“Spring is nature’s way of saying, ‘Let’s party!'” – Robin Williams

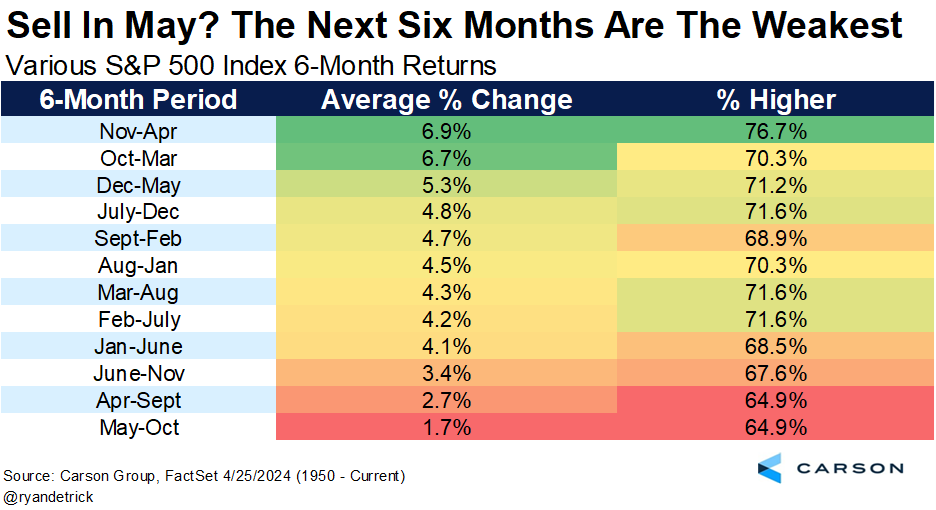

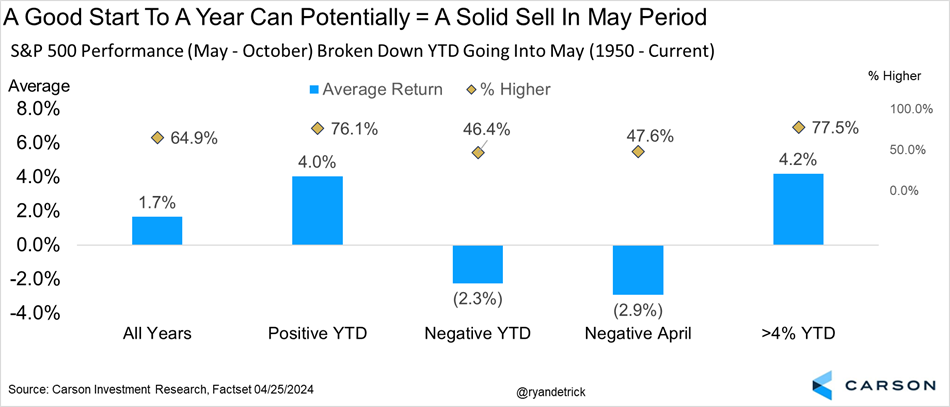

Buckle up, as the trigger points for one of the most well-known investment axioms, “Sell in May and go away,” is nearly here. This gets a ton of play in the media, as the six months starting in May are indeed the worst six consecutive months on the calendar historically. The S&P 500 has averaged only 1.7% over those six months and moved higher less than 65% of the time.

Now let’s be clear. Up 1.7% might not sound like much, but it is still an increase. Also, we do not advocate blindly selling due to the calendar. But it is worth being aware of this calendar effect, as you will hear a lot about it this week.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

