That’s pushing a lot of potential homebuyers into the new homes market, boosting single-family housing construction. In any case, this dynamic is likely to continue and even if housing doesn’t contribute a lot to GDP going forward, it’s unlikely to drag on the economy as much as it did in 2022.

Coming Next for the Big Two: Services Spending and Government Spending.

Stronger spending is a direct result of stronger incomes across all workers in the economy. Overall income growth is running around 5% right now, thanks to strong employment gains, strong hourly wage growth, and hours worked running similar to what it was pre-pandemic. Plus, as I pointed out in a prior blog, household balance sheets are in good shape. Median net worth rose 37% between 2019 and 2022. So, households feel less urgency to save and solidify their balance sheets, unlike what happened after the stock market and housing crash in 2008. Yet another tailwind: gas prices are falling. Nationwide average gas prices have fallen from about $3.90 a gallon to $3.50. Food inflation is also easing. That’s going to be a boost for household wallets.

With respect to government spending, it’s unlikely more money for nondefense gets authorized by Congress given the political makeup. However, there’s plenty left in the tank within the Bipartisan Infrastructure Act, CHIPS Act, and IRA – only a fraction of the spending authority given by Congress has been exercised to date. There’s more to come.

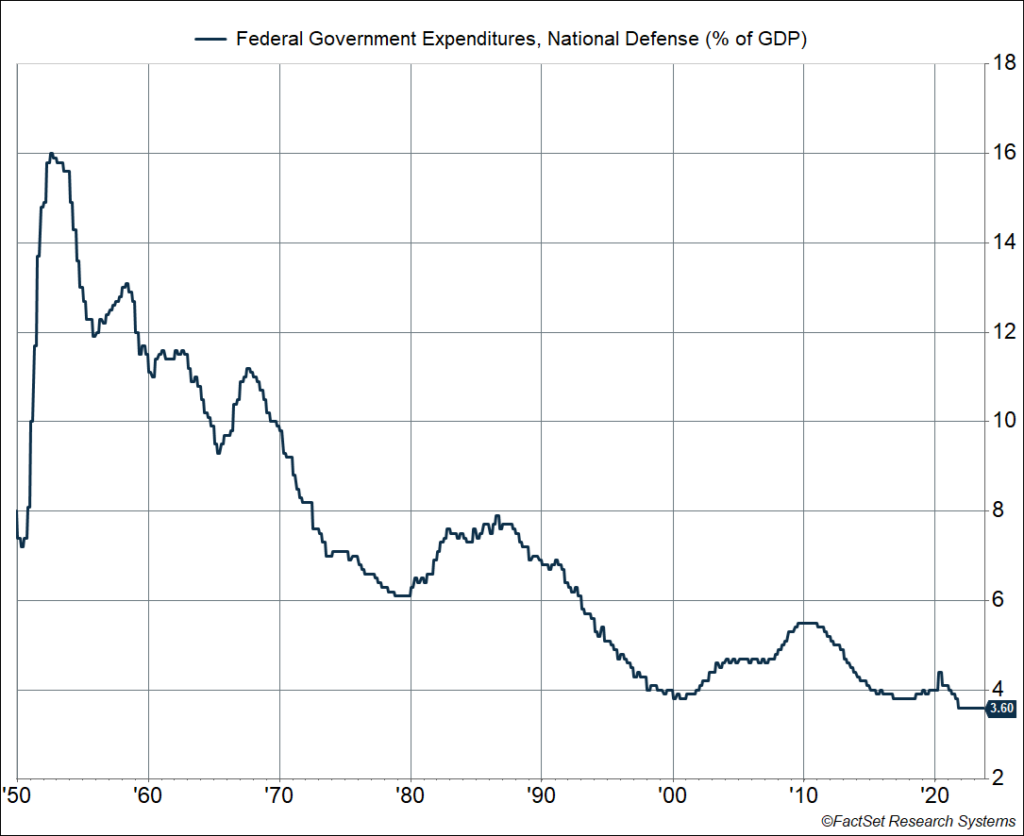

Defense spending rose at an annualized pace of 8% in Q3, the fastest pace since 2020 Q4. Defense spending is currently just 3.6% of GDP, close to an all-time low. It’s likely this will move higher going forward.

