Sometimes a meme can convey a white paper’s worth of sentiment within a single picture; that’s why they spread faster than the news sometimes. so, let’s keep it simple:

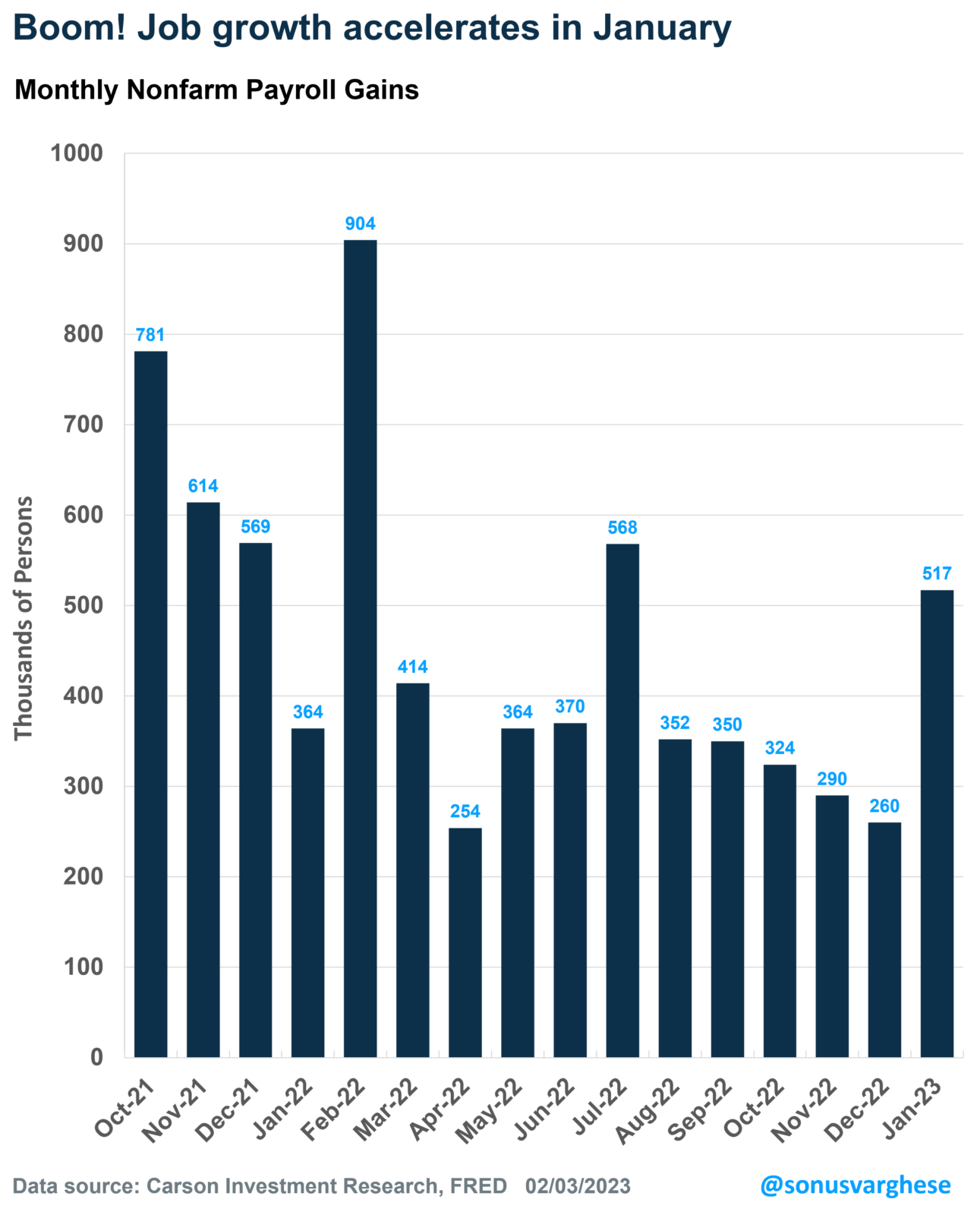

The economy created 517,000 jobs in January, well above expectations for a slowdown to 175,000.