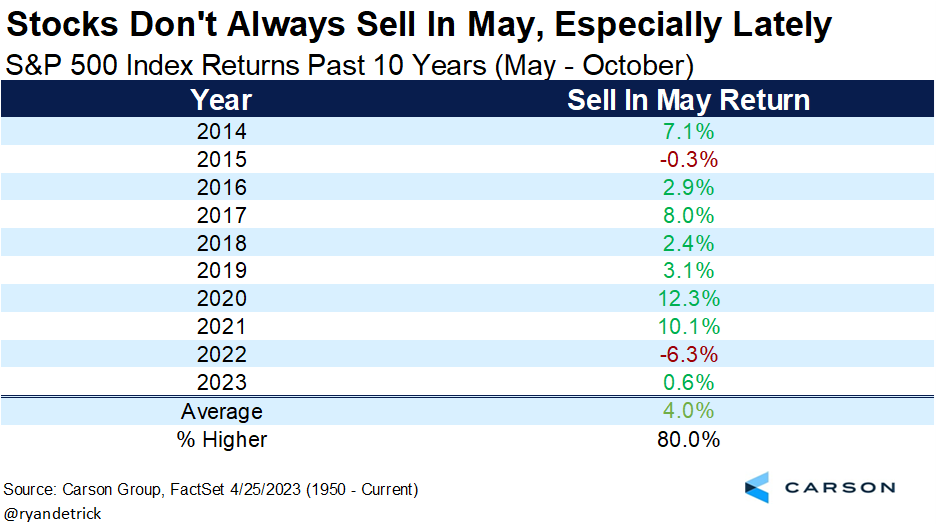

Now here’s something that might be less well known. These “worst six months” have gained in eight of the last 10 years.

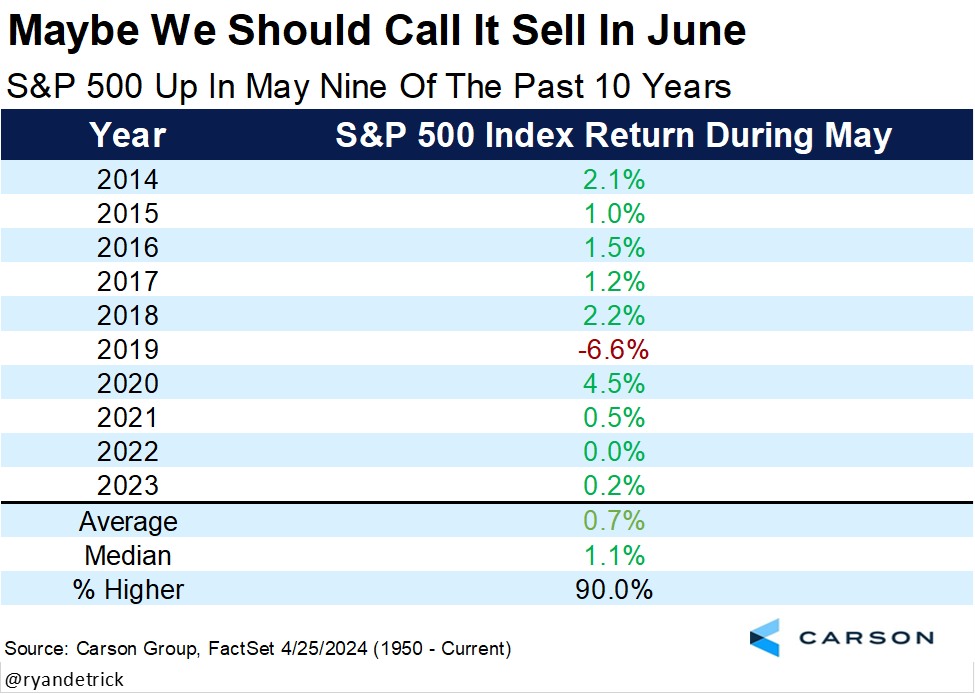

Not to mention the month of May has been higher nine of the past 10 years, so maybe we should call it, “Sell in June and go away”?

