“You make most of your money in a bear market, you just don’t realize it at the time.” Shelby Cullom Davis

We all blinked, and it is now October, which could be good if you are hoping for higher stock prices. But, as this great quote by Shelby Cullom Davis explains, people’s decisions in a bear market will significantly impact their investments down the road.

Are you going to sell now that stocks are firmly in a bear market? Many investors have done that over the years and missed out on massive rallies as stocks eventually returned to new highs. This year hasn’t been fun at all for investors, but better times could be coming, and making a rash decision now could greatly impact your investments years from now.

To help with this, today we’ll take a closer look at the fourth quarter and show why a potential year-end rally (and maybe more) could be likely.

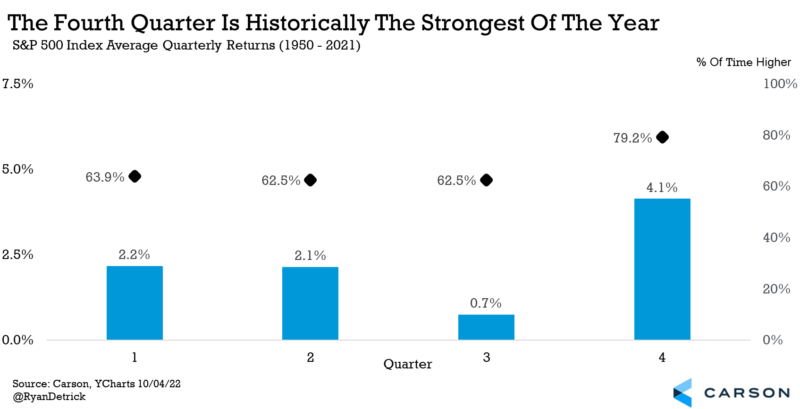

First, the fourth quarter is historically the best quarter of the year, with the S&P 500 up 4.1% on average and nearly 80% of the time.

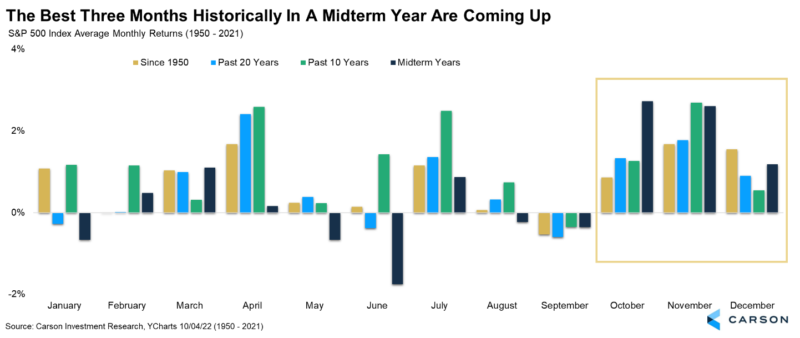

Second, this is a midterm year, and the good news is that market gains during these years are backloaded. In fact, October is the best month of a midterm year, followed by the second best month in November and the third best in December.

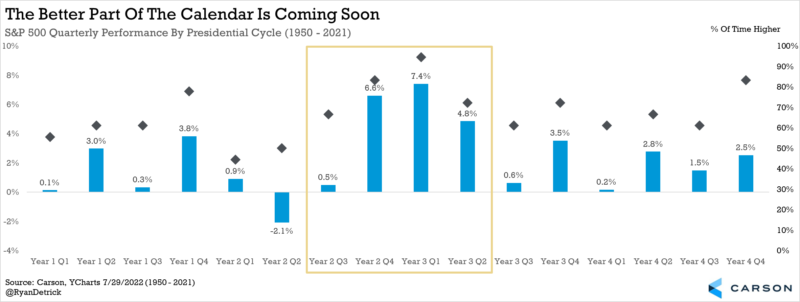

Third, here’s a chart we’ve shared a lot lately, but we’ll do it again, as it is very powerful. Midterm years tend to see weak stock returns in the first three quarters (check for 2022), but the fourth quarter of a midterm is the second-best quarter out of the entire four-year Presidential cycle. The best quarter and third best quarter are right around the corner early next year. As bad as things have been this year, the calendar is currently a major tailwind.

