“Don’t confuse brains with a bull market.” Humphrey B. Neill

The wild ride in 2025 continues, as stocks surprised many and gained 1% on Monday after the US attacked Iran over the weekend, while crude oil declined nearly 14% from the open to the close, one of the largest intraday reversals in history.

But is this choppy and frustrating action so far in 2025 really a big surprise? You’ve heard of the seven-year itch, right? It says that seven years into a relationship (or a job, a car, or something else) the level of satisfaction begins to decline and the need for a change increases. Well, it turns out bull markets have a three-year itch as we’ll discuss more in detail below.

Year Three Tends To Be Choppy

The S&P 500 gained more than 22% the first year off the October 2022 bear market lows, followed by nearly another 34% in the second year. As anyone who has invested lately knows, things have been quite choppy and frustrating so far in 2025, especially from the February 19 peak to the near-bear market April lows.

As we noted in our Outlook 2025 coming into this year, the third year of a bull market tends to be choppy historically after a typical two-year surge off of lows. This didn’t mean we were bearish, as we said 2025 could still see stocks up 12 – 15%, but it did imply there could be some frustrating moments early in the year. Well, that has sure played out, so maybe we shouldn’t be so surprised by the third-year itch?

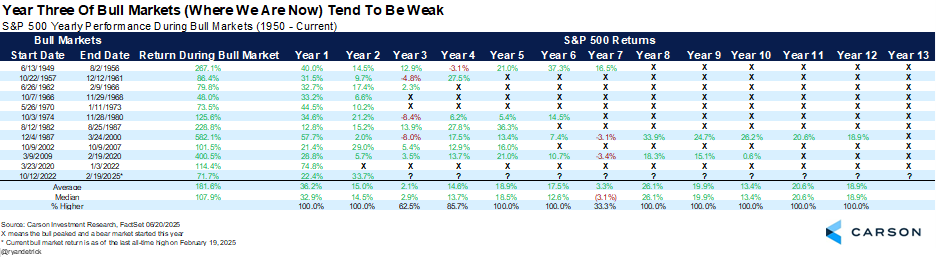

Here’s a table we’ve shared before and it shows that bull markets that make it to their second birthday tend to be rather weak in that third year, up just over two percent on average. In fact, the third year hasn’t been up double digits since the third year of the 1982 – 1987 bull market.

The good news? Years four and five of bull markets tend to be quite strong after the well-deserved break in year three. We’ll worry about that when we get there, but we remain constructive on this bull market (and the remainder of 2025) and we very well could have more gains coming down the road after this choppy year-three action.

This Looks Familiar

We love the quote from Mark Twain that “History doesn’t repeat, but if often rhymes.” Well, looking at past bull markets more closely shows similar action to what we’ve seen this year.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

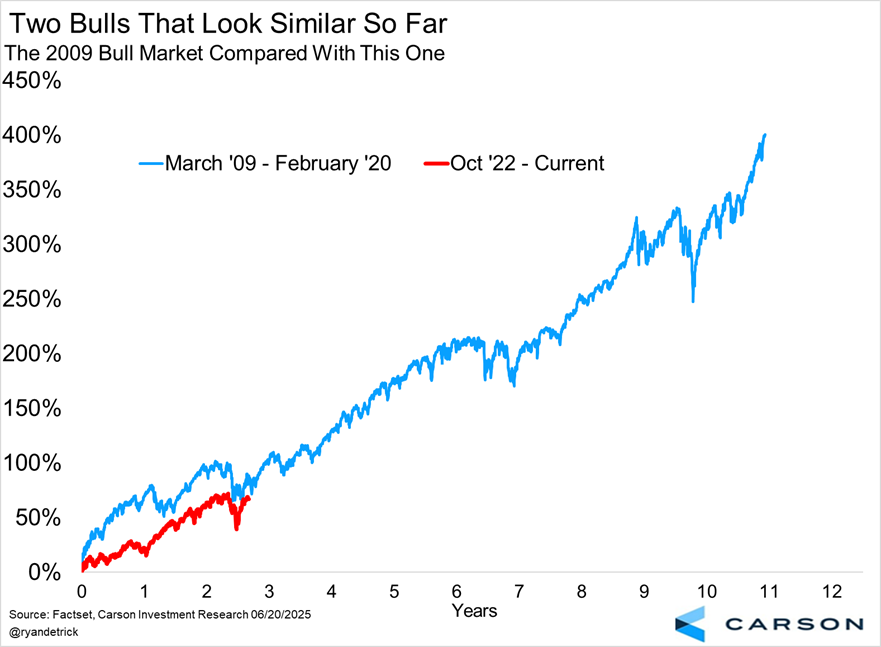

One of the longest bull markets ever was the 11-year bull market that started in 2009 after the Great Financial Crisis. Look at how that one saw a near-bear market at nearly the exact same time as this one. Back then we almost saw a bear market after the first US debt downgrade in August 2011, but what matters to us as investors is how things rebounded and continued to move higher.

