“If everyone is thinking alike, then somebody isn’t thinking.” -General Patton

The quote above is one that I’ve used more in my career than probably any other quote. Markets are all about what is priced in and what isn’t, suggesting that the big opportunities can be found by going against the crowd in some instances. I’m not saying be a contrarian for the sake of being a contrarian, but when things line up against the crowd and you have reasons to go against the herd, that is where huge opportunities can be found.

Last year is the perfect example of this. To start the year all we heard about was the near certain bear market and recession that was coming. It was the most anticipated recession we’ve ever had, even though it hadn’t happened yet. This of course meant the market had priced a recession in and the opportunity was in going against the crowd. The Carson Investment Research team shared data daily on why we didn’t see a recession ahead and expected stocks to do quite well. In fact, we’ve been overweight stocks since December 2022 and remain there today.

This year we’ve seen another example of the crowd all agreeing and the total opposite taking place.

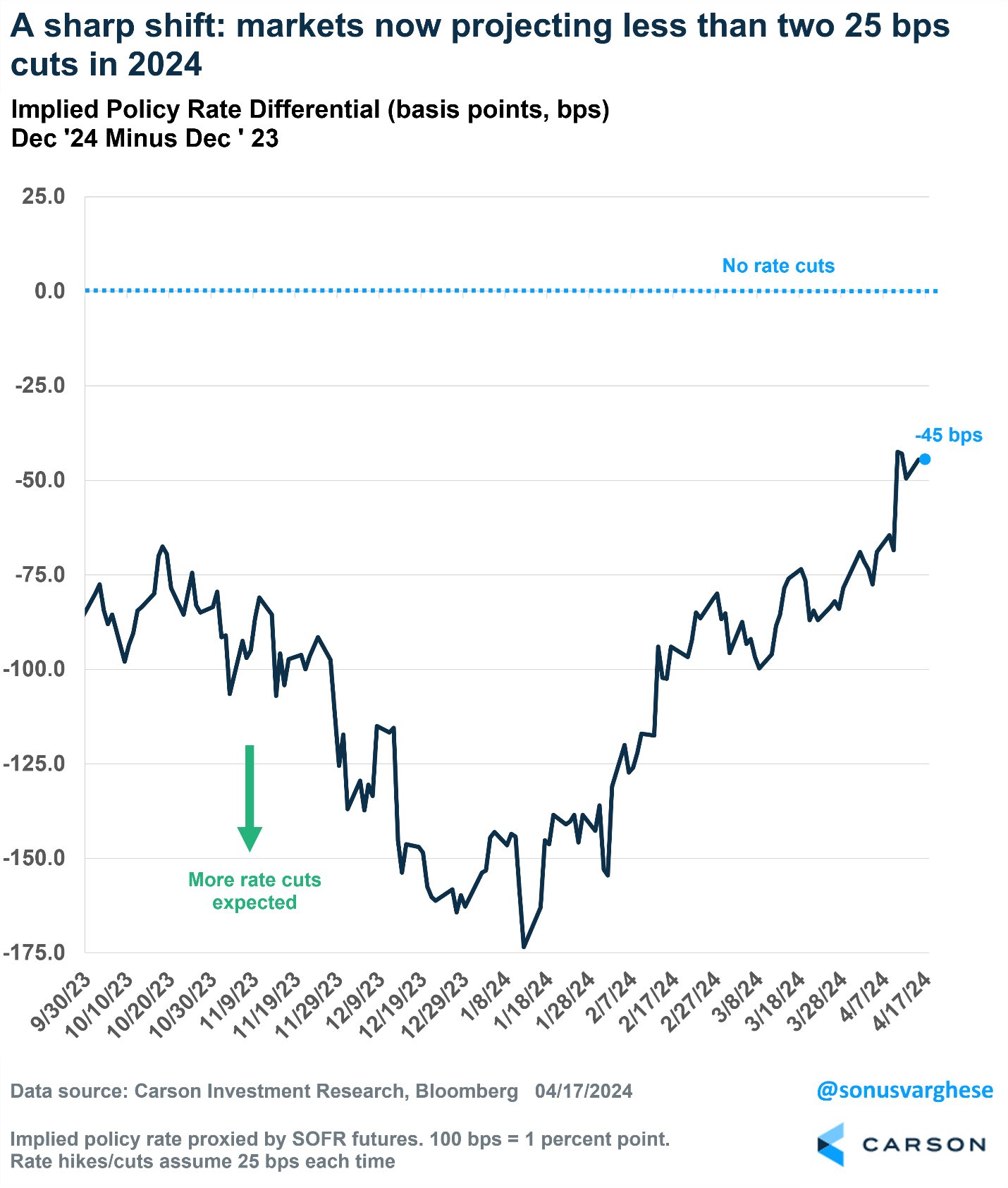

I’m a big fan of the Bank of America Global Fund Manager Survey. It comes out monthly and shows how real money managers are positioned. At the start of the year, it was widely anticipated the Federal Reserve Bank (Fed) would cut short-term rates and as many as seven cuts were expected just a few months ago. As a result, 91% of those surveyed expected rates to go lower over the coming year, the highest and most consensus view ever for this survey. Granted, we still may have lower short-term rates at the end of the year, but with record expectations the potential for extreme positioning was there.

