“We may not know where we are going, but we better know where we stand.” –Howard Marks, Co-Founder of Oaktree Capital Management

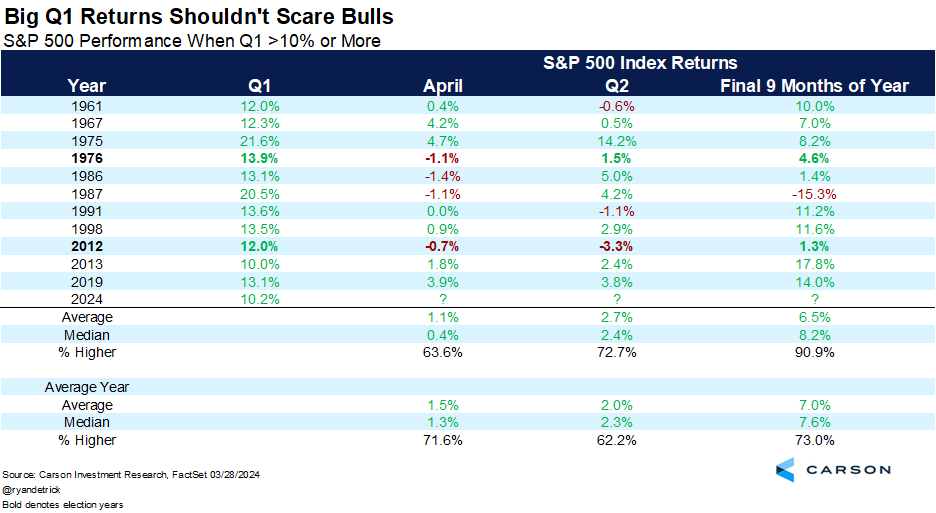

Following the huge 11.2% rally for the S&P 500 in the fourth quarter of last year, the index has given us an encore performance in the first quarter with a 10.2% gain. Big gains like this in Q1 aren’t very common. Only 11 times has the S&P 500 gained more than 10% in the first quarter. But the good news is what happened next tended to be good for 🐂s.

April gained 1.1% on average following those 11 big first quarters, not quite the average 1.5% gain, but not a bad number by any means. Looking at Q2 the returns get a tad better, and the rest of the year has been higher 10 out of 11 times with a solid 8.2% median return. Yes, the one time things didn’t work out was in 1987, but note that stocks were up 40% for the year in August back then, so that was a much more stretched rubber band than now. The bottom line, a big Q1 could be a clue the bull market is alive and well.

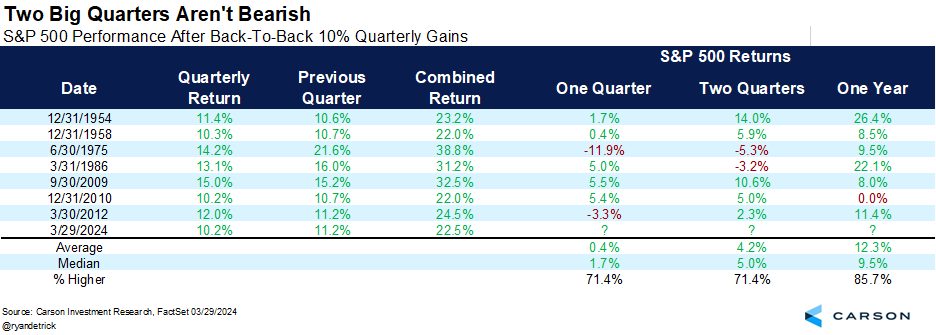

If a 10% Q1 was rare, let’s now talk about back-to-back double digit quarters. We are looking at only the eighth time that has ever happened and the first time since Q1 2012 (also an election year). The one and two quarter returns aren’t much to get excited about (but after a huge move, some type of consolidation is perfectly normal), but a year later stocks were higher six out of seven times and up 12.1% on average. Again, this is likely a positive sign of continued strength from stocks.

