“To see what is in front of one’s nose is a constant struggle.” -George Orwell

What I’m about to say might not go over well, but I’m going to do it anyways. Would you believe that in some ways higher interest rates have actually helped consumers? I get it. Half of you are furious with me for saying this, but hear me out first.

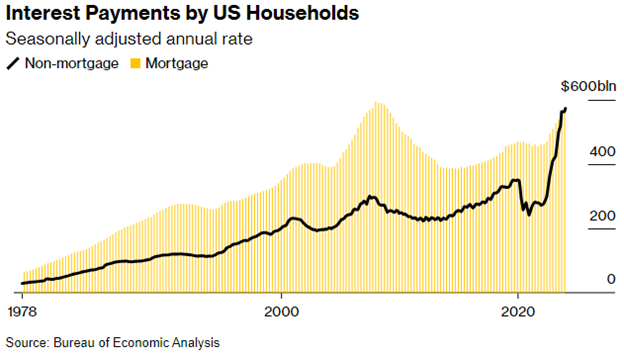

Here’s the chart that set X on fire recently. As interest rates have soared, so too have payments on debt. The big worry is eventually this will crush the consumer. I can admit I saw this first hand this year, as my daughter turned 16 and became a driver, and the rate for a car loan was substatially higher than when I got a car two years prior. Higher rates are real and when you use debt, they are adding to the pain.

Let’s look at that chart above one more time. We know that many mortgages are locked in at sub 3.5% rates and that is why interest on mortgages hasn’t spiked nearly as much as non-mortgage interest payments (think credit cards and car loans). Still, we know consumers are paying more for things if they are using debt. How can this possibly be a good thing?

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

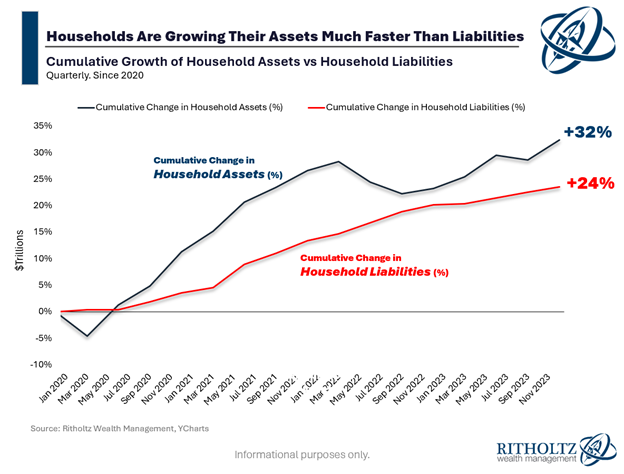

I already wrote about why consumers appear to be in their best shape in decades here, so read this one when you get a chance if you haven’t yet (think wealth increasing more than debt). But now I want to take the other side of higher rates and that is savers are finally being rewarded.

