We’ve gotten a lot of questions about the potential impact of a government shutdown and the restart of student loan payments in October. Ryan wrote about the government shutdown yesterday, while today I will take a closer look at the student loan payments restarting. The fear is that a sudden resumption of payments will result in a sharp pullback in consumer spending and send the economy into reverse.

Student loans started accruing interest on September 1st, and payments become due starting October 1st. That’s after a long pause. The federal government paused payments for all federal student loans, with no interest accrued, soon after the pandemic hit in March 2020. Since then, both the Trump and Biden administrations have pushed back the resumption of payments. The Biden administration had also originally planned to forgive at least $10,000 in loans for about 43 million eligible borrowers. However, the Supreme Court struck this plan down over the summer.

It helps to take a look at the numbers to figure out the scale of the issue here. Americans paid an average $6 billion a month toward student loans in 2019.

Meanwhile, households spend about $1.5 trillion a month on consumption. The average monthly increase was about 0.3% in 2018-2019 (about $4.5 billion per month). Consumption has been running hot recently, averaging a 0.6% increase a month (about $9 billion).

The worry is that if households have to start paying $6 billion a month in student loans, that’s going to take a massive bite out of consumption growth each month, perhaps even wiping out all consumption growth for a few months. That would be a significant blow to an economy largely dependent on consumer spending.

However, there are reasons why this fear is likely unfounded.

Student Loan Payments Have Been Surging, Even Prior to Officially Restarting

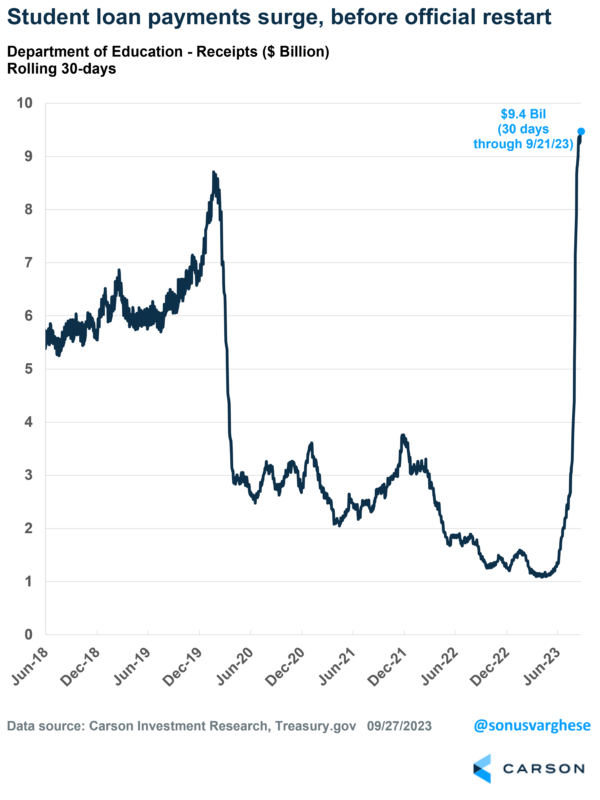

The Department of Education has seen a surge of payments recently – Over the 30 days through September 21st, they have seen receipts of $9.4 billion. That’s well above receipts across any rolling 30-day period prior to the pandemic.

Interestingly, soon after the Supreme Court struck down the Biden administration’s forgiveness plan on June 30th, payments started to go up. Receipts totaled $2.1 billion in July, up from just $1.2 billion in June. Then in August, payments exploded higher to $6.4 billion. September receipts are on track to be larger, adding up to $5.6 billion over the first three weeks of the month.

It may be that borrowers are looking to pay off loans before the official restart, especially high-income earners. Also, borrowers enrolled in new income-driven repayment plans(IDR) may have already started payments. Borrowers who had automatic payments prior to the pause might have seen payments restart earlier than expected.

Whatever the reason, the big takeaway is that payments have surged, and more importantly, it hasn’t adversely hit consumption yet.

