“Never bet on the end of the world. It never ends, and if it does, who will you settle the trade with?”

-Art Cashin, Managing Director at UBS

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

After one of the best months in history last month, the good news is we still see potentially bullish times coming. Here are a few things that caught my eye recently that could have bulls smiling.

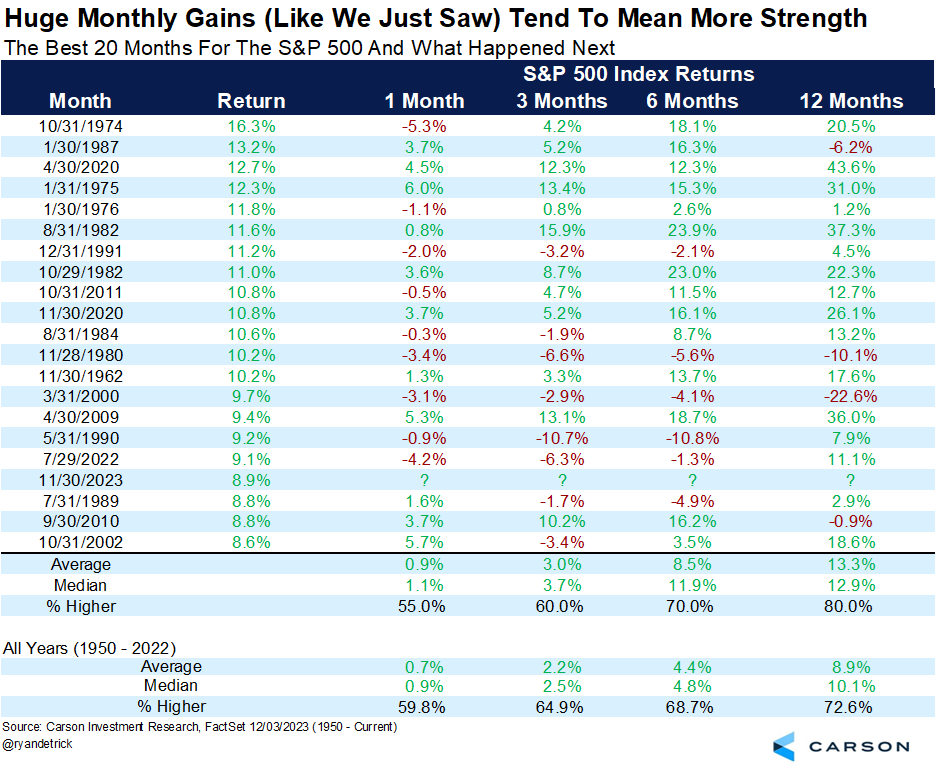

The S&P 500 added an incredible 8.9% last month, which was the 18th best month ever (since 1950). Here are the previous top 20 months ever and what happened next. The good news is higher a year later 80% of the time and up another 13.3% on average could have a lot of bulls smiling in 12 months.

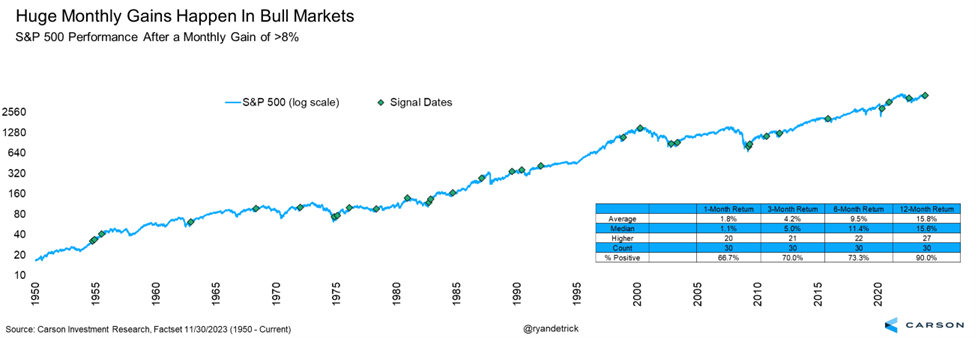

Here’s another way to look at large monthly gains. We found the S&P 500 gained at least 8% a total of 30 other times in history and stocks were higher a year later 90% of the time and up 15.8% on average. Once again, this signals the strength we just say was likely the beginning to more strength, not the end.

