Inflation has been top of mind for investors over the past year and a half, both from the perspective of what that means for the economy as well as monetary policy. So, the latest release of the Consumer Price Index (CPI), which tracks a basket of goods and services purchased by households, looms large every month. The big question going into this report was: inflation has pulled back, but will it stay lower and continue to pull back further?

Based on the July report, the answer is yes.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

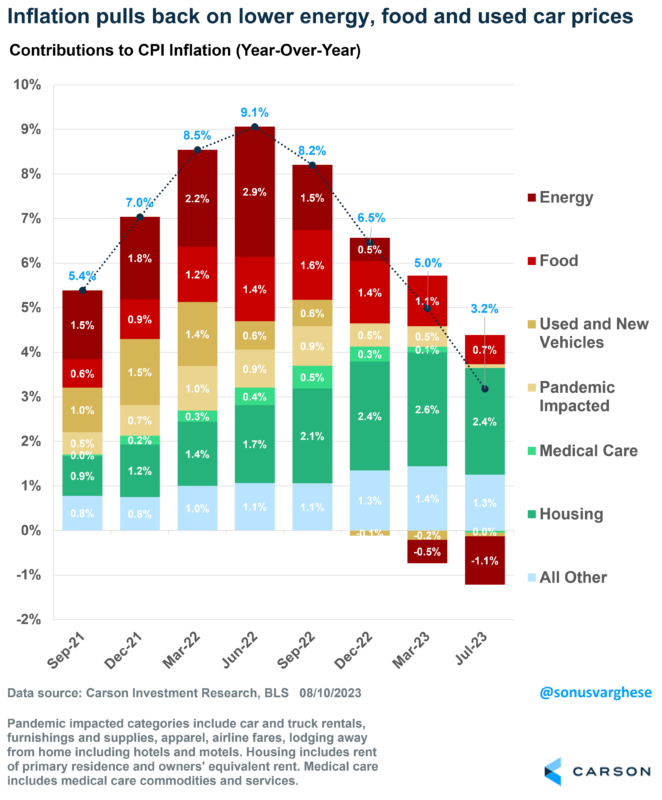

Headline CPI rose 0.2% in July, as was expected. Inflation was up 3.2% year-over-year, a tick below expectations for a 3.3% reading. That’s well below the June 2022 level of 9%. As you can see in the chart below, energy, food, and vehicle prices have driven inflation lower. Over the past year:

- Energy prices are down 12%

- Food price inflation has eased to 4.9% (it was 11% in July 2022)

- Used car prices are down 6%

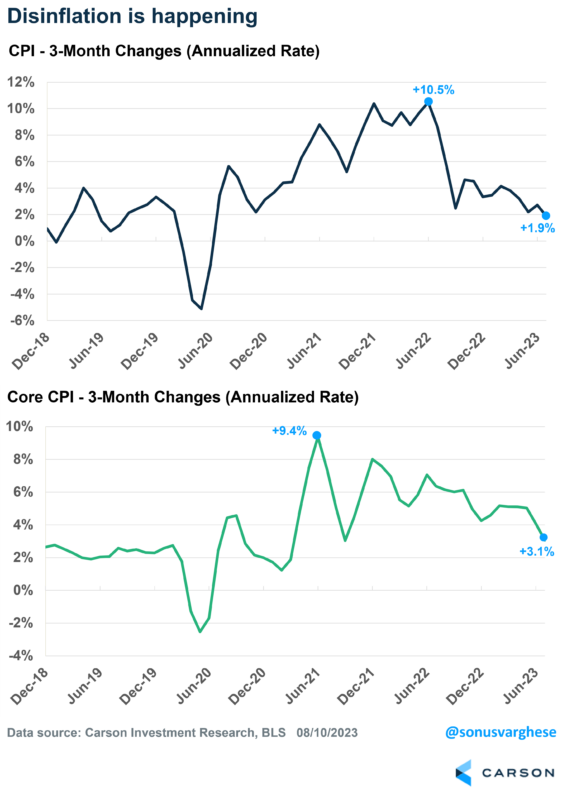

Looking at year-over-year numbers can be a little misleading, especially because they’re dependent on the data from a year ago and that’s not particularly helpful to understand what’s happening right now. At the same time, monthly data can be noisy. That is why I like to look at the 3-month average, and as of July, headline inflation is running at a 1.9% annual pace over the past 3 months.

We got good news on the core inflation front too, which is what the Federal Reserve focuses on since it removes volatile components like food and energy. Core inflation rose 0.2% in July, and over the last three months, it’s running at an annual pace of 3.1%. That’s a decisive shift lower from what we’ve seen over the past year and a half.

