Happy March 1st! Yesterday was Leap Day and we threw an extra special Facts vs Feelings event to celebrate: a 4 hour live stream with some of the top experts in the world of investing and finance, including Dan Ives (Managing Director and Senior Equity Research Analyst at Wedbush Securities), Cathie Wood (Chief Executive Officer and Chief Investment Officer at ARK Investment Management, Libby Cantrill (Head of US Public Policy, Managing Director at PIMCO), and Neil Dutta (Partner, Head of Economic Research at Renaissance Macro Research). Ryan and I had a lot of fun, and it took a village behind the scenes to put it on (thank you to all the folks at Carson Group). If you missed it, keep an eye out for individual Facts vs Feelings episodes with each of our guests, which will be released over the next few weeks.

If I had to find a common thread across all our guests, it was a general sense of optimism around the economy and markets. Neil Dutta put it succinctly when we asked him what the story of the economy was right now. His response: “The economy is fine.” He went on to add that investors have been so focused on looking for risks over the last decade, that a big risk right now is that folks could potentially miss the upside. Historically, Neil’s been more right than anyone else on how the macroeconomic environment has transpired over the last 18 months, and most importantly, he’s been right for the right reasons. We’ve been in the same camp as Neil, which is a big reason why we continue to overweight equities in our House View portfolios. In fact, in our long-term oriented strategic portfolios – amongst the most popular models at Carson – we are at our maximum possible overweight to equities.

I want to walk through some of the data Neil mentioned in our conversation.

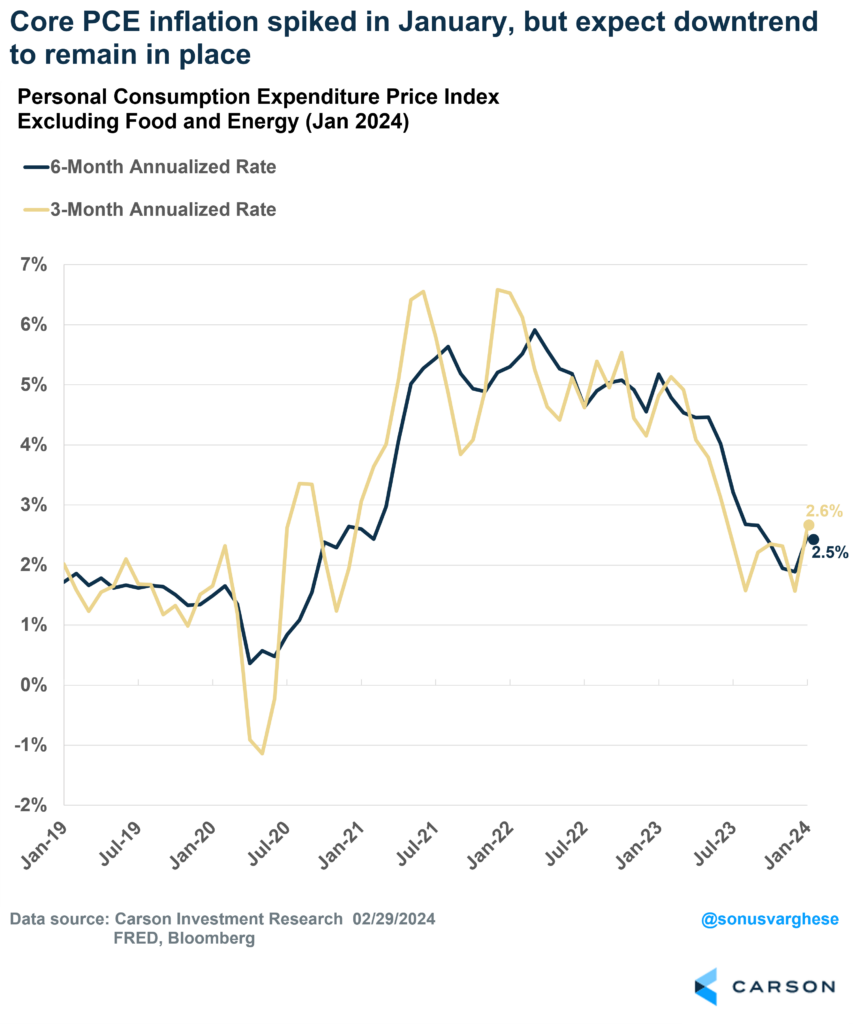

Yesterday, we also got the personal consumption index (PCE) inflation data, the Federal Reserve’s (Fed) preferred metric of inflation. There was a spike in inflation in January, mostly on the services side. But there’s good reason to believe this is a one-off “January seasonality effects,” which will ease over the next few months. The big picture is that inflation is easing. Core PCE inflation, which strips out volatile food and energy components, is running at a 2.5% annualized rate over the last three months, and 2.6% annual rate over the last six months. A year ago, these metrics were running around 5%, so the January spike in inflation data is likely just a bump in the downward trend.

