When it comes to portfolio management, what differentiates the Carson Investment Research team, or any other team, is not easy to capture. We work in an industry where there’s a lot of talent and there are many effective broad investment principles that are shared. Where standards and skill are high, just being able to demonstrate that you deserve to be in the room is an accomplishment. But simply deserving to be in the room is not nearly good enough for us.

Fortunately, there are things I know we do differently, in part because I’ve seen or been on teams that follow a different approach. And a big part of it is simply being able to function as a team. But it’s all just talk if it doesn’t lead to making better decisions and finding better solutions. So without further ado, here are eight differentiating principles that help guide the team. And if they persuade, take a look at our Midyear Outlook 2025: Unchartered Waters to see how we think things might evolve over the next six months.

We have an opinion and are willing to take a stand.

There is a lot of herding behavior among the industry punditry. Maybe there’s some “wisdom of crowds” in that, but the wisdom of crowds doesn’t work when you have herding behavior where everyone is watching what everyone else is saying and trying not to stray too far from the herd.

We have been through many periods where we had to suffer through near ridicule due to our willingness to hold unpopular views, simply because that’s what the data was telling us. To take just one example, we can go back to late 2022, when economist surveys had the likelihood of a recession in the next year were at its post-COVID peak. But in our Outlook 2023, we said we thought the economy would avoid a recession and aligned our market expectations with our view, a very contrarian opinion at the time.

We won’t always be right, but you’ll always know what we think the numbers are telling us, even if it means we lose the safety of the pack. And we try to hold ourselves accountable – see my colleague Sonu Varghese’s, Carson VP, Global Macro Strategist, year-end piece from last year, discussing what we got right, and wrong in 2024.

We are oriented to how markets actually behave, not how we think they should behave.

A thorough knowledge of market history is not the end point of making market decisions, but it has to be the starting point and it’s too often given insufficient attention. So much with markets works contrary to expectations. Markets often just don’t behave how we think they should, so much so that it’s an old saw of Wall Street that markets behave in a way to cause the most investors the most pain, even if it’s just from missing out on something good.

Studying market history is only part of it. Another part is avoiding strong pre-conceived notions driven by some sense of how the world should be. At Carson Investment Research, we have no political axes to grind. We are neither permabulls nor permabears. We have no preconceived ideological commitments that cloud our market views. Instead, we focus on what we’ve learned through careful study and exhaustive analysis.

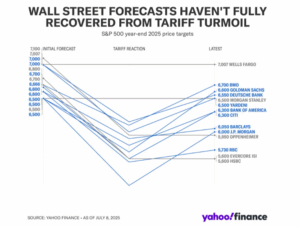

To take just one example, we didn’t lower our S&P 500 target despite the near bear market between February 19 and April 8. In an earlier blog, I provided a retrospective lookback of some of the market signals we were tracking in real time, my colleague Ryan Detrick, Carson Chief Market Strategist, in particular, as the market bottomed and began to bounce back in “Three Takeaways from a Near Bear Market.”

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

We look underneath the hood.

There’s often more going in beneath the surface of headline economic data than meets the eye. Headline numbers also need to be looked at in context. For example, when it comes to last week’s inflation data, we don’t see a uniform trend higher or lower in the underlying data, but different competing trends. While we’re concerned about the impact of tariffs on inflation, there are also some noteworthy disinflationary trends. (See Sonu’s recent, “The Fed Is in a Bind and Jerome Is on the Ropes.”) Of course, we’re not alone in this. But I have seen many cases where there is near obsession over some data point (yield curve inversion, M2 money supply, central bank balance sheets) that leads to everything else becoming distorted. More often, it’s just a little bit too much of a tendency to run with a conventional interpretation of the numbers. Those conventional interpretations are sometimes right, but that shouldn’t be taken just as a matter of faith.

We manage portfolios as a whole, not line item by line item.

This one is a little wonkier, but I’ve been on teams where there was a tendency to look at the pieces of a portfolio without understanding how it all comes together, and that causes problems. It’s not uncommon for this to happen when parts of a research teams are siloed and different teams are defending their turf, potentially with negative consequences for end investors.

