We often get asked about whether stock returns have been just too good in the near term and have formed a speculative bubble. Our Chief Market Strategist Ryan Detrick debunked that idea in his blog yesterday. But occasionally we also get asked whether returns have been too good over the longer term. We take a look at that today.

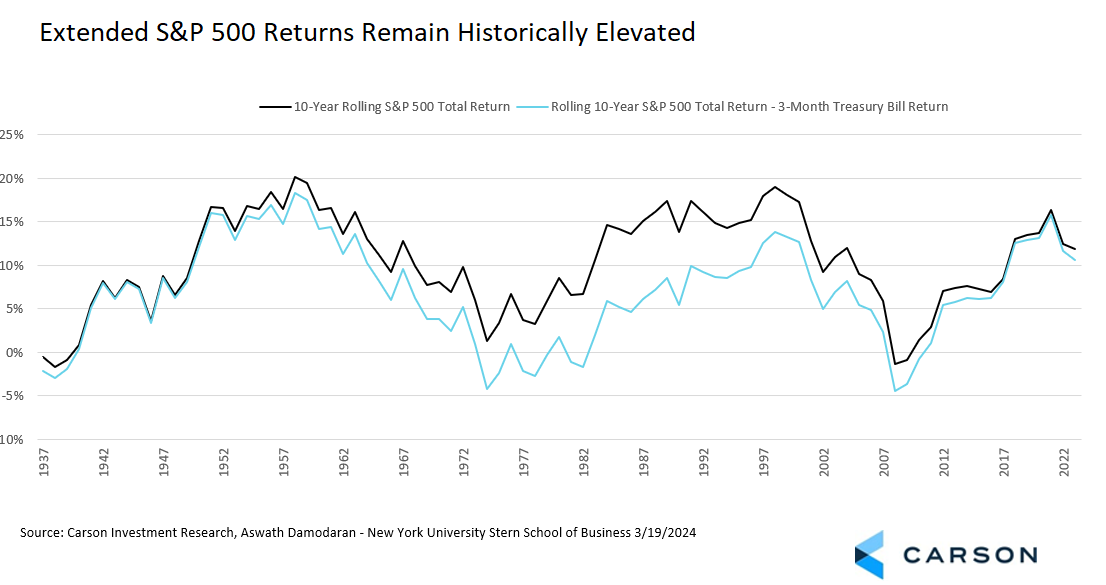

In 2021, the performance of the S&P 500 Index above Treasury bills over the preceding 10-years reached its fifth highest level on record. The four better ending years, which overlap, all occurred in the 1950s. But wait, what about the tech bubble of the late 90s? Well, S&P 500 returns were higher in the period ending in the late 90s and in 2000, but yields were higher too, making the advantage of stocks over Treasuries smaller.

