By the time most of you read this, there’s a good chance the Fed hiked rates by 25 basis points to 5.25%, the 10th consecutive hike from a low of 0.5% during the depths of COVID. We have no clue if this is their last hike, but odds are we are getting quite close.

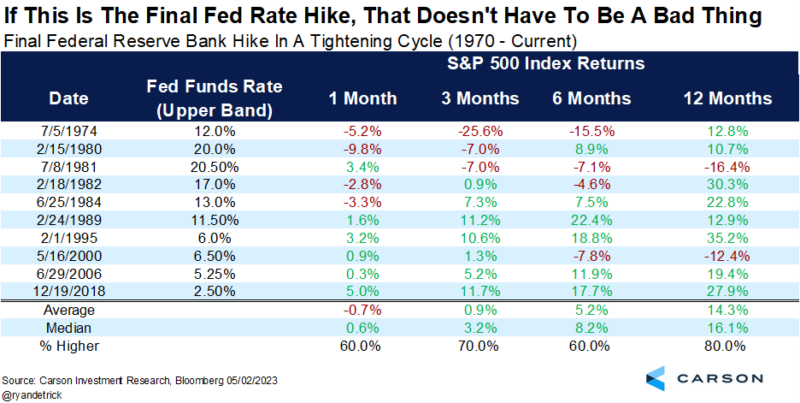

Let’s make this blog quick and easy. What if this is the last hike? Well, I went back and found the past 10 ‘last hikes’. Take note, it wasn’t until 1994 when the Fed actually announced their rate hikes for the whole world to know, so data before then isn’t always uniform. But for this, I’m using Bloomberg data.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Looking at those 10 cycles of higher rates showed that stocks were up one year later eight times and up more than 14% on average a year later after the last hike. Yes, May 2000 is in there and we all know how poorly stocks did after that hike, but for the most part, we find it hard to justify turning wildly bearish if this is indeed the final Fed hike. There are no doubt other reasons for worry, but this might not be one of them.

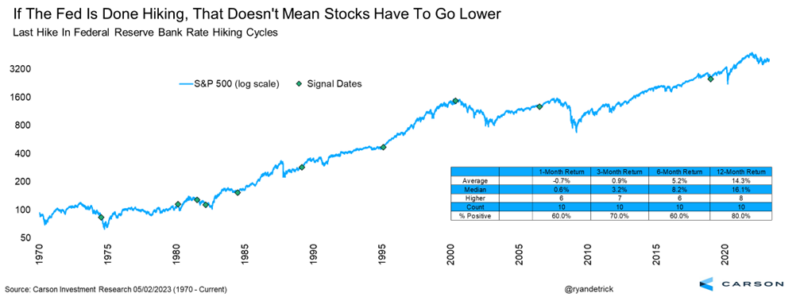

Here’s the same data, but shown a different way.

Please continue to follow Carson Investment Research, as we will break down the latest on the Fed’s decision and everything else regarding the macro and investment landscape. But on the lookout for a blog from Sonu tomorrow on the Fed’s decision and then on Friday regarding the monthly employment data.