“The Waiting”

Tom Petty’s 1981 classic “The Waiting” was inspired by a Janus Joplin quote; “I love being onstage. Everything else is just waiting.” We feel the same about earnings season. This is the main event. It only happens every three months. Everything else in between (news headlines, analyst rating changes, charts, etc.) is just waiting. This is where perception meets reality.

Thus far, things have mostly been encouraging. Stocks have responded well, rallying 2.2% since JP Morgan unofficially kicked off this earnings season, and are now up 6% YTD. Besides a few outliers, the general theme from most companies is that demand has been weak but is forecasted to improve later this year. So essentially, the current softness is temporary. While this has been welcomed the news, will we repeat recent patterns where market rallies fueled by earnings eventually get overshadowed by the macro?

In other words, will investors be able to trust corporate forecasts with a Fed still actively trying to slow things down?

The waiting is the hardest part.

Microsoft (MSFT) – Tech spending continues to slow, but where is the trough?

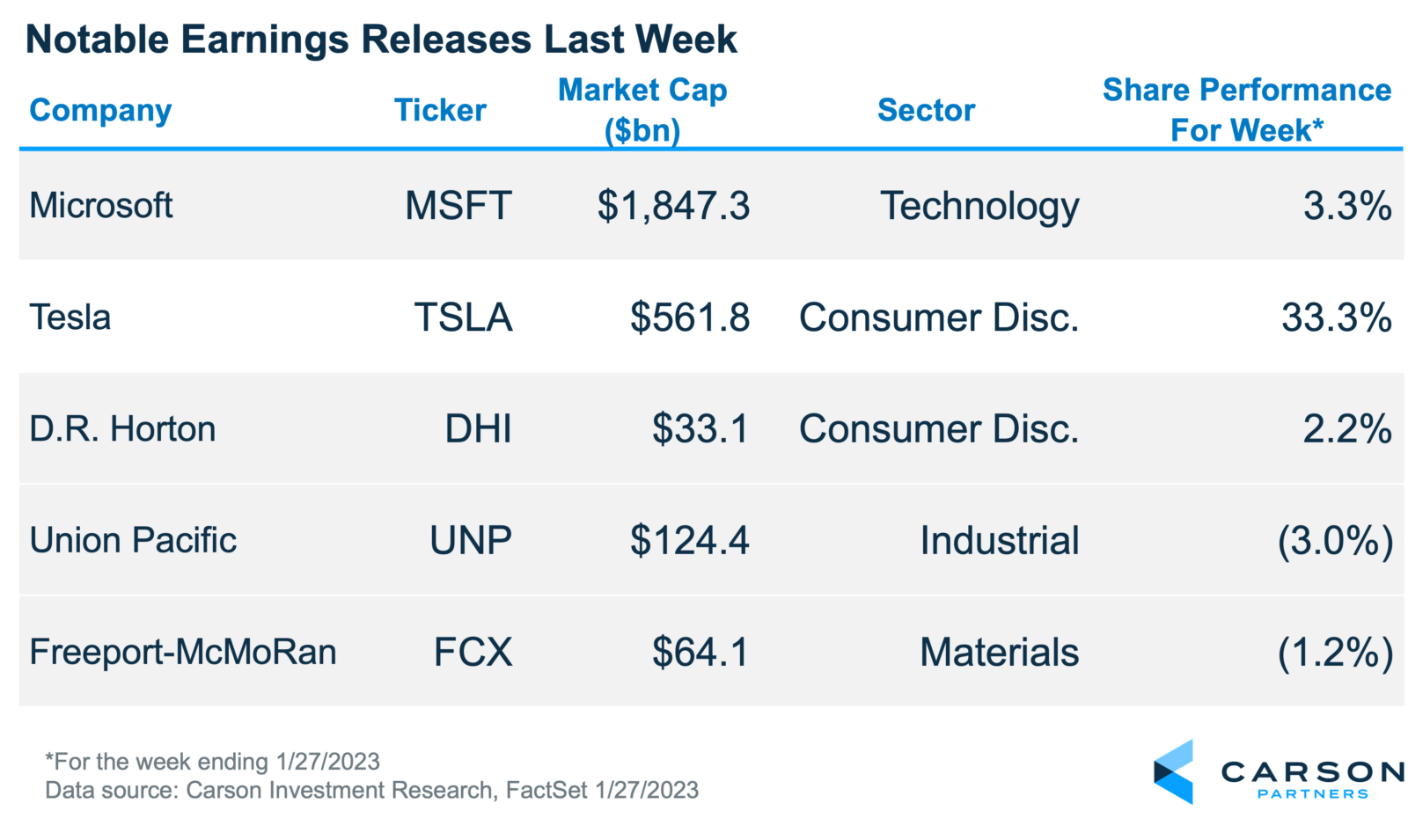

The first mega-cap tech stock to report this period was Microsoft, primarily an enterprise software company. Sales continue to increase but at a slowing pace. No surprise. While management noted that it still sees strong trends like cloud and artificial intelligence, customers continue to “optimize” their post-pandemic digital spending, which is corporate speak for pause and/or reduce.

