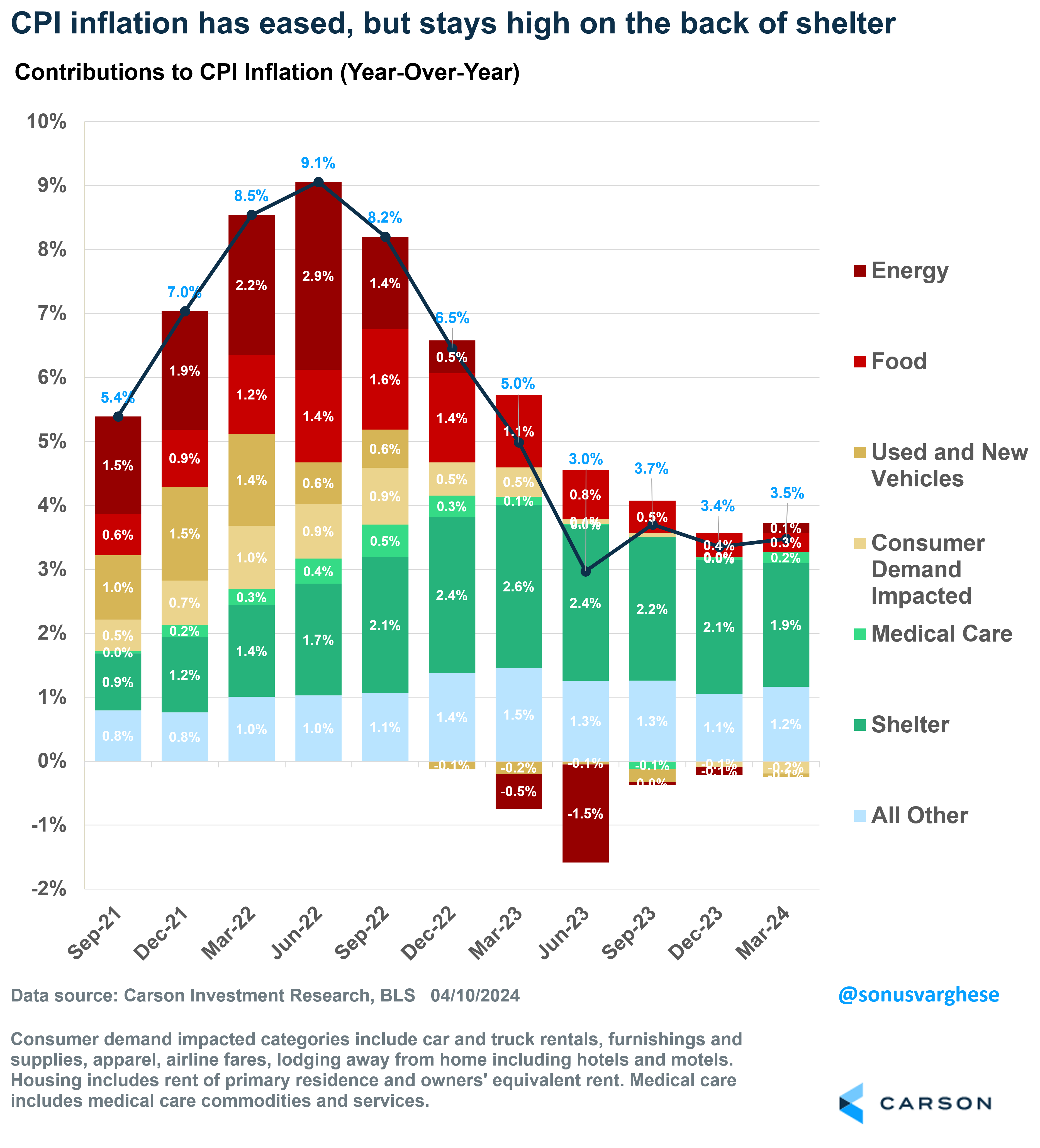

Short answer: likely not. Make no mistake, inflation ran hot in the first quarter, especially relative to the fourth quarter of 2023. The March Consumer Price Index (CPI) report was an unwelcome surprise. Both headline and core inflation (excluding food and energy) came in above expectations. Headline inflation is up 3.5% from last year, and as you can see from the solid line in the chart below, it looks like inflation progress has stalled since June 2023.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

