“However beautiful the strategy, you should occasionally look at the results.” – Winston Churchill

How about that? As soon as we released our Mid-Year Outlook and talked about this bull market broadening out the rest of this year, with other areas besides just technology and communications leading, we find the Dow up nine days in a row.

This is the longest win streak since September 2017, and the last time it got to ten wins in a row was in August 2017. Incredibly, 2017 saw three separate 9-day win streaks, the most for any one year since 1955, which had a record four different 9-day win streaks. The longest win streak ever? It took place in January of 1987, right as the stock market had one of its best starts to a year ever, but we all know what happened later that year as the rubber band has stretched a tad too far.

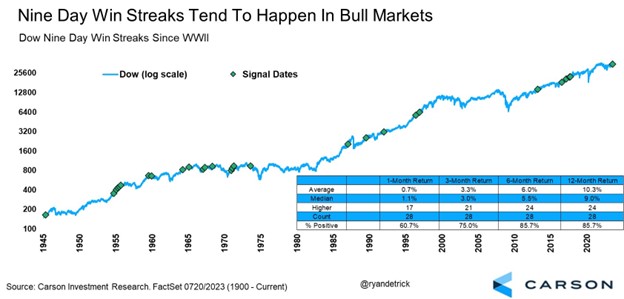

What does it mean? We found there have been 28 other 9-day win streaks going back to WWII, and future strength is quite likely. In fact, the Dow was higher 6 and 12 months later nearly 86% of the time, which could have bulls smiling. Even more surprising, the past nine 9-day win streaks saw the Dow higher a year later every single time. The bottom line, these are things you see in bull markets, exactly what we think we are in right now.

Let’s briefly discuss the elephant in the room. Many people don’t like to use the Dow anymore, as it has only 30 stocks and it is price weighted. We get it, but we’d still rather know this data than not. And let’s not forget that the Dow has more healthcare and financial exposure than the tech-heavy Nasdaq. As a result, we’ve seen the Dow greatly lag other indexes this year. But what happens if cyclical areas like industrials and financials start to lead? Or what about healthcare, the second largest part of the market and a big part of the Dow? Well, the Dow might be old, but it might still have a few tricks up its sleeve as a signal should those areas start to lead (as we expect to happen). Or, as Churchill said in the quote above, the results are what really matter to investors, and we think the results could be quite positive.

I discussed many of these concepts with Brian Sullivan last night on his new show called CNBC’s Last Call. I’ve been talking with Sully for years, and I’m a big fan. Not to mention joining him at 7 pm ET is lightyears better than when I’d join him on his last show at 5 am ET!

01842093-0723-A