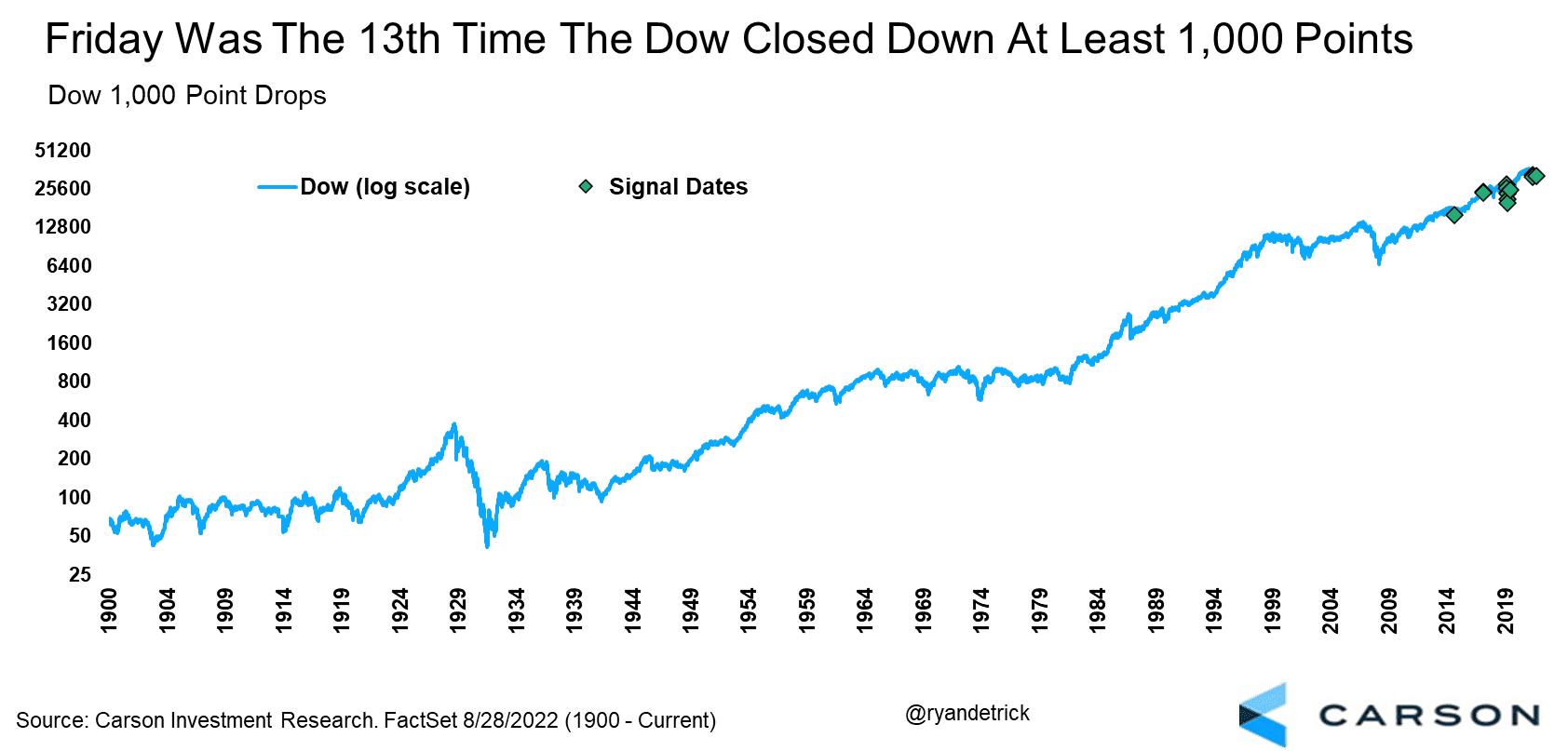

The Dow fell more than 1,000 points on Friday on the heels of a hawkish Fed at the Jackson Hole Economic Symposium, the 13th time in history that Poppa Dow fell that much. As the chart below shows, most of these big down days have taken place lately, with two in February 2018, eight in 2020, and three more this year.

