“Life moves pretty fast. If you don’t stop and look around once in a while, you could miss it,” Ferris Bueller

The bull market continues, but there are some potential small cracks forming. We will get to all of that, but what has amazed me is three weeks ago we were told there would be no rate cuts, then two weeks ago the mantra was a 0.50% cut was needed. Now the masses seem to have agreed on a 0.25% at the next Federal Reserve Bank (Fed) meeting in about four weeks. Things are changing quickly out there just like Ferris Bueller told us. One thing is that most investors expect a cut in September, but will they really cut with the stock market up near all-time highs?

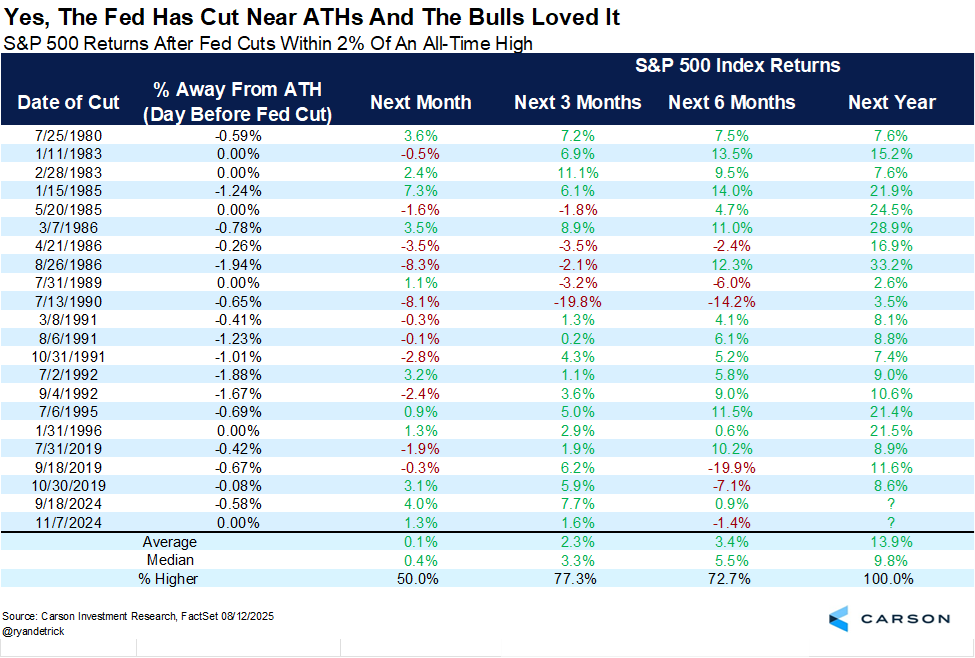

The market-based pricing suggests there is currently a little less than an 85% chance of a rate cut at the next Federal Reserve Bank (Fed) meeting in four weeks. If you remember last year around this time, we noted that a rate cut with the S&P 500 near all-time highs is rather rare, but that doesn’t mean it isn’t possible. In fact, the Fed cut rates thrice last year with the index near all-time highs (in September, November, and December). The good news is rate cuts near all-time highs have seen stocks higher a year later 20 out of 20 times and when last year’s cuts reach the one year mark, we could have 23 out of 23. In other words, if the Fed cut rates in September and the S&P 500 is still be near new highs, it could be another positive driver for stocks.

To put a bow on this, the Fed absolutely can cut with stocks near all-time highs and should they do it, this could be another reason for the bulls to have some fun.

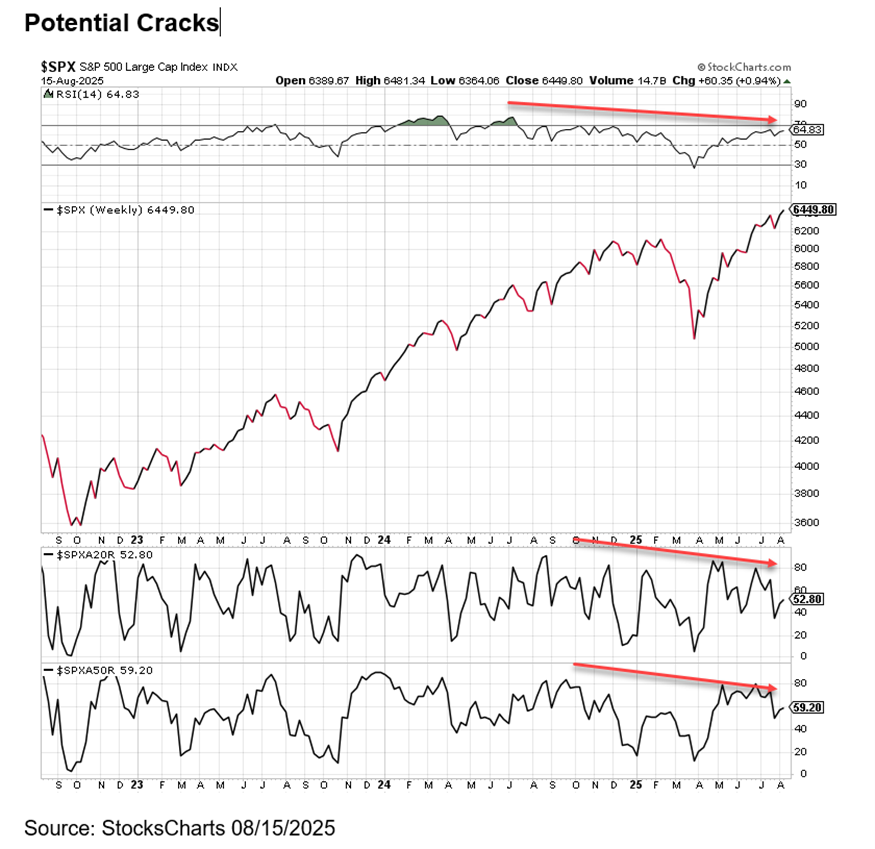

Minor Cracks

We will keep this fairly simple, but the number of stocks in the S&P 500 that are above their 20- and 50-day moving averages is lower than it was a month ago, even though the S&P 500 has moved higher. We call this a negative divergence and it could be a clue there is weakness under the surface. Additionally, we are seeing other negative divergences from other indicators we follow. Again, this isn’t over-the-top bearish action, but this coupled with the negative seasonal period we are in could suggest a well-deserved break is possible.

Thanks for reading and be sure to check out our latest Facts vs Feelings with J.C. Parets, Founder of TrendLabs. This was the most viewed episode we’ve ever had and J.C. was hilarious, opinionated, and brought some great takes.

Lastly, I will leave you with this PSA, don’t hold or use scissors like Mr. Powell does! That just looks dangerous.

8301857.1.-08.19.25A

For more content by Ryan Detrick, Chief Market Strategist click here.