Learn how your firm’s valuation could fluctuate under the proposed increased capital gains tax rate.

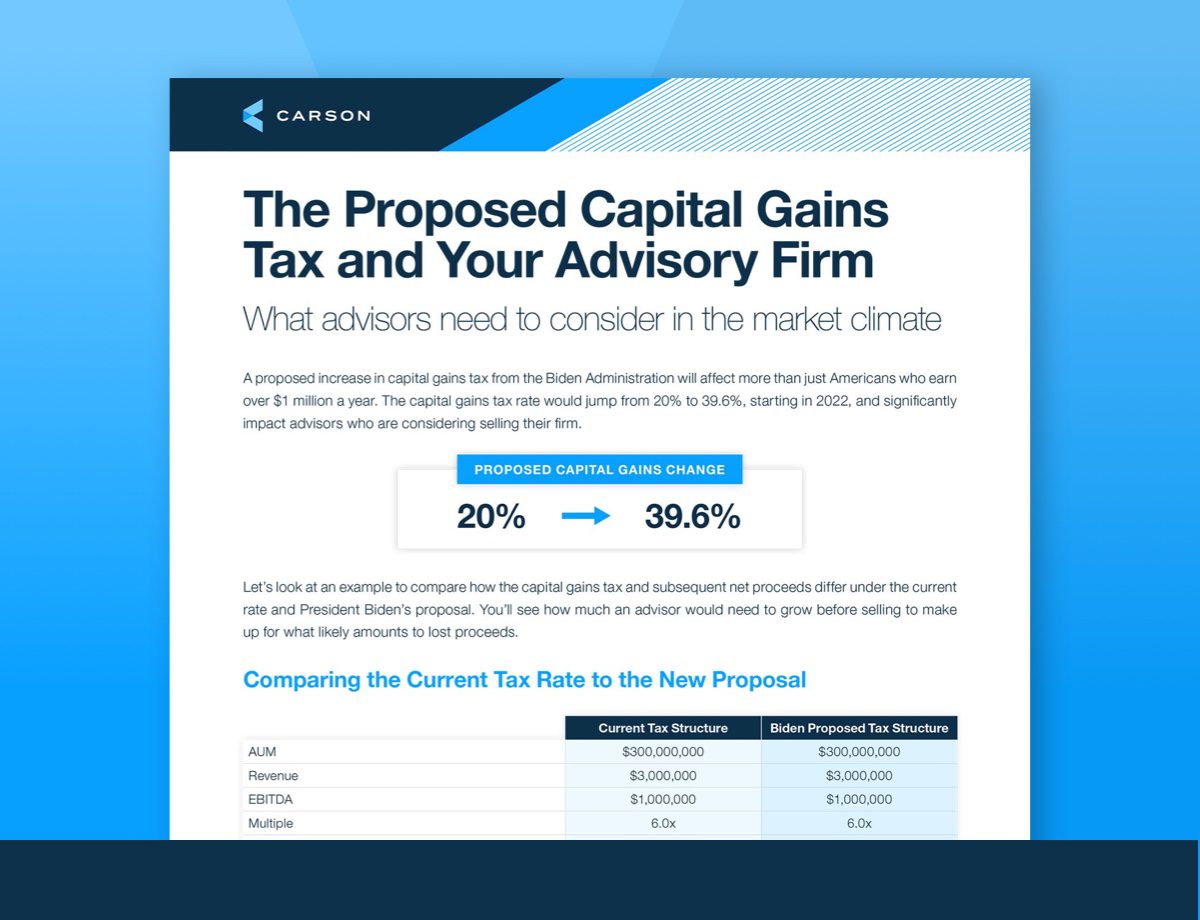

To fund his American Families Plan, President Joe Biden has proposed an increase in the capital gains tax that extends its reach to advisors in the market to sell. A proposed hike from 20% to 39.6% would start in 2022, with a potential to be retroactive.

Whether you’re looking to sell soon or several years later, you want to protect your hard work, clients, team and legacy. We explain the math to help you understand how much potential income you could lose – and how much you need to grow to make up for it.