“You don’t need a weatherman to know which way the wind blows.” Bob Dylan “Subterranean Homesick Blues”

It continues to amaze me how fearful many investors get when faced with fairly normal market volatility. Last week, everyone became a market breadth expert and we were told only a few stocks were going up (which wasn’t true). We’ve also been bombarded with scary sounding warnings like Warren Buffett holding record cash, Michael Burry (of The Big Short fame) going bearish on high flying AI names, and large bank CEOs openly calling for a market correction or bear market. If that’s not enough, chatter about something called the Hindenburg Omen (now there’s a scary sounding name) has been everywhere.

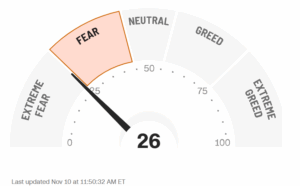

Here’s the latest CNN Fear & Greed Index (as of Monday morning), which is still firmly in the fear / extreme fear range.

To me, seeing this much fear and worry is quite bullish from a contrarian point of view. I touched on some of these concepts last week in Every Year Has Volatility and Bad Headlines.

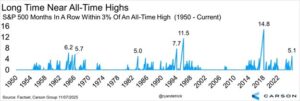

Incredibly, the S&P 500 has now traded within 3% of an all-time high for more than five months, one of the longest streaks ever. Usually investors get more bullish when stocks are in trends like this, but that isn’t the case this time around at all.

Last Week Wasn’t So Bad

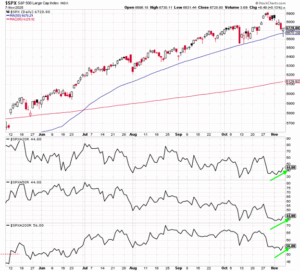

Let’s focus on last week for a second. All we heard was how bad things were, yet seven out of the 11 sectors finished higher on the week and eight sectors outperformed the S&P 500. Yes, it was the large cap tech (and tech adjacent) areas that struggled last week, pulling down the major averages, but under the surface things weren’t nearly as bad as many claimed. In fact, the number of stocks in the S&P 500 that were above their 20- and 50-day moving averages actually increased last week, while those above their 200-day moving average was flat. That my friends suggested breadth improved under the surface.

Don’t Give Up on November Yet

Our take hasn’t changed. We are still in a major bull market and it isn’t over yet. That’s why I like the Bob Dylan quote above. If you are truly objective and don’t get sucked into all the fear mongering out there, we are in a bull market and we believe it has legs. We’ve been saying this same thing for years and the good news is we still feel this way.

Yes, it has been a rough start to November, but after a six-month win streak for the S&P 500, some consolidation is perfectly normal before another surge higher. And we have found that when the S&P 500 was up more than 10% year-to-date heading into November (like this year was), the month of November has been higher 13 out of the past 14 years and the final two months (November and December) have been higher the past 16 times in a row. Don’t give up on November just yet.

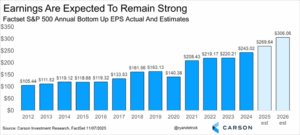

Earnings Tend To Drive Long-Term Stock Gains

While investors are worried about many things, we like to spend most of our time focusing on earnings. Earnings tend to drive long-term stock returns and we’ve seen a spectacular earnings season, again justifying the fundamentals of this bull market. Just a week ago Q3 S&P 500 earnings were supposed to be up 10.3% year over year (already up from 7.9% at the end of September), but that is now up to an incredible 13.0%. This earnings season wasn’t just about large cap technology either, as many industries came in with much better than expected earnings and revenue numbers. Here’s a nice chart that shows the jump in earnings this year and next year.

Good, It Is Still 1929

How hated is this rally? Here’s an Op-Ed in the New York Times calling for a 1929 crash. If we are seeing things like this in newspapers, I’ll take the other side. And the eye glass and top hat is too much.

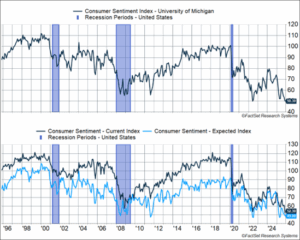

Polls Indicate Consumers Are Bracing for Pure Calamity

The Michigan Consumer Confidence poll showed that consumers are now more worried about things than they were 25 years ago during the tech bubble bursting, or in the depths of the Great Financial Crisis, or during a once in a century pandemic. Things aren’t nearly this bad and once again, this shows extremely low sentiment that is likely a reason for this rally to continue. In fact, the recent reading was the second lowest reading ever. The lowest ever? June 2022, the exact month that most stocks bottomed and started to rally from that bear market.

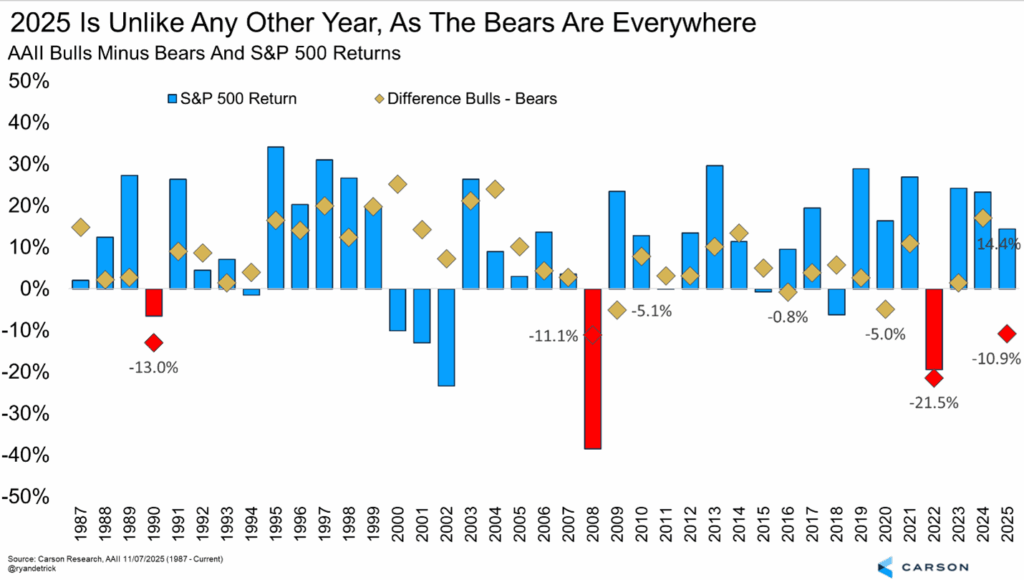

Another Clue This Rally Is Hated

The American Association of Individual Investors (AAII) sentiment poll continues to show historic levels of worry. In fact, only three years in history saw the bears outnumber the bulls by 10% or more on average for the full year and those years were 1990, 2008, and 2022. All were down years for investors (with 2008 and 2022 two of the worst years ever) and all three saw bear markets. Well, we are about to add 2025 to that, as we are seeing this rare level of skepticism, yet stocks are up nicely. Once again, this shows this rally is indeed hated and from a contrarian point of view, that could be quite bullish.

Thanks as always for reading what our team has to say. We appreciate it and be sure to stay warm, as it is cold out there! Lastly, for more of my thoughts on this bull market, sentiment, the economy, and more, I was honored to join my friend Phil Rosen, co-founder of Opening Bell Daily, live from New York to join his brand new podcast, “Full Signal.” Enjoy!

For more content by Ryan Detrick, Chief Market Strategist click here

8595413.1.-11NOV25