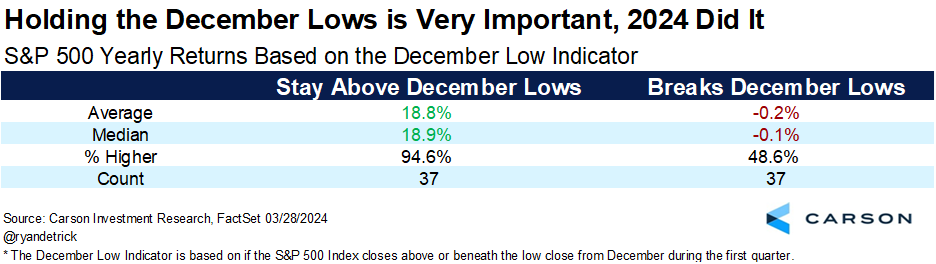

Last and certainly not least, here’s one of my favorite indicators. This is called the December Low Indicator and it is fairly straightforward. When the S&P 500 doesn’t close beneath the December low close in the first quarter, good things have tended to happen the rest of the year. The opposite, of course, is when the December lows are violated in the first quarter. To refresh your memory, last year they didn’t break the December low and it was a great year, while a break in early 2022 was one subtle clue that the odds were elevated that the rest of the year could be dicey. Given that stocks didn’t break their December low this year, this is one less worry for sure.

Interestingly, since 1950, stocks held above the December lows 37 times while they broke the lows 37 times. Talk about even-steven. Those are some pretty big sample sizes, and sure enough, the results are quite conclusive.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Those 37 times the December lows held? The full year was up an incredible 35 times and up an average of 18.8%. The times it failed? The full year was down 0.2% on average and higher less than a coin flip.

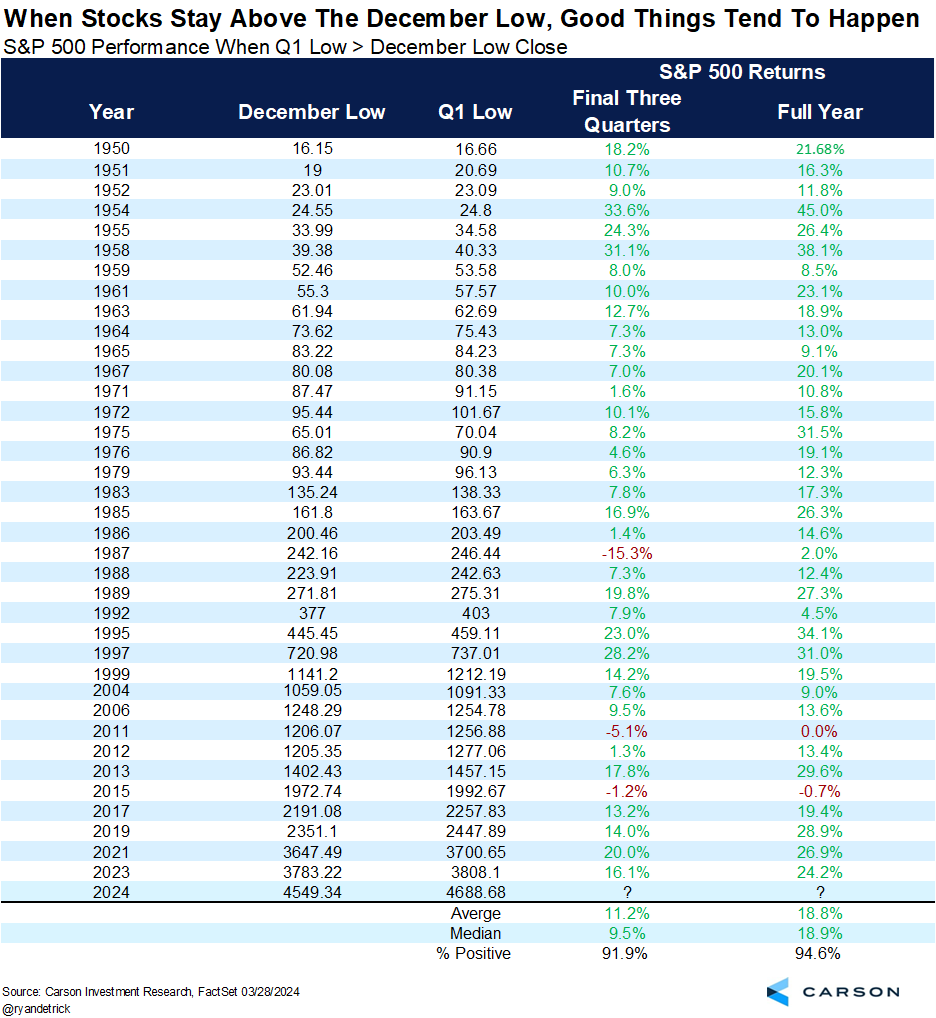

If you want to investigate things more closely, here are all 37 times the S&P 500 held above the December lows. I added what happened the rest of the year (so the next three quarters) as well, and once again, strong performance was quite normal. We get it, anything could happen from here. But the truth is it would be abnormal to see a massive bear market and horrible year for stocks this year.

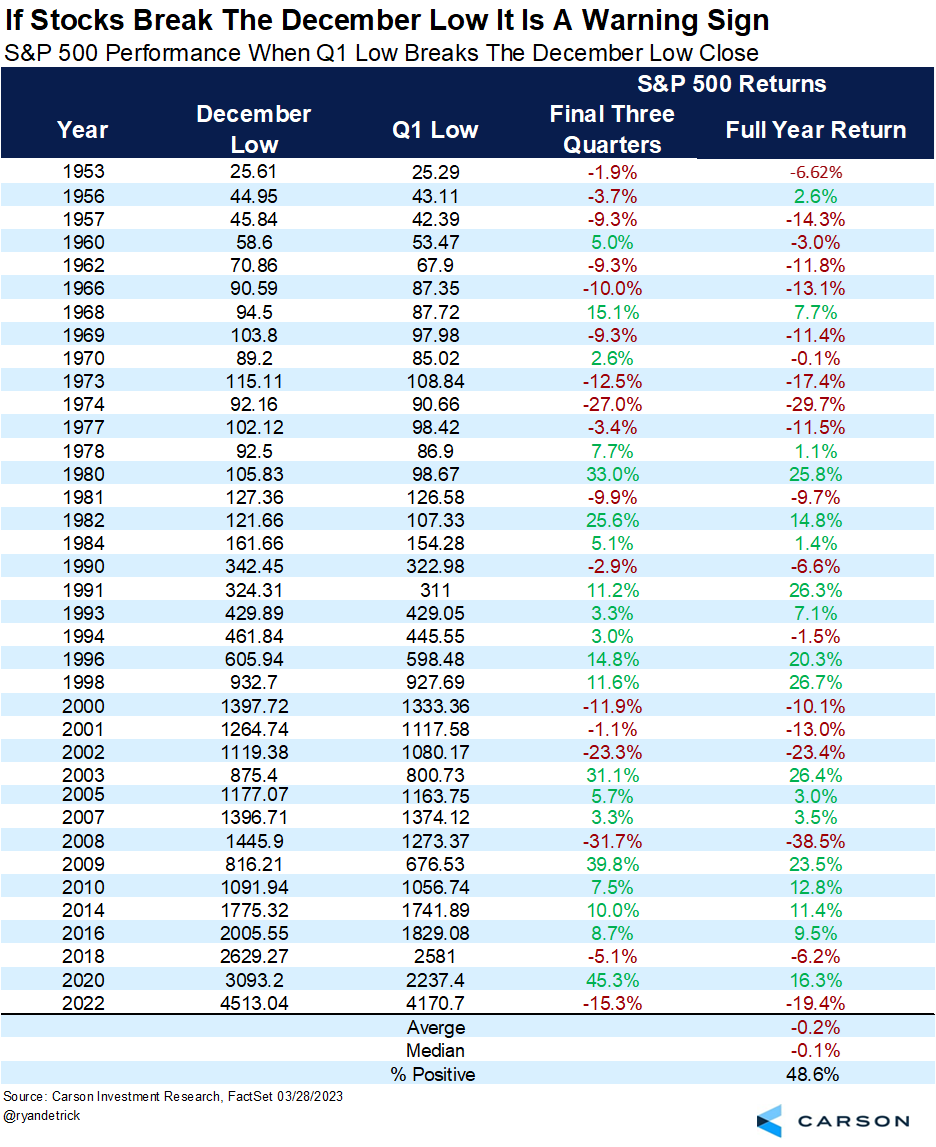

Here’s the other side to things. What happened when the December low was violated? Once again, the full year and the next three quarters’ returns were much weaker. Just a quick glance and some of the worst years ever saw the December lows broken. Years like ’73, ’74, the tech bubble, ’08, and ’22 all made this infamous list.

Odds are, as you read this, I will be somewhere in wine country out in California (probably Calistoga). You caught me. I wrote this one a few days early, so I’m not overly concerned given this potentially bullish development. I’m more into enjoying a very laid-back part of the country and some of the best food from the best chefs in the world. But starting next week I’ll be focusing on all of this more closely. Or, as Howard Marks said in the quote above, we don’t know where we are going, but we do know we stand on potentially a better backdrop for stocks than most think.

For more content by Ryan Detrick, Chief Market Strategist click here.

02181882-0424-A