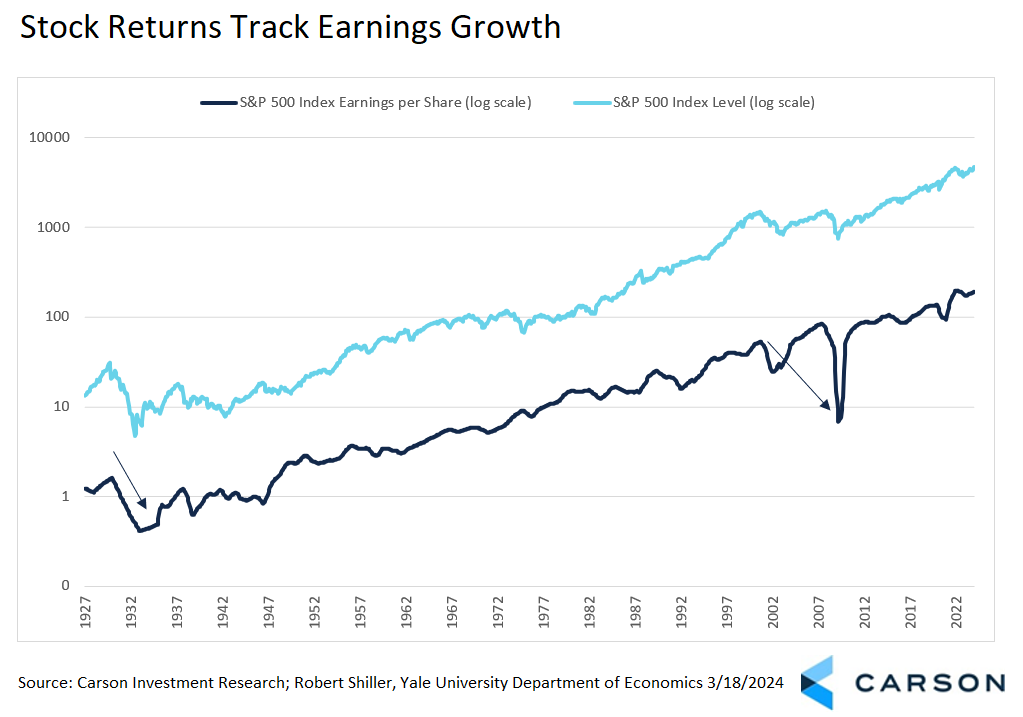

A few things to take away from the above chart. First, historically, the longer the holding period for stocks, the less likely an outright decline. Over 10-year rolling periods going back to an initial period of 1928-1939, the S&P 500 has been higher 94% of the time, or 97% of the time since 1950. This wouldn’t be meaningful if there wasn’t a reason for it, but there is. Stocks are primarily a claim on future corporate earnings. If corporate earnings grow, all else equal, stock prices should rise once you take out the noise of short-term fluctuations. While stocks are really a claim on future earnings, the perceived risk of future earnings often depends on the variability of current earnings, so shorter term fluctuations can have some relationship to current earnings too, as seen below. As Ryan highlighted yesterday, most of the recent rally has in fact been because of improved earnings expectations.

Second, it’s true there have been a few periods where stocks were a little less than flat even over a 10-year period. But remember, one of these periods was the Great Depression; the other was bookended by two bubbles bursting, first speculative investment in early, often unprofitable, internet stocks and then leveraged speculative overinvestment in the housing market. Periods of higher returns are more vulnerable to economic shocks, but it’s the shocks that lead to periods of lower returns and the timing of those shocks are unpredictable.

To highlight this, eyeballing the first chart above, 10-year S&P 500 returns start to look historically high when they get up above 15%. That’s only happened over three extended periods, the 10 years ending in 1951, 10 years ending in 1987, and most recently in 2021. But if you take the first two examples, a decade after reaching that lofty height, the S&P 500 returned an annualized 16.6% and 17.9%.

That is, not only did stocks maintain their strength over the next 10 years—they got even stronger. The point isn’t that we expect great returns through 2031, but only that there’s no reason to expect the opposite to happen, namely that a predictable weaker period is now “due.”

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

In fact, if you look at the 10-year periods that had outright declines, you notice that they are also accompanied by historical collapses in earnings. Yes, we do know that both periods were accompanied by periods of speculative excess, not just in markets but also in the broader economy (to which markets made a contribution). But it was the economic comeuppance as reflected in earnings that was their ultimate undoing, not simply that market returns had been strong.

What does this mean looking ahead? Well, one question to ask is whether we’re in a period of broad speculative excess, driven by a cycle of overconfidence, overspending, and overborrowing, that makes the economy especially vulnerable to a sharp earnings decline. It’s very hard to make that case right now. As we’ve highlighted many times, in the wake of the Great Financial Crisis (GFC), businesses and households made considerable progress repairing their balance sheets. Perhaps the most notable excess right now is the impact of the of extraordinarily accommodating monetary and fiscal policy, first in response to the GFC and then the COVID pandemic. There are likely some risks associated with that, although monetary policy is now the tightest in decades and so far the economy has remained resilient.

Our view, in fact, is the opposite. We may see some forces just starting to come into play, particular from developments in artificial intelligence (AI), that may help spur economic growth and earnings over the next decade. There are risks of speculative excess in those areas, but we’re certainly not seeing that now. To the contrary, the economic mood overall seems historically muted. From a long-term perspective, we have to land in the same place as the short-term perspective. Yes, we’ve had a decade of strong stock returns. Maybe that makes us a little more vulnerable to an unexpected economic shock, but that means little in itself. Stock returns over the next decade may not be quite as high as the historical average with valuations somewhat elevated, but there’s little reason to call it a bubble and our strategic outlook remains that stocks are likely to provide a nice risk premium over bonds over the long term.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

02164809-0324-A