The economy grew 1.6% in the first quarter, after adjusting for inflation. This was well below expectations for a 2.5% increase, and significantly below the 3.4% increase we saw in the last quarter of 2024. It also ended a streak of growth above 2% for six consecutive quarters. So, what happened – is growth really slowing down, and should we worry?

Simply put, no.

As with all macroeconomic data, you always want to look under the hood. Underneath the hood of GDP you find 5 major components:

- Household consumption

- Investment – both nonresidential and residential

- Government spending

- Change in private inventories

- Net exports (exports minus imports)

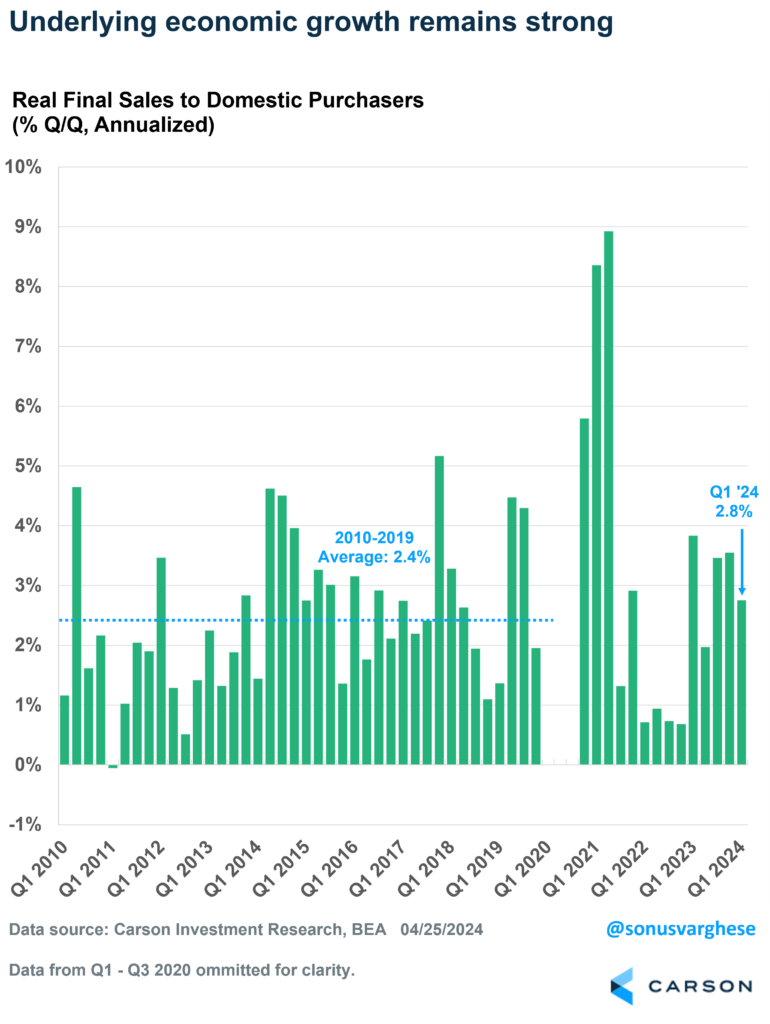

The last two, private inventories and net exports, tend to be the most volatile pieces of GDP growth. Excluding these gives us a much better picture of actual spending and production in the economy, i.e. final demand after adjusting for inflation. Think of it like “core GDP.” Real final demand rose at an annualized pace of 2.8% in Q1, well above the 2010-2019 average pace of 2.4%.

In fact, government spending eased in Q1 as federal nondefense spending fell, and state/local government investment pulled back. Excluding government spending from final demand, real private final demand rose 3.1% in the first quarter. That’s strong, no two ways about it. In fact, while last quarter’s GDP number is a lagging indicator, the most useful part of the report in terms of looking ahead is final demand. Right now, there’s not much sign that it’s slowing.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