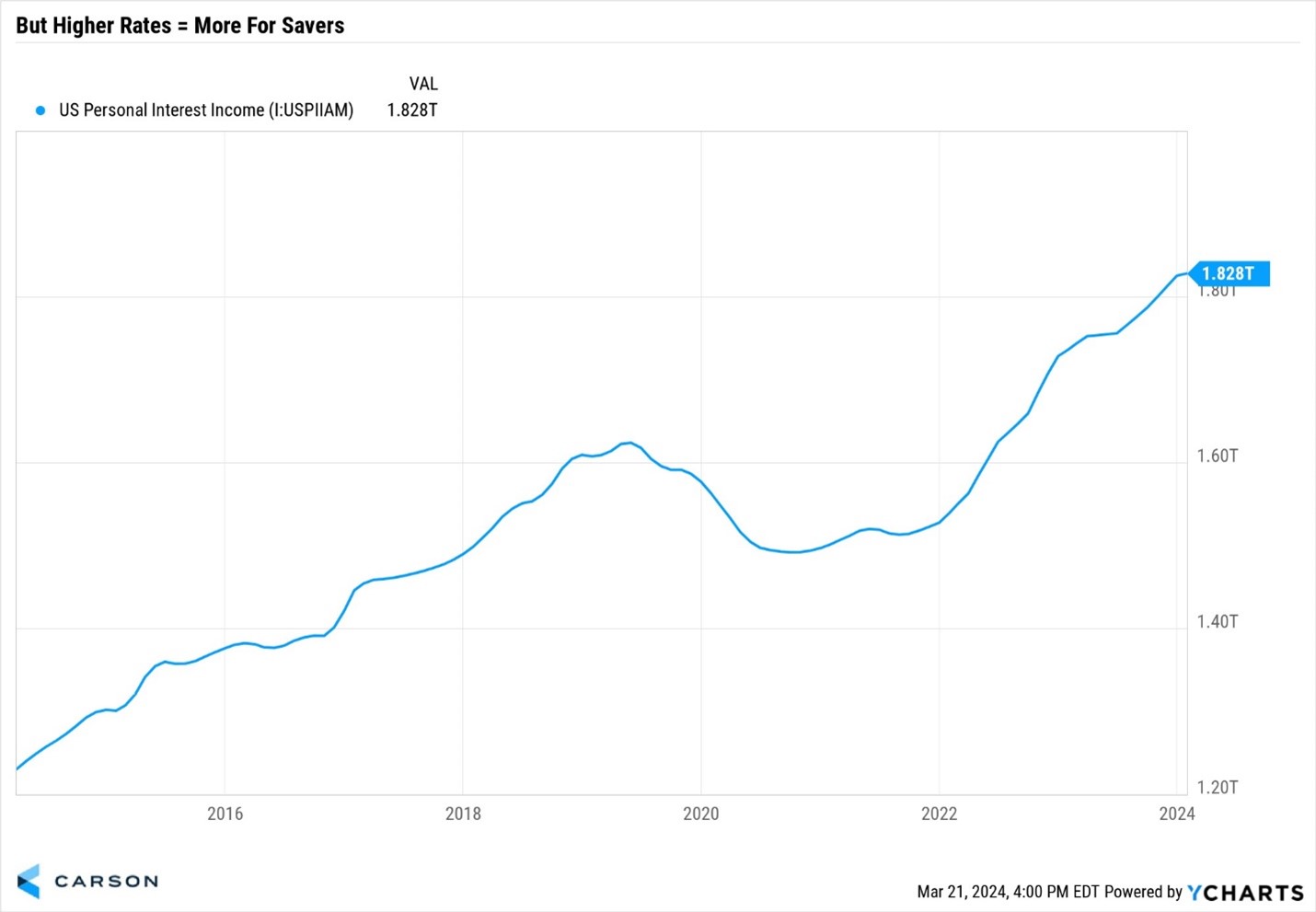

It is estimated there is more than $6 trillion in money markets currently and most of those accounts are earning close to 5%. That right there is a plus side to higher rates. Yes, no one likes all the debt we have and no one likes seeing interest rates on credit cards soaring, but the flipside is that those who have cash are being rewarded like no time over the past few decades. I can’t tell you how many times I was told over the past 15 years how savers are getting nothing on cash. Well, that isn’t the case now.

