After the disappointing all around Consumer Price Index (CPI) report last week, the worries over inflation staying higher for longer (what they call sticky) is a very real worry. That report showed prices for many goods and services were increasing more than expected (even things like dental services were much higher than expected), while nearly every economist we saw on tv before the report was saying inflation had peaked and would be heading down, and in a hurry.

Full disclosure, I was in that camp as well, as I discussed with Yahoo! Finance here.

Well, it isn’t all bad news, as there are many signs inflation could still come back down quickly. For one thing gas prices continue to head lower, as my colleague Sonu Varghese recently wrote about. Sure, core consumer prices (excluding energy and food) are higher than anyone would like, but there are other types of inflation than just at the consumer level.

Here are five reasons that suggest inflation could still fall quite quickly and last month’s CPI data isn’t the beginning of a new trend.

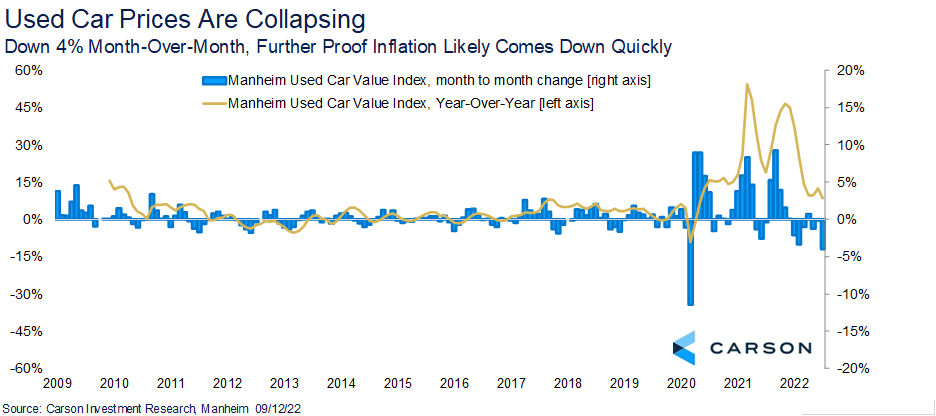

First up, used car prices collapsed four percent last month according to the Manheim Used Car Value Index. This was the second largest monthly decline ever and the year-over-year change is down to 8.4%, the lowest since June 2020. This large drop wasn’t accounted for in the recent CPI report and will put downward pressure on prices over the coming months.