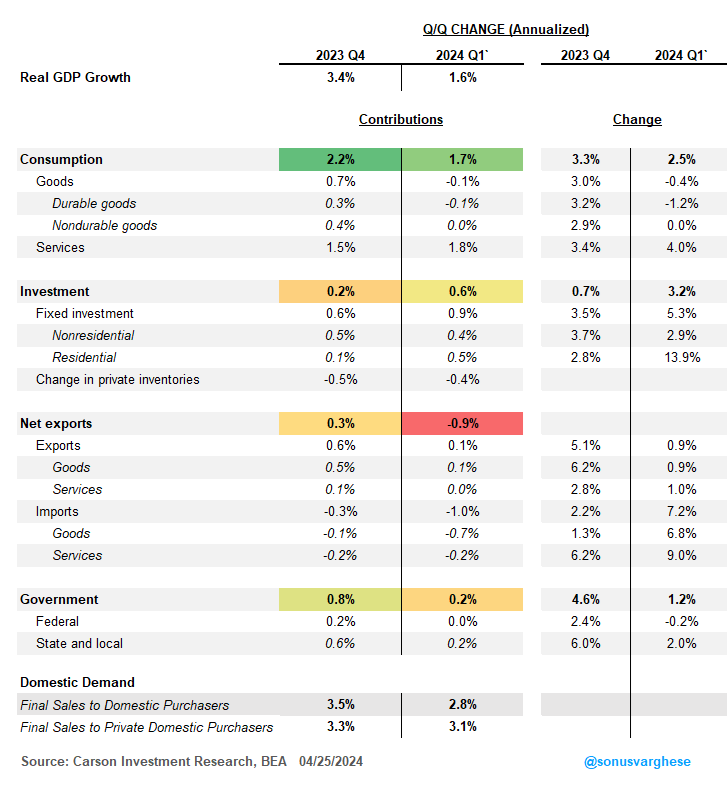

The table below shows a breakdown of GDP growth by the major groups I mentioned above. Some highlights:

- Consumption eased, but mostly because households purchased fewer vehicles and less gasoline (in real terms).

- Services spending accelerated at the fastest pace since the third quarter of 2021 (when it was fueled by the pandemic recovery).

- Investment spending picked up, with tech and industrial equipment spending accelerating.

- Residential investment (housing activity) added the most to GDP growth since Q4 2020.

You can see how the change in inventories and net exports were a big drag, pulling GDP growth lower by 1.21%-points when combined. Net exports were driven down by a surge in imports, as American households and businesses bought a lot more stuff from abroad than they did in the fourth quarter of 2023.