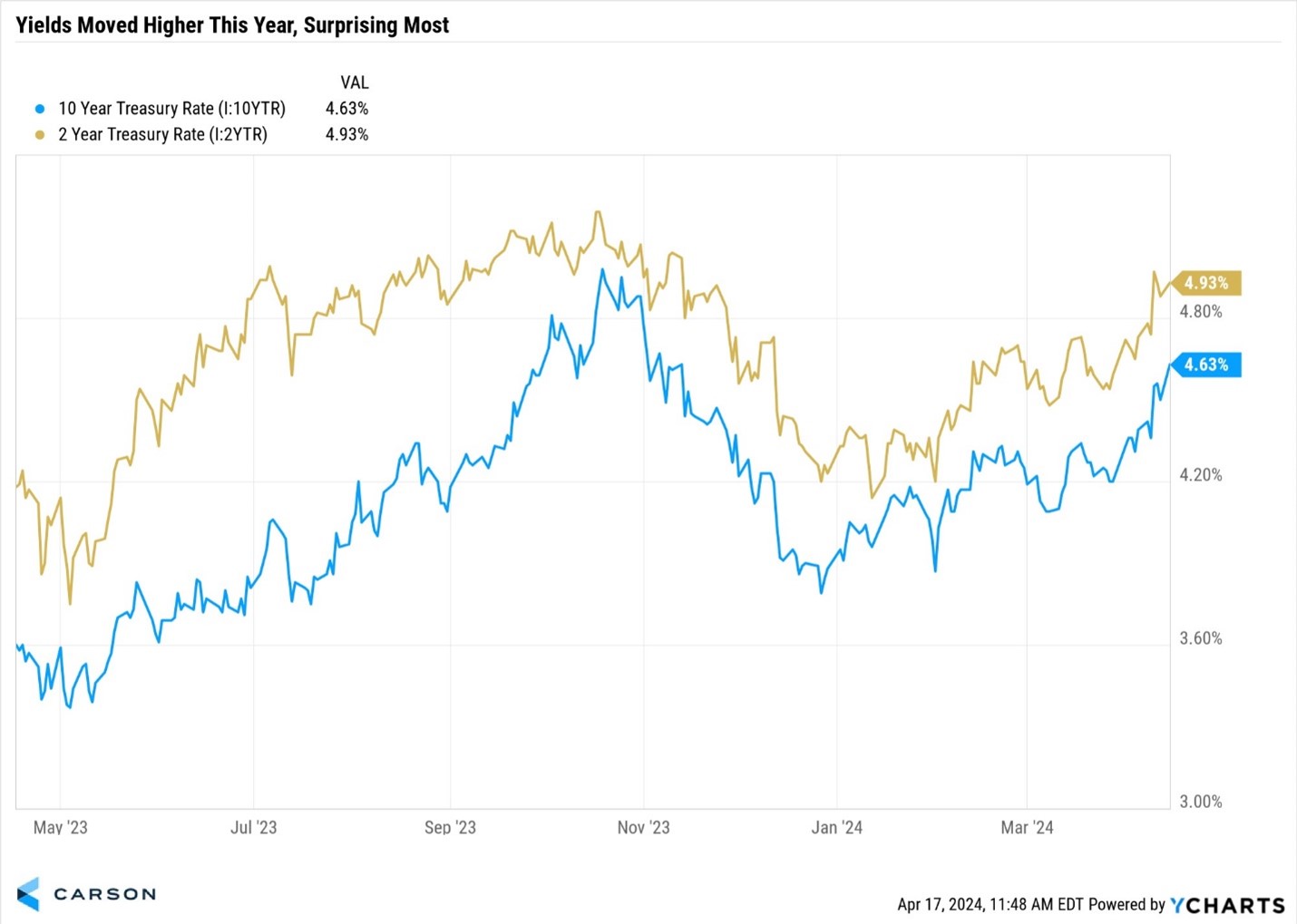

Sure enough, with everyone on one side of the boat, the opportunity was on the other side, as rate cut expectations have come down drastically the past two months, while yields as a result moved higher, not lower.

Here’s a nice chart that shows only two cuts (of 0.25% each) are now expected this year, from the peak of seven three months ago.

Even when most expected six or seven cuts, we always said it would be closer to three. Our main reason was we believed the economy would remain stronger than expected and there just wasn’t a need for that many cuts. That many cuts could mean an economic slowdown, while a few cuts could simply be recalibrating as inflation came under control, with no need for rates up over 5% anymore.

As a result, we came into this year with an underweight on bonds, with very little exposure to longer-term Treasuries. Many were in the camp that you should load up on bonds and buy longer duration bonds (think Treasuries), but we faded the consensus once again. As a result, bonds are having another rough year as rates jump.

Why are yields higher? There are two reasons: the economy is strong and recent inflation data has been a tad higher than expected. Look at recent consumer data like retail sales—the consumer isn’t slowing down. We also are seeing improvements in manufacturing sentiment, which could be a clue strength is coming there as well. Oh, and we are creating 200,000 to 300,000 jobs each month, not something you see in a slowing economy.