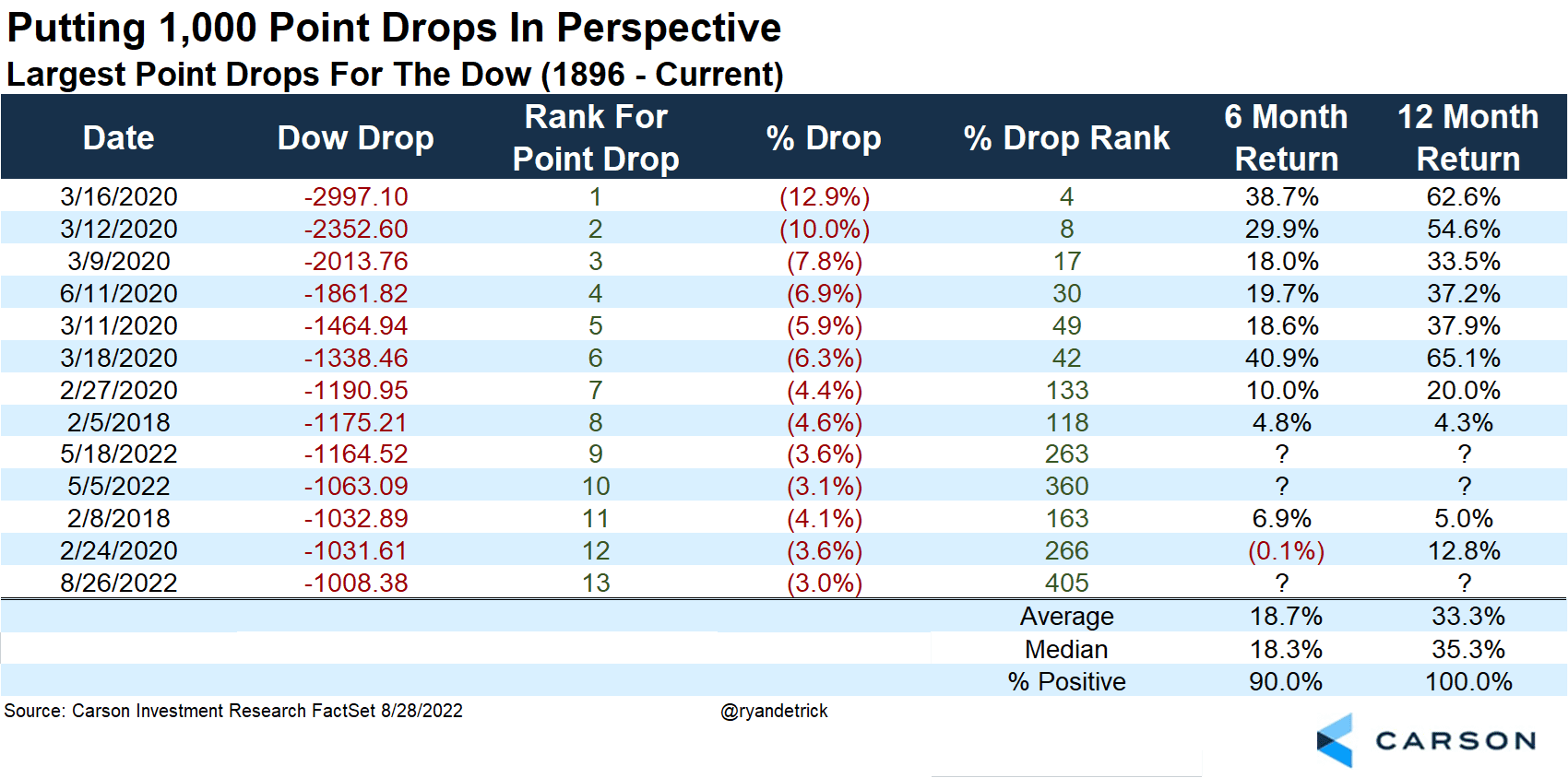

Although we would never want to minimize the impact of a big down day, it is important to put the drop in perspective. You see, the media will no doubt hype up big down days and the larger the point decline the more sensational the drop could become. But as we show below, Friday was the 13th largest point drop ever, but it came in at a more manageable 405th largest percentage decline ever.

Additionally, a year after a 1,000 point drop the Dow has never been lower, up more than 33% on average. Of course, most of these big drops took place during the pandemic bear market in 2020 and the returns a year later are stellar. Still, this is somewhat comforting after what happened on Friday.

Another angle on this is the crash of 1987 saw the Dow fall a single day record 22.6% on October 19, 1987. As horrible as that day was, the Dow lost 508 points, which means there have now been 93 days with a larger point decline. To us here at the Carson Investment Research team, paying attention to the percentage decline is much more important.

