Investors digested results from some of the largest companies in the world this past week. The reports largely met or exceeded expectations, with five of the six largest companies trading higher after their announcements – perhaps reflective of ‘better than feared’ reports. These positive surprises were a welcome relief to investors who may have entered this earnings season on a buyer’s strike, as I noted in my earnings preview. Most importantly, forward-looking commentary from many in the sector continues to point to strong demand signals ahead.

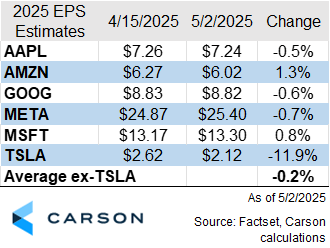

Earnings estimates for the six ‘Magnificent 7’ companies that have reported show mixed results following their announcements, according to FactSet. Excluding Tesla, the other five companies saw an average revision of -0.2% to their full year EPS estimate, as shown in the table below. The sector was, and still is, expected to outgrow the broader S&P 500 for the remainder of the year, according to FactSet, even with these negative revisions. However, the bar was set low enough entering this earnings season that these results have propelled shares higher.

Note: AMZN and GOOG 5/2/2025 estimates adjusted lower by $0.20 and $0.69, respectively, to reflect non-operating gain on equity investments included in FactSet estimates.

Despite the positive reaction, these results still signal a sharp slowdown from the year ago period. During last year’s earnings season, EPS estimates for these same five companies were revised higher by an average of 4.2% according to FactSet data which signaled fundamental strength that was greater than what analysts were expecting. This year’s lack of revisions may signal that fundamental momentum continues to slow, at least for the most immediate periods. However, tech investors may leave this earnings season reassured that even modestly negative revisions can lead to positive stock price returns – possibly because expectations for future quarters remain optimistic.

Forward looking commentary from these companies suggests the ‘AI trade’ is alive and well. These companies have invested hundreds of billions of dollars in data center-focused capital expenditures in recent years, aiming to build leading-edge AI products. And there still might be another wave of growth to come. Each CEO reaffirmed strong underlying demand trajectories and emphasized that the current levels of CapEx are still not enough:

- Microsoft CEO Satya Nadella: “In our AI services, while we continue to bring data center capacity online, demand is growing a bit faster. Therefore, we now expect to have some AI capacity constraints beyond June.”

- Google CEO Sundar Pichai: “In Q4, we exited the year in cloud with more customer demand than we had capacity. And that was the case this quarter as well.”

- Amazon CEO Andy Jassy: “Our AI business right now is a multi-billion dollar annual run rate business that’s growing triple-digit percentages year-over-year. And as fast as we put the capacity in, it’s being consumed.”

Taken together, these results suggest that Big Tech remains a cornerstone of both market performance and long-term growth narratives. While growth has slowed relative to last year, expectations were already tempered, allowing companies to outperform low investor sentiment. Continued investment in AI infrastructure and persistent demand from customers may indicate that the sector is still in the early innings of a long-term innovation cycle. Investors may continue to reward resilient fundamentals and forward-looking confidence, even amid cautious earnings revisions.

For more content by Blake Anderson, CFA®, Associate Portfolio Manager click here.

7928548.1.-0525-A