A key metric for Microsoft investors is sales growth in Azure, its cloud computing service. This slowed further and is expected to do so again next period. Investors are trying to figure out when Azure’s growth will stabilize and at what rate? This report left few answers.

Initially, the stock sold off early but staged a recovery later that day. While Microsoft’s sales growth is slowing, management is also controlling expenses to cushion the hit to EPS.

Tesla (TSLA) – The market’s biggest battleground stock delivers

Our objective is to review what companies see in the broader economy. We hesitate to talk about Tesla, the world’s largest maker of electric vehicles. To say the firm and its CEO are controversial is an understatement. However, it’s just too large and topical not to.

Shares rallied 11% on its report, largely a function of where the stock had been over recent months. It had fallen 35% since its last earnings release on concerns that the firm had to cut prices to spur waning demand. For now, this worry was overblown. Tesla reported strong revenue and earnings growth, albeit at a slowing rate. Addressing demand concerns, Elon Musk said that current orders are almost twice that of its production rate and that Tesla has seen its strongest demand ever so far in January. That latter statement better be true, considering the high growth expectations embedded in the valuation. But, even if it’s just one more car…we digress.

Several times during the call, Musk reiterated his view that the economy is probably going into a recession and that we’re moving from an inflationary to a deflationary environment due to Fed policy. Apparently, that’s for everything but Tesla cars because the company’s production is expected to rise nearly 50% in 2023.

D.R. Horton (DHI) – With ~7% mortgage rates, has housing bottomed?

D.R. Horton is one of the largest homebuilders in the U.S. We’ve previously written about the impressive rebound these stocks have seen off their June lows despite recessionary housing conditions. This quarter was no different. Orders and backlog, the two drivers of future sales, fell sharply and are forecasted to do the same next period.

However, there were a few silver linings that are giving investors hope that housing may have bottomed. First, management saw improved activity during the first few weeks in January, adding that it could see “normal seasonality” in orders in the coming period. This is a big deal because orders haven’t improved for the past nine months. Also, cancellations remained high but improved from the September period.

The stock is now down only 11% from its all-time high reached in December 2021, which must be irritating for the bears expecting a repeat of 2007/2008. The homebuilders were much better prepared for this downturn.

Union Pacific (UNP) – Sees mixed economy, but execution issues hurt the stock.

Railroads touch many parts of our economy and can be a good barometer of broader demand. However, many of Union Pacific’s recent problems have been company-specific, such as prolonged labor negotiations constraining its service capabilities in key locations and pricing not keeping pace with inflation. This caused the firm to miss analyst estimates, which prompted a handful of stock downgrades. However, our purpose here is to get a read on demand.

Sales growth decelerated to just 8%, and most of this was from pricing, which is considered lower quality/less durable. Volumes grew only 1% with strength in autos. Interestingly, Texas Instruments also saw strength in car demand. Management expects U.S. industrial production to decline by about 0.5% in 2023, and the company’s inflation will be around 4% even with lower fuel prices.

Compared to other firms, Union Pacific sounded less confident that the slowdown it is seeing is from an inventory correction instead of broader economic weakness. However, CSX, another rail peer, said last week that it felt like it had seen the bottom in some of its markets.

Freeport-McMoRan – Selling everything it can make

Freeport-McMoRan is a major copper and gold miner that reported last week. We tuned in to get an update on the global demand for copper, a major industrial metal. Freeport relies heavily on copper price, which has jumped 25% since October due to a weaker US dollar, and hopes for improved demand as China re-opens.

Management said there were pockets of weakness in US residential housing, but they’re selling everything they can produce. Freeport continues to see a disconnect between the financial market for copper (prices down 15% in 2022) and the physical market, which remains tight. That said, the firm’s production growth continues to weaken and is expected to fall slightly in 2023 after two years of double-digit growth.

Management added that inflationary pressures have been less severe in recent months.

Note that none of this commentary constitutes buy/sell/hold recommendations.