But the breakdown also tells us it’s really shelter inflation that is behind the stall. Inflation within every other major category has eased relative to last June – including food prices, vehicle prices, and even things like household furnishings, apparel, airfares, and hotels prices. Gas prices have risen this year, but we’re a long way away from the energy price surge we saw in mid-2022.

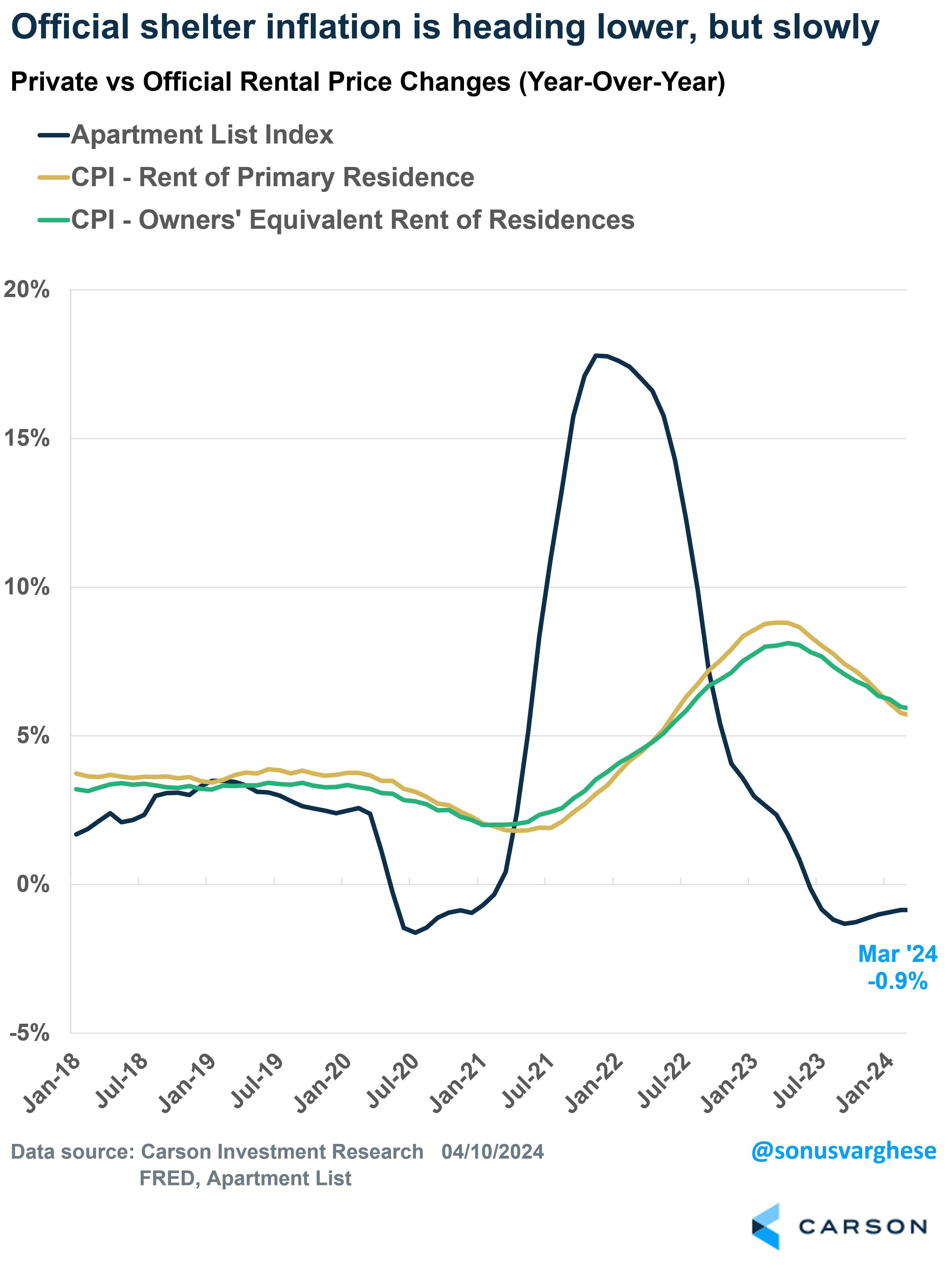

I’ve discussed shelter inflation ad nauseum over the past year and half, and so I’ll skip the details. Suffice it to say, official shelter inflation has a significant lag to rents in the private data. Shelter inflation matters a lot for CPI, as it makes up 35% of the basket. Rents of primary residence account for 8% of that, while “owners’ equivalent rent” (OER) accounts for 27%. OER is the “implied rent” homeowners pay, and it’s based on market rents as opposed to home prices.

