“The first principle is that you must not fool yourself—and you are the easiest person to fool.” Richard Feynman, American theoretical physicist

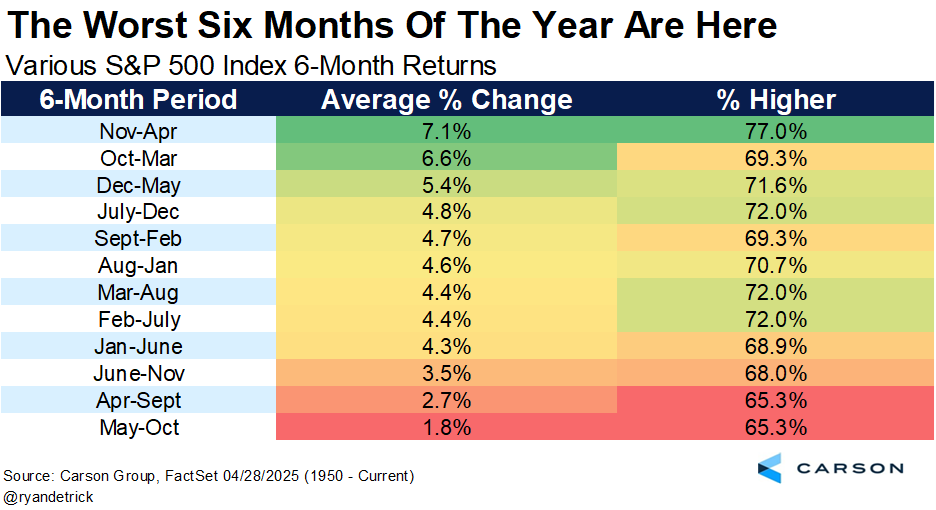

Buckle up, as the trigger points for one of the most well-known investment axioms, “Sell in May and go away,” is nearly here. This gets a ton of play in the media, as the six months starting in May are indeed the worst six consecutive months on the calendar historically. The S&P 500 has averaged only 1.8% over those six months and moved higher just over 65% of the time.

Let’s be clear, up 1.8% might not sound like much, but it is still an increase. Also, we do not advocate blindly selling due to the calendar. But it is worth being aware of this calendar effect, as you will hear a lot about it this week.

Let’s Dig Into May

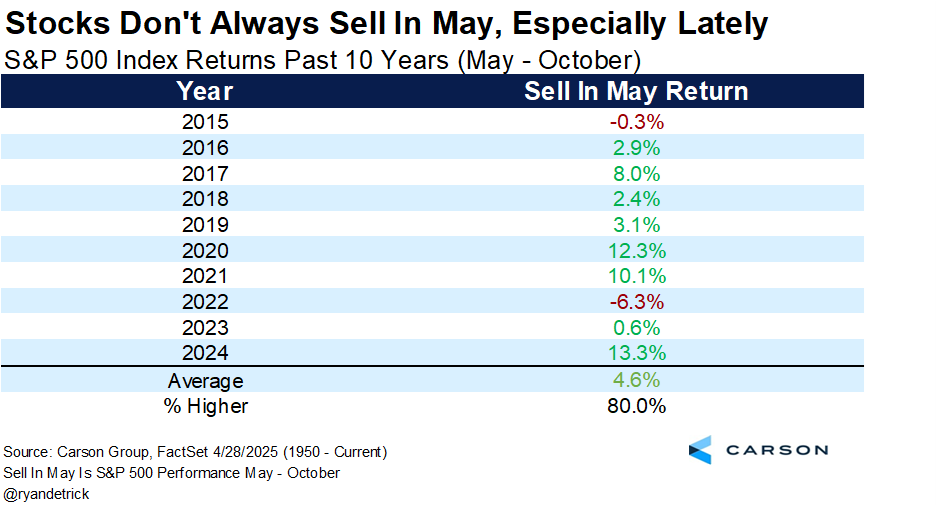

Now here’s something that might be less well known. These “worst six months” have gained in eight of the last 10 years. In fact, we noted last year why Buying In May made more sense and those worst six months soared more than 13%.