Here’s the Big Picture

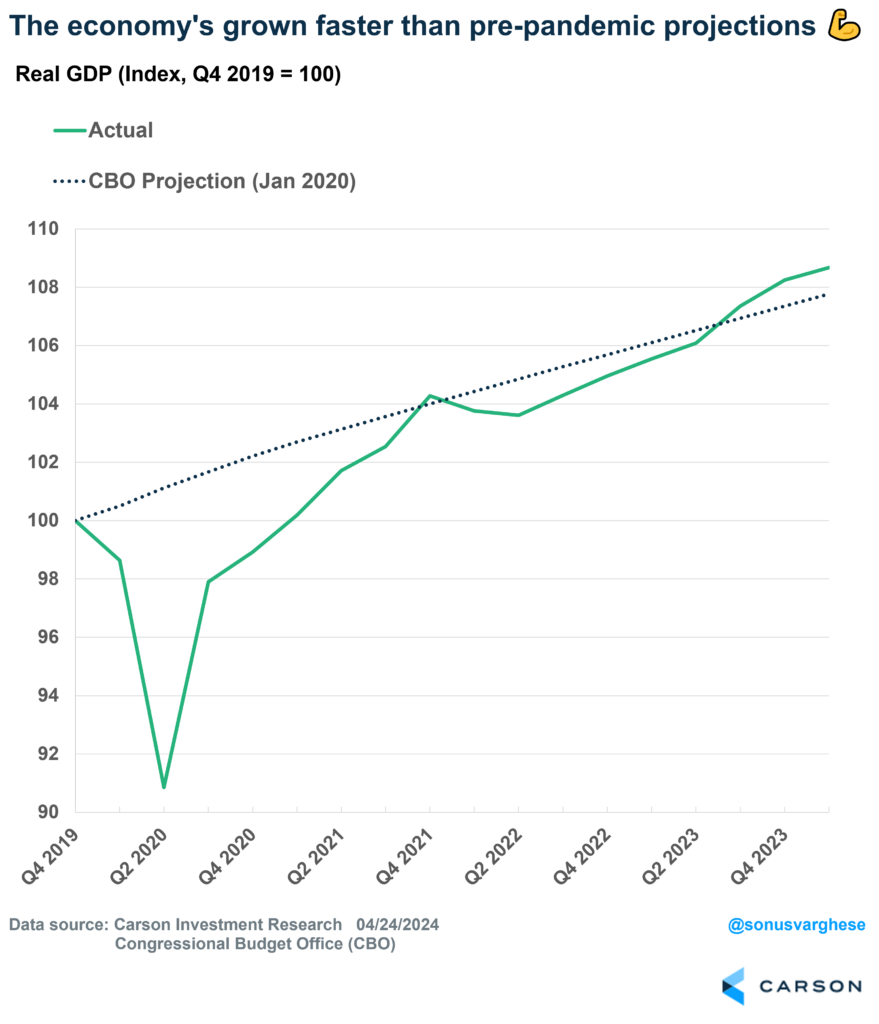

As I pointed out above, economic growth remains strong when you consider the most important parts of the economy – household consumption, investment, and yes, even government spending. What’s amazing is that the economy has grown at a faster pace than the Congressional Budget Office (CBO) forecasted in January 2020. After adjusting for inflation, the economy is almost 1% larger than the CBO had projected. That’s despite 1) a worldwide pandemic, and 2) the most aggressive rate hike cycle by the Federal Reserve in 40+ years.

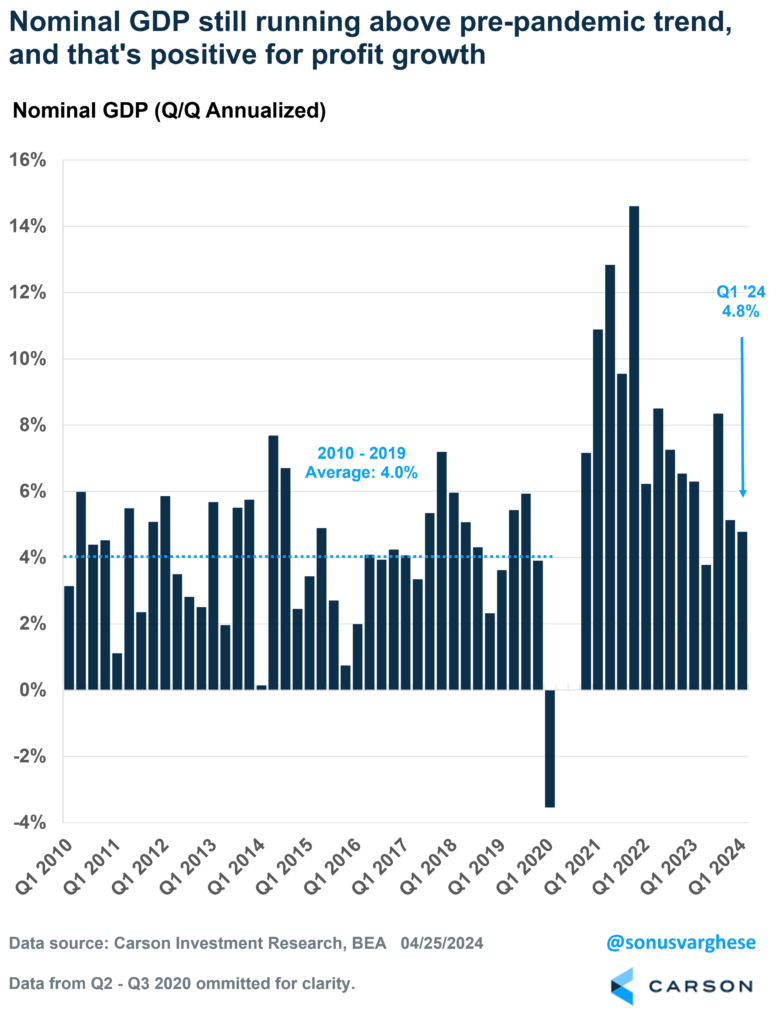

Of course, a strong economy means inflationary pressures are stronger, and we saw some evidence of that in the first quarter, which indicates that interest rates are likely to stay higher for longer, as I wrote in a blog last week. Stronger economic growth plus more inflationary pressures means the economy is growing quite rapidly in nominal terms (that is, before adjusting for inflation). That’s important because nominal GDP growth is ultimately where profits come from (the same blog linked above discusses how this happens). Nominal GDP growth rose at an annualized pace of 4.8% in the first quarter, much faster than the pre-pandemic trend of 4.0%. The underlying numbers point to a continuation of this above-trend pace. That’s positive for profit growth, which is ultimately what matters for markets over the long run.

Ryan and I discussed the recent market pullback, along with the drivers of market returns, including profit growth and valuations, on our latest Facts vs Feelings podcast. Take a listen here:

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02216793-0424-A