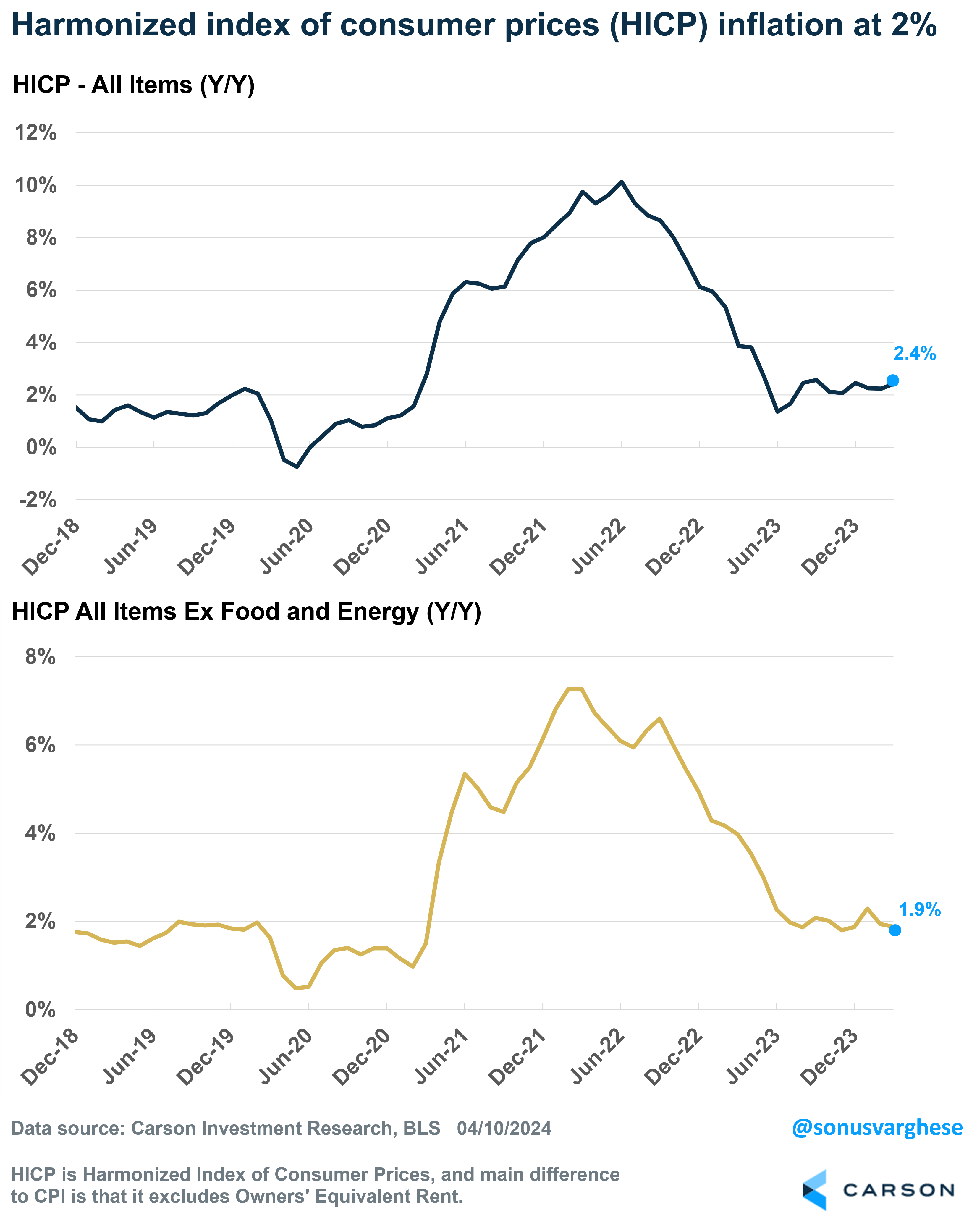

What’s strange is that the US is the only major country that includes a concept like OER in its CPI basket. Other major countries, including in Europe and Canada, include rental inflation but not OER. The Bureau of Labor Statistics calculates an equivalent measure for the US – called the “harmonized index of consumer prices” (HICP), which you can think of as CPI excluding OER. I find this a useful gauge of inflation because we don’t have to throw all of shelter inflation out, as HICP includes regular rental inflation but excludes the problematic OER. It’s also helpful for comparing US inflation to other countries’ on an apples-to-apples basis. US HICP is up 2.4% since last year, and core HICP (ex food and energy) is up just 1.9%. In March, core HICP rose just 0.2%, equivalent to an annualized pace of 2.3%. This should tell you that underlying inflation is not worrisome.

Unfortunately, regular CPI is what is widely followed in the US. The good news is that shelter inflation is easing (including in March), but it’s happening ever so slowly. Apartment List’s national rental index has been in a year-over-year decline for 10 straight months. Official shelter inflation may not get as low as this, but there’s likely more easing to come in the months ahead.

Shelter was not the only upward force on inflation in March. Core inflation (excluding food and energy) rose 0.36% in March, and shelter contributed 0.19%-points of that. But another 0.09%-points came from motor vehicle insurance, which makes up under 4% of the core CPI basket. Together, shelter and motor vehicle insurance contributed 78% of the core CPI increase in March. Motor vehicle insurance rose 2.6% in March and is up 23% since last year. A big reason is that cars and trucks are pricier now, and so insurance is getting more expensive. Repair costs are also rising – for example, a bumper used to be a cheap replacement part, but not anymore because it’s got advanced electronic sensors in there.

The strong economy is not translating to higher prices

Outside of shelter and motor vehicle insurance, most other categories are seeing disinflation or an outright fall in prices. That’s despite strong household consumption. Whether it’s food prices, commodities outside food and energy (like vehicles, household furnishings and appliances) or services like hotels, airfares, personal care services, theater and concert admissions, and car and truck rentals.

