The economy has stayed surprisingly resilient in the face of the most aggressive Federal Reserve (Fed) in 40+ years. A large part of that has to do with a strong labor market that has surprised a lot of economists and market watchers. Now, employment is certainly slowing from its torrid pace earlier this year, but as I wrote last week, this is likely just normalization.

However, this labor market is unique in many ways beyond the typical headline data that are reported, and I want to highlight three stories happening underneath the hood.

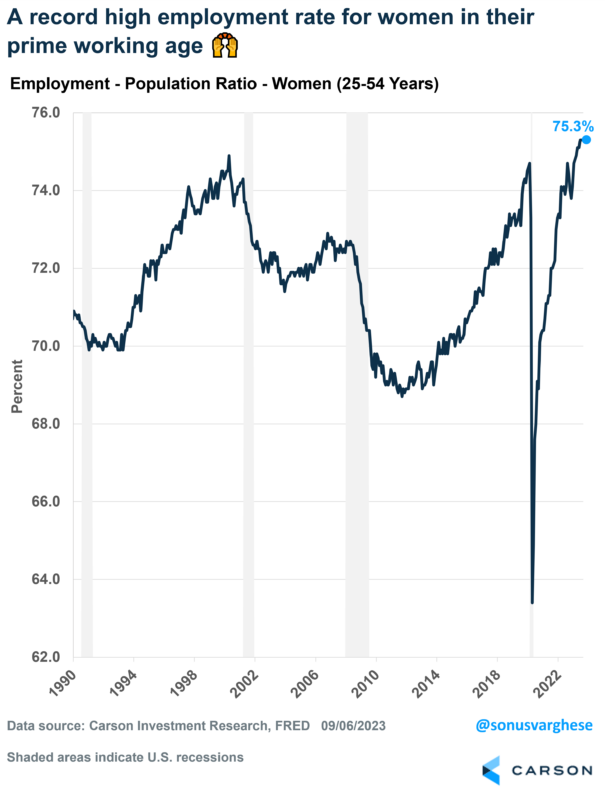

1) A Record High Prime-Age Employment-Population Ratio for Women

I like to look at the employment-population ratio instead of the unemployment rate. The latter has issues with who is classified as “unemployed” (for example, someone who’s not actively looking for work is not considered as unemployed). The employment-population ratio is more straightforward as it measures the number of employed workers as a percent of the civilian population. The ratio for “prime age” workers, i.e. ages 25-54, is especially useful since it removes the impact of an aging society.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The prime-age employment-population ratio is at a two-decade high of 80.9%. Better still, the corresponding ratio for women is 75.3%, which is a record high. So not only is this labor market the healthiest we’ve seen since the late 1990s, but it is the best ever for women in their prime working years.

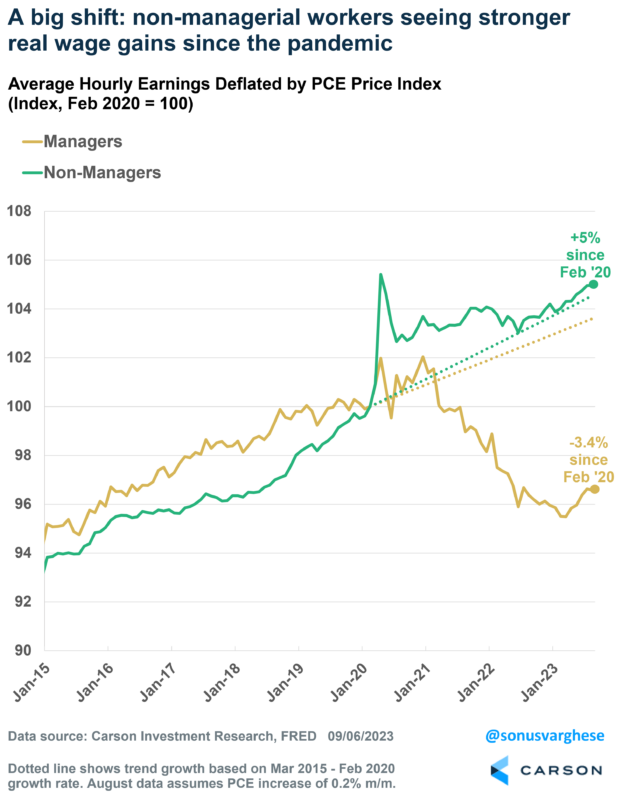

2) A Labor Market That’s Working Much Better for Lower Wage Workers

Inflation hit the highest level in 40+ years last June, and that was a blow to “real” incomes (incomes after taking inflation into account). The good news is that real incomes are rising once again as inflation recedes. But here’s something that’s not widely talked about. Income growth, especially after adjusting for prices, has been much stronger for “production and non-supervisory” workers, i.e. non-managers, than for managers. Non-managers make up about 81% of the private workforces.