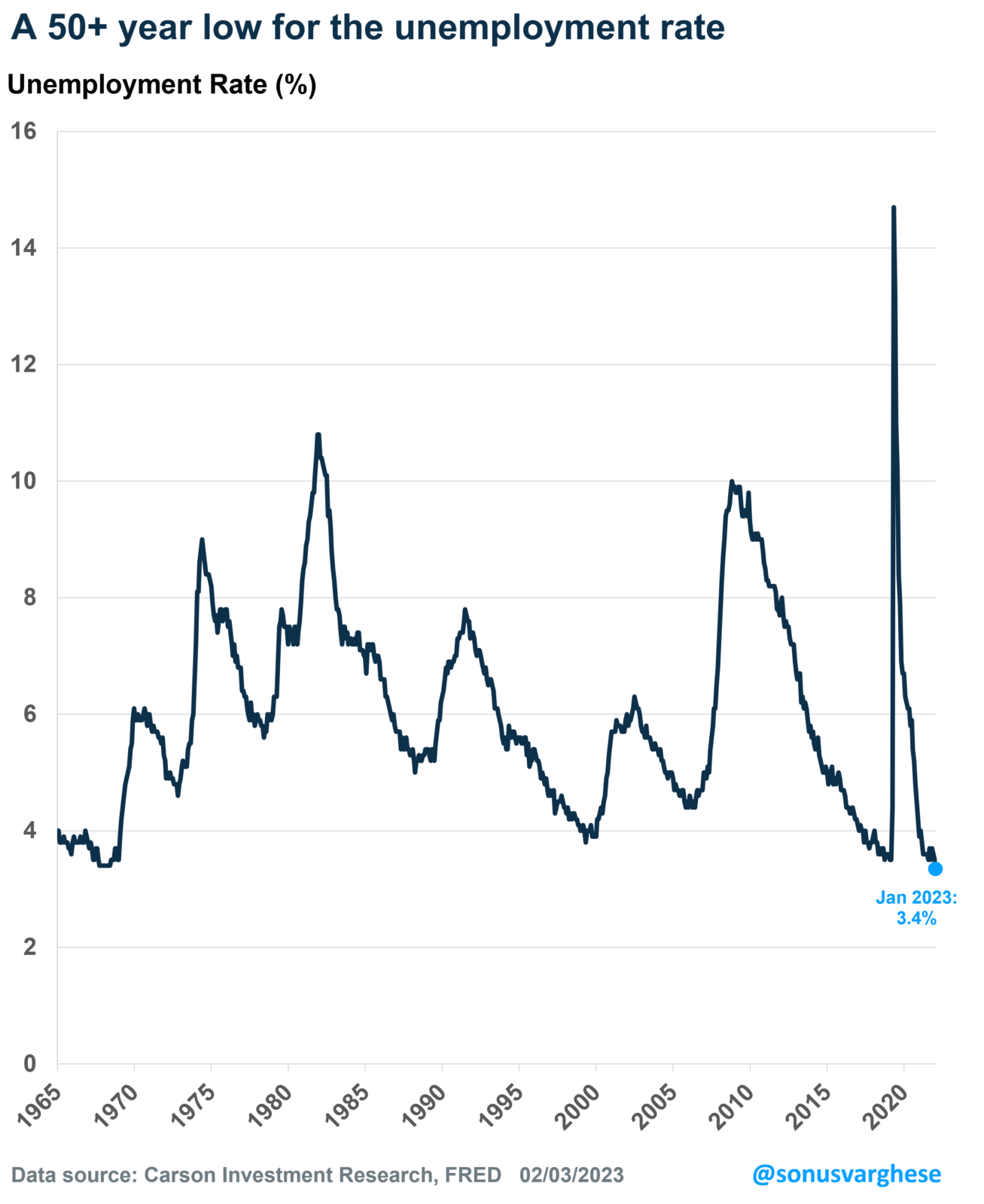

The unemployment rate is at 3.4%, the lowest level since May 1969.

It’s like the labor market, i.e., America’s employers are on a mission to upend forecasts of a recession in 2023.

Oh, and revisions suggest payroll growth was stronger than we thought in 2022. The Bureau of Labor Statistics now says the economy created 4.8 million jobs in 2022, as opposed to the previous estimate of 4.5 million.

Forget recessions and landings; these numbers suggest an employment boom!

Strong numbers under the hood

The data corroborates what we’ve been seeing in leading employment indicators like weekly initial claims for unemployment, which fell to the lowest level in 9 months last week. Now January data typically tends to be quite noisy due to seasonal effects. But even accounting for that, let’s not miss the big picture that the labor market is looking very resilient, if not outright on fire.