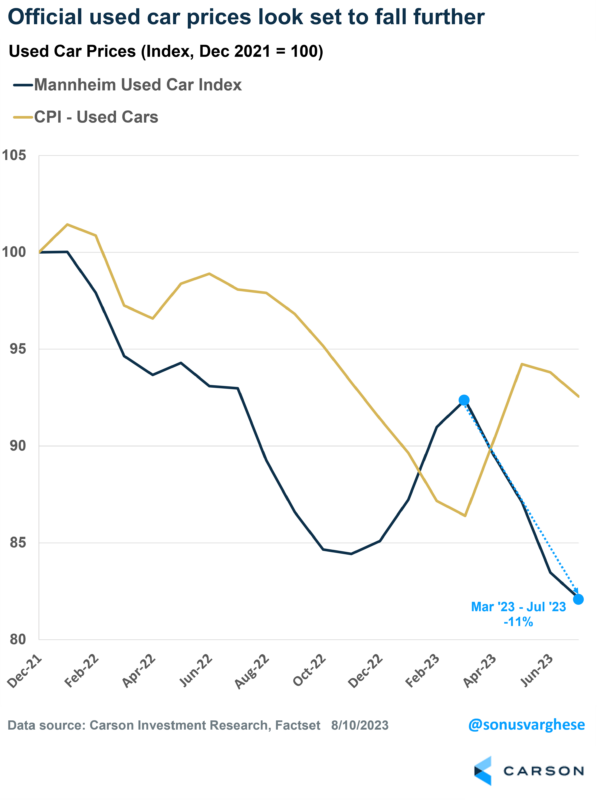

There are two big reasons why core inflation is pulling back, and it gets to why we believe inflation has more room to go lower. Vehicle and shelter make up 50% of the core inflation basket, and so what happens there is critical. Let’s talk about these.

As I noted above, used car prices are pulling back. In fact, private data indicates that used car prices have fallen 11% since March, but that’s yet to be fully reflected in official data. So, there’s further room to fall over the next couple of months. Also, new vehicle prices have fallen about 0.5% since March, and this could continue moving lower as auto production improves and inventories rise.

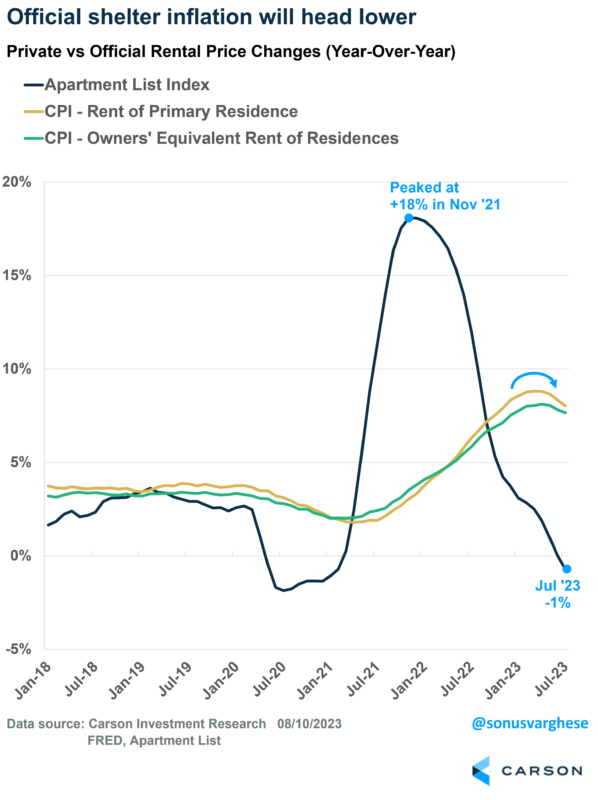

Shelter inflation has been decelerating for a while now. It was running at an 8-10% annual pace at the beginning of the year. That slowed to the 6-7% range between March and May, and over the last two months, it’s moved below 6%. That’s progress, albeit slow.

However, we know there’s a lot more room to go further down based on what’s happening in the rental market. Note that official shelter inflation does NOT include home prices and is just a measure of rents. Vacancies are up, and data from Apartment List shows that the national average rent is down 1% over the past year as of July.

Official shelter inflation may not get to that low a level, but safe to say, it’s heading a lot lower from where it is now. Shelter inflation averaged about 3-3.5% between 2018-2019, which was consistent with core inflation running at 2% (the Fed’s target). Based on what we know now, shelter could fall to an annual pace as low as 2.5%, and that would be a significant downward force on inflation.

Even beyond vehicles and shelter, there are positive signs.

A lot of supply-chain-impacted categories, like household furnishings and apparel, are also seeing disinflation. Airfares have been falling for four straight months now, with prices 20% lower from March. Even hotel/motel prices are down 4% over the same period. Of course, this is unlikely to continue, but it is more than welcome.

All in all, the big takeaway is that disinflation is happening, and we’re likely to see more of it going forward.

This also means the Federal Reserve is less likely to raise rates again at their September meeting. And if the inflation data progresses as we expect, the July rate hike may very well have been the last of the cycle. That’s going to be a big positive for investors as we head into the fall and winter.

1864264-0823-A