At the beginning of the year, we wrote in our 2023 Outlook that the US dollar was poised to weaken, creating tailwinds for Americans who invest in International stocks and S&P 500 earnings. We reiterated that this is starting to happen in our Mid-Year Outlook, “Edging Closer to Normal.”

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The chart below shows the recent swing in the ICE US Dollar Index, which measures changes in the US dollar against a basket of other currencies, including the euro, yen, British pound, and the Canadian dollar. It rose 27% between May ’21 and September ’22, but has pulled back 12% since then.

A Boost for USD-Based International Equity Investors

When an investor in the US uses dollars to buy a basket of international stocks, the interim step is first converting those dollars to the local currency, which introduces currency risk. Note that when you see quotes for international stock exchanges, like the Nikkei (Japan) or the DAX (Germany), those are in local currency terms. To buy European stocks, you must first convert dollars to euros. Your returns are not just dependent on what the European stocks do; it’s also dependent on what happens to the euro relative to the dollar. If the euro appreciates against the dollar, that’s a tailwind to your investment, whereas a stronger dollar acts as a headwind.

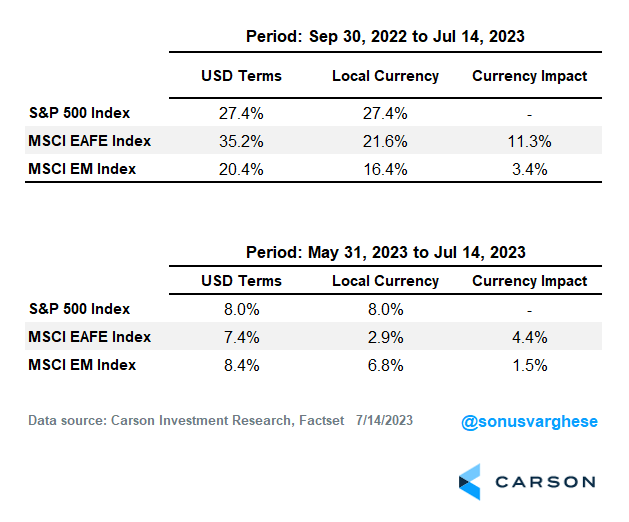

From September 30th of last year through July 14th, the MSCI EAFE Index, which represents a basket of international stocks across developed markets, outperformed the S&P 500 Index. The MSCI EAFE Index gained 35.2% versus 27.4% for the S&P 500. But as you can see from the table below, that outperformance is because of a tailwind from a weaker dollar. Emerging market stocks have also seen a tailwind from a weaker dollar but have underperformed due to a murky economic picture in China.

Even over the past month and half (May 31st through July 14th), the dollar took a renewed plunge, boosting returns for international stocks.

