“Investing is like dieting. It is simple, but not easy.” Warren Buffett, Chairperson at Berkshire Hathaway

It was a year ago this week that we moved to overweight equities and we’ve been there ever since. Obviously, this wasn’t a very popular call, as nearly everyone else on Wall Street was expecting a recession and the continuation of the bear market from ’22. Anytime you go against the crowd it will ruffle feathers, but we saw many reasons to do it then and we still see many reasons to expect continued good times in ’24.

We wrote Why We Think The Bull Market Should Continue In 2024 on November 9 (nearly six weeks ago) and all stocks have done since the publication of that blog is go up EVERY … SINGLE … WEEK.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

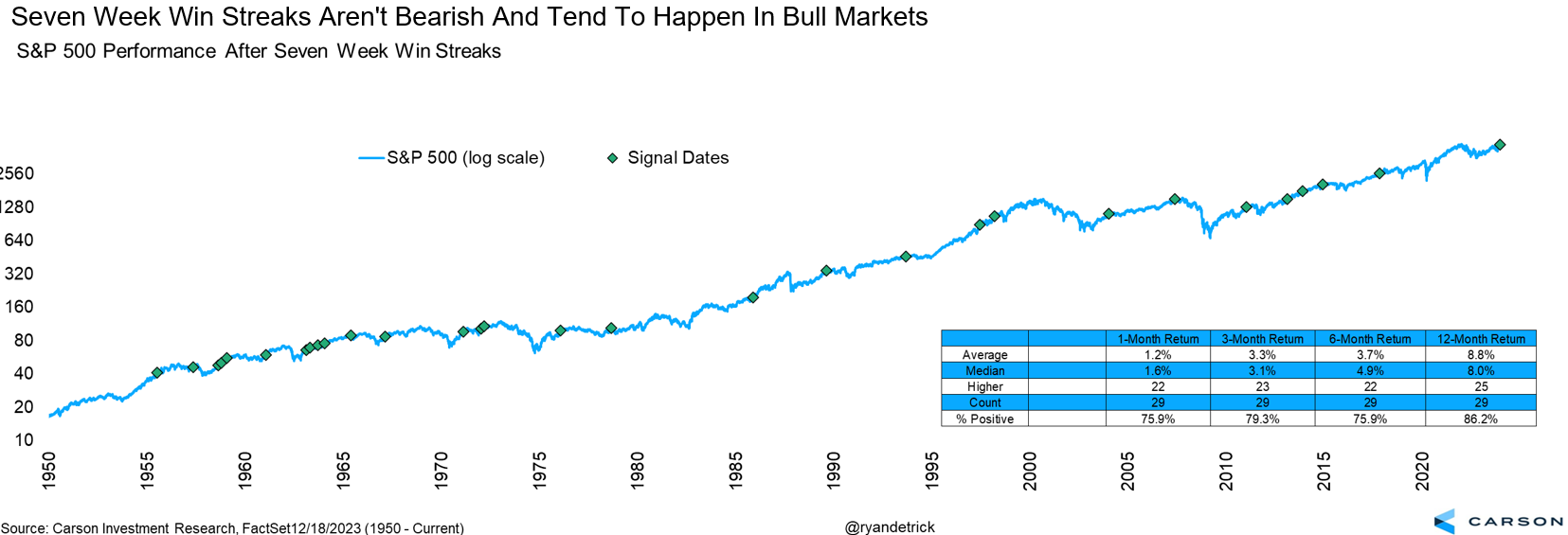

In fact, the S&P 500 is up a very impressive seven weeks in a row currently, for the longest weekly win streak since eight in a row about six years ago. You might think that long weekly win streaks like this are bearish, but that isn’t true. In fact, you tend to see streaks like this in bull markets and continued strong price action is normal. Looking at all the seven week win streaks since 1950 showed that stocks were higher a year later 25 out of 29 times, or more than 86% of the time. That’s the first recent signal we’ve seen that suggests the next 12 months could provide another good year for the bulls.