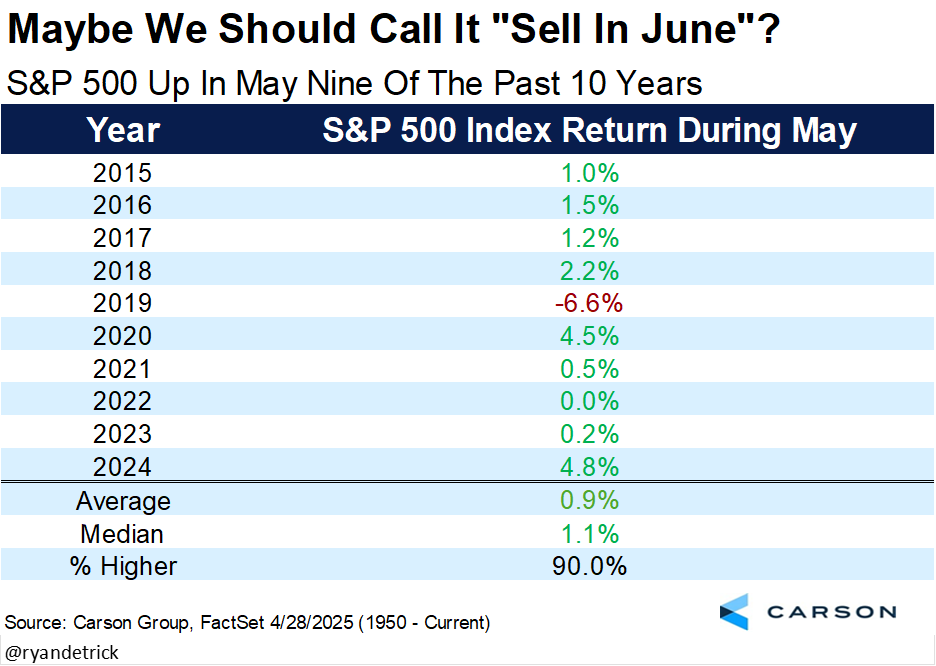

Not to mention the month of May has been higher nine of the past 10 years, so maybe we should call it, “Sell in June and go away”?

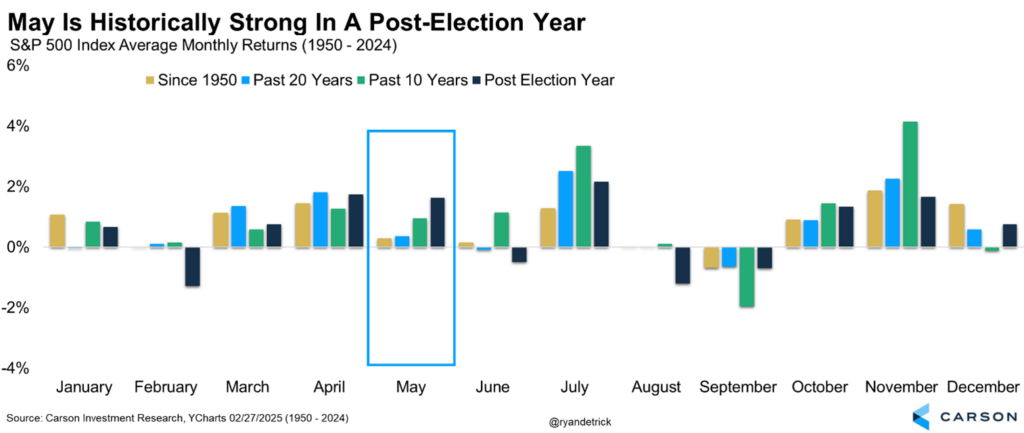

Lastly, regarding May, post-election years tend to be strong, up 1.6% on average, which is the 4th best month of the year in a post-election year. Then again, April is usually strong and that clearly didn’t work this year, but we are well off the lows at least.

How Surprising Was the Early 2025 Weakness?

No, we didn’t expect the S&P 500 to be flirting with a bear market earlier this month, but we were on record that a 10-15% correction was quite likely this year and it could be a buying opportunity. The truth is the size of the tariffs announced on Liberation Day on April 2 were way more than we (and nearly anyone else) expected. That is why we had the two-day drop of more than 10%, pushing stocks much lower, and with it came historic confusion over what Washington’s goal exactly was (lower tariffs or better trade deficits, or even something else?).

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

We’ve shared the chart below quite often this year and it shows that early in a post-election year tends to be quite weak. Couple that with typical weakness early after 20% years and the first quarter the past two decades both being weak, and we can see that some weakness early this year wasn’t a huge shock, but the size of the weakness did catch us off guard. But as well discuss next, all hope isn’t lost.

Up Six Day in a Row Says Don’t Sell

So should you blindly sell for the next six months? We don’t think so, as there are always opportunities. We continue to be quite impressed with how the rest of the world (ex-US and India) have been doing. In fact, the German DAX is flirting with all-time highs again today. That isn’t something you’d expect to see if this was truly some global calamity like they keep telling us.