A Tailwind for Earnings

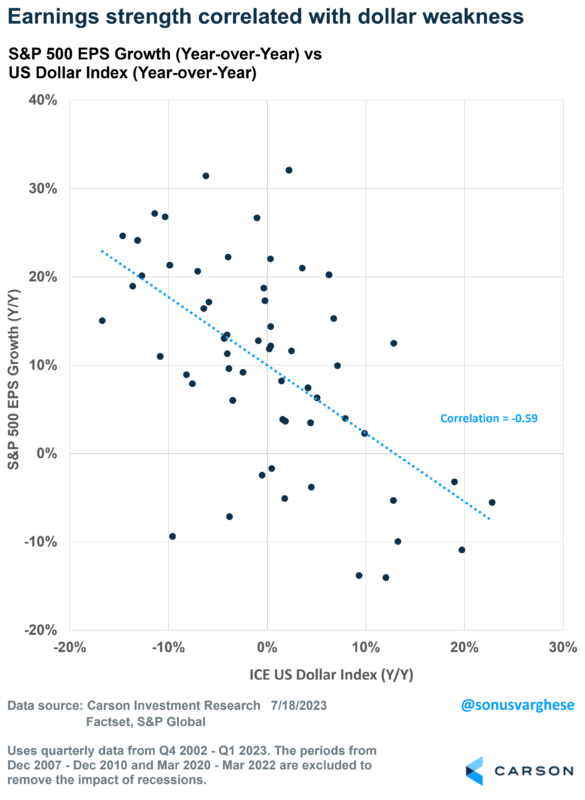

Over the last two decades, movements in the US dollar have negatively correlated with S&P 500 earnings changes. Excluding recessions and post-recession recoveries (since those skew the numbers significantly in either direction), earnings weakness for the S&P 500 has coincided with dollar strength, whereas a weaker US dollar has correlated with stronger earnings growth.

This makes some intuitive sense once you realize that 40% of S&P 500 revenue comes from outside the US. The logic here is that if a company used to sell a machine abroad that generated the equivalent of $1,000 in the past, now that would be about $1,100 because the local currency rose 10% against the US dollar.

So, while the US economy is very relevant for S&P 500 company earnings, much of it also hinges on what happens outside the US and what happens with the US dollar.

Why Is the Dollar Weakening?

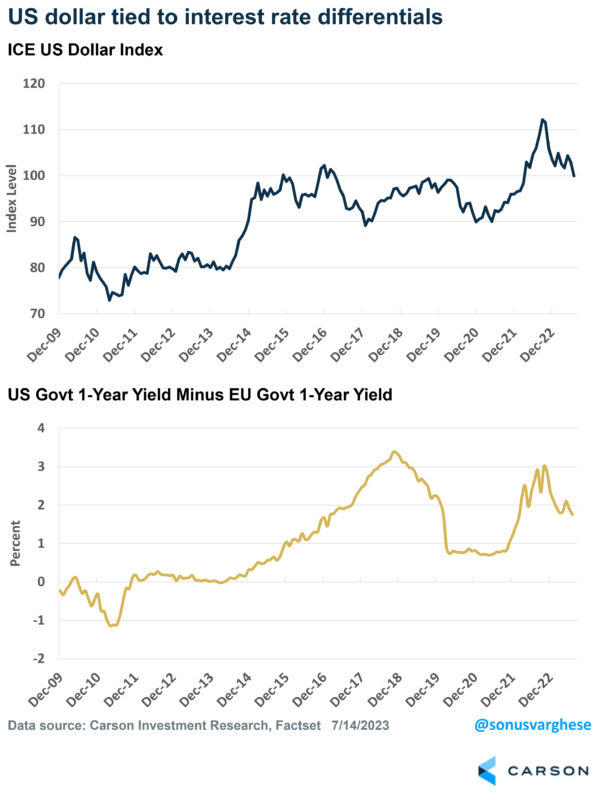

It probably helps to understand why the dollar strengthened in the first place. The simplest explanation is that interest rate differentials between the US and other countries rose – the idea is that if interest rates are much higher in country A rather than country B, money will flow into country A, thus raising the value of that country’s currency.

The chart below shows the dollar index on the top panel, while the bottom panel shows the difference between 1-year US treasury yields and EU government 1-year yields. You can see how the dollar has moved higher when interest rate differentials climb, most notably after 2014 and in 2022. In contrast, the dollar has pulled back when the differential falls, which is what happened in 2019-2020 and this year.

Short-term interest rates, like 1-year yields, are an estimate of central bank target rates over the next year. 1-year yields in the US surged in 2022 because the Federal Reserve (Fed) raised rates to tame inflation. They were much more aggressive than their counterparts at the European Central Bank (ECB).