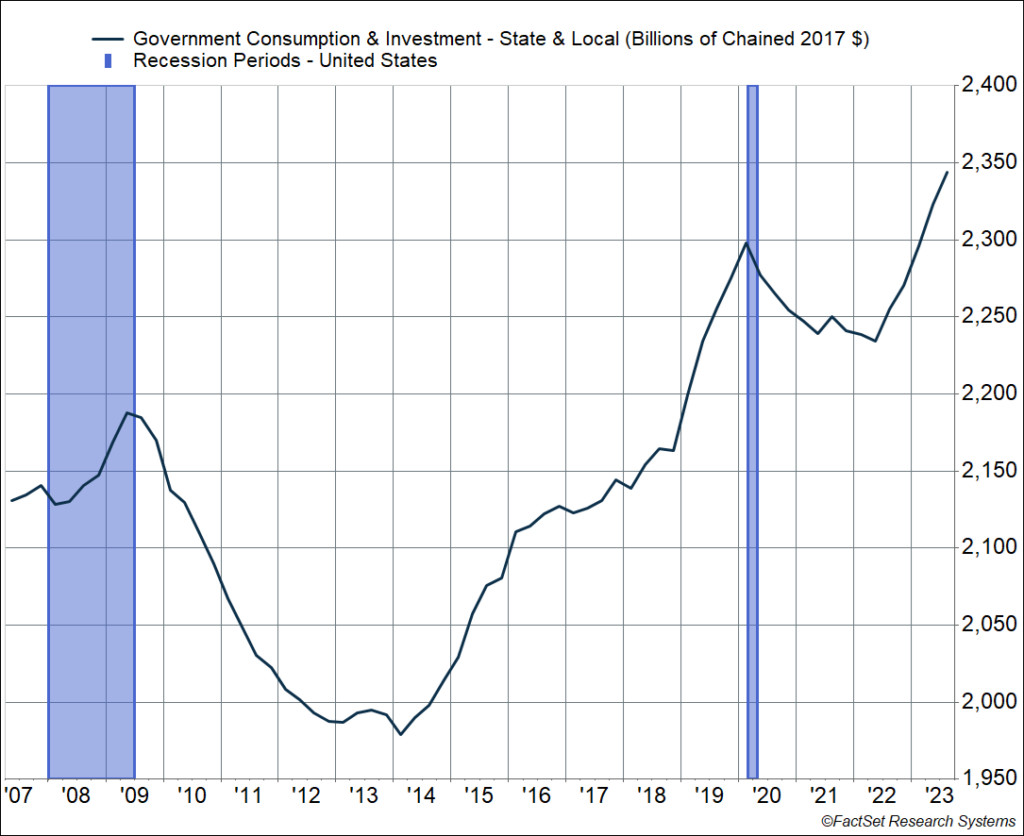

State and local governments spending makes up 11% of the economy, which is significant. They cut back significantly between 2020 and 2022, in preparation for a storm. But they’re starting to ramp up spending and investment, and this likely to continue over the next few quarters. Sales taxes and property taxes are likely to remain strong if spending remains strong (likely if we avoid a recession, as we expect), and we avoid a housing market crash (also likely given demand dynamics). This is in sharp contrast to the post-Financial Crisis period when states struggled and cut back on spending for several years.

What Does This Mean For the Fed?

There are two key pieces to how this data matters for the Fed.

- Economic strength solidifies the idea of higher for longer. That’s likely to continue until we see some softness in the data, which is coming given the torrid pace of growth in Q3 is unlikely to continue.

- However, slower inflation will probably stay their hand from raising rates further. Core inflation, as measured by the personal consumption expenditures index, clocked in at 2.4% in Q3. That was softer than expected and the slowest pace since the end of 2020.

Equity markets appear to be struggling to come to terms with the idea of elevated interest rates. But ultimately, higher rates are mostly just reflecting a stronger economy, and that’s good news for profits. Ryan Detrick, Chief Market Strategist, just wrote about how forward estimates of profits and profit margins are rising. It’s just that we’re currently experiencing a “good news is bad news” dynamic – that’s likely to shift eventually.

Ryan and I recently chatted with PIMCO Group’s Chief Investment Officer Dan Ivascyn in Newport Beach, California, for our Facts vs Feelings podcast. PIMCO manages around $2 trillion, and Dan leads the management of some of the largest bond mutual funds in the world. He had some great insight into what’s happening in the bond market right now, and how he thinks about interest rates. Take a listen:

1954393-1023-A