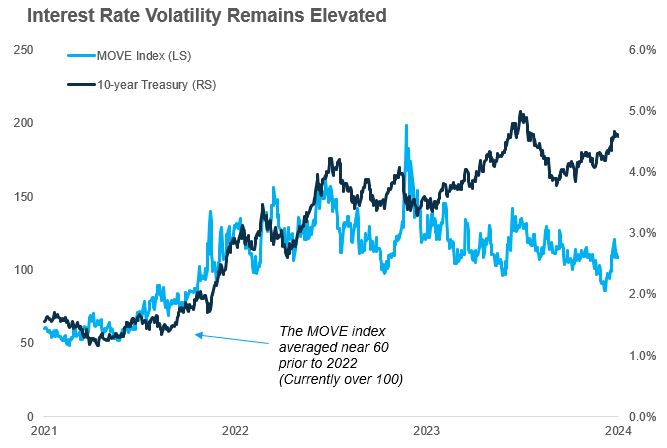

We’ve written a lot recently (here, here, and here) on the recent backup in yields as Fed Reserve interest rate cuts have been repriced following hotter-than-expected inflation and stronger-than-expected economic growth. Interest rate volatility as measured by the MOVE Index, the VIX’s cousin but for bonds instead of stocks, has also subsequently picked back up following a slow decline since the end of 2022. Interest rate volatility not only causes angst for investors, but also for businesses trying to borrow. Despite still high rates, corporate bond issuance has surged this year following the decline in rates (and spreads) from last years high’s, more than an 80% increase year-over-year versus 2023 when interest rate volatility was substantially higher.

Source: Factset 4/23/2024

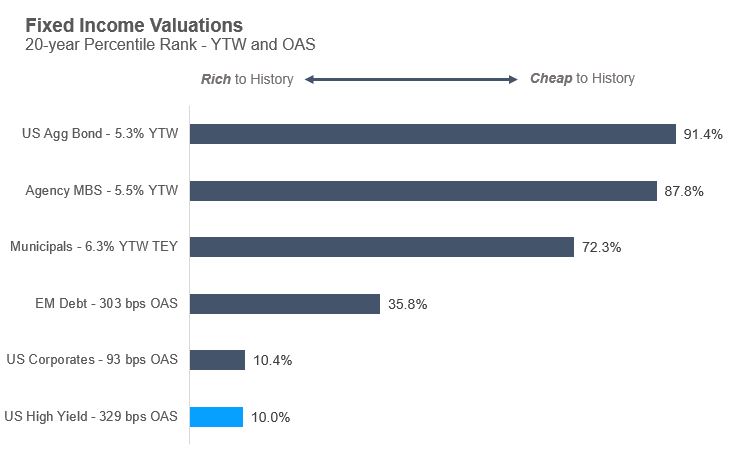

Rising real and nominal interest rates aren’t exactly comforting for anyone borrowing money, but for bond investors – those lending money to borrowers – higher yields mean better opportunities and future returns. Of course, those opportunities are not all created equal. Looking across the fixed income landscape there are certain opportunities in areas that are often overlooked. The chart below shows various asset classes within fixed income by two different measurements: yield-to-worst (the most conservative yield metric) and option-adjusted spread to Treasuries. Higher-quality debt can be ‘valued’ by looking at the current yield relative to the history of the asset class (in this case 20 years). Non-government-related fixed income is generally looked at in terms of yield spread relative to Treasuries, which is done here for investment-grade corporate and high-yield bonds.

Source: Carson Investment Research, Factset 4/23/2024. Indices used: Bloomberg USD EM, US Aggregate TR, Bloomberg US Securitized – MBS, Bloomberg US Municipal TR, Tax Equivalent yield shown, ICE BofA US Corporate, ICE BofA US High Yield

Fixed income valuations read in in the opposite manner of equities. High relative yields and wide relative spreads imply value opportunities, all else equal. The broad aggregate bond index, which consists of 70% Treasuries and government-backed agency mortgage-backed securities (MBS), is trading at top-decile yields – not all that surprising after delivering a -3.5% annualized 3-year return. Agency MBS have become very attractive as well, by some measures yielding more than comparable corporate bonds – something that has rarely occurred. The bifurcation of the mortgage market is striking, as mortgages packaged in groups of 2-3% coupons face almost no foreseeable prepayments, whereas 6-7% coupon mortgages are likely to be refinanced as soon as the borrower is able. These high coupon mortgages trade at a premium due to their very attractive government-backed yield, but once those borrowers are able to refinance, they will be paying back at the lower par value, hurting the value of the MBS month after month. For this reason (amongst others) active management in the core bond space is becoming as important as ever.

On the other hand, while absolute yields are relatively high, spreads versus Treasuries in investment-grade corporates and high-yield bonds are trading near the tightest they ever have historically. This wasn’t always the case – during 2020 and again in 2022 spreads presented opportunities, but markets move fast. At this juncture, the risk/reward opportunity seems to favor higher-quality asset classes where absolute yields are high and spread risk is very low.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Fixed income has been a thorn in the side of balanced investors in recent years and it’s no surprise that short-term Treasuries and money market funds have garnered so many assets. That too will change eventually. As rates fall even a little bit of duration (a measure of interest rate sensitivity) will pay off. Certain sectors of fixed income become more attractive every day that rates rise further, and this future predictability of fixed income can be valuable. We will continue to be flexible yet controlled in our allocations, leaning on high-quality active managers where applicable.

For more content by Grant Engelbart, VP, Investment Strategist click here.

02214454-0424-A