Whether we are in a recession is top of mind right now, with good reason as Americans experience the highest inflation in four decades. Not to mention the fact that we just got two consecutive quarters of negative GDP growth, which, on the face of it, appears to be an open and shut case that the U.S. economy is contracting. Or in other words, we’re in recession territory?

Well, not quite. There’s more than meets the eye here, at least with respect to figuring out whether or not the economy is in a recession.

That gets to what we’ll talk about in this blog. There’s always more nuance behind flashy headlines you see on CNBC or Bloomberg or the Wall Street Journal. A lot of it involves digging into the guts of the macroeconomic data and weaving a story through a common thread. At other times there may simply be no coherent story, and that is ok – this is after all macroeconomic data we’re talking about, and a lot of numbers can be revised; by a lot (like GDP!). I like to think of it as getting someone else’s box of Legos, without instructions, and trying to build something.

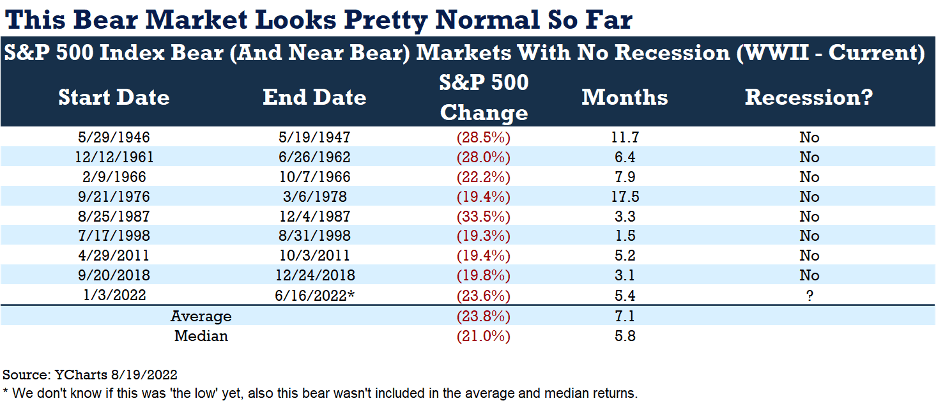

Back to the recession topic. First, from an investing perspective, it helps to understand why we’re concerned about a recession in the first place. I like this table shared by my colleague Ryan Detrick, showing how bear markets that occur outside of recessions average close to a 24% decline, before recovering (a bear market being defined as one in which the S&P 500 index falls more than 20%).

In contrast, bear markets accompanying recessions can be deep and protracted, like in 2008 or 2001. Hence our interest in figuring out whether we’re in a recession now.

In the U.S., the National Bureau of Economic Research’s “Recession Dating Committee” determines the dates of a recession. The problem is we’re typically well beyond the recession by the time they declare it, which makes the actual declaration useful only from a historical perspective.

However, we can use some of their tools to see where the economy is right now. The NBER looks at several economic indicators to make their call, including employment, industrial production, manufacturing and wholesale sales, consumption and income. Interestingly, they do not consider GDP in isolation. GDP can fall by relatively small amounts across quarters, whereas they’re looking to mark a recession as a “significant decline in economic activity.”