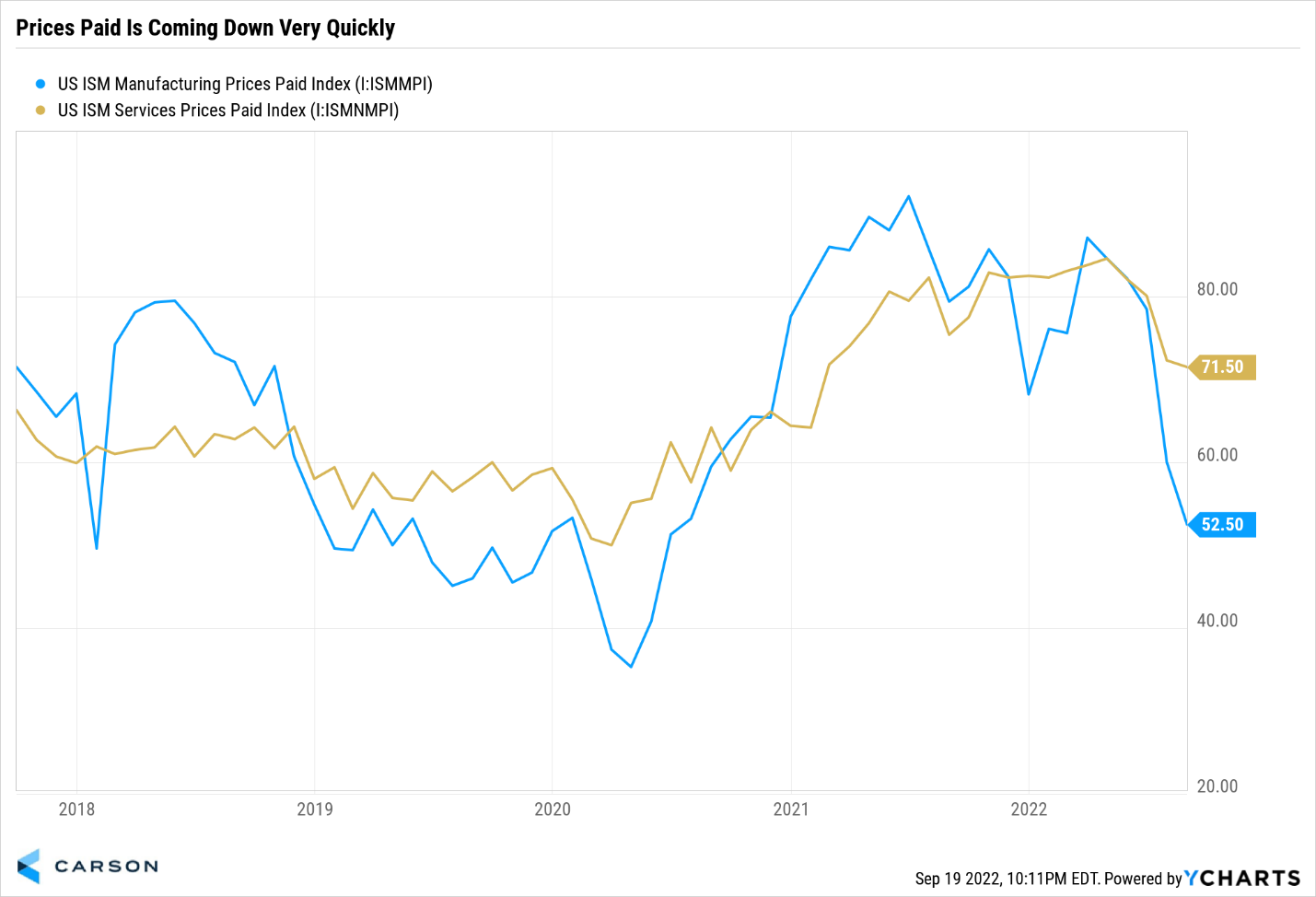

Second, how much companies are paying for things is going down and quickly. Looking at the prices paid component of the ISM services and manufacturing surveys show a big move lower the past few months. Prices paid tends to lead overall CPI by several months, and so this is another reason to think inflation could come down quickly before year-end.

