The big picture, coming out of the Federal Open Market Committee (FOMC) meeting is that inflation has eased considerably since last year, but it remains elevated. As a result, they’re choosing to maintain policy rates where they are (in the 5.25-5.50% range). At the same time, Federal Reserve Chair Jerome Powell believes the disinflation process will continue and so the next major move they make will likely be to cut rates. However, that’s not going to happen until they gain “greater confidence” (in their own words) that inflation is headed back to their target of 2%.

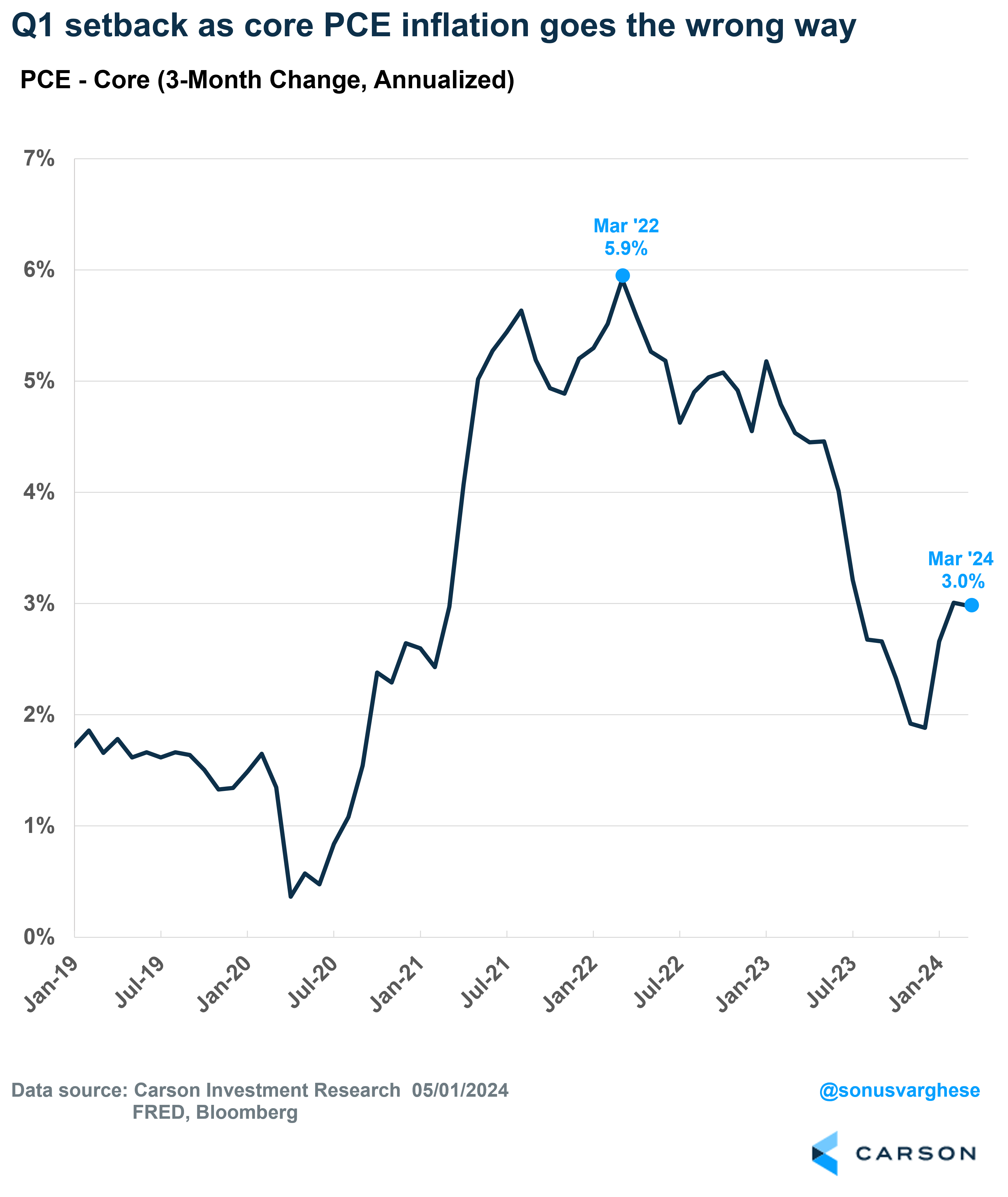

There’s no question that inflation ran hot in the first quarter, in my opinion, especially relative to the second half of 2023. As you can see below, it looks like inflation progress has stalled, with the Fed’s preferred inflation metric, the Personal Consumption Expenditures Index (PCE) running 2.5-3% since December. Core inflation, which strips out volatile food and energy components, has been going the wrong way – over the last six months core PCE is running at an annualized pace of 3.0%, and over the last three months it’s up to 4.4%.

It would be easy to look at the above chart and say that the inflation progress made in the second half of 2023 has reversed.

However, Powell and the Fed did not say this. Instead, they emphasized that inflation has eased a lot over the past year (6-month core PCE was running around 4.5% a year ago). However, it’s clear that inflation remains elevated relative to their 2% target. Hence the need to keep rates where they are.

The hot Q1 inflation data also raised concerns about the dreaded “stagflation” scenario. However, Powell pushed back hard on this in his post-meeting press conference, noting that stagflation is when unemployment is really high (around 10%) and inflation is in the high single digits. That’s not the situation right now. The unemployment rate has been below 4% for 26 straight months, and headline PCE inflation has been in the range of 2.5-3%.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

In fact, Powell added that they expect inflation to continue to ease. Mostly for two reasons:

- More supply-side improvements: This was behind the historic drop in inflation in 2023, and they believe there’s more to supply-related relief to come.

- Policy rates: Policy rates are restrictive, but they need time to play out.

This is why Powell said the next move will likely be a rate cut, rather than a rate increase. The hurdle for a rate hike at this point is fairly high.

As far as the Q1 inflation data is concerned, the signal the Fed took from it was that it’s going to take longer for them to gain confidence that inflation is headed back to their target – confidence they would need in order to start cutting interest rates. The inflation data in January and February did not really suggest anything that leads them to believe that inflation is headed higher. This is something I wrote about when we first saw the inflation data. A lot of the “heat” and “persistence” was due to idiosyncratic factors like housing inflation and auto insurance.