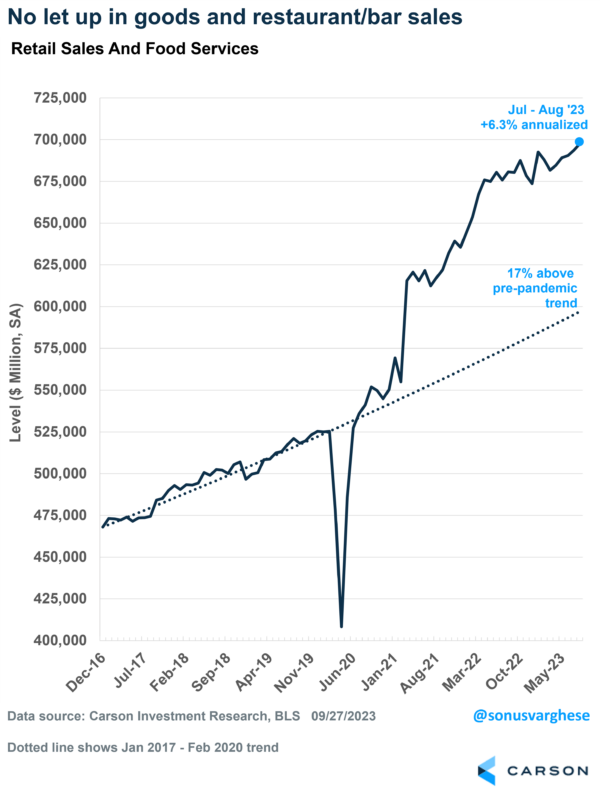

Take retail and food services sales: they rose 0.5% in July and 0.6% in August. That translates to an annualized pace of 6.3%, almost double the 2018-2019 pace of 3.2%. In fact, retail sales are 17% above the pre-pandemic trend, and rising. This is not exactly what you’d expect given the surge in student loan payments.

Other Factors Also Suggest We’re Not Facing a Consumption Cliff

In my opinion, payments were never going to go from $0 to $6 billion on October 1st for four reasons, though going by the data above, it looks like even a sudden surge didn’t put a dent into consumption.

1) Many borrowers continued to make payments even during the pause, thus reducing their principal. Payments averaged $1.2 billion a month over the first 6 months of this year, and averaged $2.3 billion in 2021-2022. So, a lot of borrowers continued to pay down their debt even when they didn’t have to, and with interest suspended those payments went entirely to reducing principal.

2) The Biden administration recently canceled $116 billion in loans for more than 3.4 million borrowers. These were borrowers on income-driven repayment plans, but there were mistakes on the administrative side that put borrowers further behind in paying off the loans. These borrowers typically had made 240-300 monthly payments already, or 20-25 years of a 30-year loan, so the rest of the debt was forgiven. About 1.1 million of them were misled by a for-profit college and granted relief under a program called borrower defense to repayment.

3) The administration is also implementing a loan on-ramp for those who will have to resume payments. It’ll allow consequence-free nonpayment for the first 12 months after restart, as nonpayers won’t be reported to collection agencies and credit bureaus. Though interest will continue to accrue.

4) The administration released a new plan (SAVE) that will benefit another 20 million borrowers. It is estimated that SAVE will cut payments in half for these borrowers, even as balances don’t grow from unpaid interest. Existing income-driven repayment plans are also becoming a lot more generous. SAVE raises the amount of money considered “non-discretionary,” which is protected from repayment requirements. This will lower payments significantly. For example, a borrower who makes $15 an hour will not make any payments. Borrowers earning more than this will save approximately $1,000 a year on payments. The plan also ensures that borrowers who keep up their minimum payments will not see their balances grow, i.e. additional interest above the minimum payment will not accrue to the balance.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

There are a lot of details but the long and short of it is that we’re most likely not going from $0 to $6 billion in loan payments on October 1st. And based on the Department of Education receipts, and July-August, retail sales, it looks like even a sudden surge of payments wasn’t enough to put a dent into consumption.

We’re not saying there won’t be any impact on consumption when payments restart. Consumer spending will probably ease up in Q4. But it’s unlikely to be large enough to send the economy into a significant slowdown.

For more on the latest on student loans, shutdowns, and strikes, be sure to watch our new Facts vs Feelings Take Five video with Ryan and myself below.

1915950-0923-A