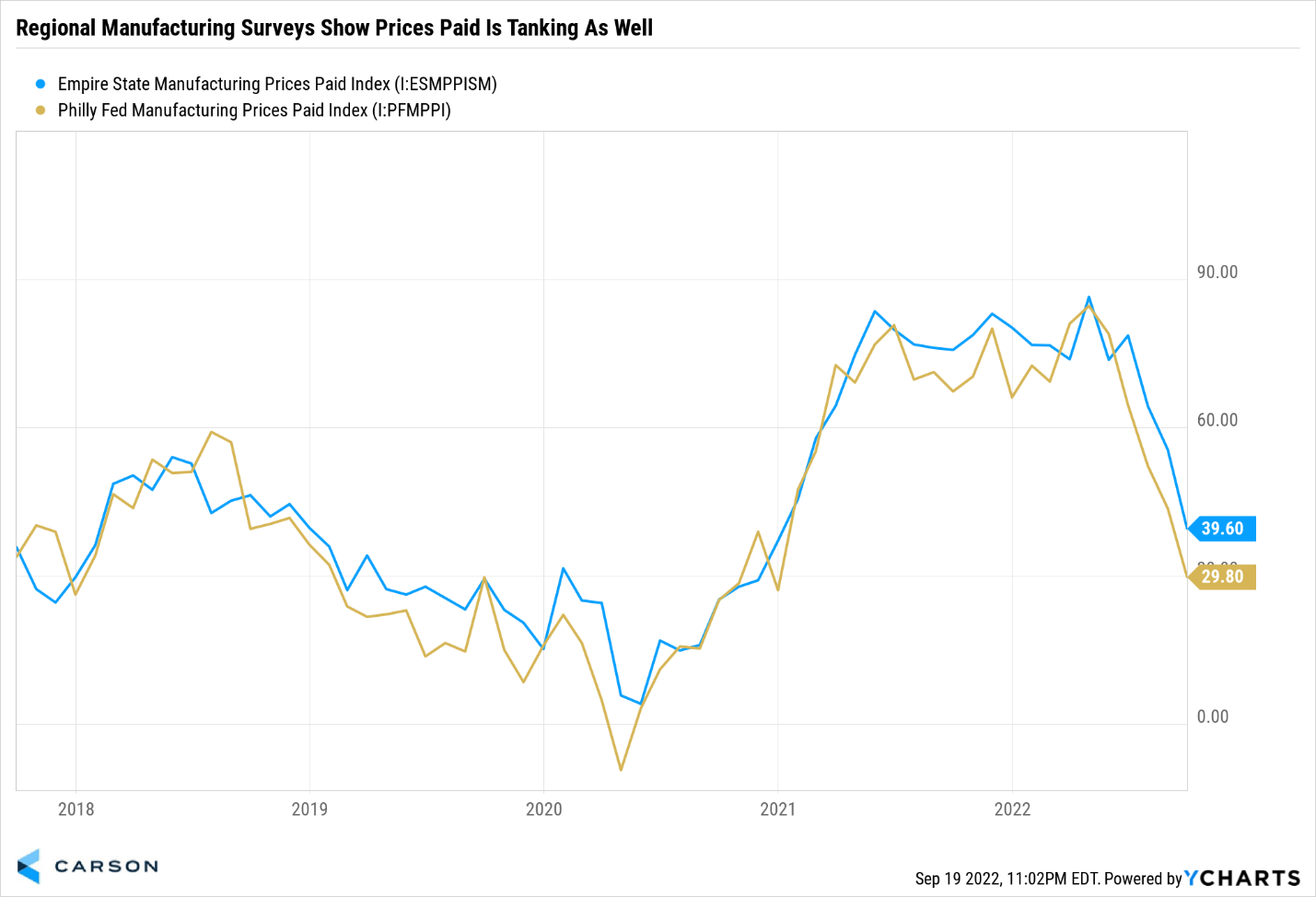

Third, the ISM is a national survey, but regional surveys show similar results. The recent Philly Fed and Empire State surveys each show prices paid crashing lower.

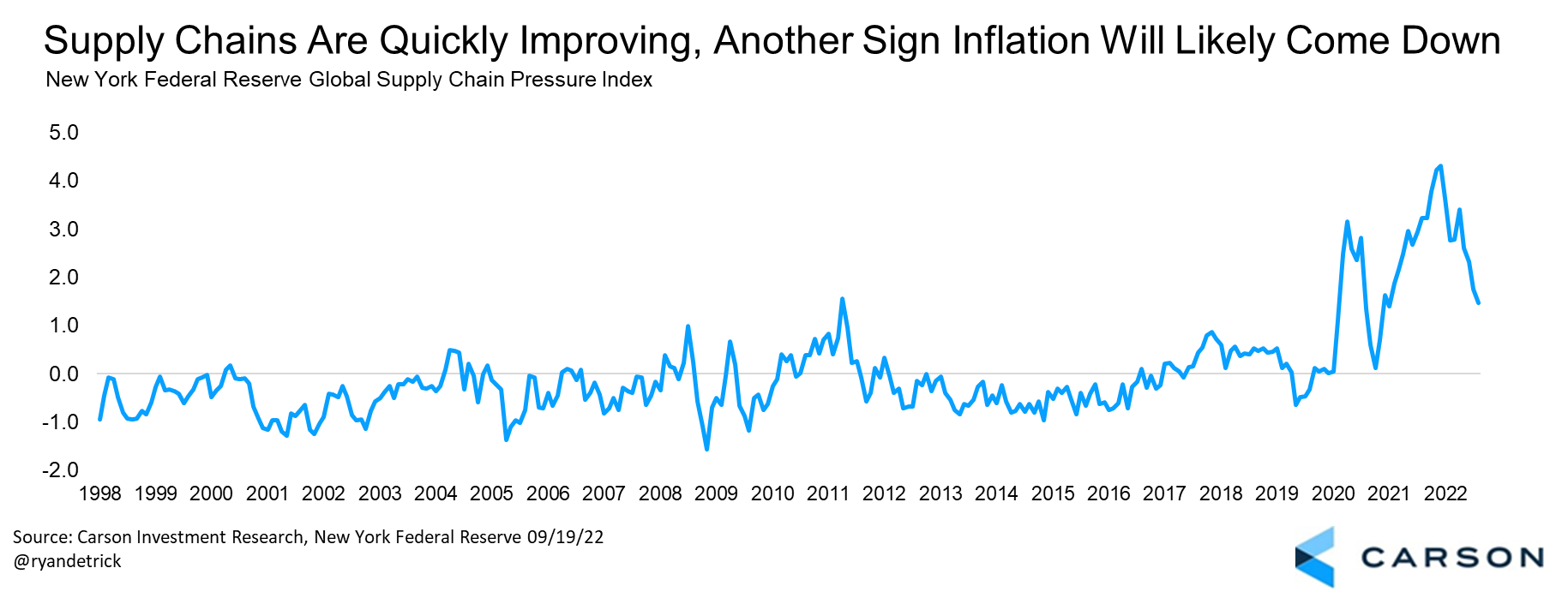

Fourth, supply chain issues were a major reason for the huge spike in inflation. So, you would think once those supply chains begin to improve, so would inflation. The good news is we are seeing substantial improvements in supply chains. For instance, back in January more than 100 ships were caught in a logjam at the Port of Los Angeles, yet earlier this month there were less than 10 ships. And as the chart below shows, overall supply chain pressures have come down significantly. Another source of potential downward pressure on overall inflation.