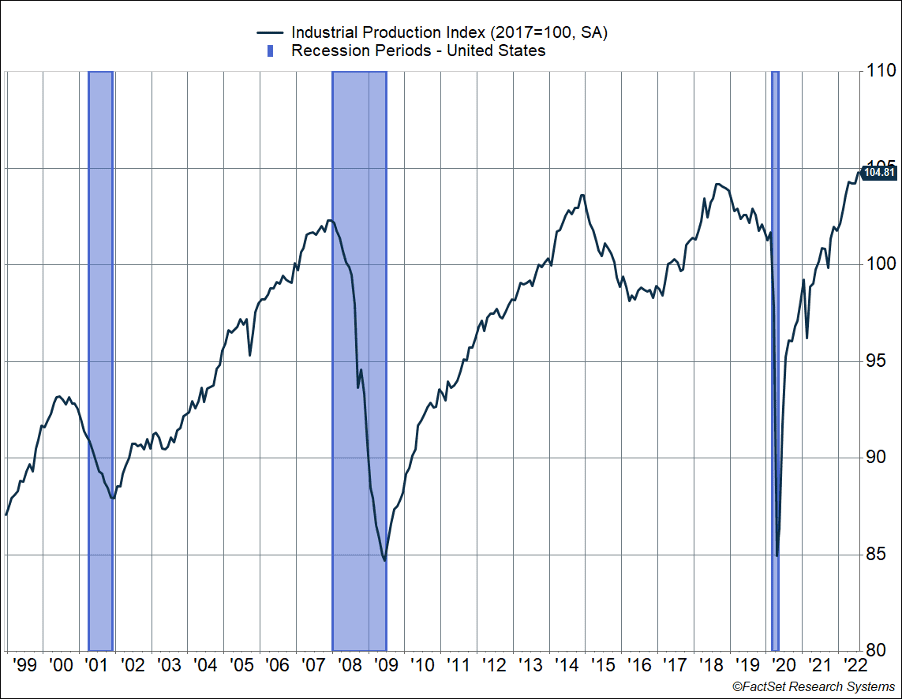

And to that end, we just got some positive data from the industrial sector. The Federal Reserve measures industrial production using a monthly index, and this rose 0.6% in July to a new record high. This is a volume-based index, and that means we’re looking at real output, i.e., adjusted for inflation.

Source: FactSet Research 8/14/22

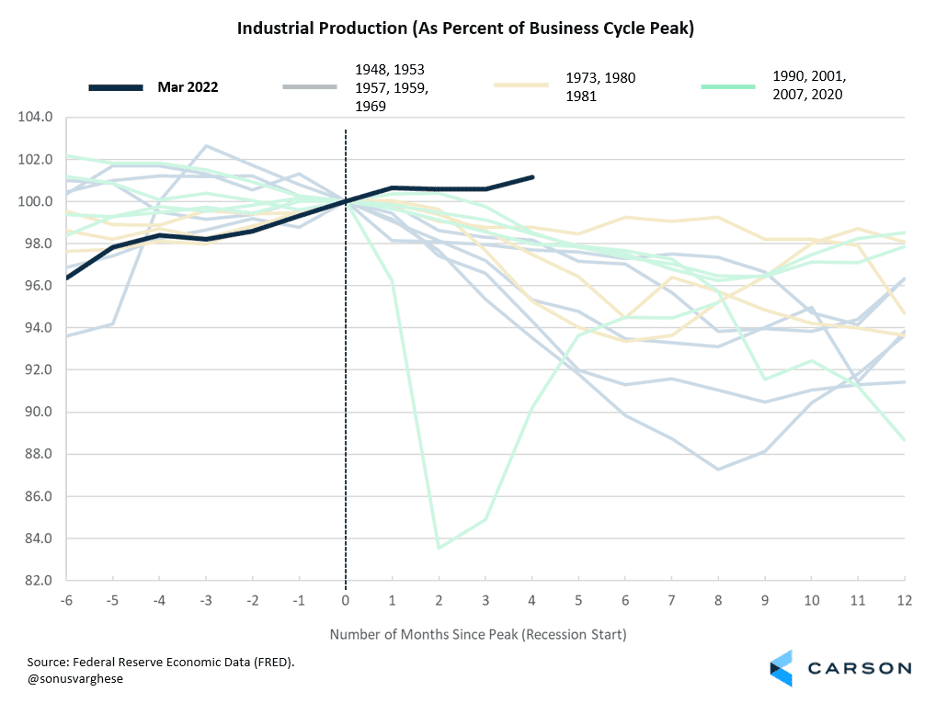

This is not what we have seen during past recessions. Even if we assume that economic activity peaked in March of this year, industrial production is running more than 1% higher than March levels. That pace is well above what we saw four months into the last 12 recessions.