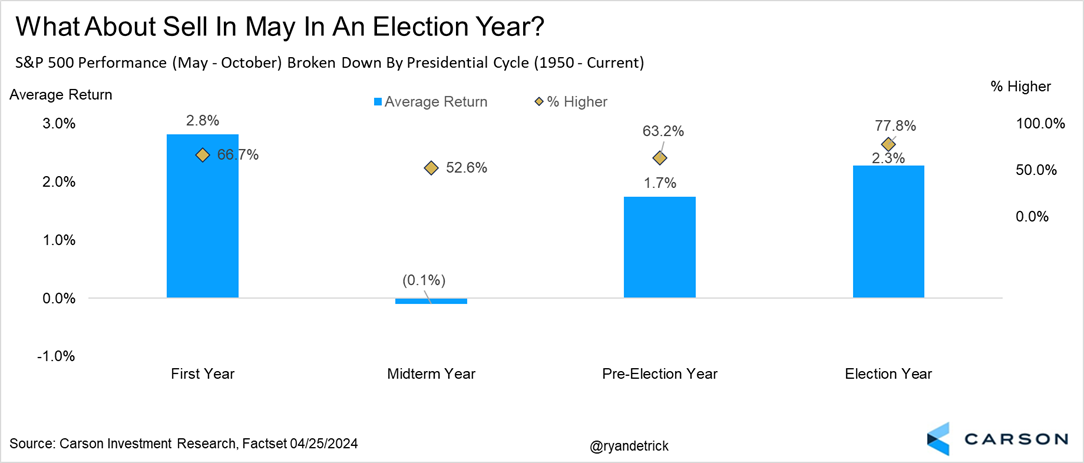

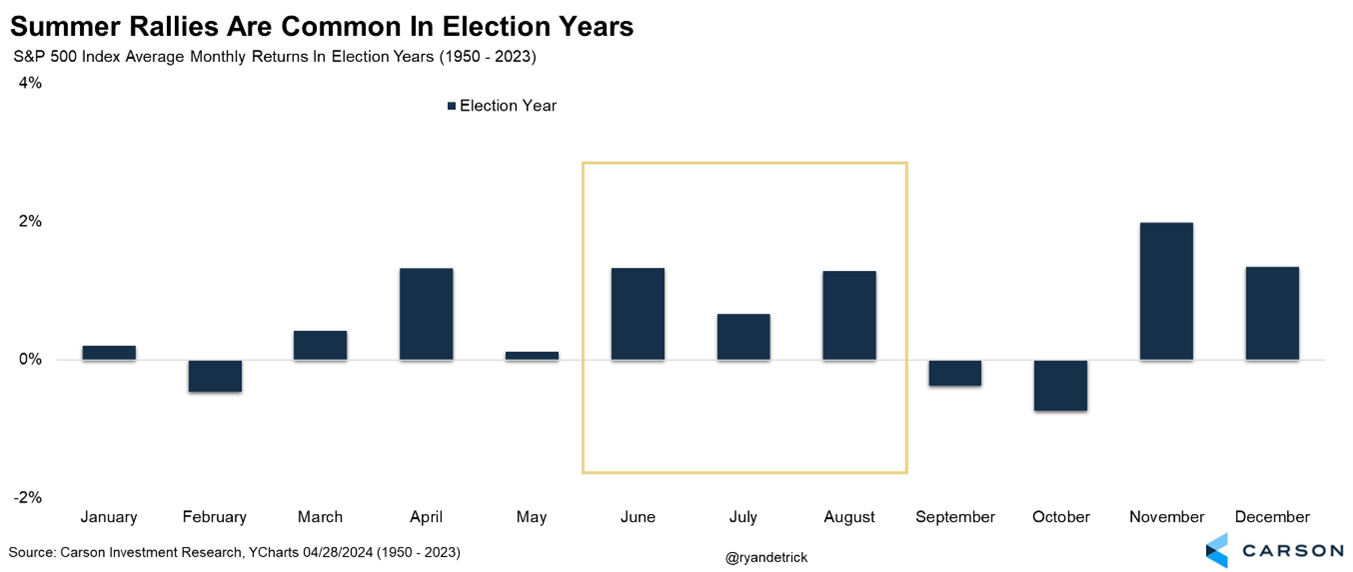

Election years also tend to see a summer rally and strength during these six months, with the May through October period up 2.3% and higher an impressive 77.8% of the time.

Here’s another way of showing that a summer rally in an election year quite normal. What stands out to me is October tends to be quite weak, as those jitters are strong ahead of the election.