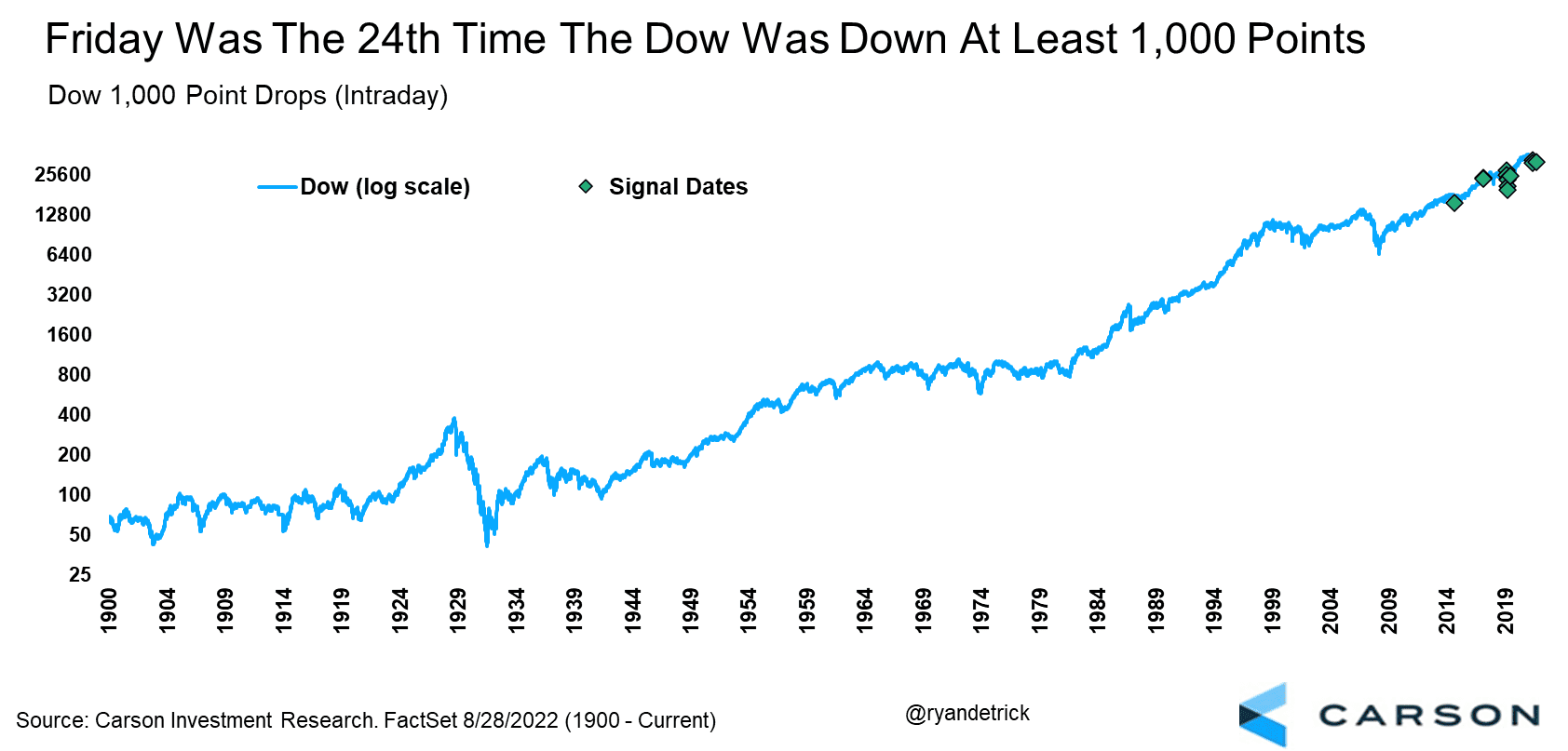

Lastly, as the chart below shows, there have been 24 times the Dow was down at least 1,000 points at some point during the day. In fact, the first time the Dow was ever down more than 1,000 was on August 24, 2015.

Although the Dow managed to rebound some and avoid a 1,000 point drop that day, it is still a day I’ll never forget. I was unemployed and struggling to find the right fit. At the same time, I had a herniated disk and spent most of that summer in pain, laying on the floor. I’ll never forget struggling to walk into my back doctor’s office and while I’m sitting there the stock market was collapsing and boom, it was officially down 1,000 points. At the time it was a very surreal feeling, although it could have been the meds. Sitting there I just kind of laughed to myself and said I sure hoped things don’t get much worse, because being unemployed when the market was crashing and it hurts to even get out of bed, that was a pretty bad situation.

Fast forward exactly seven years and the Dow is up more than 100% from that day and I’m at a job that I love. Seven years ago if you’d have told me this, I’m not sure I’d have believed you. I’ll leave you with this, keep the faith, work hard, and treat people the right way. No matter how many 1,000 point drops there are, if you do those three things I feel confident that things will work out just fine.