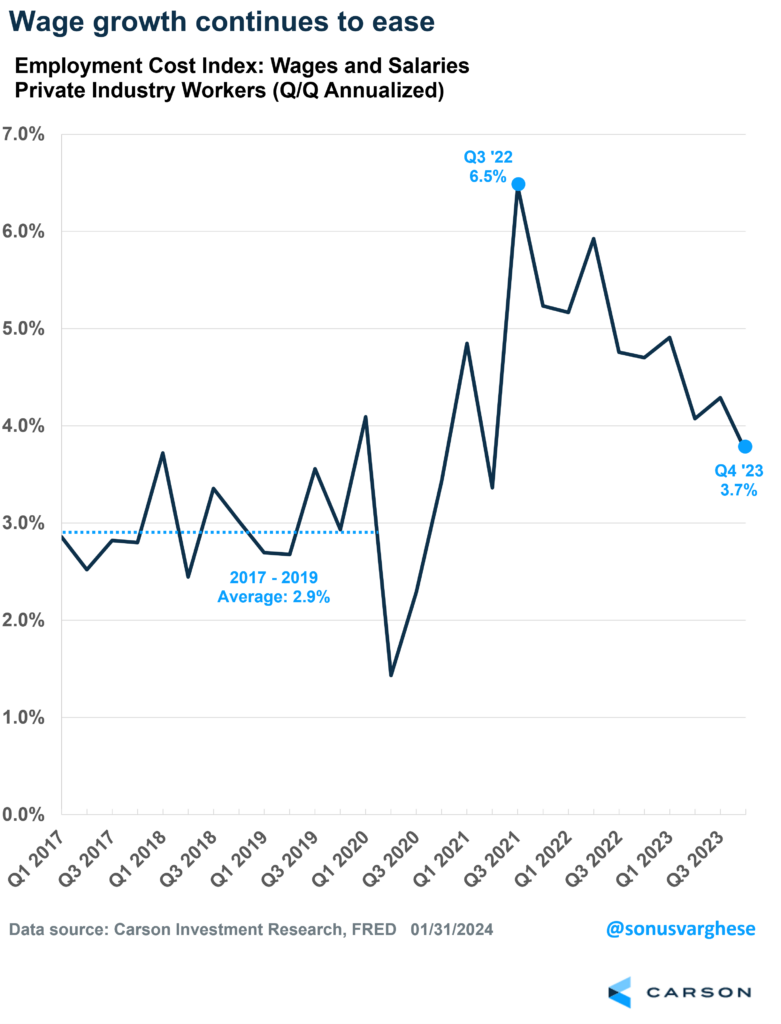

A big reason to be skeptical of another inflation surge is what we’re seeing in the labor market. For one, wage growth is not accelerating. The Employment Cost Index (ECI), which is considered the gold standard of wage growth measures, continues to decelerate. As of the fourth quarter of 2023, ECI for private sector workers was running at an annualized pace of 3.7%, well below peak levels in 2022 to early 2023. It’s only slightly elevated relative to the 2017-2019 average of 2.9%. Nevertheless, the downtrend in wage growth suggests the January inflation spike is not the beginning of an uptrend.