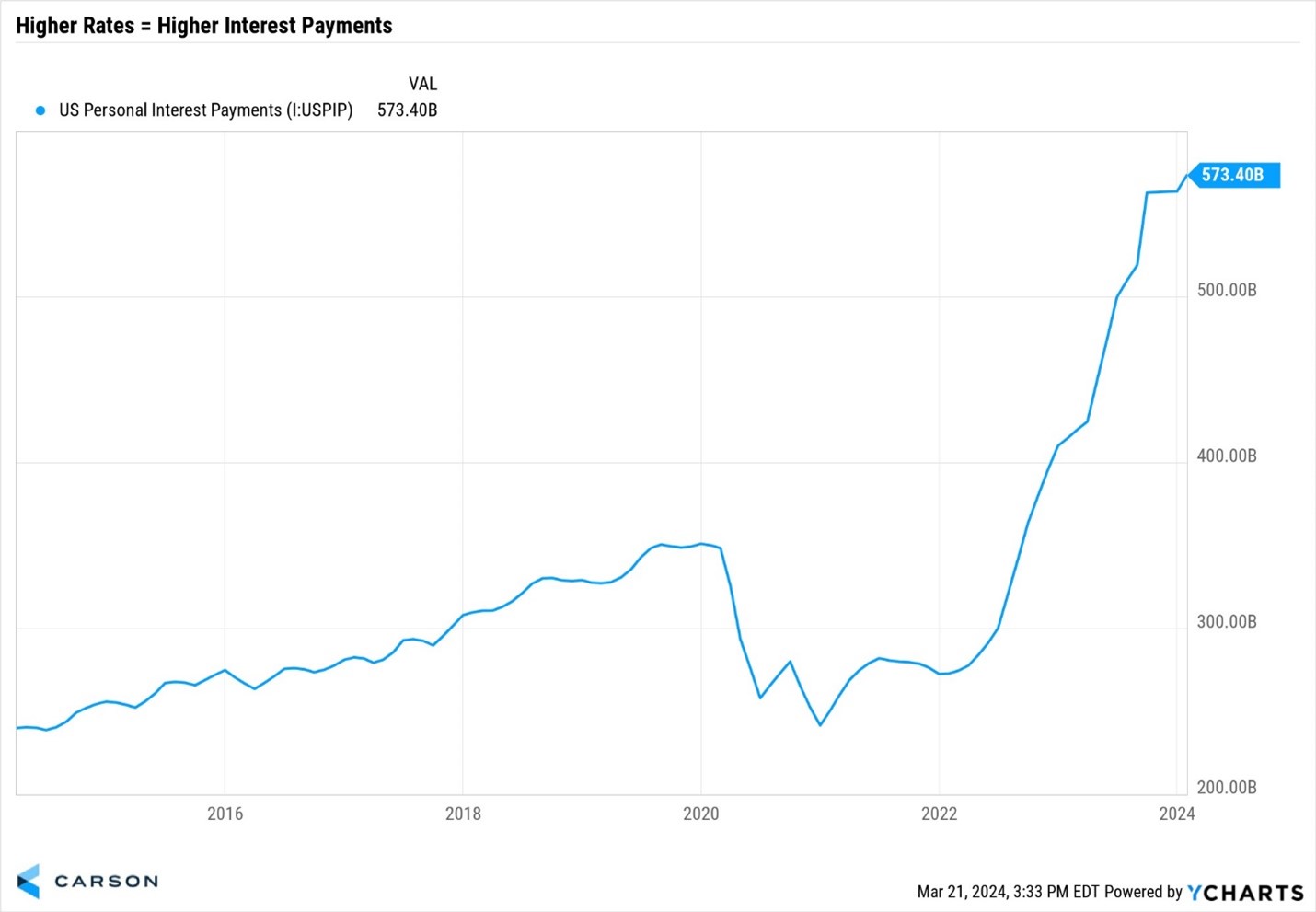

Looking more closely, interest payments surged from $241.5 billion in December 2020 to the current level of $573.4 billion, for an increase of nearly $332 billion! Given the jump in rates from 0% to above 5%, higher payments make sense and no doubt would likely hurt consumers, as they are now paying more for things any time they borrow 😢.

But while higher rates might mean higher borrowing costs, it also means higher rates of return for savers. For some reason, we don’t hear nearly as much about this positive development 😕. Our team was hated last year for saying stocks would do well and the economy was going to avoid a recession. One of the main reasons we saw light at the end of the tunnel was we believed the consumer was quite healthy and would be able to weather the higher rates. That has happened. But another major plus (and honestly, not one we focused on) has been those same higher rates have helped savers.

Now let’s look at personal interest income. This was $1.5 trillion in December 2020, but was up to $1.83 trillion last month, for a jump in personal interest income of $330 billion. In other words, interest payments were virtually offset by the jump in interest income! 😁

We are aware this isn’t an ideal backdrop for everyone, as many are struggling. But the truth is if you’ve owned stocks and a house the past decade or more, are college educated, and willing to work hard, then your net wealth is likely near all-time highs and these are the people who likely move the needle on the economy. My friend Ben Carlson wrote a great blog recently discussing many of these concepts and I agree with nearly everything he said. I especially liked this chart that showed household assets have grown more than household liabilities since 2020, pushing back against the narrative that we are drowning in debt.

For more of our latest thoughts on this bull market, why we aren’t in a bubble, the Fed, the economy, and more, be sure to listen our latest Facts vs Feelings podcast or watch it below.

For more content by Ryan Detrick, Chief Market Strategist click here.

02168673-0324-A