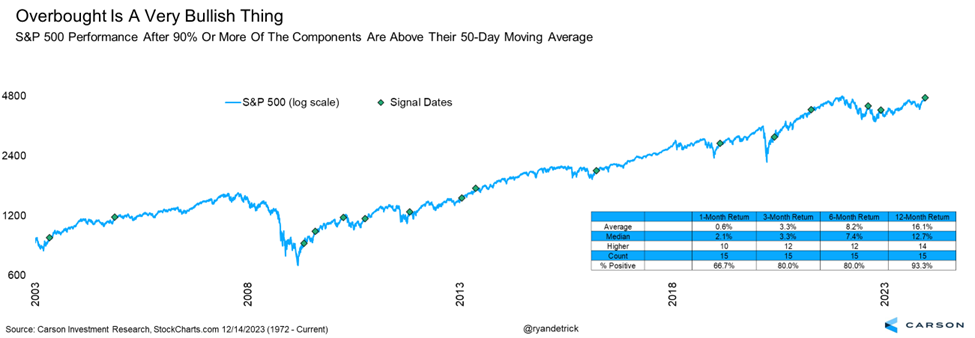

Second, we’ve seen huge jumps in breadth, otherwise known as participation. For most of this year we heard the same bears on TV tell us (over and over) that only seven stocks were going up. We disagreed with this analysis the whole time, as many stocks were indeed going higher, but the blast of buying pressure we’ve seen the past few weeks further confirms there are way more than only seven stocks supporting markets now.

Last week saw more than 90% of the stocks in the S&P 500 above their 50-day moving average. This might mean we are near-term overbought, but you also tend to see this kind of strength at the beginning of bullish moves. Going back the past 20 years, previous times we saw such strong participation, the S&P 500 was higher a year later 14 out of 15 times and up 16.1% on average. Yet another clue stocks could be in a for a nice year in ’24.