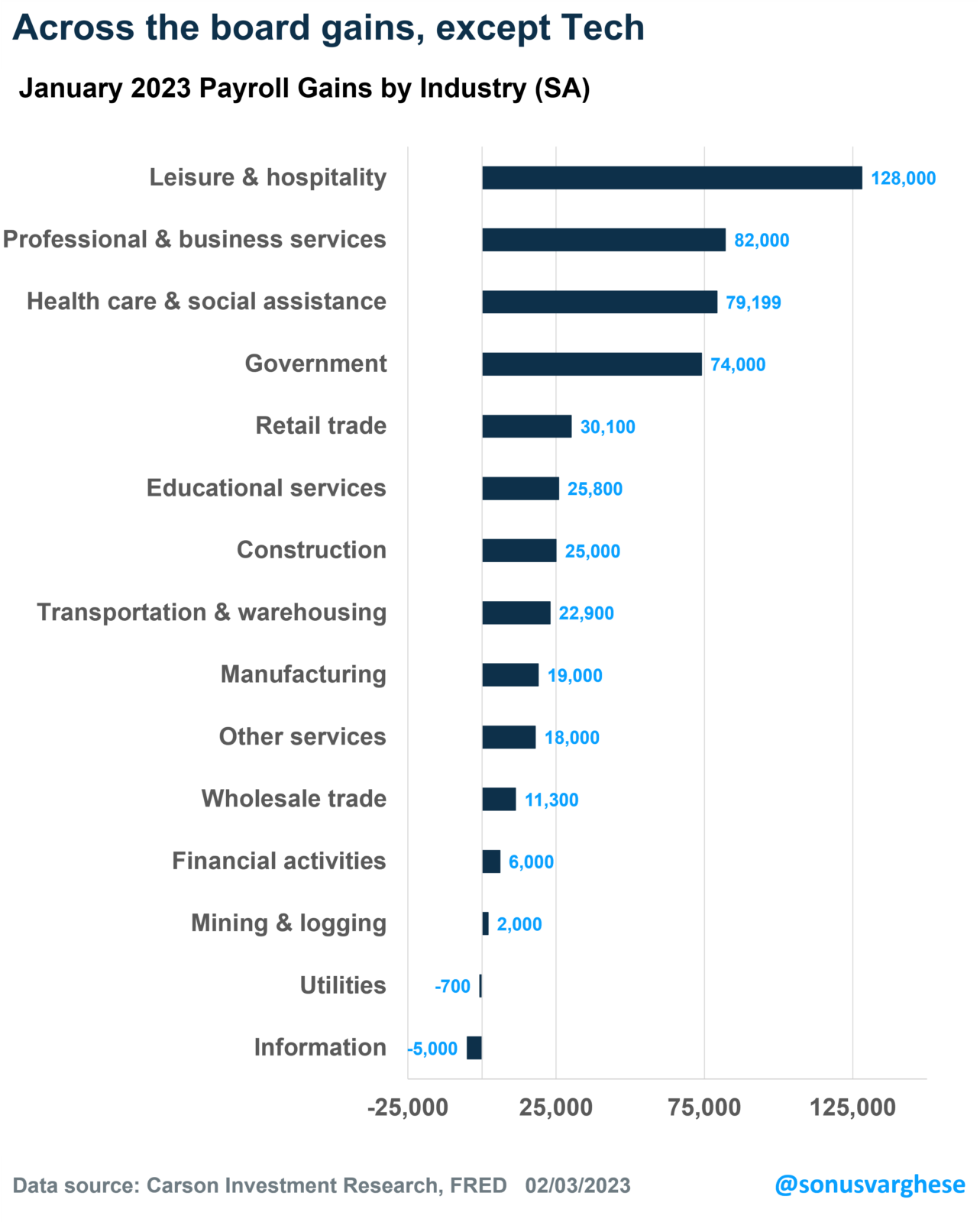

The huge payroll gain in January was not due to outsized gains in one sector either. Cyclical sectors like manufacturing, construction, and wholesale/retail trade services all added a total of 85,000 jobs – which goes against the story of a significant slowdown in these areas.

Meanwhile, the service industry is on fire. Americans are spending, and employers are responding – including adding 113,000 net jobs across accommodation, restaurants, and bars.

Information processing, which includes Technology, and Utilities, were the only sectors that saw job losses. And not a lot, either.