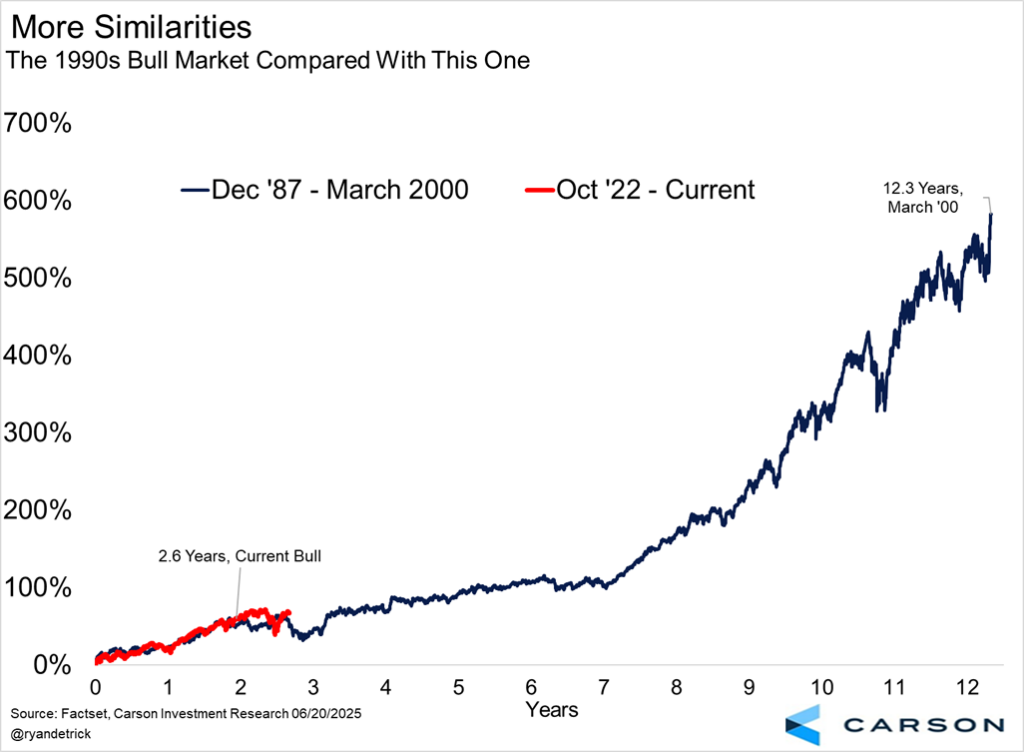

Here’s another look at our current bull market, but this time compared to the longest bull market ever, from 1987 to 2000. That bull market was weak from around now until the end of its third year, but again, better times were coming once we got past the third-year itch.

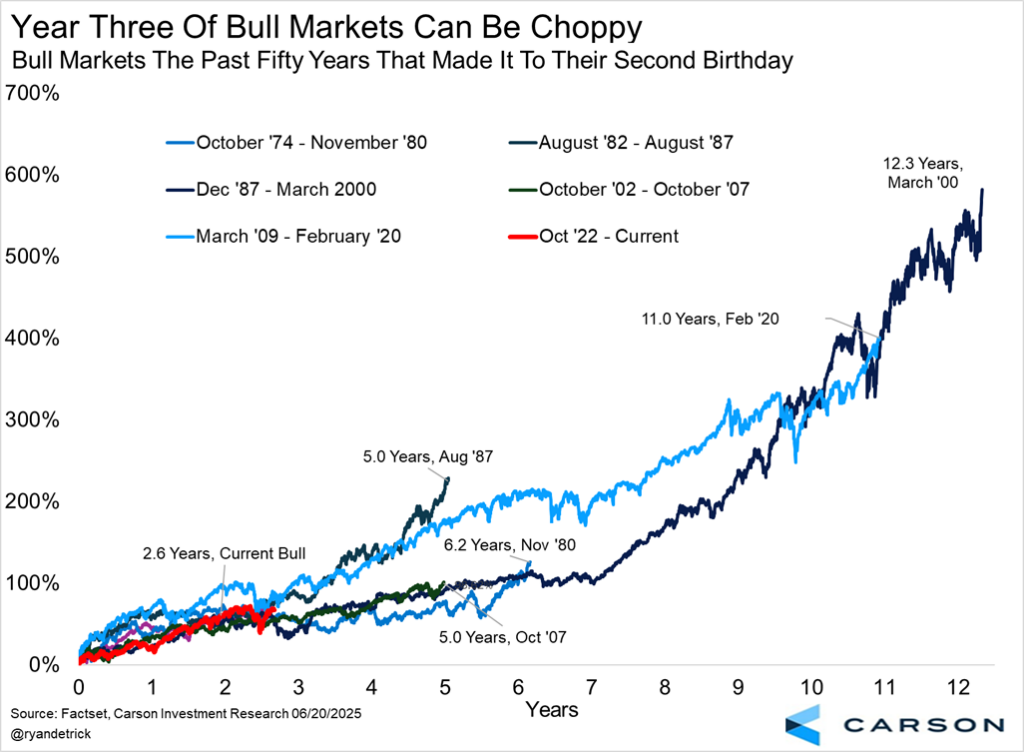

Lastly, here are the five bull markets over the past 50 years that made it past their second birthday and into their third year. Chop and frustration were perfectly normal in year three much of the time, but so was a bull market that lasted several additional years. In fact, five years is the shortest bull market we’ve seen for those that made it as far as we are now, with an average of eight years. We don’t think any investors will be too upset if there were that many years left to this bull market.

Thanks for reading and stay cool out there, as it is HOT 🥵🔥🥵

For more content by Ryan Detrick, Chief Market Strategist click here.

8102645.1-0625-A