“I’ve been on a calendar, but I’ve never been on time.” -Marilyn Monroe

The S&P 500 fell slightly last week. It was probably due to happen, as this comes on the heels of the first time in history the index was higher 14 out of 15 weeks while advancing more than 20%. In other words, some type of a pause would be perfectly normal.

Looking at last week’s weakness, it was mainly due to large tech and communication services names, while areas like small and mid-caps actually gained on the week. We all know how well the largest tech names have done over the past year, so some potential weakness taking place is noteworthy. But then, there are always opportunities somewhere and if we do see continued rotation out of some of the highfliers we wouldn’t be surprised to see flows move to some of the under-loved areas of the market like small and mid-caps.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

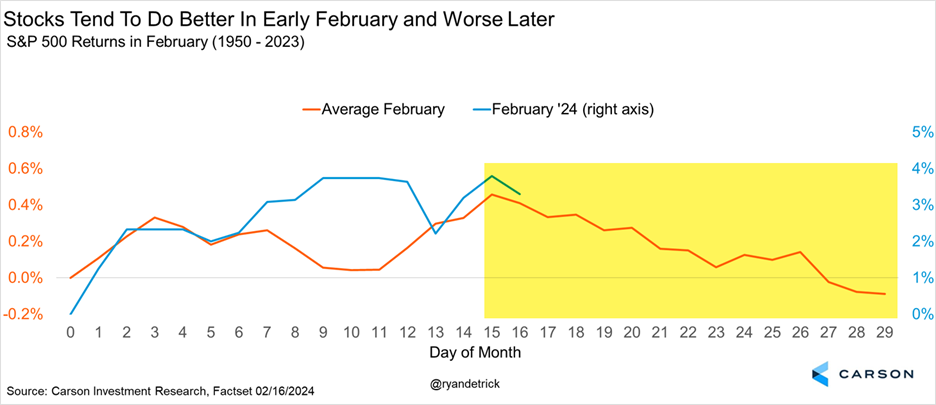

Take note that February is typically one of the weaker months of the year, but most of that weakness happens the second half of the month. Since the first half of February was strong, we’d suggest being open to possible weakness over the coming weeks.

Additionally, our Carson Cycle Composite suggests the potential for a break heading into late March is quite high. This composite looks at various types of years and combines them into one cycle. We look at the average year, average year the past 20 years, year four of the Presidential cycle, and year four of a new President, the year after a 20% gain, and years that had a higher January. As you can see here, combining all those years has the potential for near-term weakness on alert.

We Aren’t Alone Anymore

This time a year ago we would tell anyone who would listen that the economy was likely going to avoid a recession and stocks were going to have a great year. Not many agreed (it felt like no one agreed to be honest), but fortunately things played out as we expected. We are now noticing many others are coming around to our more optimistic views, which is why we called our 2024 Outlook Seeing Eye to Eye.

But in the near term, to see many bulls coming into the fold is a potential concern. I’ve even seen some of the more vocal perma-bears from last year claiming they are now bullish. Of course, they blame the Fed or United States Secretary of the Treasury Janet Yellen for the rally, as if they have some magic button that creates a bull market. They don’t and they surely don’t have an easy button that lets productivity grow at 3.9% annualized the past three quarters either. The stock market is strong because corporate profits are improving, the consumer is healthy, inflation is trending lower, and the Fed is likely going to start cutting over the coming months.

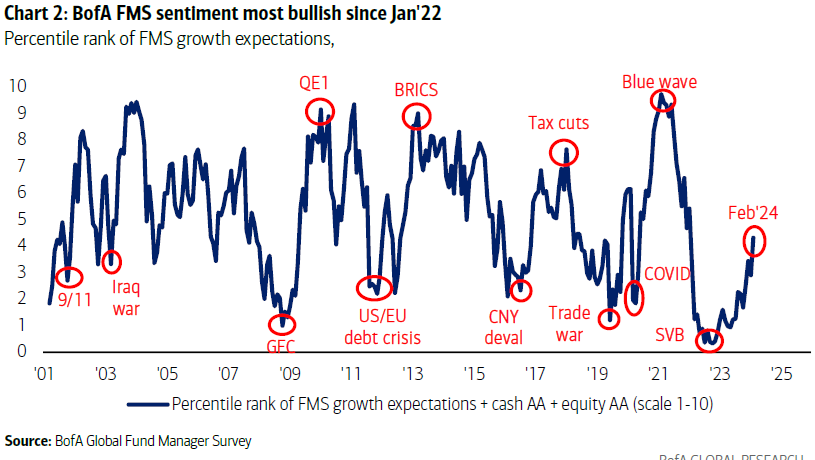

Multiple sentiment polls are indeed showing big jumps in optimism, which has my contrarian bell dinging. I’m a big fan of the Bank of America Global Fund Manager Survey and it just showed overall sentiment at the highest level in two years. Now note, this is still nowhere near previous peaks, which says we could have a ways to go before the ultimate peak, but this jump in optimism should be noted.

