At the beginning of the year, we titled our 2023 Outlook “The Edge of Normal”, as we expected markets and the economy to normalize in 2023. What we saw as the year progressed confirmed that view, so much so that our Mid-Year Outlook was titled “Edging closer to Normal”. Normalization has now continued into August. Ryan wrote a piece earlier this week on how the stock market pullback in August was normal. Of course, normalization also means that employment is easing from red-hot levels, and that’s easy to confuse with a slowdown foreshadowing a recession. But current numbers remain very healthy.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The economy created 187,000 jobs in August, above expectations for 170,000 jobs. These numbers can be volatile, as we were reminded by the downward revisions to prior data. This is why it helps to look at a 3-month average, and that’s running at 150,000. That’s more than enough to keep up with population growth and supports the view that the labor market is just normalizing.

Within the payroll data, we did see encouraging signs, including 38,000 jobs added in cyclical sectors like construction and manufacturing. There were also one-off items weighing on the August payroll report, like the Hollywood Writers’ strike, which pulled employment in the motion-picture industry lower by 17,000.

The unemployment rate did jump from 3.5% to 3.8%. But this was for “good” reasons. The Bureau of Labor Statistics (BLS) counts a worker as unemployed only if they are “actively looking for work.” In August, 736,000 more potential workers came “into the labor force” (as defined by BLS) to look for work, That’s the largest monthly increase since January, and would only happen if workers were confident that the labor market was strong. Usually, during weak labor markets, workers get discouraged and stop looking for work, i.e. they’re assumed to have left the labor force and are no longer counted as unemployed. Right now, we’re experiencing the opposite effect.

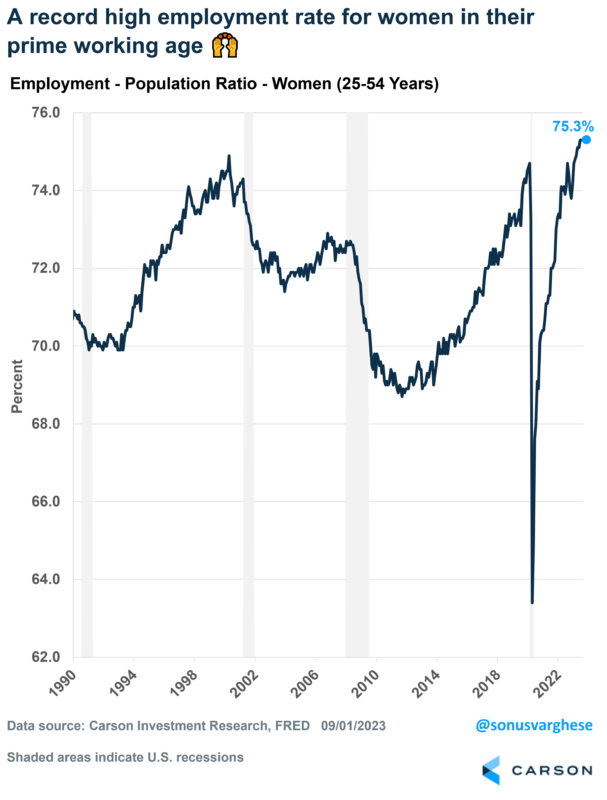

The above issue with the unemployment rate is why we have consistently preferred to look at the employment-to-population ratio, which is sort of the opposite of the unemployment rate. It measures the number of employed workers as a percent of the civilian population. We also like to look at that metric for “prime age” workers, those between the ages 25 and 54, since that takes away the impact of an aging population (as baby boomers retire, they leave the labor force).

The good news is that the prime age employment-to-population ratio was unchanged at 80.9%, the highest level since 2001. In fact, the ratio for women is at 75.3%, which is a record high – it’s interesting that you don’t hear a lot of news on this. These metrics indicate that the labor market is the healthiest it’s been since the late 1990s.

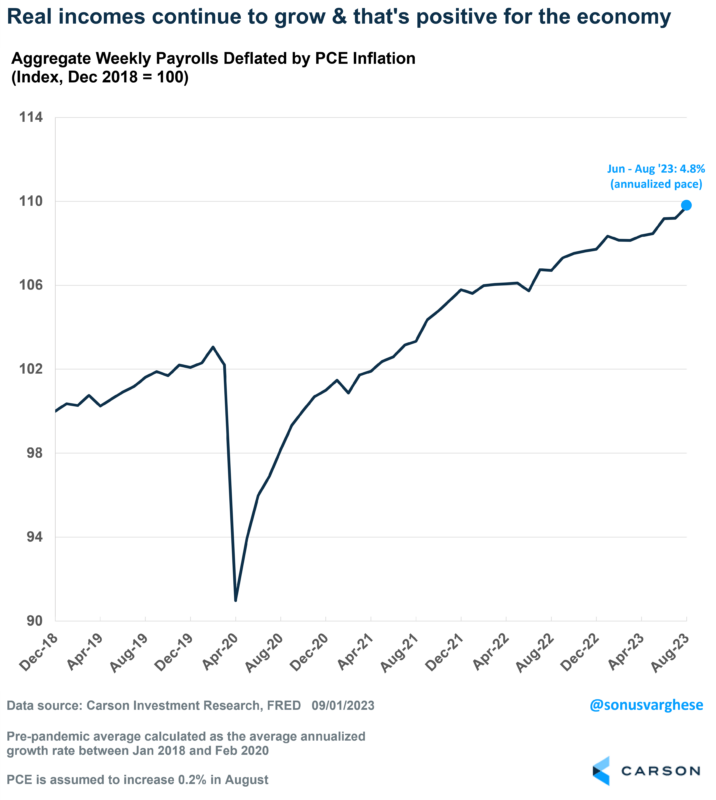

Ultimately, what matters for the US economy is consumer spending, and for that you need income. Overall weekly payroll growth across the economy rose at a whopping 7.2% annual pace over the past three months. That’s because:

- Employment growth has been steady

- Workers are working more hours

- Wage growth remains strong

The good news is that overall inflation’s been running close to 2% over the past three months. That’s thanks to lower energy prices, as well as disinflation in food, vehicles, and other goods that were impacted by the pandemic-related supply chain issues. As a result, over the past three months real incomes, i.e. incomes adjusted for inflation, have grown at close to a 5% annual pace. This is not what you would see if the economy were close to a recession.

The big picture is that there’s no recession in sight, barring unforeseen shocks. The economy is normalizing, but don’t confuse that with a slowdown into a recession. The labor market remains healthy, and incomes are growing above the pace of inflation, which provides a positive backdrop for future consumer spending.

1890061-0923-A