Regarding fears that inflation will continue to be sticky or is about to surge, we think there’s room for skepticism. We still see many reasons to expect overall inflation to continue to trend lower and the recent blip is just that, a blip after massive improvements over the past year. Sonu Varghese, our VP, Global Macro Strategist, wrote about this last week in Is It Time to Worry About Inflation Again?, so I won’t say much more on the subject.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

As a result, we went from hearing about six to seven cuts, to potentially none being floated! Some economists in bowties are even saying we need rate hikes.

What did the Carson Investment Research team do as a result? For the first time in a very long time we added some bond exposure on the longer end of the curve in the tactically-oriented models we run for our Carson Partners. We are still overweight stocks relative to bonds, but the pendulum swayed too far the other direction the past few months, creating an opportunity to again go against the crowd, as we still expect inflation to improve and as a result, we’re likely see at least two rate cuts.

Let’s sum it up. If you have an average portfolio, you will have average results. There is nothing wrong with that, but our job is to take the big swings when it makes sense. Being overweight equities has made sense and worked very well; now we think fading the masses talking about no cuts (or even a hike) could be quite successful.

Lastly, be sure to watch below or listen to our latest Facts vs Feeling podcast, as we were joined by Dan Ives, Managing Director at Wedbush. Sonu and I had a lot of fun talking with him about the latest trends in technology, AI, and the future.

For more content by Ryan Detrick, Chief Market Strategist click here.

02206651-0424-A