In today’s episode of Framework, Jamie talks with Dana Anspach, the CEO and founder of Sensible Money. Dana has worked in nearly every capacity as a financial advisor and is a champion for fee-only advising.

After getting tired of the way firms work with advisors, Dana decided she wanted to do business independently. Leaving the quotas and product sales behind, she moved forward with creating a client-centric financial planning firm to better serve her clients.

When Dana founded Sensible Money, she realized that being transparent with her employees and stakeholders was critical to her growth as a business owner and leader. She values ongoing education as a way to continuously improve her leadership skills and her value as a financial advisor. Figuring out how to become a better leader is one of the biggest challenges she faced as a business owner, but also the most rewarding.

Dana talks with Jamie about how she started her journey as an advisor, why she got tired of working with firms, and how she finally took the leap into running her own business.

“I will say, as an advisor, you have to make a choice. I knew, for me, that I wanted more out of my career than being a solo practitioner. I knew growing a firm would be a challenge, but that’s what I was up for. I knew the path I was headed down.” ~ @moneyover55

Main Takeaways

- Being an advisor means you have to be a good listener. Listening to your clients helps you better understand who they are and their goals.

- If something is not working and you feel that you can make a difference in that area, don’t be afraid to take the leap. Doing things independently can be challenging but the rewards are there.

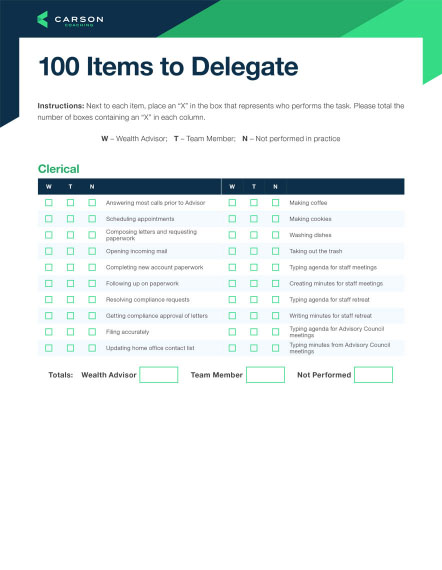

- Put processes and systems in place — everything is more efficient when it’s organized.

- Be an authentic leader. Showing vulnerability doesn’t mean you’re weak — it means you’re human.

Links and Important Mentions

- Dana on LinkedIn

- Dana’s Email

- Sensible Money

- Control Your Retirement Destiny: Achieving Financial Security Before The Big Transition by Dana Anspach

- Social Security Sense: A Guide to Claiming Benefits for Those Age 60-70 by Dana Anspach

Get a Free Coaching Call From a Carson Group Executive Business Coach

It’s important to get an outside perspective from inside the industry. Our executive business coaches have years of experience in building and growing advisory firms. In fact, our coaching members grow 2.5x the industry average over a two-year period.

So here’s our challenge to you: put a framework in place for your business by getting a free coaching call. One of the most important calls with your coach is the first one. And we’re giving it away for free.

Go to CarsonGroupCoaching.com/Framework to sign up for your free coaching call with a Carson Group Executive Business Coach.