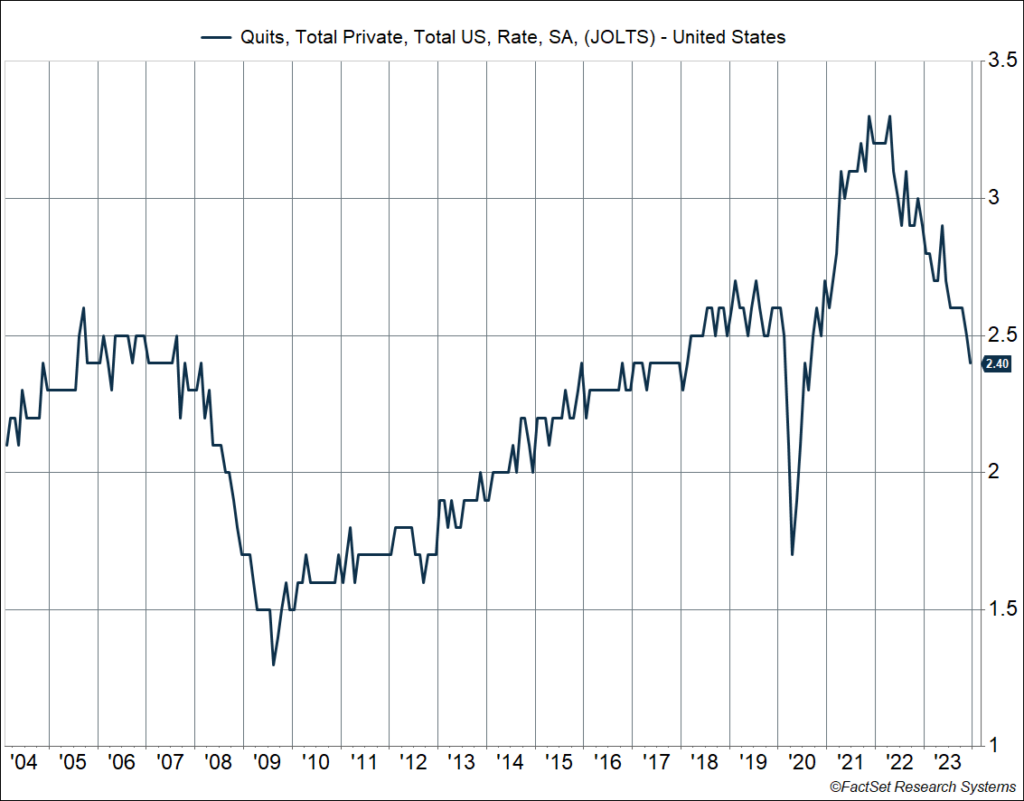

Another sign that we’re not likely to see a burst of wage growth (and inflation) is that the rate at which workers are quitting their jobs has fallen significantly over the last ear. As a percent of the workforce, the number of workers quitting their jobs is now at 2.4%, well below where it was a year ago, and in fact, even lower than where we were pre-pandemic. Lower turnover implies that the labor market is not as hot as it was and validates what we’re seeing in the wage growth data.