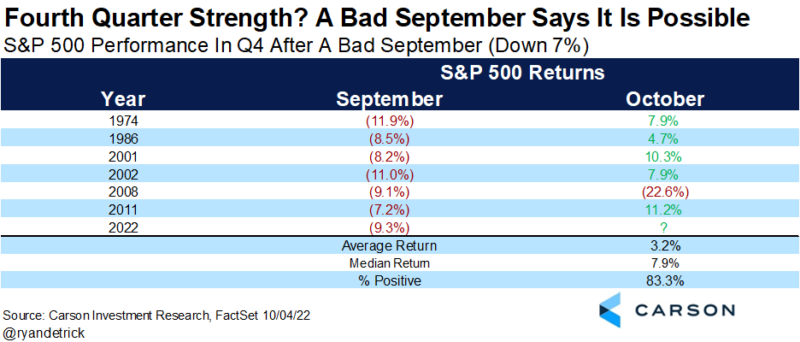

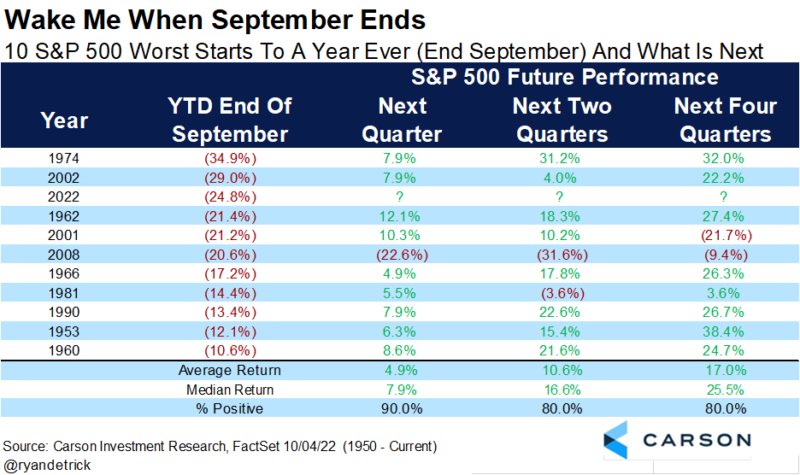

Fourth, the fourth quarter has historically done even better when September is down big. Given this year saw one of the worst Septembers ever for stocks, this could be another clue a bounce back is possible. To quote Lloyd Christmas, “So you’re telling me there’s a chance!”

Fifth, this was the third worst start to a year ever for the S&P 500. Well, the good news is looking at the ten worst starts ever to a year saw the fourth quarter higher nine times. Only in 2008 was it red; fortunately, we don’t think we are in that environment. Going out a year, the S&P 500 was up eight times and higher, a median of 25.5%.

