“I am an optimist because I don’t see the point in being anything else.” -Abraham Lincoln

And with that, the first half of the year is a wrap. What can we say other than all those calls for a recession and new bear market lows sure didn’t play out. We were one of the only places predicting there wouldn’t be a recession this year and to look for stocks to possibly gain 12-15% (and maybe more with some good news). It was a lonely call and we took a lot of heat for it, but we are noticing more and more shops are coming over to the no-recession camp.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

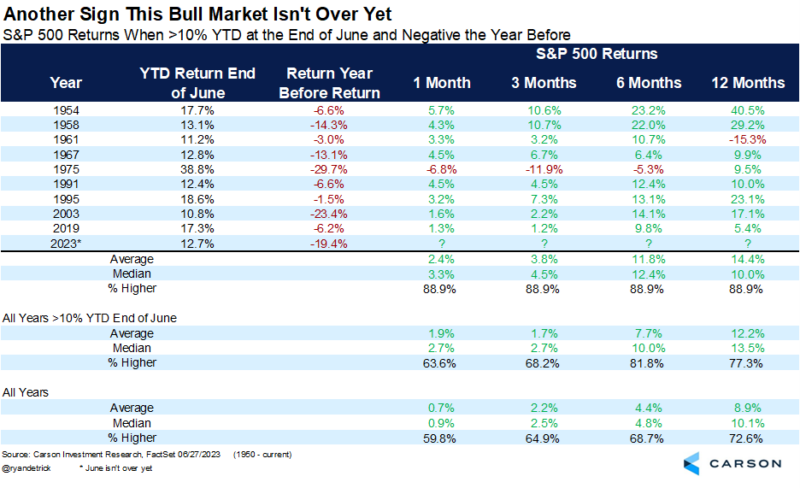

I noted in Why a Sunny Second Half of 2023 is Likely some reasons to expect more gains after the big start to this year. Well, here’s another angle on that. I looked at all the years that were up more than 10% at the midpoint of the year, but were also negative the year before. In other words, a potential slingshot move. Sure enough, stocks did even better when this took place, with the S&P 500 higher those final six months eight out of nine times and up a median of 12.4% – well above the median final six month return of 7.7% when those first six months gain more than 10%.

So, can this surprise summer rally continue? As Honest Abe would say, might as well be an optimist and we think it can, as July historically is a strong month. Of course, it isn’t just about seasonals, as the realization the economy may not be going into a recession and a Fed that is likely done hiking are both also positives, which should keep things moving higher in July.

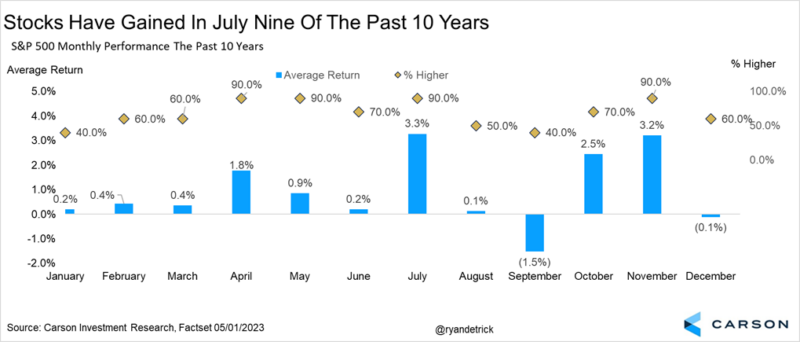

For starters, stocks have gained 9 of the past 10 years in July, with no month sporting a better average return over the past decade than the 3.3% July gain for the S&P 500. Why is this you ask? The one thing I keep thinking about is July kicks off Q2 earnings season and in the past 10 years overall we’ve seen a lot of doubt out there. It is likely that earnings come in better than expected, calming many of the fears and allowing for a rally. We think that could happen once again this year.

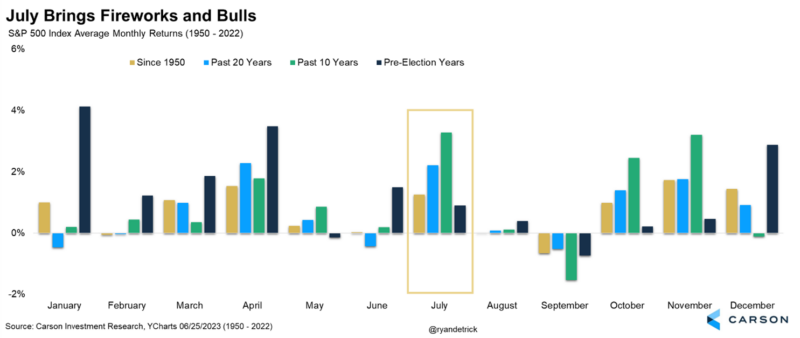

Let’s be clear though, July is usually a good month in the middle of the weak summer months. The chart below shows this nicely. Since 1950, stocks gain 1.3% on average in July, but this goes up to 2.2% in the past 20 years and 3.3% in the past decade. Pre-election years are a little weaker, up 0.9%. Lastly, when stocks gain more than 3% in the usually weak June (15 times since 1950), stocks gain only 0.8% on average and are higher only 8 times. So, there could be the chance June steals some of July’s gains.

Lastly, we’ve shared the next chart many times the past few months, as it suggested the potential for a summer rally when very few expected it. We call this the Carson Cycle Composite, as it is a proprietary indicator that combines the past 20 years, pre-election years, the third year of a new President, and years that saw stocks gain at least 5% in January (like ’23). As you can see, a rally in July is normal and we don’t believe ’23 to be any different.

We want to be clear, at some point stocks will take a well-deserved break. August, September, and October usually can see this volatility and it very well could happen again this year. But we remain overweight equities and we’d use any seasonal weakness as an opportunity to add to core equity exposure.

For more of our thoughts on July, the strong economy, and more, watch our latest Facts vs Feelings podcast with Sonu and me here.

1820547-0623-A