We’ve seen volatility come back into equity markets over the last few weeks. Ironically, this has come amid a slew of stronger-than-expected economic data, including payrolls and consumption. Consumer confidence is also rising.

The problem is that inflation numbers have stopped decelerating as fast as they were a few months ago. We wrote about this when the January CPI data was released – inflation’s much lower than last year, but it is still elevated. Part of the reason is that a strong economy puts upward pressure on prices, including prices for eating out, going to movies/concerts, recreational activities, buying clothes and household goods, etc.

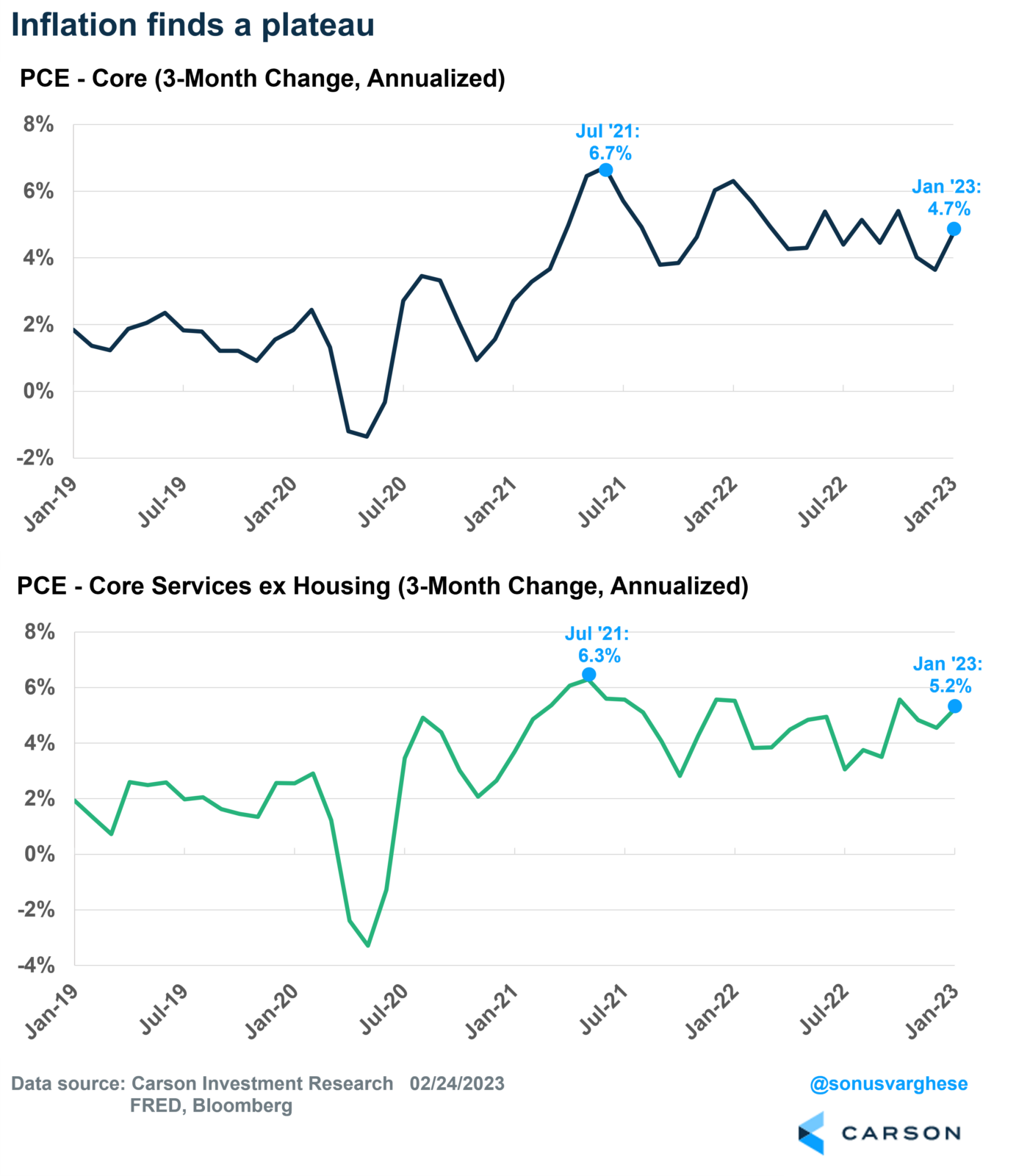

The latest PCE inflation data (personal consumption expenditures-based price index), the Fed’s preferred inflation metric, confirms that story. Core inflation, i.e., inflation excluding food and energy, is now running at a 4.7% annualized pace over the past three months. That’s down from a peak of 6.7% we saw 18 months ago, but still high. And recently, Fed Chair Powell has also talked about keeping an eye on core services ex-housing inflation. That’s running at an annualized pace of 5.2% over the past three months and has more or less plateaued.

