“If you torture numbers enough, they will tell you anything.” Yogi Berra

Stocks have seemingly gone up each day this year, which is quite different from what we all experienced last year. Today I’ll look at some potentially positive developments which indeed could have bulls smiling in 2023.

It’s been a strong start to 2023, with stocks up nicely after the first five days. Although we’d never suggest investing based on five days, this is something many people watch for clues as to how the year might go, and it has a solid track record. As Yogi told us, if you have a bias, you can likely get the numbers to confirm that bias. We’ll try just to state the facts, and the facts do suggest this is a good sign. Of course, let’s not forget that stocks were down the first five days last year, and we know how that worked out.

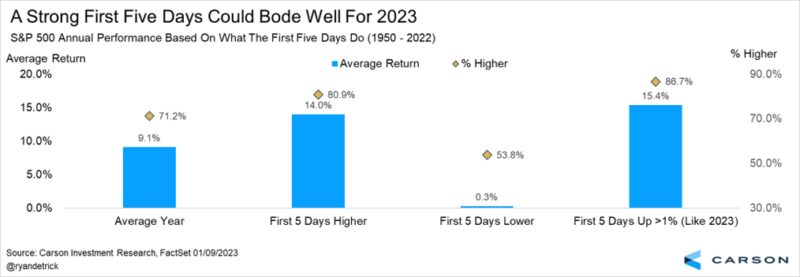

It turns out that when the first five days are higher for the S&P 500, the full year is higher nearly 81% of the time and up 14.0% on average. Compare this to when those days are lower, and the full year is virtually flat and up only 54% of the time. Lastly, when these five days are up more than 1% (like 2023’s 1.4% gain), the full year does even better, up 15.4% on average and higher more than 86% of the time.

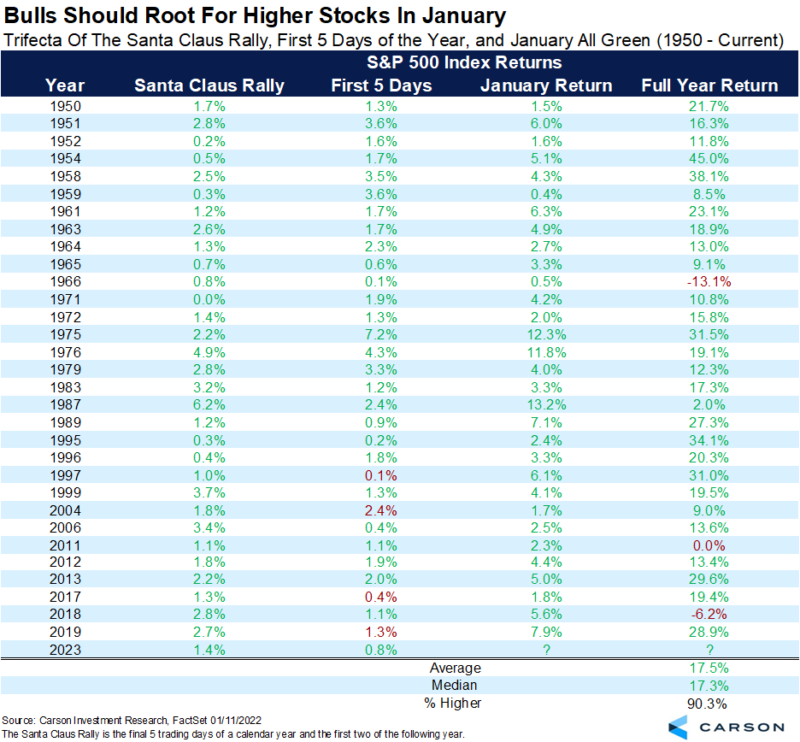

Let’s take things a little bit deeper now… We talked a lot about the Santa Claus Rally (SCR) last month, and the good news is that stocks, indeed, were higher during those historically bullish seven days. When stocks are higher during the SCR, the first five days of the year, and in January, the full year has historically done quite well.

Below we show the 31 times that the trifecta of bullishness (I may have made that word up, but I like it) happened, and the full year finished in the green more than 90% of the time and gained 17.5% on average. Sure, this month isn’t over yet, but we are off to a great start, and a higher January could be in the cards. If you are bullish, you should be rooting for a green January based on the table below.

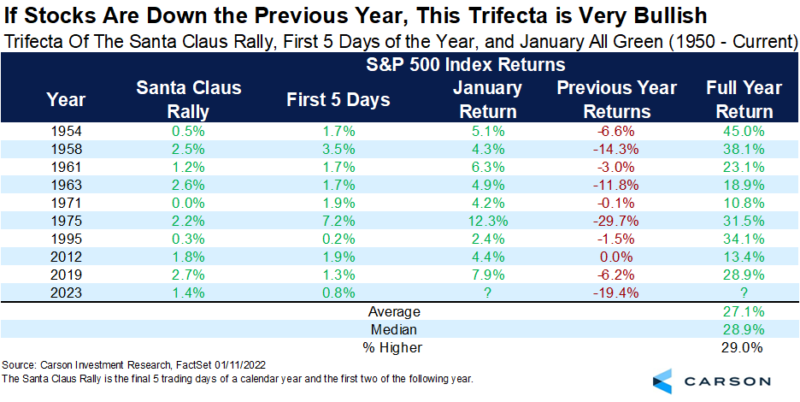

Lastly, stocks were down last year, which makes the potential trifecta in 2023 even more special. That’s because when the previous year saw stocks in the red, the annual returns of the S&P 500 the following year were typically strong (just look at those numbers in the righthand column in the table below!). In fact, stocks have never been lower during the year and gained more than 27% on average. After last year, that’s something I think we’d all take!

There are still many worries out there, but we continue to see more positives than negatives, and we think 2023 could actually be quite a good year for investors. We are putting the finishing touches on Outlook 2023: The Edge Of Normal, and we can’t wait to share it with you soon. Be on the lookout for it.

For more of our immediate thoughts on the economy, stock market, and more, be sure to listen to our latest Facts vs. Feelings podcast, where Sonu and I break it all down.