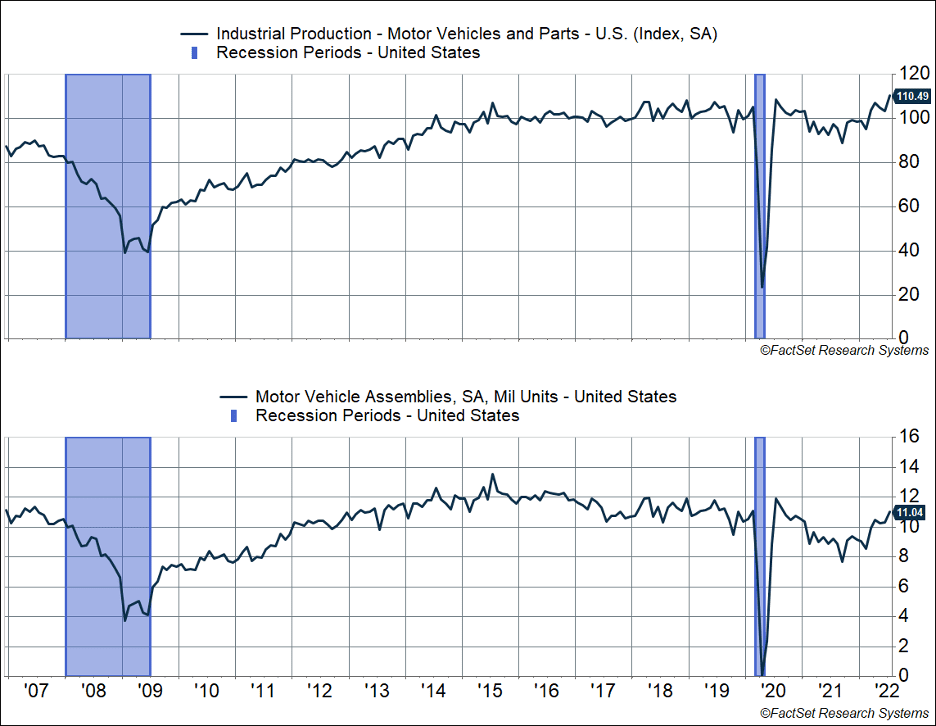

There was more positive news within the report, with the auto manufacturing sector driving much of the rising industrial production. This sector has struggled to increase production over the last two years amid the semiconductor shortage. But production rose almost 7% in July, and output is now higher than pre-crisis levels. In fact, total vehicle assemblies are now up to just above 11 million units, which is where it was pre-crisis. Rising supply of new vehicles should also help ease inflation in the auto sector.

Source: FactSet Research 8/14/22

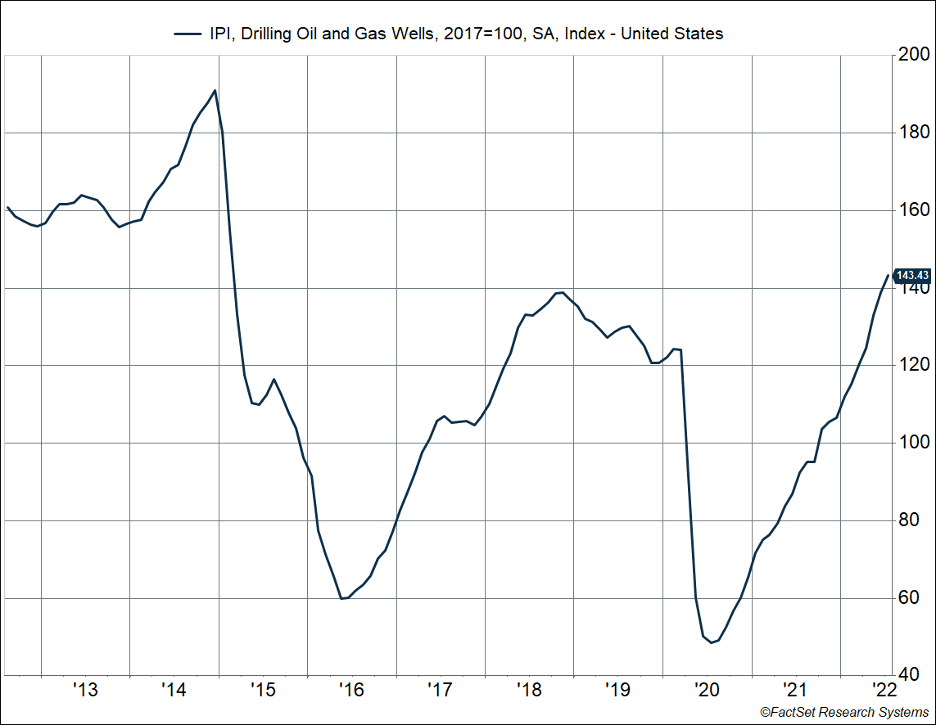

Oil and gas drilling activity were another positive from the report. Output in this industry rose more than 3% in July and is up a whopping 55% over the past year. Rising oil and gas drilling output is welcome news on the inflation front, as energy prices accounted for almost 30% of the inflation over the past year, using the CPI index.

Source: FactSet Research 8/14/22

Combine the industrial production numbers with July’s strong employment data, and it becomes a bit of a stretch to think that the economy was in a recession in July, let alone the first two quarters of the year.

Of course, that does not tell us whether we will head into a recession next month or the month after. But that is why I believe improving auto production was the highlight of the report, as it suggests that supply chain constraints are easing. If this is indeed the case, the auto manufacturing sector could potentially provide a tailwind to the economy in the second half of 2022. And not a moment too soon, given the pullback in the housing sector amid rising mortgage rates.

Please continue to read and share our blog as we put together the various blocks of information to give you a better picture of markets and the economic backdrop.

Check back weekly as we give you a better picture of the markets and the economic backdrop (Bookmark this link for easy access).

Subscribe to Carson’s newsletter, The Trend Line, to help grow your business.