Diversification away from US stocks has been a frustrating exercise for those of us involved in asset allocation for a good 15 years or so now. There have been a few good years, notably 2017, but it’s been rare. Coming into 2025, you would not have thought that international stocks would outperform, let alone by as much as they have. The dollar had been running strong on the back of hot US growth expectations, and almost everyone was bullish. US stocks seemed like a lock to outperform once again. This was the economist cover last fall.

Moreover, with tariffs on the way (albeit more moderate than we saw on Liberation Day), there was an expectation that the dollar would appreciate (mitigating some of the impact of the tariffs). Instead, we’ve gotten the opposite, across the board. The dollar index has fallen almost 9% year-to-date and is at its lowest level since mid-2022. The dollar index is now over 10% off its peak in January. Of course, the dollar’s seen sharp downturns before, most recently in late 2022, but this time it’s happened despite elevated treasury yields (back in 2022 yields were also pulling back in a big way).

I’ve discussed in the past how the dollar matters for international equity returns (for USD-based investors). International equity returns have been highly correlated to currency moves over the last 24 years (2001 – 2024)

- International market excess returns are typically negative, i.e., US equities outperform, when the USD appreciates

- International markets usually outperform when the USD weakens

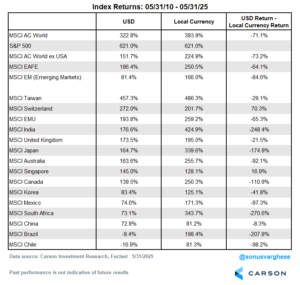

Things have played out to form this year as well. The S&P 500 index is up 1.1% year-to-date (through May 31st). Compare that to

- The MSCI All Cap World Index Ex US is up 14.0% year-to-date

- The MSCI EAFE Index is up 16.9%

- The MSCI EM Index is up 8.7%

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

In fact, if you look at major countries (using MSCI indices, including the MSCI EMU index for Europe), nine out of fifteen are up over 15% year-to-date, and eleven are up over 10%. And as you can see below, they’ve all benefited from the tailwind of a weaker dollar.

Of course, it’s not just about the dollar though – eight out of the fifteen international indices I track below have double digit gains even in local currency terms.

Taiwan is the big laggard, mostly because over a fifth of the index is made up of one company, the chip manufacturer TSMC, which is down over 11% this year. Japan has also lagged, with local currency returns of 1% – but this is where the yen’s appreciation against the dollar has helped, boosting the USD return to almost 10%.

On the other side, Mexico is up almost 20% in local currency terms, as is Chile and South Africa (which have been helped along by higher commodity prices). Even the MSCI China Index is up almost 14%.

In theory, tariffs should hurt foreign exporters more than the US. In reality, that’s not being reflected in equity market performance.

Still a Long Way To Go To Catch Up

Of course, this is just five months of outperformance. Roll the horizon back to a decade or even the last fifteen years, the picture still looks extremely skewed, in favor of US stocks.

The S&P 500 is up a whopping 621% (14.1% annualized return) over the last fifteen years. Compare to

- MSCI All Cap World Ex US Index is up 152% (6.3% annualized)

- The MSCI EAFE Index is up 186% (7.3% annualized)

- The MSCI EM Index is up just 81% (4.1% annualized)

A strong dollar was a clear headwind for international equities (for Americans, unless you hedged for currency), but even in local currency terms, the cumulative returns were less than half that of the S&P 500.

In local currency terms, the best two countries after the US were Taiwan (+486%) and India (+425%), followed by South Africa (+344%) and Japan (+340%) – the S&P 500 cumulative return was well above these.

Of course, that’s the rearview mirror and as the saying goes, you should never drive a car by looking back (note that the picture changes a bit if I move the lookback window to 25 years, instead of 15 years). Though within the realm of investing that’s all we have. So, the big question is whether things shift.

One idea that’s been going around Wall Street over the past month is the TACO trade, i.e. “Trump Always Chickens Out” and so things will go back to normal. Combine that with recent court rulings, and the thinking is that we’re past the tariff worries. However, as I wrote in a piece last week, that’s not quite the case – tariffs are likely here to stay, though we may not see a dial up to ridiculously extreme levels (one can hope). The US average effective tariff level was about 2% at the start of the year, and when all this is said and done (again, one can hope), average effective tariff rates may be 15-20%. That’s a big shift over a relatively short period of time, and ultimately, tariffs are a tax. And the data so far shows that the tariff tax is being paid by US businesses (via a hit to margins) and consumers (via goods inflation). Interest rates are also higher, which is mostly normalization but also partly reflective of future inflation uncertainty (tariffs can also create supply shocks, even as massive fiscal deficits continue to prime the pump) – and elevated rates are hurting cyclical areas like housing.

Until early this year, expectations were that the US economy would significantly outpace the rest of the world – hence, the dollar strength, and the Economist cover. But expectations have shifted now, in two ways. There are clear drags on the US side, but the tariff situation has also pushed the rest of the world to get its act together. Even before Liberation Day, I wrote about how Germany’s fiscal policy announcements are a potential game-changer.

But at the end of the day, this is all about expectations. If US growth expectations shift down, even as expectations for growth everywhere else shifts higher (and it doesn’t take much given how bad it’s been, especially in Europe), we could see more dollar weakness and potential outperformance for international stocks. It’s not to say that the US economy will underperform, but there’s a lot of uncertainty now. This is big reason why the equity allocation mix in our portfolios look very different now compared to how we’ve been positioned over the last few years – since the beginning of the year, we’ve moved from a big US overweight position to a more neutral US-International mix (relative to our benchmark).

We’re not quite ready to move to an international equity overweight and one reason is the dynamism of US companies, especially on the AI front. On our latest Facts vs Feelings episode, Ryan and I spoke to Dan Ives about AI, US technology companies, and even why its tough to decouple from China. Take a listen below.

8032685.1 – 06.03.25 A

For more content by Sonu Varghese, VP, Global Macro Strategist click here