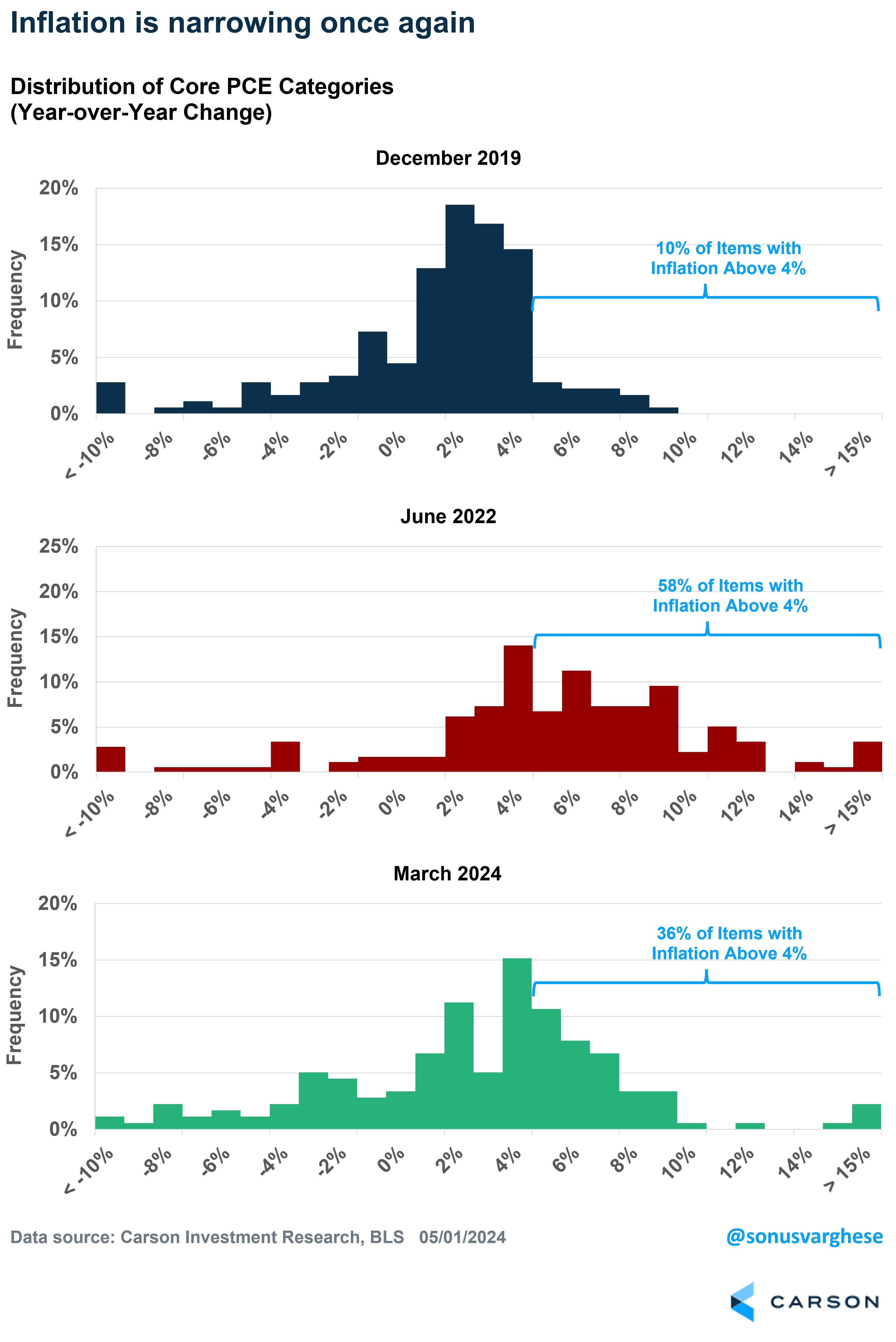

The overall inflation numbers, including for core inflation, can hide what’s happening under the surface. To illustrate this, I looked at all the 178 categories within core PCE inflation, and calculated the distribution of year-over-year inflation across all of them over different periods. You can see how inflation really broadened out in June 2022 relative to December 2019. The good news is that the distribution is narrowing once again. The picture for March 2024 looks closer to what it looked like in December 2019, rather than June 2022.

As the chart shows:

- In December 2019, just 10% of categories had inflation rates above 4% year over year

- In June 2022, 58% of categories had inflation rates above 4%

- In March 2024, 36% of categories had inflation rates above 4%

This gets back to the big picture:

- We’ve made considerable progress on inflation over the last two years.

- But inflation remains elevated.

In fact, we actually made some progress on inflation even in Q1. Back in December 2023, 42% of categories had inflation rates above 4%, versus 36% of categories in March. Ideally, we’d have seen even more progress, but it’s still progress. And it gets to why the Fed isn’t panicking about the Q1 inflation data. Neither are we. It helps to focus on the big picture, and the ultimate objective (which is not bad advice even as far as investing is concerned).

Of course, this means interest rates are likely to stay close to their peak rate for this cycle (5.25-5.50%) for a tad longer. But continued progress on inflation means we could very well see 1-2 rate cuts in 2024, perhaps in September or December. Of course, this means that the next few inflation reports take on outsized importance as far as markets are concerned.

Ryan Detrick, Chief Market Strategist, and I discussed market expectations for monetary policy rates, and how much they’ve swung around, in our latest Facts vs Feelings podcast.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02225376-0524-A