What does this mean for the Fed

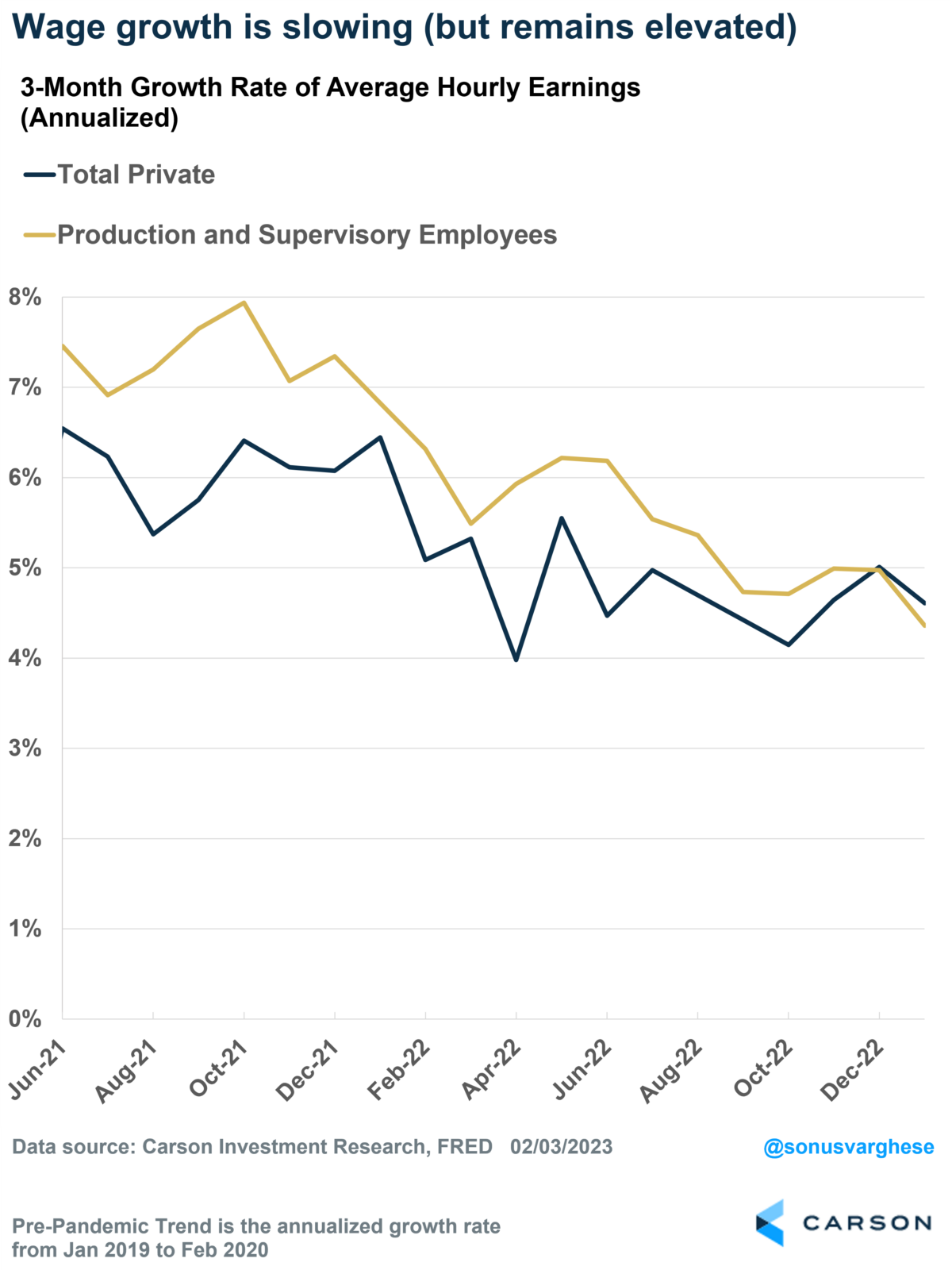

Again, let’s keep it simple with respect to what the Fed will, or will not do. As I wrote after the FOMC meeting, the Fed is downshifting and waiting to see disinflation in the “core services inflation, ex housing” category. This is closely tied to wage growth, and there’s good news on that front.

The average hourly earnings (AHE) data that came through with the payroll data shows further deceleration, especially for non-managerial employees, who tend to spend a relatively higher portion of their income.

The hourly earnings data can be noisy and subject to revisions, but we also saw the employment cost index (ECI) for Q4 moving lower. The ECI comes out only quarterly, but it is considered the most stable measure of wage growth – so the deceleration in that data should count heavily when thinking about wage growth.

The best news amongst all this is that wage growth appears to be slowing even as the unemployment rate is at 50+ year lows. This is not what textbook theory would predict, or forecasters for that matter. But we’ll take reality over that. And Powell’s comments after the FOMC meeting suggest he may do the same.

Of course, stronger economic growth means the Fed is more likely to keep interest rates higher for longer (Contrary to market expectations of rate cuts in the second half of 2023). We believe the economy is strong enough to handle higher rates currently.

To summarize

- The employment data shows no sign of a slowdown

- This suggests the economy is not really slowing, let alone close to a recession

- Wage growth is trending lower, which should be good news for the Fed as they look to get close to peak rate

- A relatively stronger-than-expected economy means the Fed is more likely to keep rates higher for longer