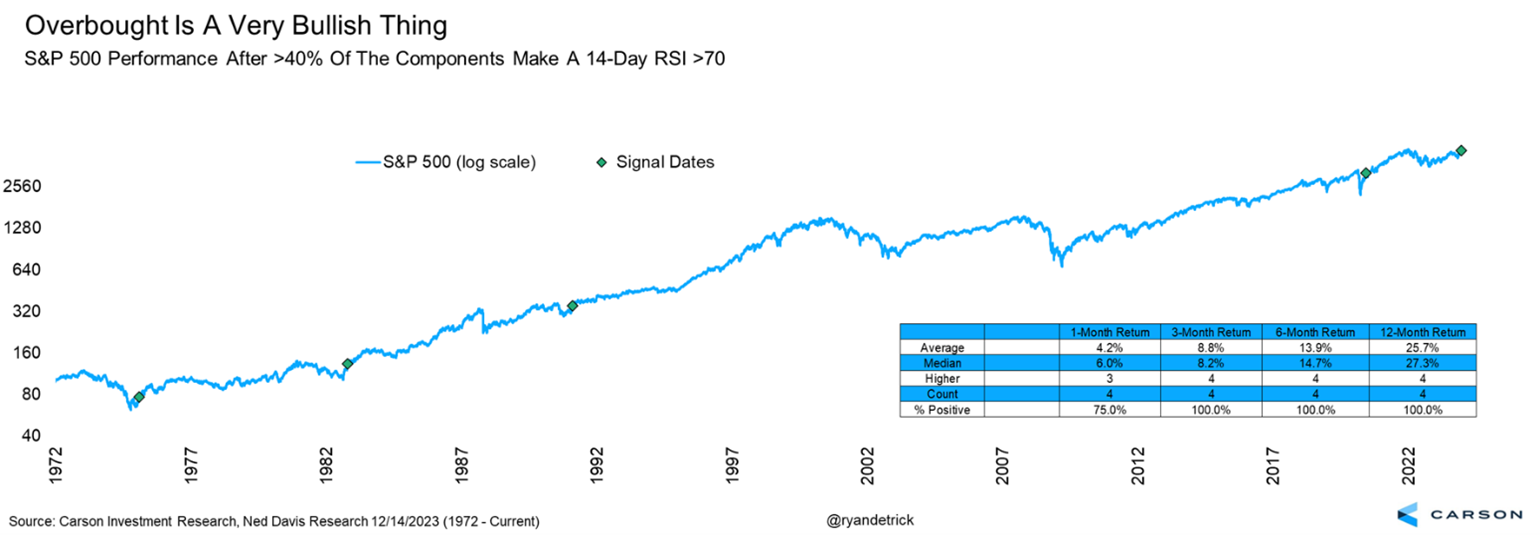

Another rare, yet potentially bullish, signal is our third reason to expect higher prices in ’24. Recently more than 40% of the components in the S&P 500 saw an RSI of more than 70. We will keep this fairly simple, but the RSI (or relative strength Index) is an overbought/oversold indicator where the general guideline is above 70 is overbought and below 30 is oversold. You can read more about the RSI from our friends at Investopedia here.

The bottom line is when you see a large spike in the number of stocks in the S&P 500 that are overbought, it is very bullish. Thanks to data from Ned Davis Research we found there were only four other times since 1972 (as far back as NDR data goes) that also had above 40% of stocks at overbought levels. The average return a year later was an extremely impressive 25.7% and higher all four times. In fact, the worst return a year later was ‘only’ 17.6% after the signal in February 1991. I don’t know about you, but I could live with a 17% gain in 2024. 😉

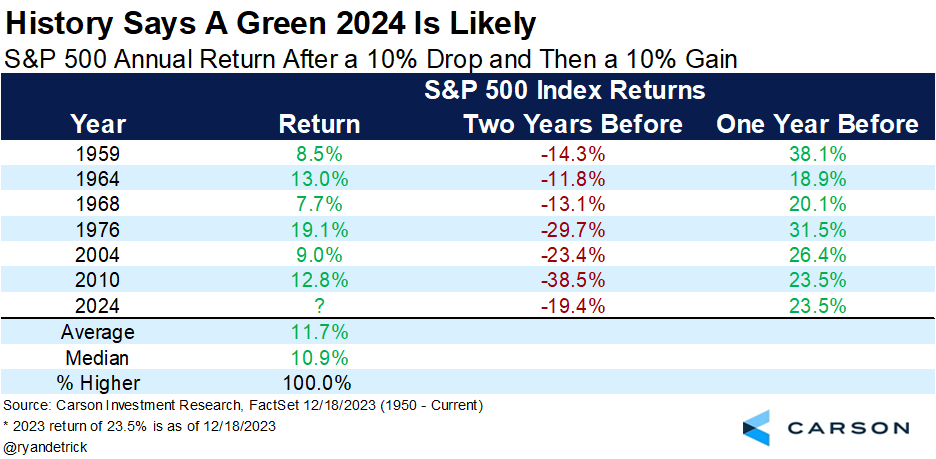

The last reason to be bullish in ’24 — when stocks have dropped more than 10% (like 2022), then jumped more than 10% (like this year), that following year tended to be quite solid, up six out of six times with an 11.7% gain on average, which would likely make most bulls smile in ’24.

As Uncle Warren told us in the quote at the top, investing can be very tough. There will always be reasons to worry and reasons to sell. Yet, some of the very best investors in history are those who simply used the scary times to add when others are selling.

Sure, it isn’t always that simple, but look at 2023. As we laid out all year, the overwhelming evidence suggested stocks would go higher, and they sure have. That’s why we invest based on facts, not feelings. Have you seen our podcast?

As we’ve noted many times the past few months, we continue to see many reasons to expect continued good times in ‘24, so here’s to keeping it simple and enjoying what could be a nice year in 2024.

Please have a happy and safe holiday season and here’s to all these bullish signals playing out in ’24!

For more of Ryan’s thoughts click here.

2031294-1223-A