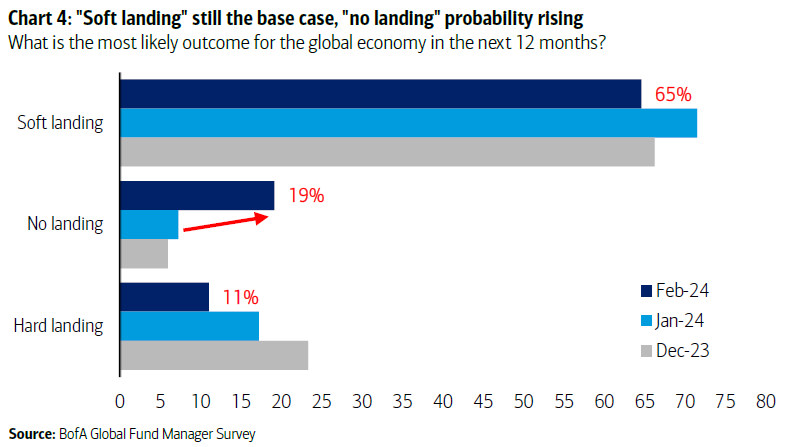

One more from that recent GFS that caught my attention was the number of managers looking for ‘no landing’ is jumping. If you’ve followed us then you know all of last year Sonu Varghese, VP, Global Macro Strategist, was saying the plane had plenty of fuel and never needed to land, but it appears others are finally catching onto what he was saying all along. This is fine, but from that contrarian point of view is worth noting. Since avoiding a recession is normal, falling concern about the economy isn’t contrarian in itself, but we do lose some of the potential extra fuel from bearish views unwinding.

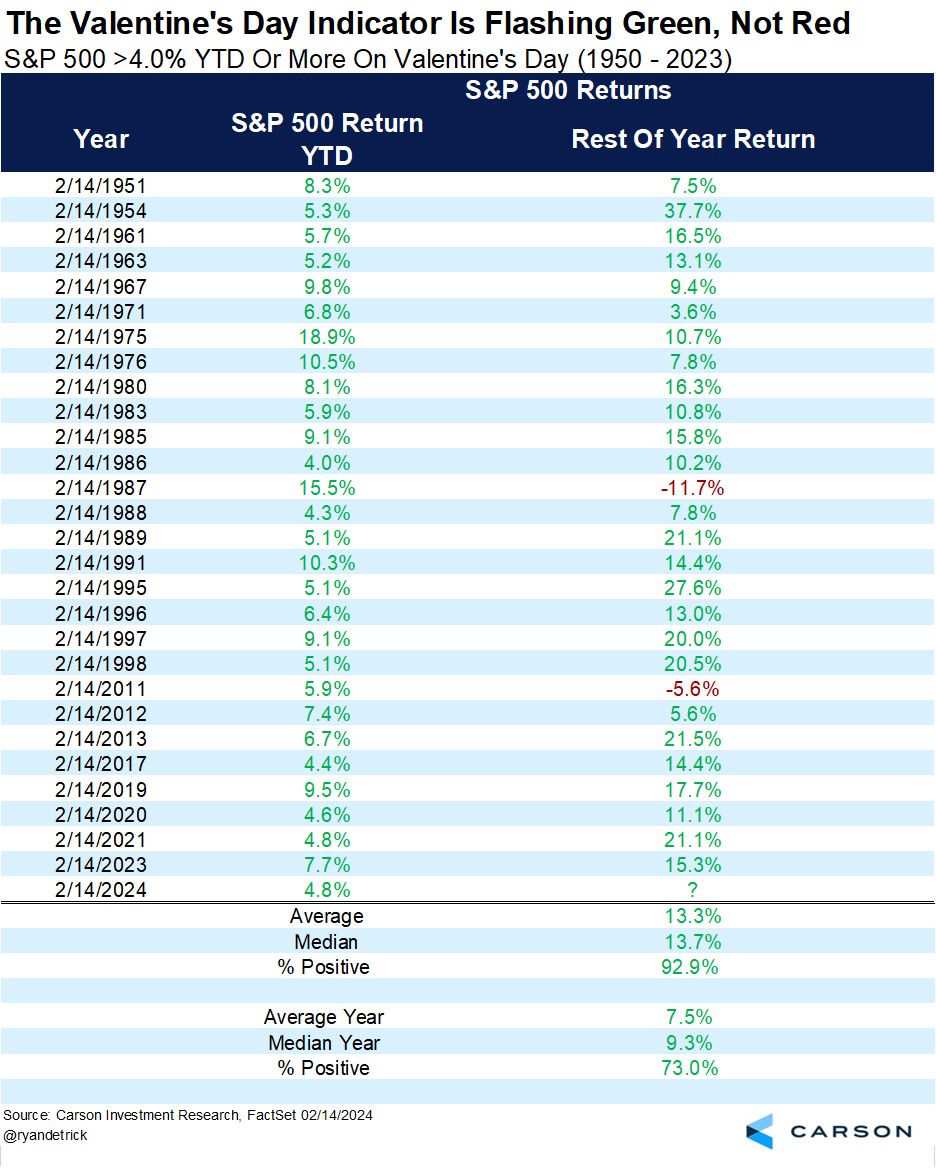

The Valentine’s Day Indicator Flashes Green, Not Red

We want to be clear here. Should stocks take a well-deserved break, we would still expect likely higher prices by year end. The economy remains on a firm footing overall, we expect to see record earnings this year, profit margins are curling higher, business investment is strong, inflation overall remains in a downtrend, and the Federal Reserve Bank (Fed) will likely begin cutting over the coming months. We were bullish all of last year, when many others were forecasting a recession and a bear market. Fortunately, we continue to see many positives out there overall.

Here’s one more bullish bullet point. The S&P 500 was up more than 4% for the year on Valentine’s Day, which trigged a positive Valentine’s Day Indicator. We found 28 other times stocks were up at least 4% for the year on this day and the rest of the year was quite green, higher 26 times (92.9% of the time) and up more than 13% on average, compared with the average year up 7.5% and higher 73.0% of the time.

For more of Ryan’s thoughts click here.

02122152-0224-A