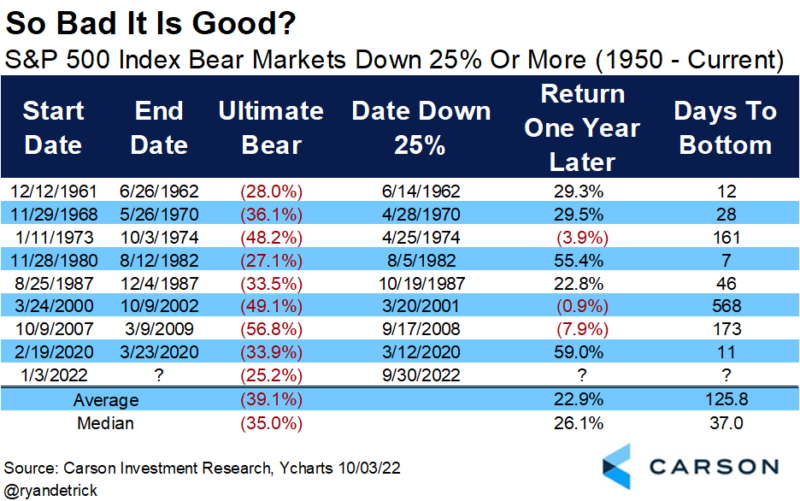

Sixth, the S&P 500 bear market cracked down 25% last week. As bad as that feels to investors, the stock market doesn’t care about what just happened and only cares about what is next. The good news is once a bear market is down 25%, the returns going out can be quite strong, with the S&P 500 up nearly 23% on average a year later. Additionally, many lows took place soon after this milestone was hit, so a major low could be near. Yes, the ’73/’74 recession, tech bubble, and financial crisis all saw more weakness (and in some cases for a long time), but we don’t see an economy nearly as weak as those times. Therefore, we think this time will play out like the others, and stronger returns could be quite likely.

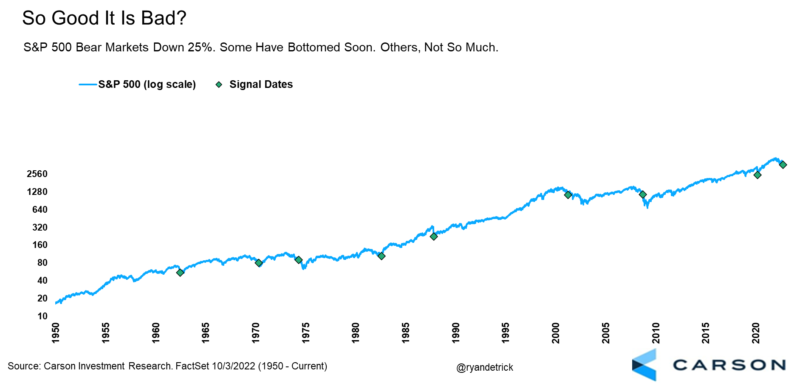

Here’s another way of showing the study above. As you can see, many times once the S&P 500 was down 25%, it was quite near a major low.

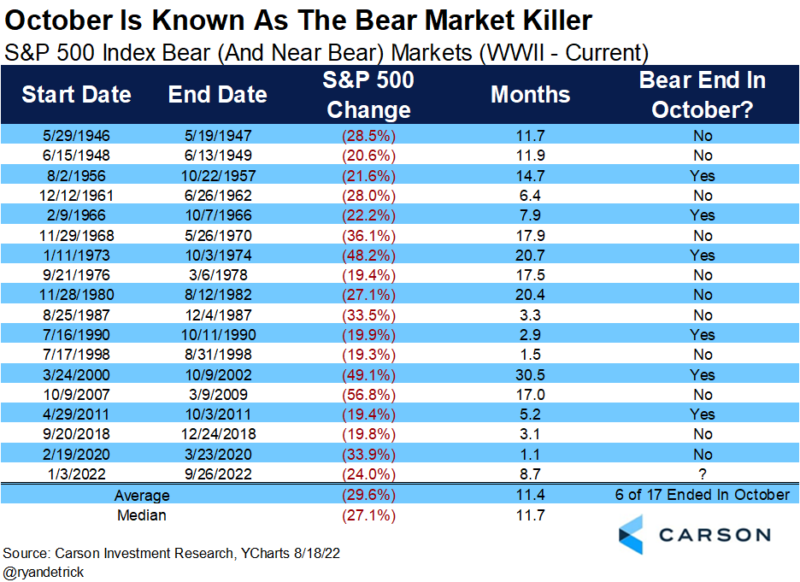

Seventh and lastly, October is known as a bear market killer. Remember, this year was the worst start to a year since 1974 and 2002. Below we show how bear markets tend to bottom in October, and sure enough, both of those vicious bears ended in October. The ’73/’74 bear ended on October 3, while the tech bubble bear market bottomed on October 9.

Investors are worried, and we understand those feelings here at the Carson Investment Research team. Could stocks bottom and rally? We think there’s an above-average chance. And a chance is all we need, as Lloyd Christmas would say.

Please continue to follow us as we break down what is happening to the economy and markets.