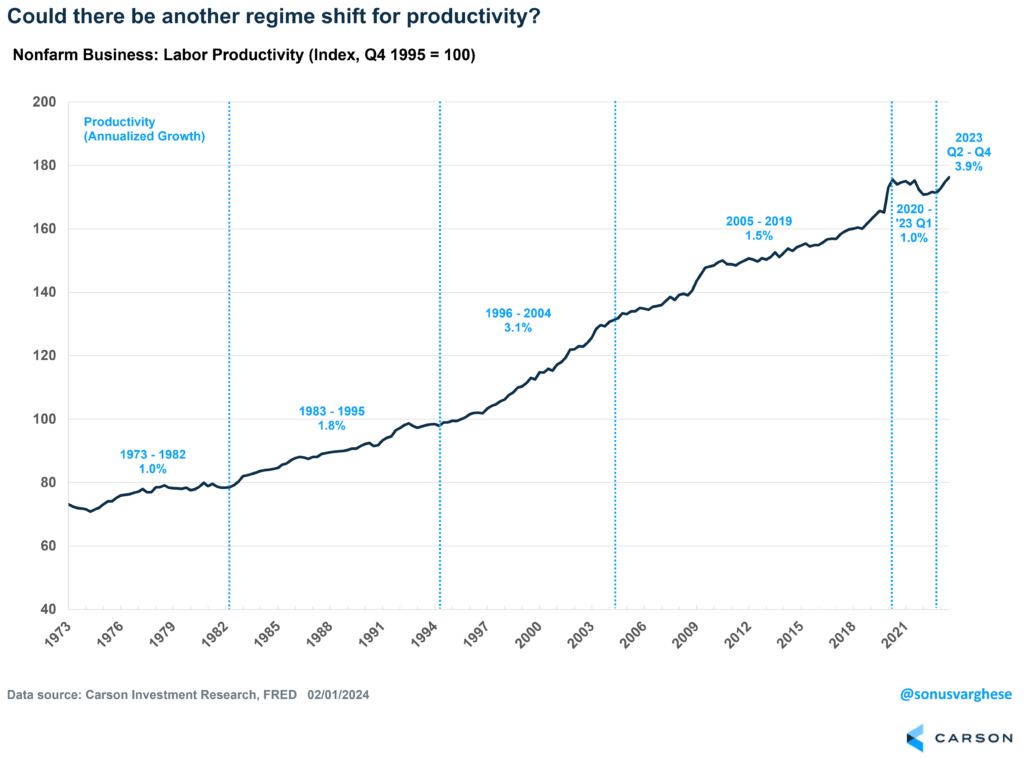

As I noted above, wage growth is still elevated relative to where we were pre-pandemic. That’s not necessarily a bad thing – inflation can still remain muted if productivity is running strong. And we’ve seen some evidence of that. Over the last three quarters, productivity growth has run at an annualized pace of 3.9%, the strongest pace outside of recessions since the late 1990s. (Labor productivity “artificially” goes up during recessions and their immediate aftermath, as the same level of output is generated by fewer workers.) In fact, Neil made a good point that the lower quit rate is likely boosting productivity. If a worker sits at the same seat for a longer period, they likely become better at their jobs.

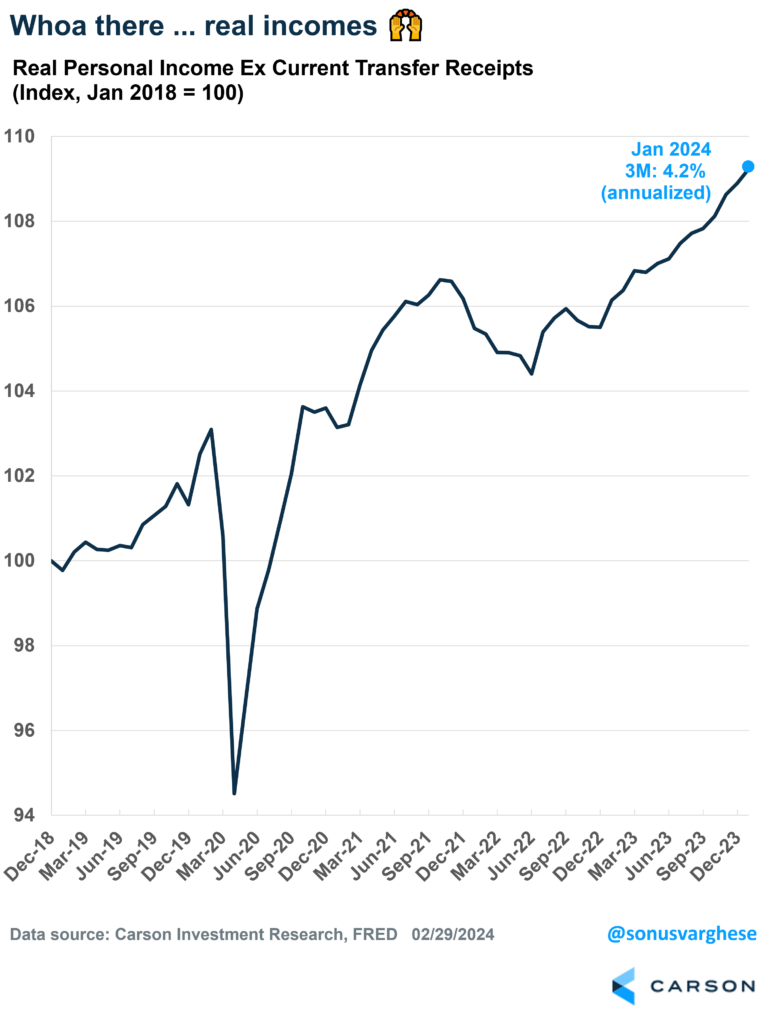

Ultimately, what matters for an economy that runs mostly on consumption is inflation-adjusted income growth. Relatively strong wage growth combined with decelerating inflation means real incomes are growing. Along with the latest PCE inflation data, the government also released personal income data, which perhaps got less attention than it deserved. Over the last three months, real incomes excluding transfers (like social security) are running at an annualized pace of 4.2%. For perspective, it was running at 2.6% across 2018-2019.

Yeah, the general consensus is the economy is fine. Perhaps more than fine.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Take a listen to our latest Facts vs Feelings episode, in which Ryan and I discussed the recent market rally that’s come on the back of an improved profits outlook (including NVIDIA). Keep an eye out for much more in the coming weeks.

For more of Sonu’s thoughts click here.

02138372-0324-A