One of the most important myths when it comes to the value of a financial advisor is that the value lies primarily in selecting individual securities that provide better returns. But even when it comes just to portfolio returns (ignoring all the other ways a financial advisor helps clients reach financial goals), research suggests that’s not actually a financial advisor’s main way to add value. There is another area that we believe can have a larger impact on portfolio returns, sometimes called “advisor alpha.” “Alpha” is industry lingo for risk-adjusted returns above a benchmark; “advisor alpha” is ways to improve returns that come from other aspects of sound advice, not strictly security selection, such as behavioral coaching, portfolio efficiency, diversification, tax management, and integrating portfolio management with broader financial planning. (There is the potential for traditional alpha on top of that too, but that’s not the focus here and often provides less value.)

Most ways in which advisor alpha gets expressed are things that people could potentially do for themselves. The problem is many don’t. Like so many things in life, it’s often relatively easy to know what to do, but acting on that knowledge can be difficult for all the usual reasons: we’re too busy, or are making a big decision emotionally, or just have incomplete knowledge and don’t realize it. To take a simple example, everyone knows the main path to losing weight is eating better and being more active, but the knowledge itself doesn’t change behavior. Investing is often actually something like that. Or as Dr. Suess once said, “Sometimes the questions are complicated and the answers are simple.”

So I put together this list of questions. They are intentionally backward looking in order to make self-assessment easier and also probably more useful. What we have done rather than what we could or would like to do is often the most useful baseline for what might happen in the future. As for what to do with it, there’s also a light but hopefully useful qualitative guide to interpreting the results.

And the upshot: Studies have suggested that “advisor alpha” could make a difference of up to 3% or more a year to after tax portfolio returns, although it depends widely on circumstances. (See for example here and here.)

On to the quiz. Here are the 20 questions divided by some broad topics. Answer yes or no to each. Even if the “yes” is in the distant past or partial, I would still treat it as a yes if there hasn’t been something structurally put into place to turn it into a “no.” The list of questions is by no means complete, but I do think it’s enough to establish a good baseline.

BEHAVIORAL

- Have you ever bought or chased an investment near a high, or sold near a low?

- Do you believe you’re an above-average stock picker without objective evidence?

- Have you bought an investment simply because it was “in the news”?

- Do you base investment choices mainly on the last five years of performance?

- Do you seek out financial media that confirms your existing views?

- Are you attracted to high-risk “home-run” investments?

- Do you pay attention to outlets that regularly predict a market or dollar collapse?

- Do you hold on to a personal investing theory you can’t let go of?

RISK MANAGEMENT

- Do you rebalance your portfolio regularly to maintain your intended risk level?

- Do you hold too much cash—or too little—for your goals and risk tolerance?

- Have you planned for how you’ll handle the normal ups and downs of risky assets?

- Is your portfolio properly diversified—and would you know if it wasn’t?

- Is a large portion of your wealth concentrated in one stock or a single position?

FINANCIAL PLANNING

- Do you know how much you must save—and how to invest—to meet your retirement goals?

- Have major life events (marriage, divorce, inheritance, business sale) changed your financial picture?

- Do you have a trusted, knowledgeable sounding board for major financial decisions?

- Are you making full use of available tax-advantaged accounts (401(k), 403(b), IRA, Roth, 529, HSA, etc.)?

TAXES AND EFFICIENCY

- Do you actively harvest losses in taxable accounts to improve after-tax returns?

- Do you coordinate charitable giving with your investment and tax strategy?

- Do you prefer higher-tax income strategies over lower-tax capital gains strategies even when risk levels are similar?

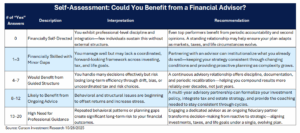

And as promised, a little rubric to interpret the results:

The focus in this blog has been on ways to enhance real life after-tax portfolio returns versus a current baseline based on factors other than portfolio management in the most traditional sense. I’ve focused on portfolio management because it’s what I know best. At the same time, a major theme in the background is the importance of integrating portfolio management within a broader framework of financial planning. Financial planning reaches well beyond portfolio management, but often understanding the connection with portfolio returns is a first step toward seeing its full value. I hope for some readers out there this little quiz provides a small but meaningful nudge toward better financial well being and many happier returns.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here

8551845.1.-29OCT2025A