The Federal Reserve has done all but carve in stone a September interest rate cut – market expectations are at 100% (70% for 25bps and 30% for 50bps). The broad bond market has been higher four months in a row as investors pile in ahead of cuts, pushing interest rates below 4% across maturities from 2 years to 10. Bonds were negative on the year until June, and now year-to-date returns are nearing their starting yields with a quarter to go. As investors reposition ahead of next week’s Fed interest rate decision, the question naturally arises – is it too late to buy (more) bonds?

Source: Morningstar 9/5/2024

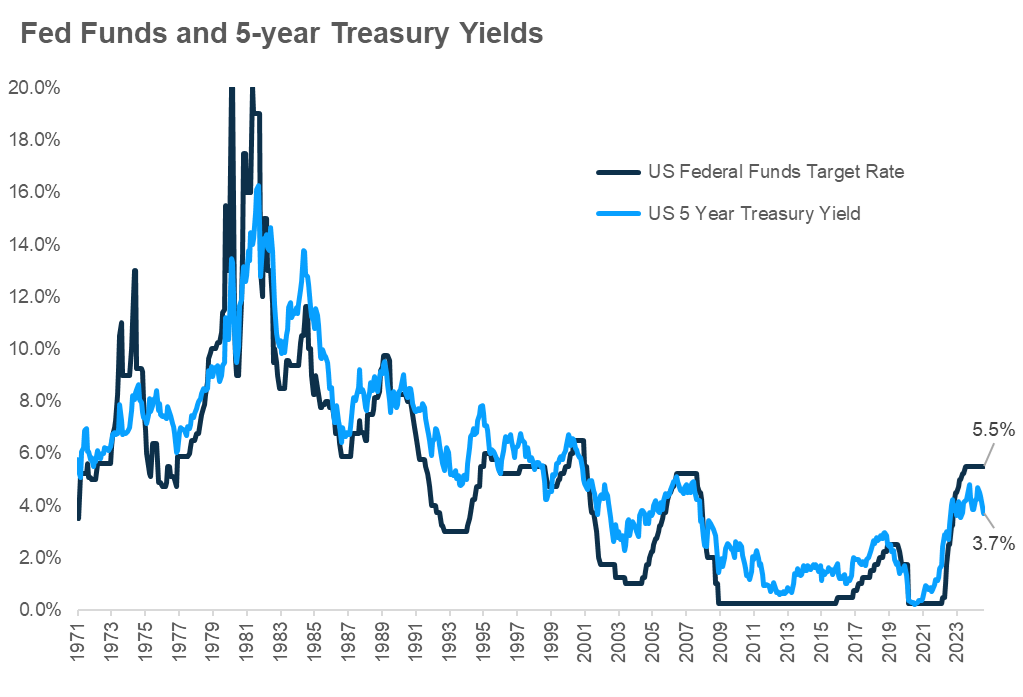

In our Mid-Year Outlook, we wrote about the strength in bond returns following the first interest rate cut (chart 24). Results for increasing duration and moving out of cash-like instruments are compelling. However, with such a highly telegraphed rate cut coming this September, it is hard to know how much of those returns have been priced in over the last several months. Looking to history as a guide, we see that bond prices (in this case the 5-year Treasury) generally begin to move ahead of rate cuts (yields down, prices up), and continue to move through the cutting process. While there is no direct connection between Treasury prices and the Fed funds rate per se, lower inflation and growth expectations generally bring longer parts of the curve lower.

Source: FactSet 8/31/2024

While of course “this time is different” are the four most dangerous words in finance, we do face circumstances that differ from previous emergency rate adjustment situations. Current expectations are for rates to level out somewhere around 3% in the middle of next year, a situation somewhat similar to mid-year cuts in 2019 prior to the pandemic upending the economy. We believe economic and corporate profit growth will continue to be positive and as a result, interest rates will stay “higher” for longer – at least not cut to zero! And while there have been signs of a cooling labor market, 4.2% unemployment is still lower than 90% of historical observations. Higher starting rates bode well for bondholders – lowering overall duration and contributing to the ‘self-healing’ mechanism of bonds that is monthly interest payments.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

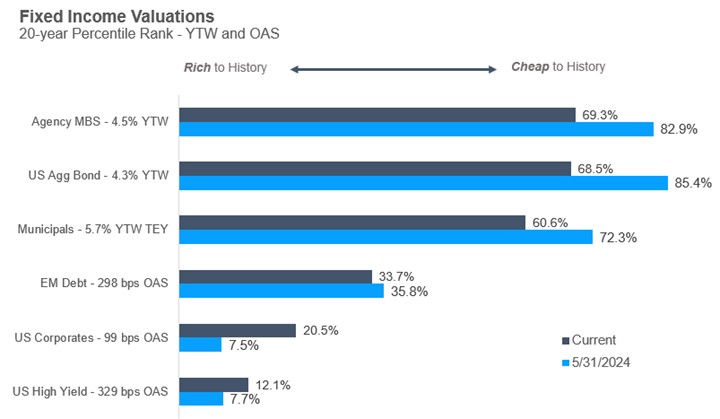

We have seen a shift in pricing across the fixed income universe. As rates have come in, high quality sectors offer lower starting yields than they did to start the year – but still attractive valuations and forward return expectations. Credit, both investment grade and high yield, has seen some spread widening but still trade in the bottom quartiles of their historical spread levels – not necessarily a compelling entry point. We continue to favor high quality fixed income, particularly active core and mortgage managers that can dissect a bifurcated market.

Source: Carson Investment Research, FactSet 8/31/2024

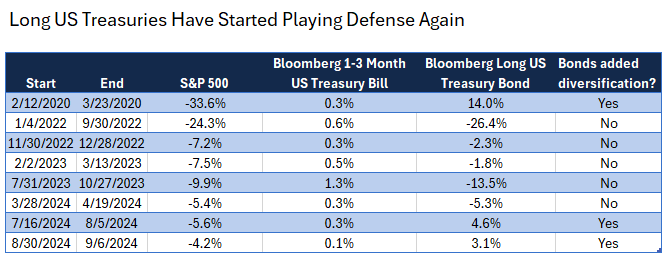

Finally, historically defensive bonds (long maturity Treasuries) have started to play defense once again, something they failed to do miserably during stock market declines in 2022, 2023, and even the start of 2024. Below is a list of S&P 500 declines of more than 5% since the start of 2020. We added last week’s move off peak, although it hasn’t reached 5% yet. During the two most recent equity declines (including last week’s), long Treasuries have finally been playing some defense for the first time since the Covid-related bear market. While a major equity decline is not at all our base case, it is reassuring that longer maturity, high quality bonds have become reasonable again as a “just in case,” in addition to their potential in our base case discussed above.

Source: Carson Investment Research, FactSet 9/8/2024

Putting it all together, to answer my own question, we don’t believe it is too late to buy bonds or add to duration. While the longer parts of the curve are overbought and could see more volatility, moving out of the safety of cash into the safety of high quality duration is a way to take advantage of still higher yields ahead of interest rate normalization.

02401753-0924-A