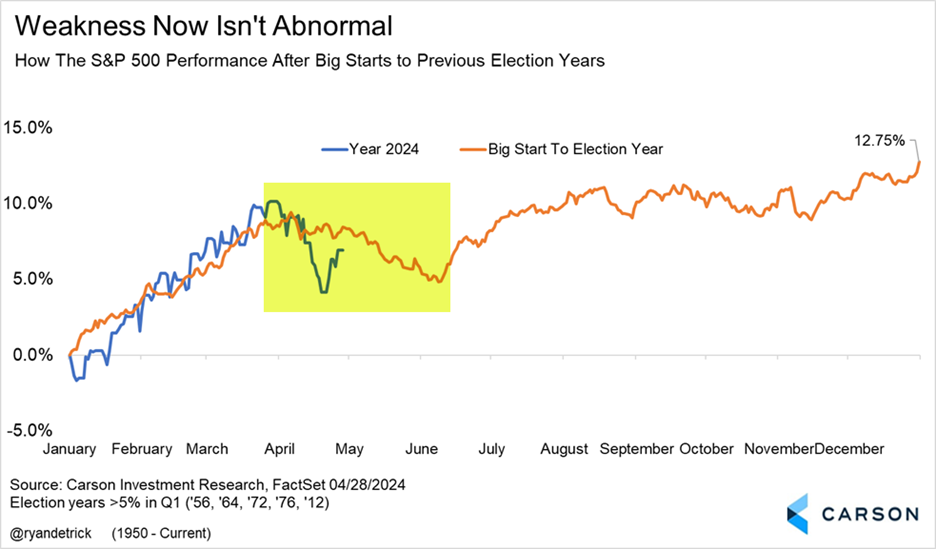

Given this year started off with more than a 10% rally in the first quarter, what has tended to happen in election years that saw big gains early in the year? April and May were weak, but stocks usually bottomed in early June before a summer rally. So far, this year is playing out to form.

How the market was doing going into these six months also mattered. Some of the worst “sell in May” periods have taken place when stocks were down year to date before May began, whereas if stocks were positive, the following months improved. In fact, when the S&P 500 was up more than 4% for the year at the end of April (as it likely will be this year), the following six months gained 4.2% on average and were higher nearly 78% of the time. Of course, when stocks were lower in April (like 2024) then those six months were quite weak, but much of this was due to the big drop in 1987.

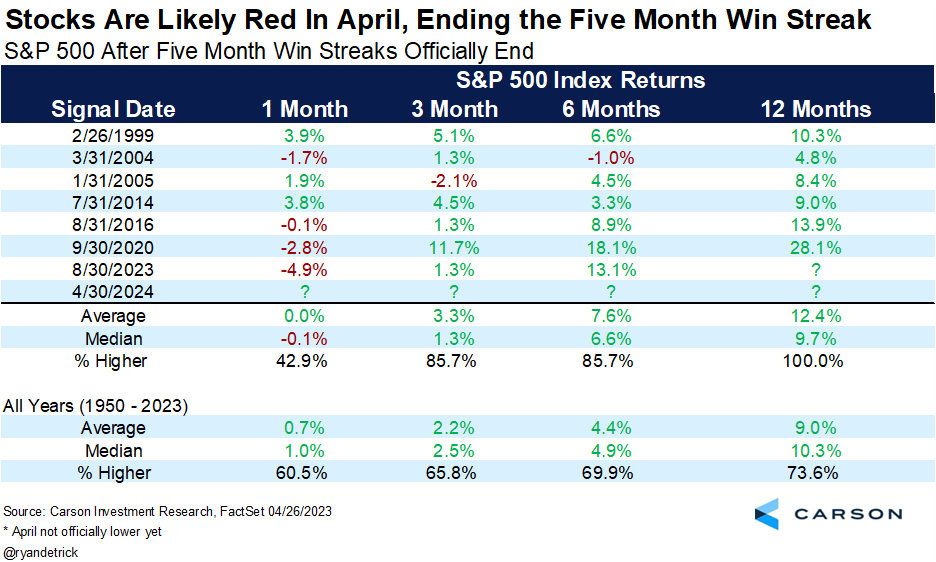

We aren’t overly worried about the normally bullish April struggling this year, as we were up five months in a row heading into it and some type of break was warranted. In fact, we wouldn’t be surprised if stocks consolidated for another month or so, working off some of the historic rebound off the late-October lows. We do not expect major weakness, but a break makes sense. However, since this is an election year and stocks have been strong so far this year, we think a summer rally and strength during these six months is likely.

Lastly, a five-month S&P 500 win streak is about to end, proving once again that all good things come to an end. The good news is looking at the end of previous five-month win streaks showed that a month later things were dicey, but going out 3-, 6-, and 12-months showed above-average returns. In fact, a year later stocks have been higher every time (six for six).

I joined Frank Holland on CNBC’s Worldwide Exchange last Friday to discuss the recent inflation trends, GDP, and why a summer rally in an election year makes sense.

For more content by Ryan Detrick, Chief Market Strategist click here.

02221592-0424-A