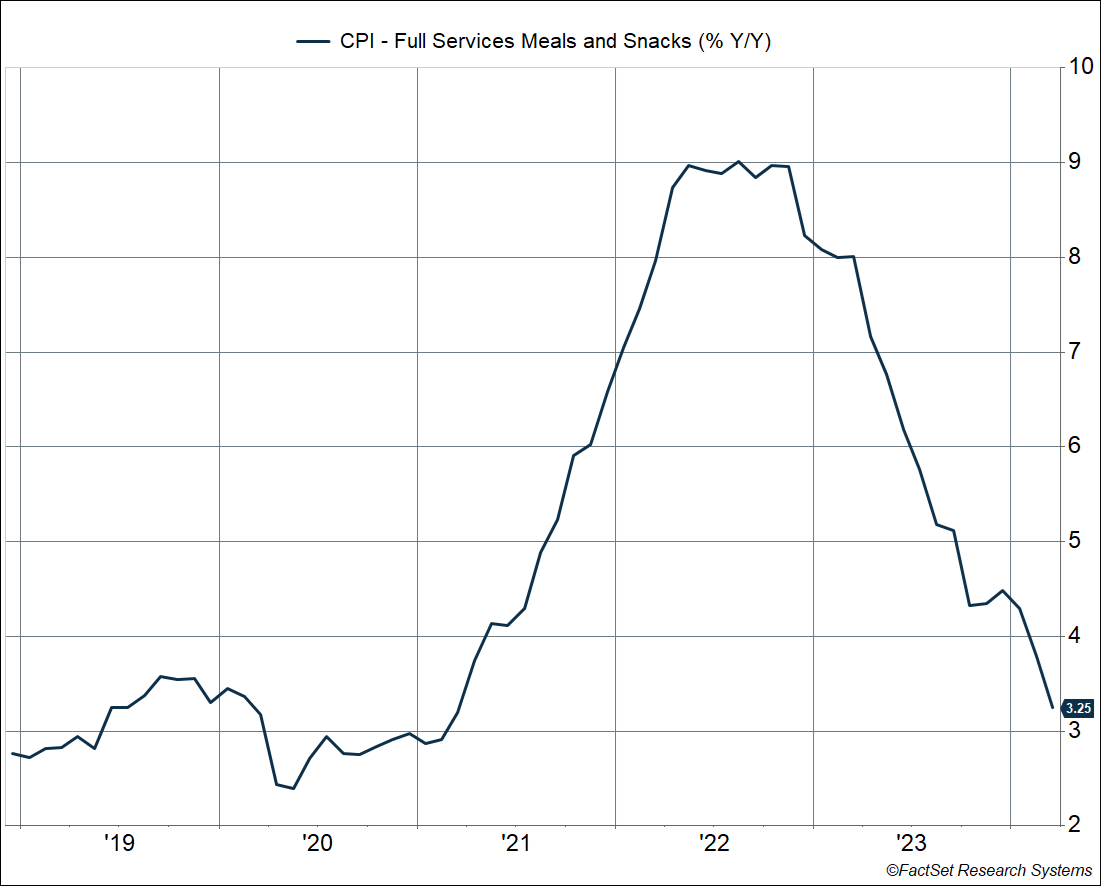

As I wrote last month, one category I like to follow is inflation within food services, i.e. “full service meals and snacks.” It’s tracked core inflation closely even though it’s not included within the core inflation basket. I find it useful because full-services restaurant meals combine several elements that go into inflation, including:

- Commodity prices – food, but also energy (which is used for transportation, amongst other things)

- Wages – for restaurant workers

- Rents – of restaurant premises

Inflation for restaurant meals has eased a lot over the past few months. It was up just 3.3% from last year, which is in-line with what we saw in 2019. At its peak in August 2022, inflation for restaurant meals was as high as 9%. The current level tells me that underlying inflation is quite benign.