Now, core services ex-housing tend to be correlated to wage growth. And there is fairly strong evidence that wage growth is decelerating, which should ultimately push core inflation lower.

However, until that shows up in the official data, expect the Federal Reserve (Fed) to keep pushing rates higher and keep them there.

More uncertainty around the Fed

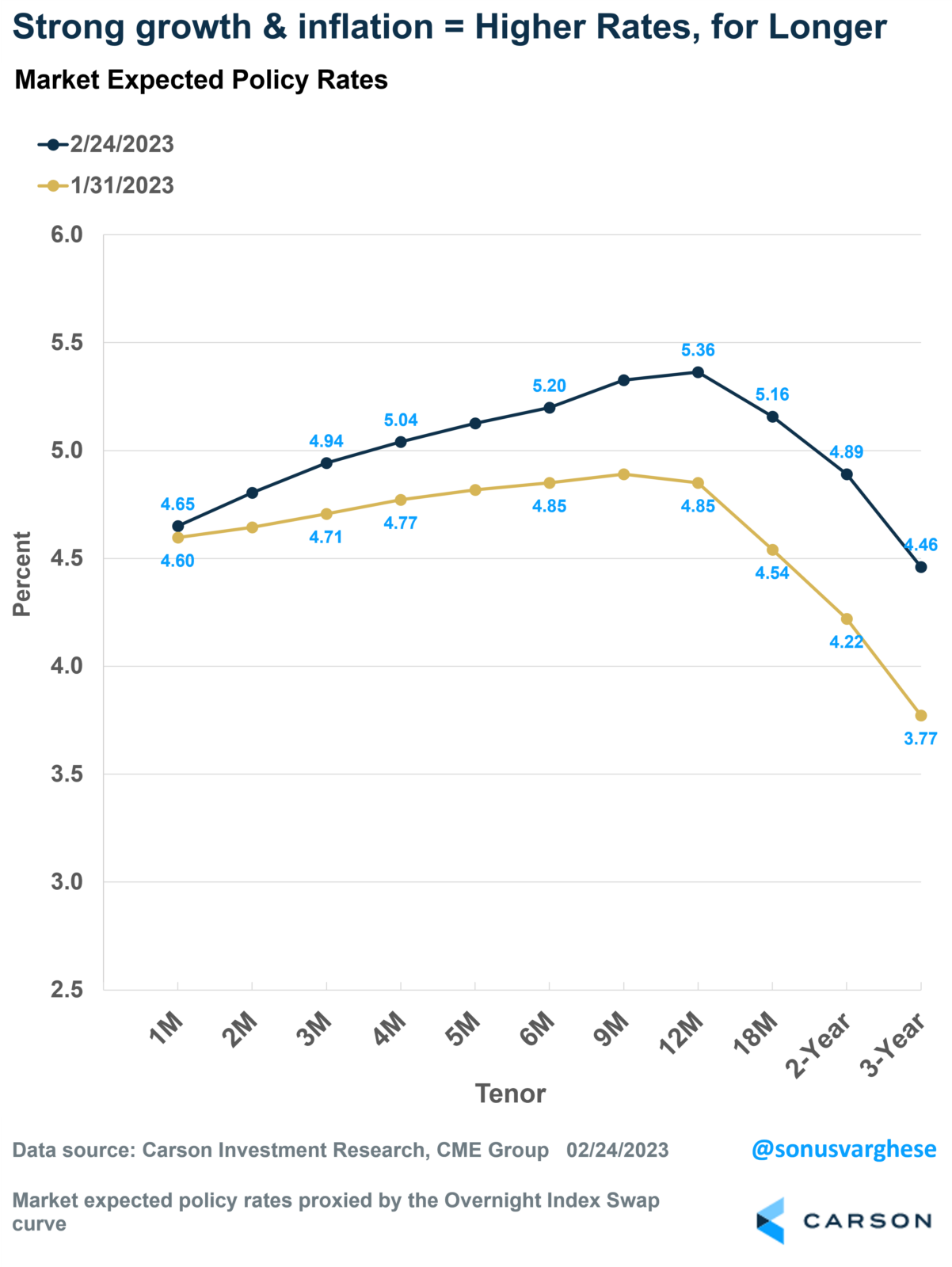

Three weeks is not a very long time, but that’s all it took for investors to move up their interest rate expectations. At the end of January, the expectation was that the Fed would get to a peak rate (for the federal funds rate) of about 4.9% by the end of the year. Instead, they were followed by a series of cuts over the following year.

That’s shifted quite significantly, with markets expecting the “terminal rate” to move as high as 5.36% by the end of this year. That translates to an additional 0.50% of rate hikes this year. The Fed expects to raise rates by 0.25% over the next three meetings, i.e., March, May, and June. Previously, the expectation was that they would be done in March.

There’s even a 33% probability that the Fed will raise rates by 0.50% at their March meeting. We think this is unlikely, but it reflects uncertainty about what the Fed will do, which has added to market volatility.

Also, as you can see in the chart above, higher rates are expected for longer. Investors now expect the federal funds rate to be above 5% even in June 2024. Three weeks ago, they expected rates to fall to around 4.5% by then.

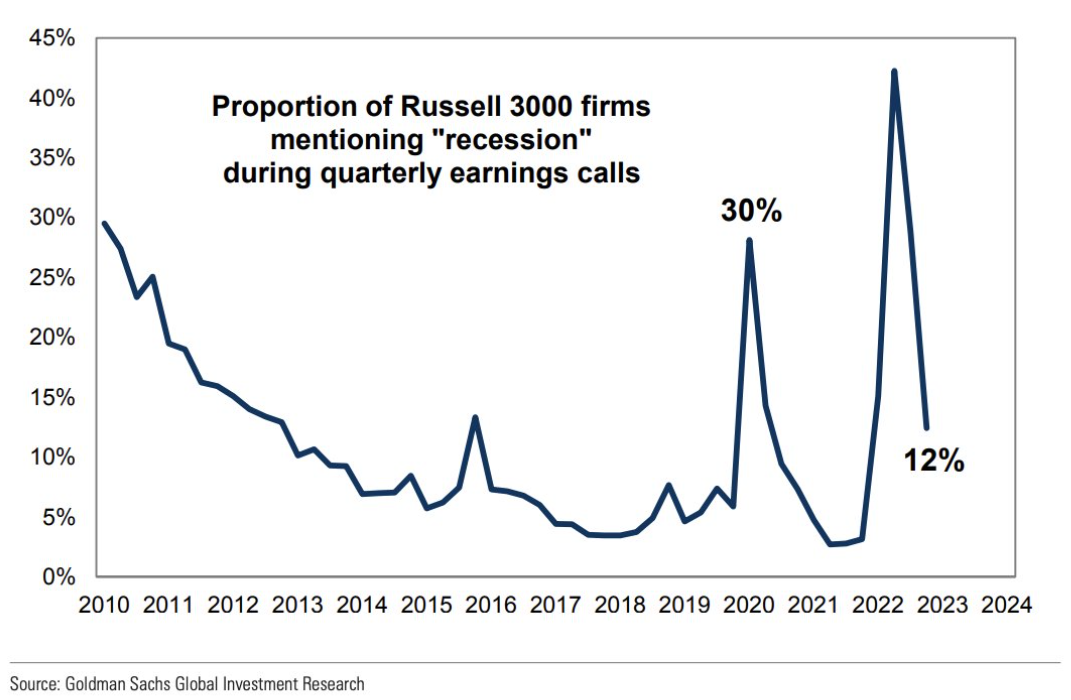

All in all, we’ve gone from a period where there appeared to be consensus on what the terminal rate would be to renewed uncertainty. And that’s happened on the back of firmer core inflation readings and stronger-than-expected economic data (we’re getting fewer recession calls now). In fact, the proportion of firms mentioning “recession” in quarterly earnings calls has fallen significantly.

We think strong economic data is good news that could ultimately be reflected in stocks. But, going by what we see in the wage growth data, we also believe inflation will continue decelerating – it just may not happen as quickly as anyone would like. For any number of reasons, including the way things are measured in official data.

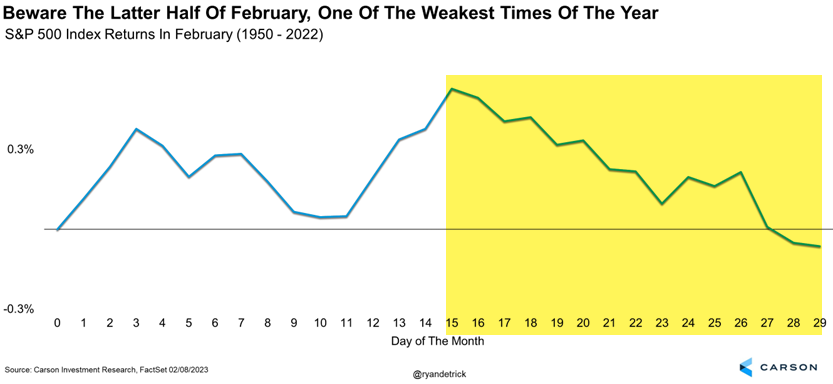

Note that the second half of February has historically been troublesome for stocks, as my colleague Ryan Detrick illustrates in the chart below. However, as he points out, we do have two of the strongest months of the cycle coming up in a week.