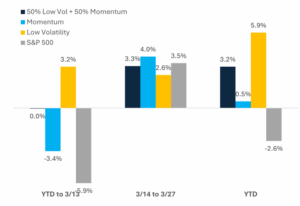

This also means not everything in a portfolio needs to work at the same time. In fact if it does, there’s a pretty good chance there’s extra underlying risk in the portfolio that you might miss. An example is our pairing of “factor” exposure from low volatility and momentum stocks. While sometimes these do both work at the same time relative to the S&P 500 (such as much of the first quarter of 2025, as shown below) they often don’t and that’s ok, because we believe they serve as effective complements. My colleague Grant Engelbart wrote about this back in March in “Offense and Defense in 2025.”

We analyze policy (fiscal too!) but aren’t political.

It has been a steady feature of our advice to ignore politics when it comes to investing. We make no assumptions about one party or the other being better for markets, simply because there’s no real evidence supporting it. I sometimes joke that there’s one American institution that loved Barack Obama and Donald Trump equally, and that’s the stock market. (See our pre-election blog, “16 Charts (and Tables) to Know This Election Year Revisited” for some of the numbers.) In fact, we added risk to our models just before the election simply because we thought post-election clarity would support markets no matter who won, given solid underlying economic fundamentals.

But just because we ignore politics doesn’t mean we ignore policy. In fact, we pay attention to fiscal policy, which often gets less attention than monetary policy, including from a national accounts perspective. See Sonu’s “How Will the One Big Beautiful Tax Bill Impact Markets?” for a recent example.

We don’t believe in traditional factor premiums like a small cap premium or a value premium.

I discussed above our use of a mix of exposure to low volatility and momentum factors, which has a long historical track record of providing solid risk-adjusted returns. We think that will continue to hold true over a strategic timeframe, but not that it will necessarily run forever and always. We have seen other traditional “factors” (certain underlying characteristics that some stocks have) work for long periods and then not work for long enough that the payoff to the factor is neutralized for a typical investor. This gets all the more complicated today because of the number of factors that are out there and the wide variety of ways of measuring each.

We believe in starting simple with a sound “neutral portfolio.”

Sometimes, people can get so sophisticated about portfolio construction that they forget the basics. Over the long run, there’s a reason why stocks and bonds are expected to provided a return for the risk you take on and why stock returns are expected to be better than bond returns. (See Ryan’s “10 Talking Points About the Recent Volatility” from August 2024 for some perspective here.) While a benchmark-like neutral portfolio isn’t exciting, it does a lot of heavy lifting when it comes to investing. (I share my thoughts in “The Starting Point for Effective Portfolio Management.”)

We think most of the value in financial advice comes from financial planning, not from portfolio management.

This is a humbling statement for a team that is on the portfolio management side, but nevertheless I think it’s true. That doesn’t mean I think what we do is unimportant. But I do believe good financial advice has a much larger impact on financial wellbeing than finding someone who is “better” at portfolio management (assuming that the default otherwise is a basic, sound, well-diversified portfolio at an appropriate risk level). This kind of financial advice falls into two basic categories. The first has a direct impact on (after tax) returns, but not through asset allocation and security selection. Rather, it comes from things like guidance on tax planning and behavioral coaching. Beyond that there’s also the entire realm of comprehensive wealth planning that can help create a clear, more manageable path to meeting long-term financial goals. I wrote a little about this in my first blog at Carson and knowing that these views were shared at Carson is part of why I was excited to join this team. The actual experience has topped expectations.

How does this help make us better portfolio managers? Fundamentally, we want to build portfolios that support the value advisors can add, from avoiding behavioral mistakes to creating opportunities for smart tax management. The value still comes from the advisor, but understanding the work they do gives us a perspective on the decisions we make that helps us do our job better.

I recently had the opportunity to join Ryan and Sonu on Facts vs Feeling to discuss these ideas and many others. Inspired by that, I would have to add one last item to this short list of things that I believe differentiates the Carson investment team: We work together to get to the right answer, rather than simply averaging out our views, and that’s part of what gives us the courage of our conviction as we learn from and our challenged by each other’s ideas every day. Take a listen.

8193927.1.-07.21.25A

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here