Listen to consumers

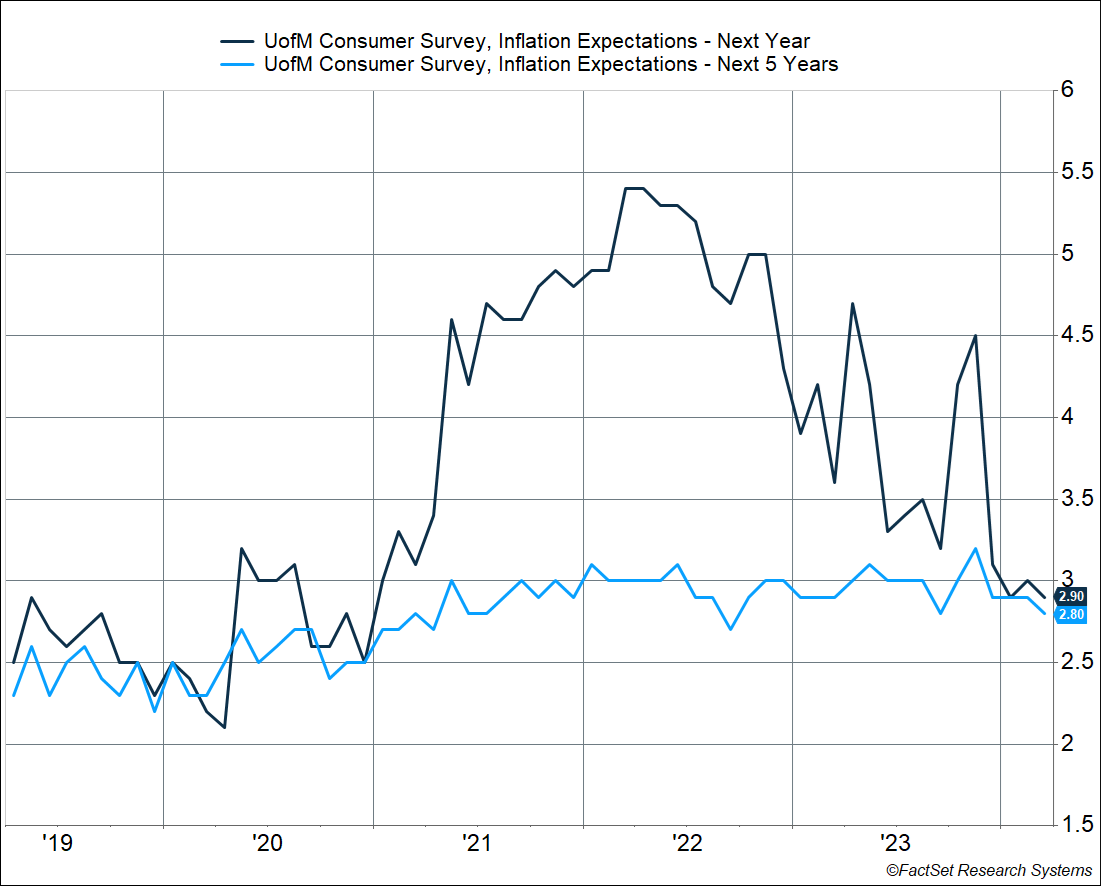

Fed Chair Powell has said that one cause of spiraling inflation is rising inflation expectations, which is what happened in the 1970s. If consumers expect higher inflation, they tend to demand more wages and that puts more pressure on prices for goods and services. He can rest easy, because consumer expectations of inflation – both over the next one year and the next five years – have come in below 3% for three months straight (using the University of Michigan consumer survey). That’s not far above pre-pandemic levels, when expectations were running around 2.5-2.8%.

Consumer inflation expectations are not particularly accurate in forecasting future inflation. (It’s hard even for the Fed.) But I find it useful as a gauge of current inflation, because consumers usually project current inflation out into the future. And right now, consumers are saying inflation is running only slightly above where it was in 2019.

Rate cuts get pushed out

The firm inflation data in Q1 likely pushes out the timing of the first interest rate cut by the Fed, perhaps to July at the earliest, if not September. There’s even less urgency to cut because the labor market continues to run strong. At the same time, there’s a lot more inflation data to come between now and June, let alone July. The underlying data points to core inflation hitting the Fed’s estimate of 2.6% by the end of the year – and based on their own projection, that’s good enough for the cuts.

As Powell noted in his press conference in March, they didn’t sound victory bells when inflation really eased in the second half of 2023, and they’re not going to panic based on the Q1 data. The disinflation trend is likely on track, albeit with a few bumps along the way.

Ryan and I chatted about the strong economy, its impact (or lack thereof) on inflation, and the prospect of rate cuts in our latest Facts vs Feelings podcast. Take a listen: