Consumer confidence has been rising recently. Maybe it’s Taylor Swift, and her weekly Sunday appearances. Or maybe it’s rising stock prices, rising home prices, and falling gas prices. Ultimately, perhaps the best signal to draw from rising confidence is that the labor market is strong. Keep in mind that the close to 70% of the US economy is made up of consumer spending, and since consumption is driven by incomes, a strong labor market holds the cards when it comes to the economy.

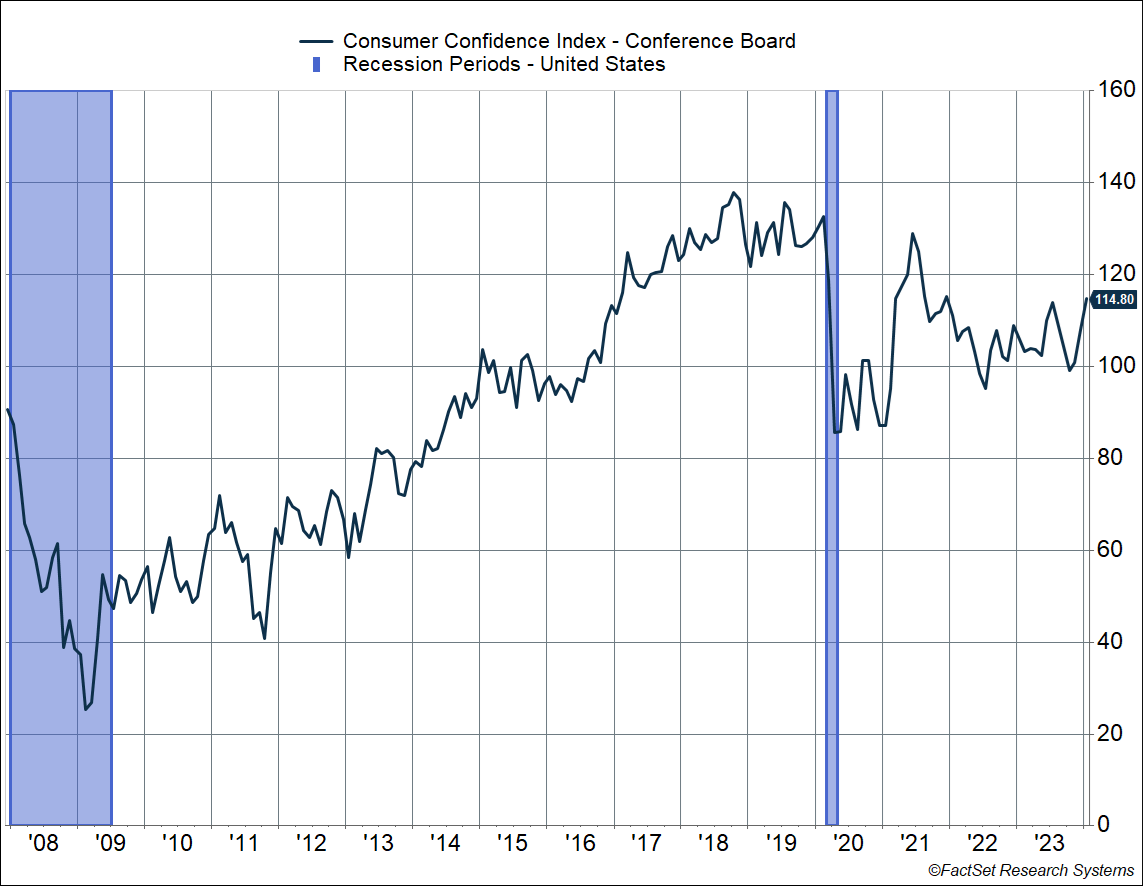

The Conference Board’s Consumer Confidence Index jumped by 6.8 points to 114.8 in January, taking it to the highest level since December 2021. Consumer confidence remains below levels we saw in 2018-2019, but the recent surge is welcome, after almost two years of depressed sentiment.

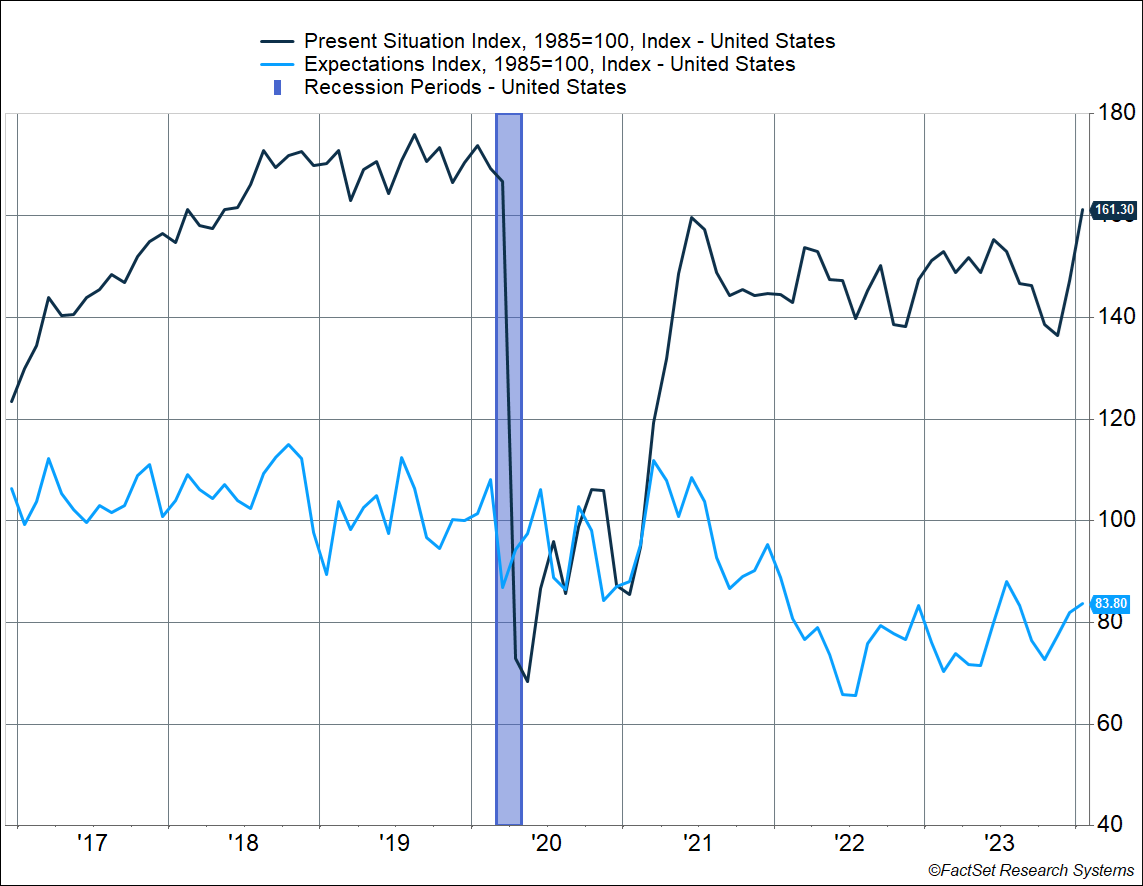

The big driver of the jump was how consumers feel about present conditions, specifically job availability and business conditions. The Present Situation Index jumped 14.1 points to 161.30, the highest level since the pandemic hit in March 2020. In contrast, Americans are still relatively concerned about the future, with the Expectations Index – measuring expectations of future household income, job availability, and business conditions – still hovering well below levels we saw before the pandemic. It has risen over the last three months, which is positive, but we have quite a ways to go. The good news is that consumers’ perceived likelihood of a recession over the next 12 months continued to fall, hitting the lowest level since August 2022 at 66%.

Consumers Are Telling Us the Labor Market Is Strong

Later this week, we’ll get the December payroll report, which is the most comprehensive early look into the status of the labor market. However, the fact that consumer’s appraisal of the present situation surged in January suggests that the labor market is in a very healthy place.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

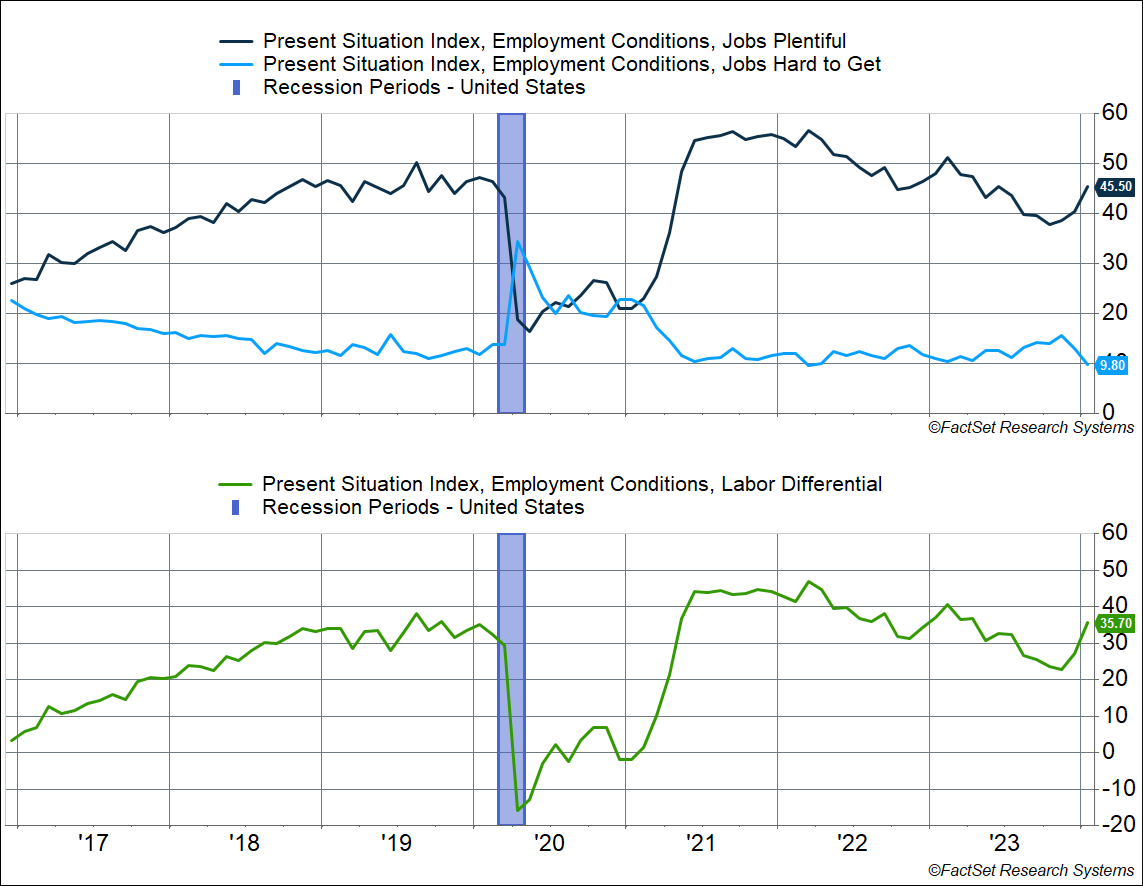

In fact, the number of survey respondents saying “jobs are plentiful” rose by 5.1%-points to 45.5%, the highest level since April 2023. At the same time, respondents saying “jobs are hard to get” fell 3.3%-points to 9.8%, the lowest since March 2022.

The difference between the two is called the “Labor Differential Index,” and as you can probably guess, that jumped as a result. It surged 8.4 points to 35.7, which puts it above the 2019 average of 33.3. Outside of the pandemic recovery in 2020-2021, the increase in January is the largest we’ve seen in the history of this index (since the late 1970s). Historically, it correlates strongly with the unemployment rate, a large value corresponding to a low unemployment rate and vice versa.

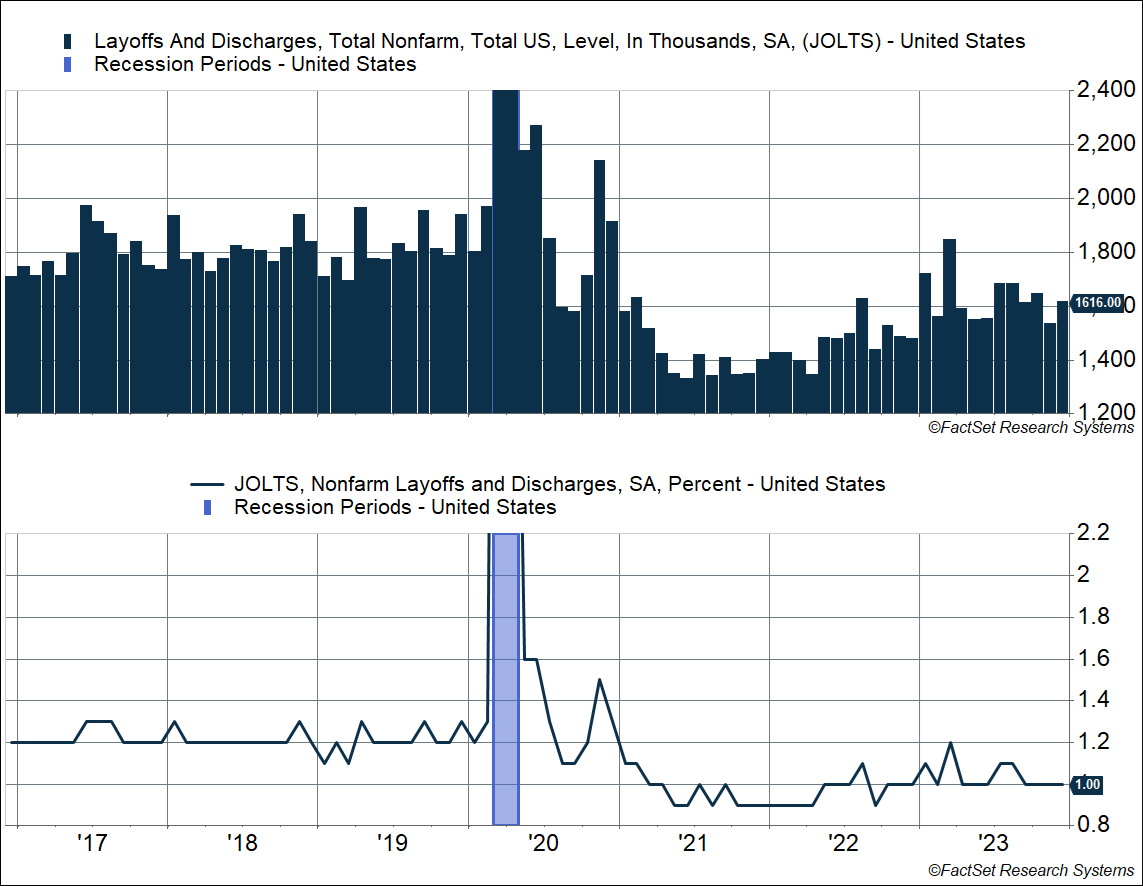

What consumers are telling us also corroborates with other “hard” data we got this week. Layoffs continue to run relatively low. In December, the level of layoffs was around 1.62 million, well below the 1.8 million we saw before the pandemic. Keep in mind that the workforce is also larger now. If we normalize for that, the “layoff rate,” or layoffs as a percent of the workforce, is running at a historically low 1.0%. For perspective, it was running around 1.2-1.3% in 2018-2019. (Note: I’ve truncated the y-axis in the chart below, to provide more clarity, since layoffs surged in March – April 2020 and overwhelms everything else.)

Big picture, the economy is in a good place, especially the all-important labor market, and consumers are starting to perceive it as such. Strong incomes are what pushes consumption higher, and that’s good for economic growth, as well as company revenues and profits.

Another huge benefit of a strong labor market and strong incomes, along with falling inflation, is that the economy is less dependent on credit as a driver of growth, for households, but also for businesses. It allows businesses to fund expansion with profits, as opposed to solely debt financing. This is a big reason why we saw economic growth run above trend in 2023, even as bank lending eased to 2% year over year, well below the historical run rate of around 5%. That’s another way in which we may be in a different sort of economic environment than what we’ve experienced since the 1980s – one that is fueled by incomes rather than credit.

That’s a big reason to feel good.

For more of Sonu’s thoughts click here.

02093234-0124-A