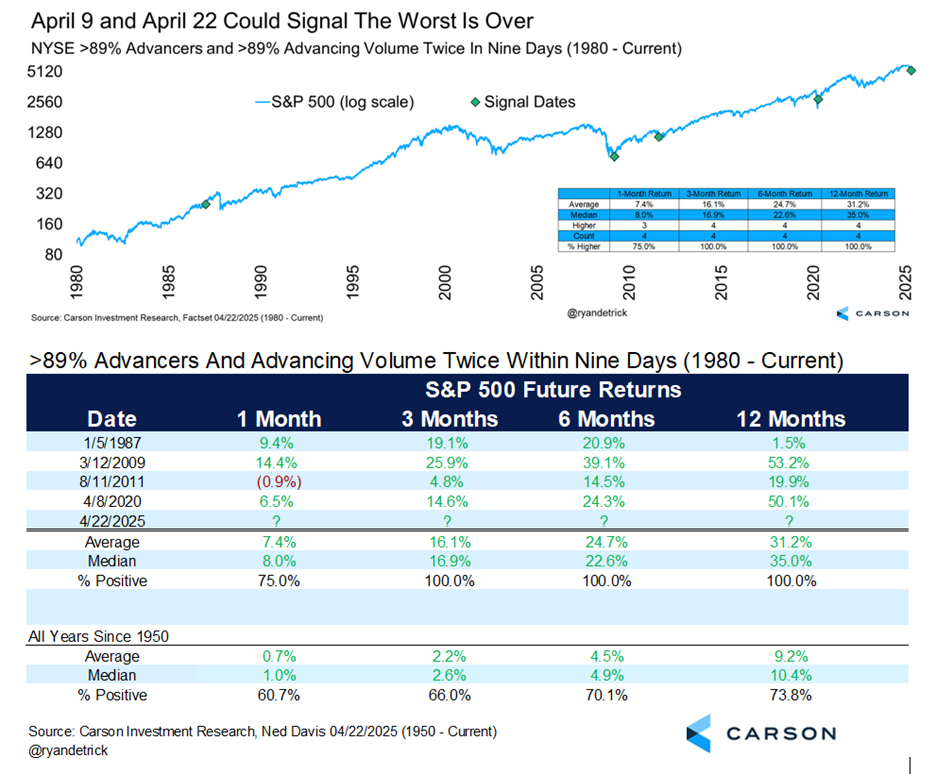

I noted many rare and potentially bullish buying thrusts in Houston, We Have A Zweig Breadth Thrust and Four More Bullish Developments, which all adds up to many reasons these next six months could be solid, especially with some good news on the trade front.

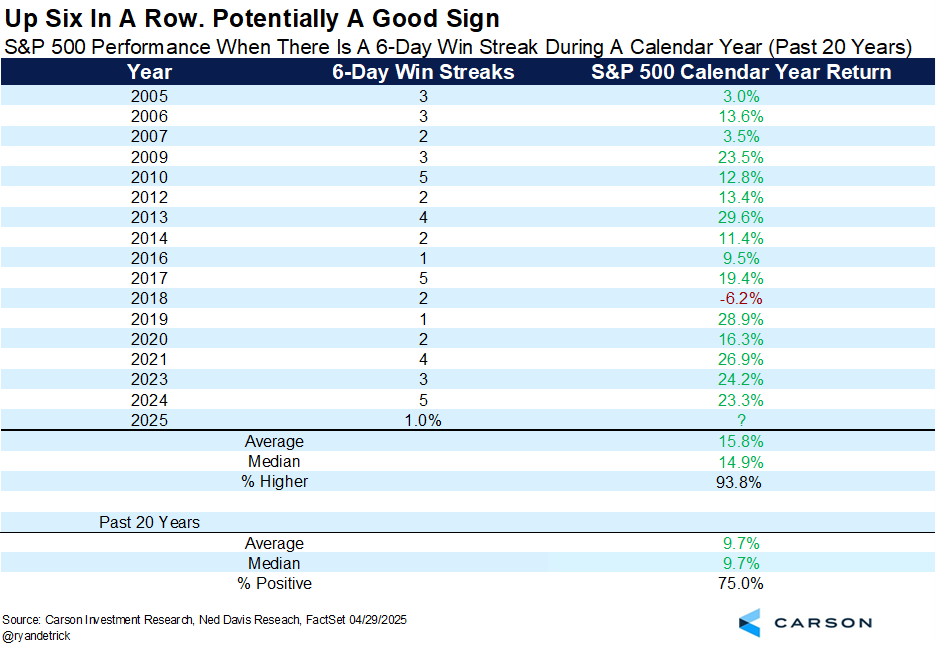

And here’s something to add to the list of potential bullish triggers. The S&P 500 is up six days in a row the first time this year. I looked at the past 20 years and there were only four years that didn’t have a six-day win streak: 2008, 2011, 2015, and 2022. Stocks were lower all four of those years, with 2008 and 2022 being two of the worst years ever. The flipside is looking at the 16 years that had at least one six-day win streak and stocks were higher 15 times and up more than 15% on average, with only 2018 being lower on the year. Not bad, not bad.

Digging a little deeper, this six-day win streak also saw stocks gain more than 7%, another rare, yet potentially bullish development. This has happened only eight other times and stocks were higher six months later seven times and never lower a year later, with substantially better than average forward returns going out a year.

I want to be clear, take any study that I share with a grain of salt, but to see multiple triggers over the past week or so has my attention that the lows are likely in and six months from now investors will be rewarded. Of course, that doesn’t mean it’ll be straight up and some back and forth would be perfectly normal and healthy. So we go all the way back down about 14% to re-test those recent lows? I don’t think so, but some giveback would be perfectly normal before another march higher.

For more of our thoughts on the latest market developments, be sure to watch our latest Facts vs Feelings below. Thanks for reading!

For more content by Ryan Detrick, Chief Market Strategist click here.

7917010.1-0425-A