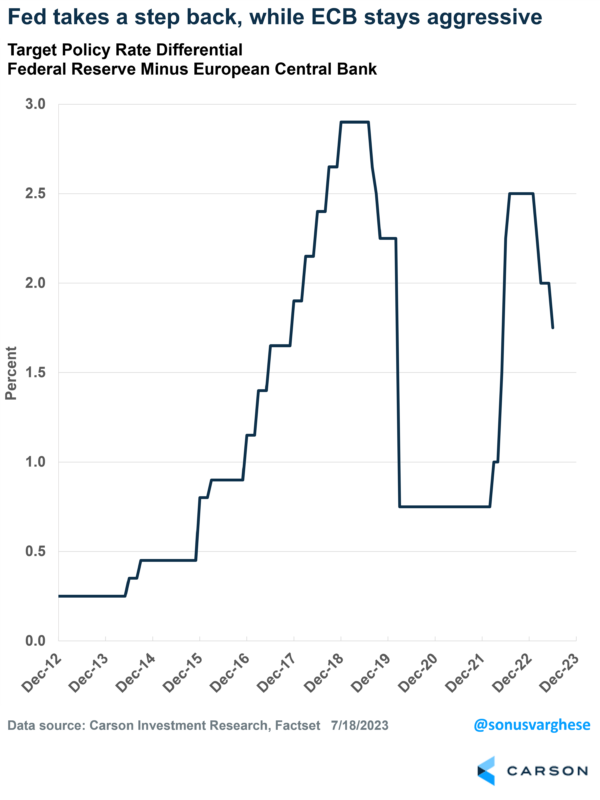

You can see the difference between the Fed and ECB’s target interest rates below. The differential jumped in 2022 but it’s been pulling back recently. The Fed’s taken its foot off the gas, while the ECB remains aggressive. Since the beginning of the year, the Fed has raised rates by 0.75%-points, whereas the ECB has raised it by 1.5%-points.

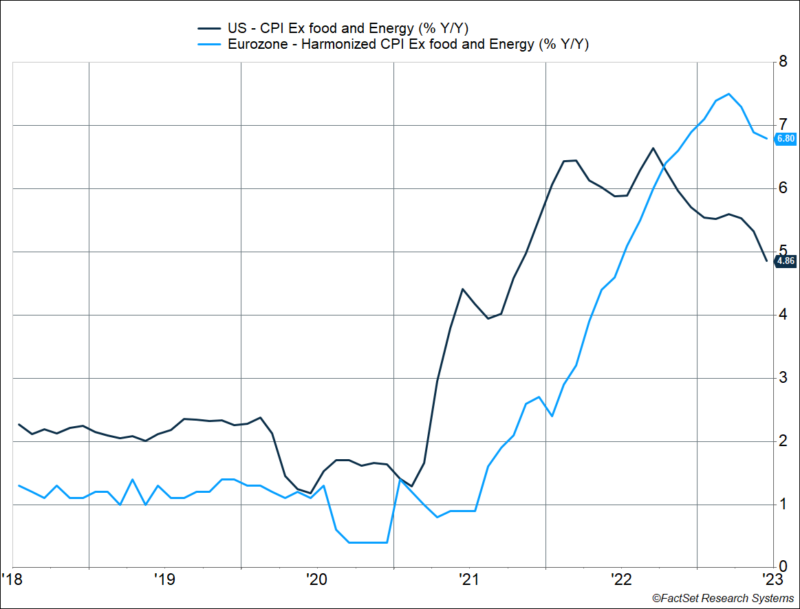

The reason is that US inflation has started to pull back, and is poised to fall further – see our blog from last week discussing this. In contrast, European inflation has remained stubbornly high, which has kept the ECB much more hawkish. In fact, core inflation (excluding volatile components like food and energy) is currently running at 6.8% year-over-year in the Eurozone. That compares to a 4.9% core CPI reading in the US. Up until September 2022, core inflation in the US was running higher than Eurozone core inflation – and then things switched, which shifted investor expectations and sent the dollar lower.

We expect this dynamic to continue as US inflation eases further, while Europe deals with higher inflation and a more hawkish central bank. Tighter policy does create some headwinds for European equities, but that’s offset by a stronger currency. Combine this with the tailwind that a weaker dollar creates for S&P 500 company earnings, and we are keeping our overweight to US equities while maintaining International developed market stocks at neutral. Emerging markets remain at underweight.

1837526-0723-A