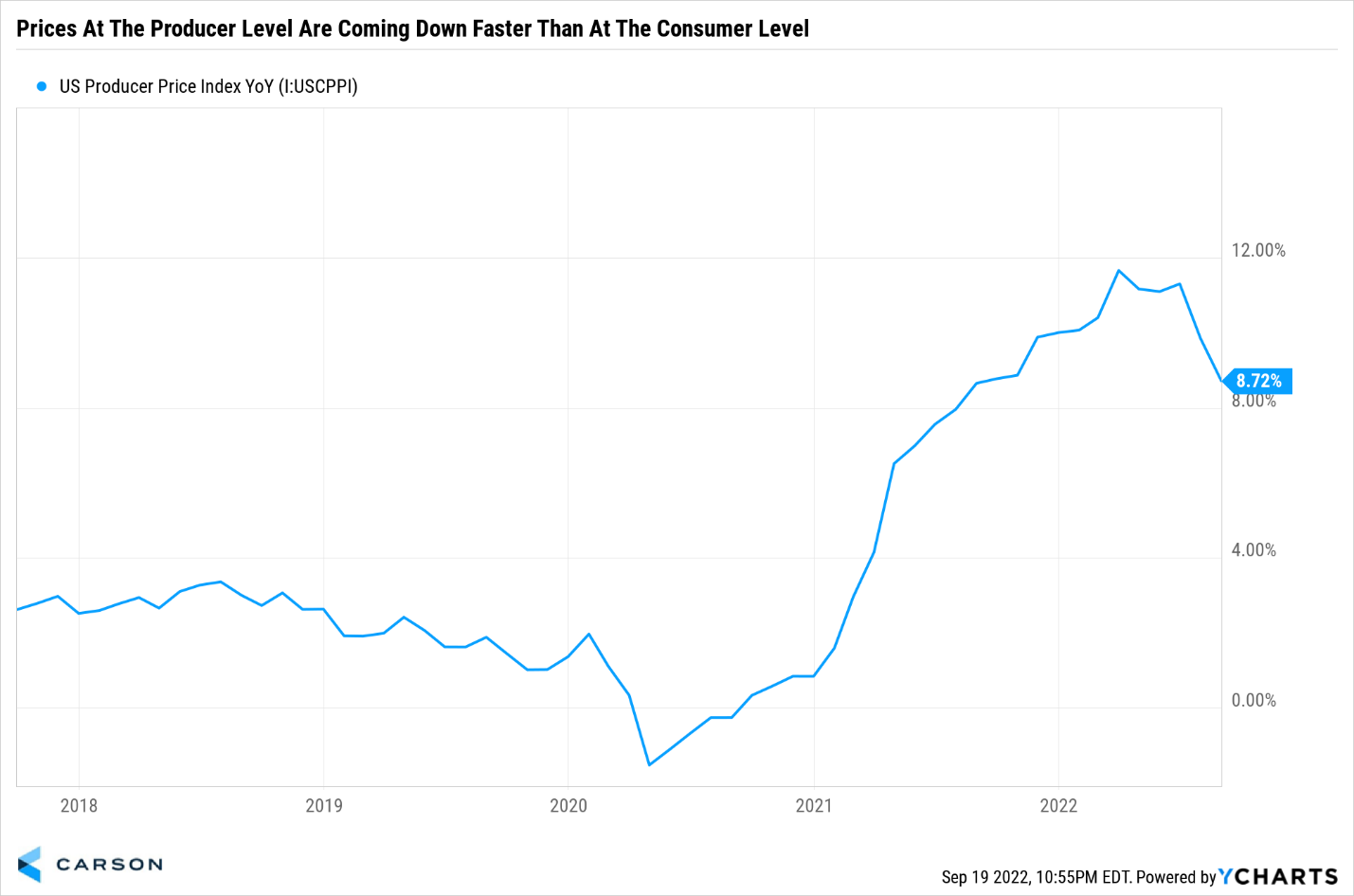

Lastly, prices at the producer level have come back much quicker than at the consumer level. The Producer Price Index (PPI) year-over-year peaked at 11.6% in March, but it was already down to 8.7% five months later. Compare that with the CPI peaking at just over 9.0% and only at 8.3% currently.

So there you have it. Inflation is still a major issue, and that recent CPI report wasn’t pretty in any way. But there is light at the end of the inflation tunnel, as other aspects of inflation is showing some incredible improvement and not many people are noticing.