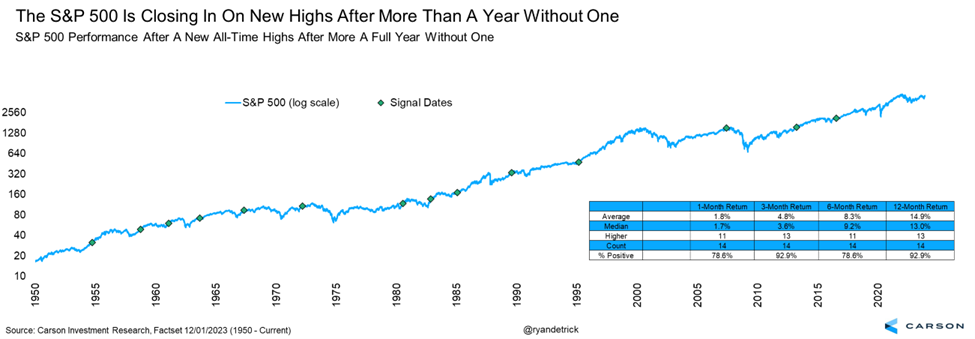

The S&P 500 hasn’t hit an all-time high since January 2, 2022 – nearly two full years! Here’s the good news, the S&P 500 is about 5% away from new highs and we expect new highs to hit sometime early next year. But what investors need to know is previous times stocks went at least one full year without new highs and then hit one, the future returns were very solid. In fact, stocks were up 13 out of 14 times a year later and up 14.9% on average after long streaks without a new high and then finally making one.

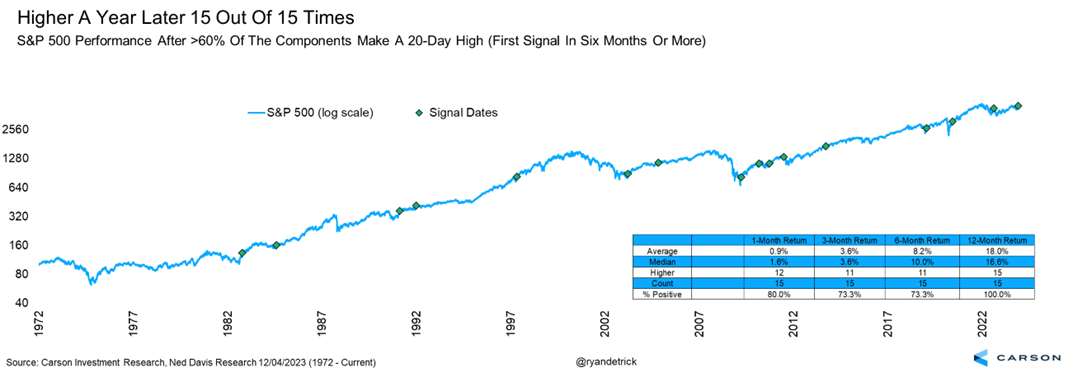

Lastly, we’ve heard time and time again that only seven stocks were going up. We disagreed with that, but there is no question that some of the largest tech and communications names have been spectacular this year. Well, times are a-changing, as we are now seeing this bull market broaden out, as many other groups are beginning to outperform.

Last week, we saw a very rare breadth thrust, which suggested many stocks were surging, which tends to be a signal of impending strength. In fact, more than 60% of all components in the S&P 500 hit a new 20-day high last Friday. This is extremely rare and showed a lot of buying has taken place recently, not just in a few large stocks like they keep telling us. Looking into the data we found that the S&P 500 was higher a year later 15 out of 15 times and up 18.0% on average after previous signals. Wow.

Any one of these signals by themselves could be argued to be random, but when you start stacking them all on top of each other, we continue to expect stocks to do quite well and we remain overweight equities (where we’ve been for a full year now). For more of our thoughts on this bull market, the economy, and remembering Charlie Munger, please listen to (or watch below) our latest Facts vs Feelings podcast.

For more of Ryan’s thoughts click here.

2014703-1223-A