Over the five years prior to the pandemic, inflation-adjusted average hourly earnings for managers grew at an annual pace of 1%. Real income growth for non-managers grew slightly faster, running at a 1.3% annual pace. There’s been a stark shift since the pandemic. Real incomes for non-managers have grown 5% since Feb 2020 (through August 2023), translating to an annual pace of 1.4% and slightly higher than the pre-pandemic trend. However, real incomes have fallen more than 3% for managers (-1% annualized)! Here’s the actual non-adjusted data, since Feb 2020:

- Average hourly earnings for managers rose 11%

- Average hourly earnings for non-managers rose 20.7%

- Inflation, as measured by the PCE price index, rose 15%

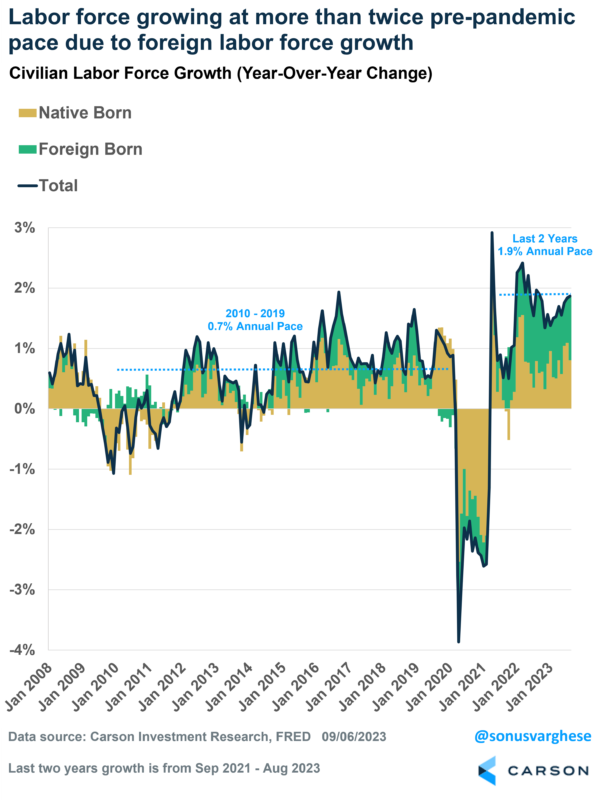

3) The Labor Force Is Growing at More Than 2x Pre-pandemic Pace, Due to Immigration

Over the last two years, personal consumption has grown at a pace of 2.6% after adjusting for inflation, compared to the 2018-2019 pace of 2.1%. That’s because of strong compensation growth across all workers in the economy, which has come on the back of solid wage and employment growth. A big reason for strong employment growth, which has pushed the unemployment rate below what most economists (and the Fed) predicted it would be, is that labor force growth has also been strong. More and more workers keep coming off the proverbial “sidelines” to look for work and have found it.

Over the last two years, the labor force has grown at an annual pace of 1.9%. That’s the fastest pace we’ve seen in a long time. For comparison, the labor force grew at an annual pace of 0.7% from 2010-2019, and the pace was 0.9% over the decade prior to that. What’s interesting is that immigration is mostly driving above-trend labor force growth right now. Over the last two years, the foreign-born labor force has grown at an annual pace of 6.3%, versus a pace of 1.6% over the last decade. Even the native-born labor force, which makes up just over 80% of the total, has grown at a 1% annual pace over the past two years. That’s twice the pace over the last decade.

The current labor market is advantageous for lot of workers in ways it wasn’t over the past two decades, including:

- Women

- Non-managers, and lower wage workers

- Foreign born workers and workers on the “sidelines”

It’s hard to say whether this will continue, but it’s something to make note off. Especially as we think about relationships across the economy that we’ve gotten used to, and comfortable with, over the past couple of decades. The different nature of the post-pandemic economy is a big reason why we believed the economy would be resilient and avoid a recession this year. Instead of relying on traditional indicators like the inverted yield curve, M2, PMIs, and the Conference Board’s Leading Economic Index.

Ryan and I talked about the labor market in the latest episode of Facts vs Feelings:

1893186-0923-A